Posted by Wesley Tharpe

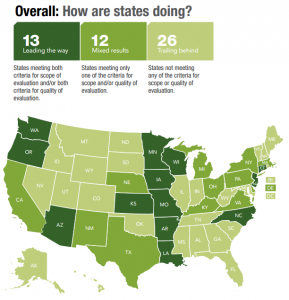

Looking to grow their economies and create jobs, lawmakers across the country spend billions each year on various tax credits, exemptions, and deductions for businesses in their state. Georgia is certainly no exception, with business tax incentives currently costing taxpayers more than $100 million each year. But according to a new report from the Pew Center on the States, Georgia is also among the 26 states that fail to measure whether these programs actually work.

Pew ranks Georgia as “trailing behind,” which basically means that it doesn’t evaluate tax incentives very often, or very thoroughly. The state received the lowest possible ranking on all four criteria examined by the report, which is important for two reasons:

- Failure to effectively review the state’s tax incentives makes it impossible to know whether the programs are achieving their goals. Unlike other areas of state spending that are closely-examined through the budget process each year, most tax credits remain on the books for years without review.

- Since lawmakers can’t tell whether incentives are effective, they’re unable to judge whether the economic benefits of credits outweigh the economic harm of the budget cuts required to pay for them. Every dollar legislators give to private business is a dollar they must take away from public investments like education and public safety, which are critical to the state’s economy and quality of life.

States that Pew ranks as “leading the way” employ strategies that give legislators the information they need to periodically review whether tax incentives are working, so they can make tough choices about where scarce public funds will do the most good:

- North Carolina allows academic experts to access restricted data from the Departments of Labor and Revenue, which they use to determine the true costs and benefits of the business credits.

- Oregon requires tax credits to sunset every few years so they can be reevaluated, a strategy that the Special Council on Tax Reform proposed for Georgia.

- In Massachusetts, analysts found that while an existing tax credit program had created around 1,600 jobs, the budget cuts required to pay for it had eliminated nearly the same amount. The analysis allowed policymakers to direct state funds toward other priorities with a higher return on investment.

There are several ways that Georgia can improve. A good first step would be to enact legislation similar to House Bill 920, which failed to pass in the most recent session. The proposal would have allowed independent experts from a state university to thoroughly-review one or two of Georgia’s tax incentive programs each year, and to make suggestions for improvement when appropriate.

Reviving the idea next year should be a top priority, and it needn’t be a contentious issue. Other states have enacted similar proposals with a broad consensus of bi-partisan and business support. In Ohio, the state Chamber of Commerce endorsed a call for a “full assessment” of whether tax expenditures were meeting their goals and whether they were worth the cost. And in New Mexico, the legislature almost unanimously passed a bill requiring better analysis of its film tax credit—a move that eventually saved taxpayers more than $10 million per year while also improving the program’s effectiveness.

All sides can agree that lawmakers should get taxpayers the biggest bang for their buck, and strengthening Georgia’s review of its business tax incentives is an essential tool to help them do so.

2 thoughts on “Getting Georgians’ Money Worth on Tax Expenditures”

Great proposal. Let’s hope next year’s legislators see the value of a comprehensive costs / benefit analysis of every special corporate tax break or exclusive grant of state resources to private interests, so we can realistically see what works and what doesn’t, and get this state back on track with balanced and sustainable economic success.

Pingback: Baxter Deal is a Drop in the Bucket | Georgia Budget and Policy Institute