State and federal lawmakers are changing higher education financial aid programs and that makes it harder for Georgia’s students to earn a college degree. These changes aren’t just hurting students and their families. They’re undermining Georgia’s economy, which is increasingly dependent on having an educated workforce.

State and federal lawmakers are changing higher education financial aid programs and that makes it harder for Georgia’s students to earn a college degree. These changes aren’t just hurting students and their families. They’re undermining Georgia’s economy, which is increasingly dependent on having an educated workforce.

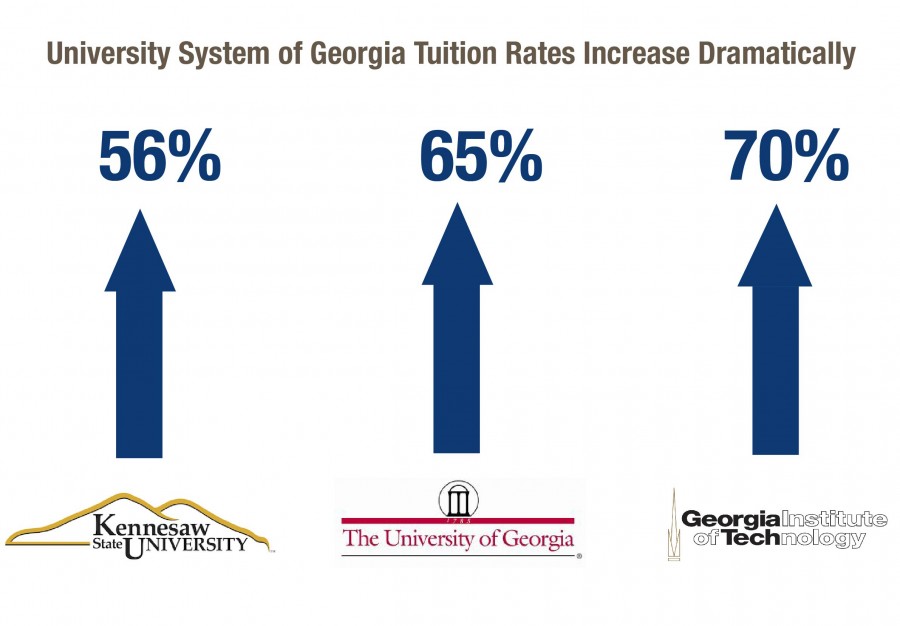

The Legislature imposed new budget cuts on higher education in the last session. To compensate the university system announced tuition hikes for the upcoming school year. These hikes are now an annual ritual and their cumulative impact is large. Students entering the system this fall will pay on average 55 percent more than those who entered in 2008. For those starting at the University of Georgia or Georgia Tech, the increase is even greater: 65 percent at UGA and 70 percent at Tech.

While tuition soared, the HOPE Scholarship shrunk. In 2011 the legislature made significant changes to it. Now the scholarship covers only a portion of tuition instead of the full cost. For the current school year, the HOPE Scholarship covers about 83 percent of full-time tuition for students in the university system. It’s expected to cover a steadily declining portion of tuition in years to come.

There are signs that students in the university system are having a harder time covering college costs. The proportion of students with loans in Georgia is growing. Fifty-eight percent of Georgia graduates had student loans in 2011, three percentage points higher than 2010 graduates. At the same time student debt is growing. 2011 graduates owed on average $22,443 in student loans, almost 19 percent higher than the $18,888 owed by 2010 graduates.

The financial pressures these students face are about to intensify. On July 1 the interest rate on federally subsidized student loans is set to rise from 3.4 percent to 6.8 percent. In response the Obama Administration and the U.S. House of Representatives have proposed plans to tie the student loan interest rate to the interest rate of a 10-year U.S. Treasury note plus several percentage points. Under both plans the interest rate would rise, adding thousands of dollars to the cost of the loans.

Raising costs and reducing financial aid doesn’t help Georgia’s students. It will prevent many from completing a postsecondary program, making the state’s workforce less competitive. Those who manage to finish will increasingly do so at the cost of significant student loan debt, which limits their ability to buy a house or a car as well as save for retirement—all a drag on Georgia’s economic growth.

Georgia must keep college affordable. It needs to reinvest in its institutions of higher education and develop a comprehensive approach to financial aid to help students from all families complete a postsecondary program.