Tax Day arrives every April, annually stirring a conversation about the benefits of taxes and their influence on the state economy. GBPI’s analysts break down Georgia tax policy to help the public better understand the fundamental value of taxes and the vital investments that result in the short and long run.

We jumped into a timely Twitter conversation on April 18, playing off the trending #TaxDay hashtag. The tweetstorm from our @GaBudget handle provided a fact-based case for the importance of taxes in Georgia and some documentation of ways tax-cutting measures in other states failed to deliver tangible results in promised job growth or economic improvement.

1/ On #TaxDay, let’s explore an underappreciated aspect of state taxes: their importance to a strong economy & thriving communities #gapol

— GBPI (@GaBudget) April 18, 2017

2/ Businesses and a strong economy depend on world-class schools, sound infrastructure, police and other quality tax-funded services

— GBPI (@GaBudget) April 18, 2017

3/ We explained as much in our recent piece on how slashing tax rates is a bad economic formula #gapol https://t.co/vJVl6VzcVq

— GBPI (@GaBudget) April 18, 2017

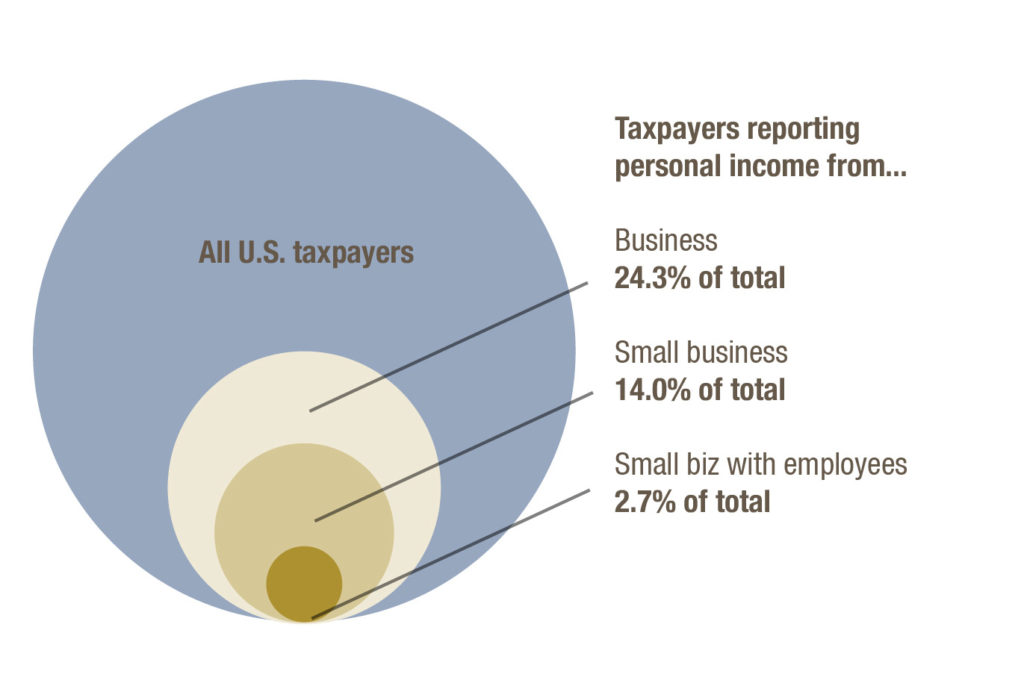

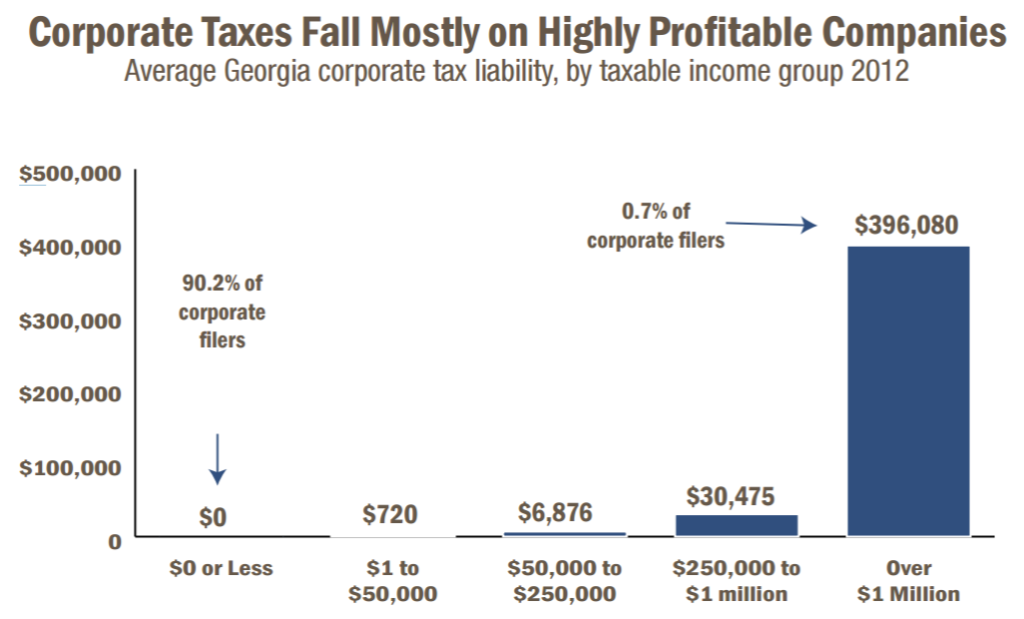

Tax cuts don’t benefit nearly as many businesses as advertised, and the small businesses that are often propped up as beneficiaries of tax cuts typically aren’t in position to create jobs. Only 2.7 percent of all personal income taxpayers nationwide are owners of bona fide small businesses with employees other than the owners.

4/ But tax policy is complex and even some national groups struggle with the finer points https://t.co/C6XqpHVfMC

— GBPI (@GaBudget) April 18, 2017

5/ So here’s a tax policy 101. Bottom line: Neither mainstream research nor experience of other states point to tax cuts as economic elixir

— GBPI (@GaBudget) April 18, 2017

Everyone can find value sitting through a 101 lecture now and then, especially on a topic as complicated as taxes. Here’s where we dive in to the heart of the matter.

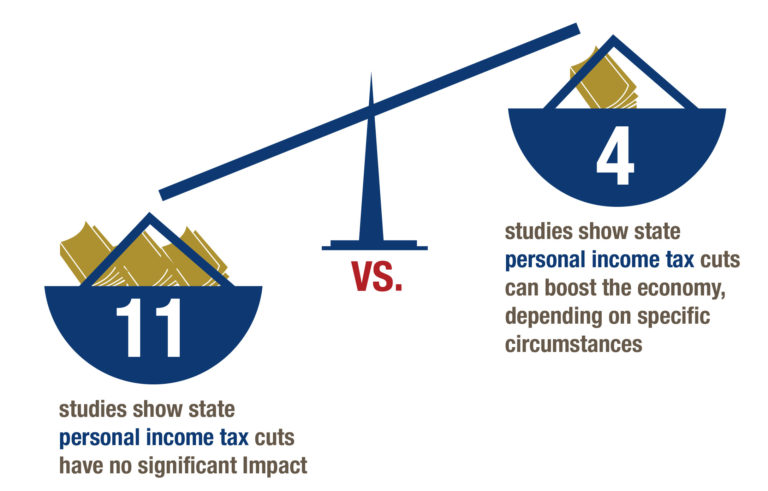

6/ Of 15 major studies since 2000, 11 find state income tax cuts don’t matter much #gapol #taxday2017

— GBPI (@GaBudget) April 18, 2017

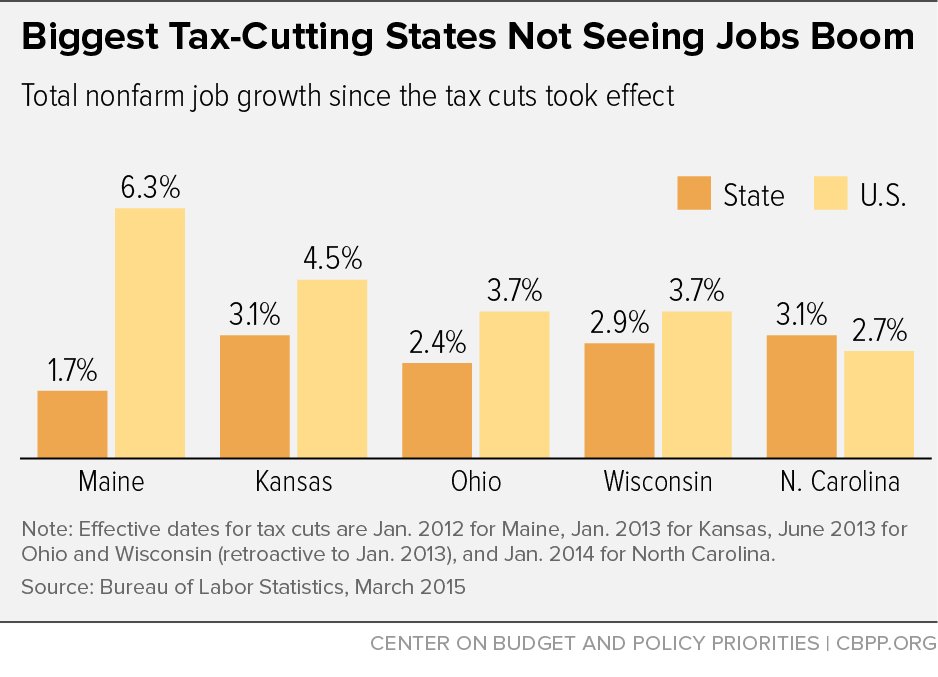

There are recent examples of states implementing tax cuts only to find little gained in compared to the rest of the nation.

7/ And of five states with big tax cuts since 2010, four saw resulting job growth below the national average pic.twitter.com/P8ypJnnaLs

— GBPI (@GaBudget) April 18, 2017

North Carolina is a key example in this scenario. The state continues to push for more tax cuts, yet the numbers offer little encouragement to support the argument.

8/ NC cut taxes, saw slightly above average job growth (6.9% vs. 6%). But GA had stronger job growth over that span (9.1%). SC, TN & FL too.

— GBPI (@GaBudget) April 18, 2017

9/ Why don’t income tax cuts boost state economies? Many reasons. One, they help fewer businesses than advertised. https://t.co/v1Fb1HOrda

— GBPI (@GaBudget) April 18, 2017

10/ And they don’t attract many new ones either. Only 5% of CEOs cited taxes as deciding factor in 2014 survey https://t.co/920PXAy8gk

— GBPI (@GaBudget) April 18, 2017

11/ Tax rates also don’t really influence where workers and entrepreneurs choose to live. Jobs, family matter more. https://t.co/0znGZHcQhY

— GBPI (@GaBudget) April 18, 2017

With the majority of entrepreneurs choosing to continue working in a city they’re familiar with, it’s clear that local environment and connections weigh more than things like tax cuts.

Tax cuts are politically popular, but the other side of the ledger is often left out of the discussion. When you take a deeper look at the state budget, cutting taxes squeezes another area of the budget. The money has to come from somewhere.

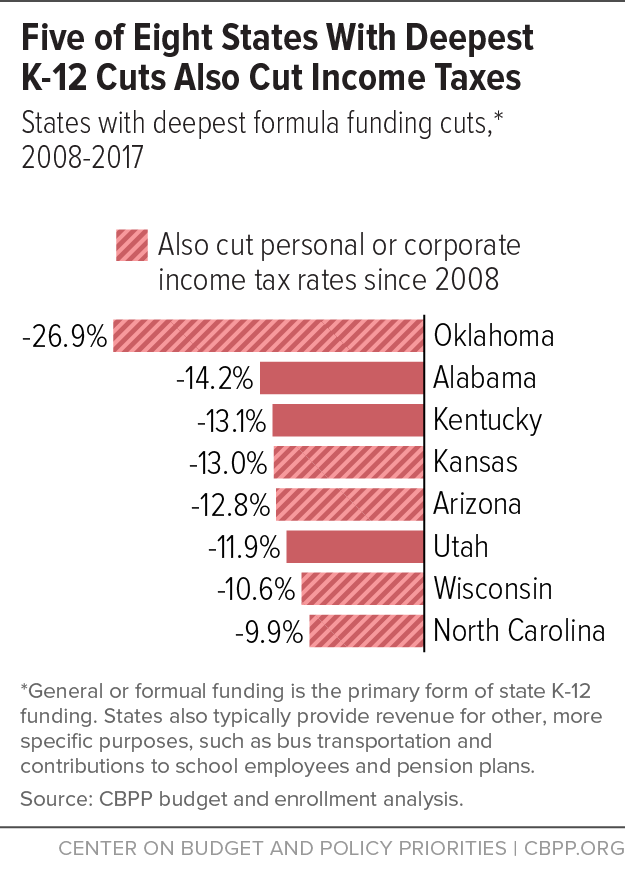

12/ Critically, tax cuts aren’t free. States pay for them by slashing schools, roads, other services. These are just as important for jobs.

— GBPI (@GaBudget) April 18, 2017

13/ Tax-slashing states often wind up with buyer’s remorse #TaxDay

— GBPI (@GaBudget) April 18, 2017

14/ NC suffered historic cuts to their universities and K-12 schools. All in exchange for fairly mundane job growth https://t.co/xvuZbnhRo9

— GBPI (@GaBudget) April 18, 2017

North Carolina experienced slightly above average job growth since 2010. That’s part of the story. Looking at the full picture, other parts of the state budget took a corresponding hit due to tax cuts.

15/ Kansas was sold on tax cuts as a path to prosperity. They received credit downgrades & a broken economy instead https://t.co/A4Y5DUAx56

— GBPI (@GaBudget) April 18, 2017

Kansas’ gross state product declined 1.1 percent in 2015 vs. 2014. Also, personal income estimates showed a one-year growth rate of 2.4 percent in Kansas, which trailed the average of 2.7 percent for the region and 3.9 percent for the United States.

16/ And Louisiana slashed taxes for years assuming the oil boom would last forever. The state almost went bankrupt https://t.co/3b0niQ7LQy

— GBPI (@GaBudget) April 18, 2017

Louisiana is still reeling from past measures like these, as Nick Albares, Senior Policy Analyst for Louisiana Budget Project, noted in response to our tweetstorm.

@GaBudget And we still face $440M shortfall for FY 18 & staring at $1.4B fiscal cliff for FY 19. More: https://t.co/2K5YK2w59W #TaxDay #lalege #lagov

— Nick Albares (@NickAlbares) April 18, 2017

Turning back to Georgia, GBPI sees opportunities to build a better future for the state.

17/ We think there’s a better way: an economy built on widespread opportunity and a strong middle class https://t.co/3IfnwPIJJf

— GBPI (@GaBudget) April 18, 2017

18/ Georgia deserves a tax system that gives families a fair deal and also protects the state’s finances #gapol https://t.co/ESkdsA07YW

— GBPI (@GaBudget) April 18, 2017

19/ We’ll keep working for that better path as we have every #TaxDay since 2004. Learn more at https://t.co/WLdlj7rTtk pic.twitter.com/NCfQ8nL6m3

— GBPI (@GaBudget) April 18, 2017

The Georgia Budget and Policy Institute is working to build a more inclusive economy, and we believe taxes play an integral role in shaping the lives of all Georgians. We strive to bring you thought-provoking content, like this thread of tweets, to shine a light on paths that lead to all Georgians sharing in the state’s prosperity.

Along with keeping up with our website, be to follow us on Twitter and Facebook for daily discussion and insight.