An Updated Case for a State Earned Income Tax Credit

Updated Dec. 2016. Originally published Aug. 2015.

Building a better Georgia, with a strong economy and vibrant communities, requires a more resilient middle class and more opportunities for working families to climb the economic ladder. One of the best tools to help ensure that all Georgians share in that prosperity is a state-level Earned Income Tax Credit (EITC), or Georgia Work Credit.

Created in 1975, the Earned Income Tax Credit is a federal policy that serves as one of the nation’s most effective tools for low- to middle-income families. It cuts federal taxes for low-wage workers like cashiers, mechanics and nurses – providing a wage enhancement for families striving toward the middle class. Twenty-six states and the District of Columbia build on the EITC’s success with their own state-level versions of the credit. State EITCs piggyback on the federal version by providing a limited credit against state and local taxes, up to a value determined by each state. Here are the benefits that enacting the policy in Georgia can deliver.

- Provide a bottom-up tax cut to more than a million Georgia families. About 1.1 million Georgia families, or 26 percent of all Georgia households, received the federal EITC in 2014.[1] State EITCs provide a modest yet critical boost to those same families. A refundable Georgia Work Credit set at 10 percent of the federal EITC would cut taxes by a few hundred dollars a year for eligible workers, up to a ceiling of around $630. The largest value goes to families earning from about $10,000 to $24,000 a year, though families making up to about $39,000 to $53,000 (depending on number of children) still benefit.

- Help Georgians with jobs afford the basics and work their way into the middle class. State EITCs are available only to people who work. The credit also grows in size, up to a point, as wages rise. That combination encourages people to stay employed and work more hours, rather than rely on public assistance. The extra funds help working families afford basic necessities like food and child care, as well as larger investments that smooth the path to the middle class. One recent survey of tax credit recipients estimated that 87 percent of EITC dollars went to either paying bills, saving, affording basic needs or making personal investments such as course tuition, reliable transportation or more livable housing.[2]

- Give an economic booster shot to local businesses and communities. A Georgia Work Credit would pump millions of dollars into local communities by giving families more disposable income to spend locally. Studies indicate the federal EITC delivers an economic multiplier effect, with every $1 of tax credit claimed by local taxpayers generating between about $1 and $2 of local economic activity.

- Put Georgia’s children on a firmer pathway to success. Decades of research and evidence from other states show that children whose families receive more income from the EITC are likelier to excel in school, graduate high school, attend college and earn more as adults. Over time this helps break the cycle of poverty.[3]

The EITC Supports Hardworking Georgians from All Walks of Life

The federal EITC is a credit against income taxes designed to supplement the wages of low- and moderate-income people. It is available only to people who work, providing a strong incentive for people to enter the workforce and put in more hours. Established in 1975, the program developed a base of bipartisan support which led to subsequent enhancements under Presidents Reagan, Clinton, W. Bush and Obama. EITC expansions in the mid-1990s helped move half a million families from cash welfare to work, according to a landmark study.[4] Roughly half of all taxpayers with children make use of the EITC at some point in their lives, usually for a year or two at a time.[5]

The size of the credit depends on a family’s income, marriage status and number of dependent children. The largest value goes to families making from about $10,000 to $24,000 a year, though families making up to about $39,000 to $53,000 (depending on number of children) still benefit. The federal credit is refundable, which means that if a family’s credit exceeds their income tax liability, they receive the spillover as a refund. A detailed explanation of how the credit works is provided in the Appendix. Below are some key facts about who benefits from the federal EITC. These same families would qualify for a Georgia state match.

- About 1 million Georgia families claimed the federal EITC in 2014, 26 percent of all Georgia households.[6] These families include an estimated 2.6 million individual Georgians, including 1.2 million children.[7]

- An estimated 770,000 working mothers and 410,000 working fathers were in Georgia households that received the credit in 2012.[8]

- More than 80,000 veterans and military families in Georgia got the federal EITC in 2012. About a quarter of these households include an active service member, and the others include a veteran.[9]

- The EITC lifted an average of 248,000 Georgians, including 131,000 children, out of poverty each year, from 2011 to 2013.[10]

Georgians who receive the federal credit and would qualify for a state match work in a range of professions throughout the state. About 27 percent of recipients work in retail or hospitality, 20 percent in construction or manufacturing and another 10 percent in health care. More details below.

| Top Five Industries | Top Five Occupations | |||

| Retail | 14.6% | Office and Administrative | 13.5% | |

| Food Service and Hospitality | 12.5% | Retail Salesperson | 11.6% | |

| Health Care | 10.1% | Food Preparation and Related Services | 10.2% | |

| Construction | 9.9% | Transportation and Material Moving | 9.6% | |

| Manufacturing | 9.3% | Construction, Resource Extraction | 8.7% | |

Share of Georgia EITC population, by industry and occupation, 2013

Source: “Characteristics of the EITC-Eligible Population,” Brookings Institution

The EITC Delivers Big Bucks to Georgia Communities

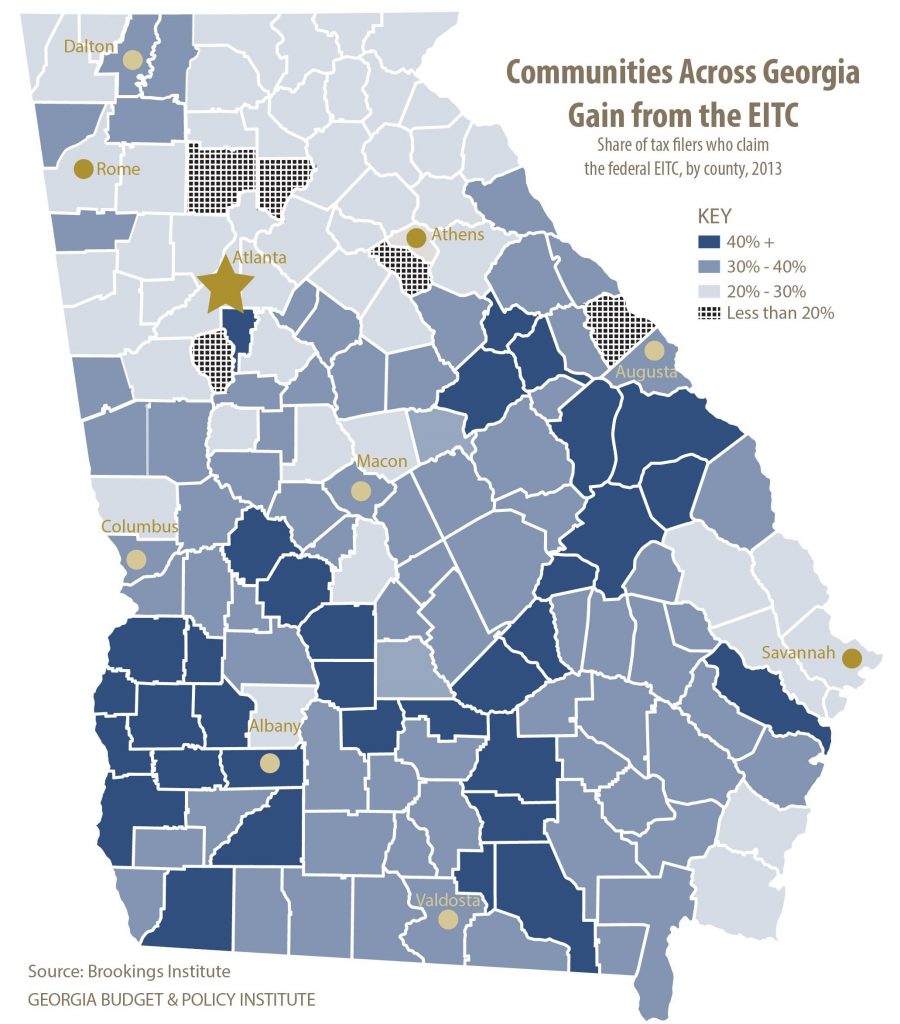

In 2013, the most recent year available at the county level, the federal EITC injected $2.93 billion into local Georgia economies. In 154 of Georgia’s 159 counties, at least 20 percent of households filing a federal income tax return claimed the credit that year. The share of recipients exceeds 30 or 40 percent in many counties, as shown below. The average benefit for EITC families is $2,700 per year, money which recipients often spend locally.[11]

A Georgia Work Credit Can Build on the Federal EITC’s Success

A Georgia Work Credit Can Build on the Federal EITC’s Success

Twenty-six states and the District of Columbia enhance the considerable value of the federal credit by providing their own state match. These state credits provide a modest yet critical boost for taxpayers who already receive the federal EITC. State EITCs are typically claimed as a percentage of the federal credit’s value, ranging from a low of 3.5 percent in Louisiana to a high of 40 percent in Washington, D.C.[12] Here is one example of what this means in practice. In a state with a 10 percent EITC, a family with a $3,000 federal credit receives a $300 state match.

In all but four states with an EITC, that extra $300 would help to reduce the full range of state and local taxes that low-income families pay. That’s because most states allow working individuals and families to keep the full value of the credit, even if it exceeds their state income taxes. This is important because lower earning households spend a greater share of their income paying other taxes, like sales taxes and fees, than do affluent households.[13]

A refundable state EITC helps correct that imbalance and lets working people keep more of what they earn. The extra funds help working families afford basic necessities like food and child care, as well as larger investments that smooth the path to the middle class. One recent survey of tax credit recipients estimated that 87 percent of EITC dollars went to either paying bills, saving, affording basic needs or making personal investments such as course tuition, reliable transportation or more livable housing.[14]

More Than Half of States Enhance the EITC

A Georgia Work Credit Can Cut Georgians’ Taxes from the Bottom Up

A state EITC would reduce taxes for Georgians who need it the most – workers in low-wage jobs and their families striving toward the middle class. Through its unique design, a Georgia Work Credit can reduce income taxes from the bottom up, rather than the top down. That stands in stark contrast to the more common tax-cut approach of reducing income tax rates, a tactic that disproportionately benefits people at the top.[15] Consider three hypothetical cases of Georgia families can benefit from a Georgia Work Credit. These examples assume lawmakers set Georgia’s new work credit at 10 percent of the federal level. A lower state match would deliver smaller though still meaningful benefits, which would accrue over time if recipients receive the credit for more than one year.

Jane is a single mother of one in Macon who works full-time as a cashier, making minimum wage. She earns $14,500 annually before taxes, so she would owe about $189 a year in Georgia state income taxes. A refundable Georgia Work Credit at 10 percent of the federal credit comes out to $337 for Jane, delivering her an estimated state refund of $148. That offsets her state income taxes and also delivers an indirect tax cut against some of the other state and local taxes she contributes, such as sales taxes on everyday purchases.

Jack and Sarah are a young Atlanta couple with two children. She works part time as a home health aide; he tends bar at a local restaurant. Their combined income is $29,000. They owe an estimated $496 a year in Georgia state income taxes. A 10 percent Georgia Work Credit comes out to an estimated $446 for them, dropping their Georgia income tax bill down to $50. They use the savings for child care, transportation and other investments critical to staying employed and moving to the middle class.[16]

Married Couple, Three Children

Married Couple, Three Children

Brooke and Jamal live in Athens with three kids. He works construction almost full time, while she puts in a few hours a week as a substitute teacher. With an income of $42,000, they would owe Georgia an estimated $1,096. Because they’re nearing the middle class, this family’s benefit is in the process of gradually phasing out. But a 10 percent Georgia Work Credit would still reduce their state income tax bill by $242.

Enacting a bottom-up tax cut rather than a top-down approach such as cutting the top rate responds to two key drawbacks in Georgia’s tax system.

First, as in most states, low- and middle-income Georgians pay a greater share of their income in state and local taxes than do the wealthy. This is known as a regressive tax structure. The poorest fifth of Georgia taxpayers pay an average 10.6 percent of their annual income in state and local taxes and the middle fifth pays 9.6 percent, while the wealthiest 1 percent pays only 5 percent on average.[17]

Regressive Taxes Call for Bottom-Up Approach

Georgia’s state and local taxes as a share of family income, non-elderly taxpayers, 2015 income levels

Second, Georgia’s income tax contains a design flaw that causes it to fall more sharply on workers with small paychecks than do other states’ systems. Georgia’s income tax is mostly unchanged from the 1930s, when $10,000 a year was considered a high-wage salary. As a result, the state’s income tax starts applying to families at unusually low levels of income. Georgia parents in poverty with two children faced the third highest income tax in the country in 2013.[18]

A Georgia Work Credit Can Boost Main Street Businesses and Communities

The EITC also helps communities thrive by putting more money in the pockets of those who earn low wages and are most likely to spend additional money in local businesses, creating a ripple effect throughout the economy.[19]

A refundable Georgia Work Credit set at 10 percent of the federal credit would provide an estimated $308 million to Georgia consumers. Those additional funds can further enhance the economic value of the federal credit, providing a needed boost for local businesses and communities.[20] The table below shows the potential value of a Georgia Work Credit in the state’s 10 most populous counties. Estimates of how many dollars a work credit could send to all Georgia counties are available in the appendix.

Potential Georgia Work Credit Value in Select Georgia Counties

| County | #Tax Filers Claiming EITC* | EITC Share of All Returns* | Federal EITC Dollars Received† | Value of 10% Refundable Credit† | Value of 5% Refundable Credit† | |

| METRO ATLANTA | ||||||

| Clayton | 45,005 | 41.4% | $153,088,915 | $13,778,002 | $6,889,001 | |

| Cobb | 59,661 | 20.1% | $177,340,654 | $15,960,659 | $7,980,329 | |

| DeKalb | 87,721 | 29.0% | $276,791,033 | $24,911,193 | $12,455,596 | |

| Fulton | 94,985 | 24.4% | $298,949,149 | $26,905,423 | $13,452,712 | |

| Gwinnett | 86,837 | 25.1% | $269,269,322 | $24,234,239 | $12,117,120 | |

| OTHER POPULATION CENTERS | ||||||

| Bibb (Macon) | 21,813 | 36.2% | $74,426,647 | $6,698,398 | $3,349,199 | |

| Chatham (Savannah) | 32,003 | 28.6% | $96,681,640 | $8,701,348 | $4,350,674 | |

| Dougherty (Albany) | 14,804 | 41.9% | $52,054,825 | $4,684,934 | $2,342,467 | |

| Hall (Gainesville) | 18,139 | 24.6% | $56,349,413 | $5,071,447 | $2,535,724 | |

| Muscogee (Columbus) | 29,312 | 35.0% | $96,722,383 | $8,705,014 | $4,352,507 | |

| Lowndes (Valdosta) | 13,566 | 32.9% | $42,668,089 | $3,840,128 | $1,920,064 | |

| Richmond (Augusta) | 28,960 | 36.3% | $94,960,320 | $8,546,429 | $4,273,214 | |

Source: GBPI analysis of 2013 IRS data on EITC receipt by Georgia county and Joint Committee on Taxation estimates of 2017 EITC nationwide cost

* Number of tax filers claiming the EITC and percentage share of EITC returns of all returns based on data from 2013

† Federal dollars received by counties from the EITC and the potential value of 10% or 5% refundable credit based on projections for 2017

Studies indicate that the federal EITC delivers a multiplier effect, with every $1 of tax credit claimed by local taxpayers generating between about $1 and $2 of local economic activity. For example, the city of San Antonio estimates each additional EITC dollar generates another $1.58 in local economic activity, and each $37,000 of activity results in one additional job.[21] A similar analysis in Michigan finds an estimated $1.67 worth of economic benefit for each EITC dollar.[22] And a rigorous study in California suggests that in some communities the credit can create economic impacts equivalent to at least twice the amount of EITC dollars received.[23]

A Georgia Work Credit Can Help Put Children on a Path to Success

The potential value of enacting a new Georgia Work Credit extends beyond the workers who directly receive the credit. Decades of expert research and evidence from other states shows that children living in EITC households receive outsized benefits from the extra money provided by the policy. By providing a targeted boost to families straddling the line between poverty and self-sufficiency, the credit helps stabilize family finances and provide better opportunities for children to thrive in adolescence and escape poverty as adults. Studies link the EITC to several key benefits that strengthen children’s foundation for success as students, workers and eventually parents.

Healthier from the start. Researchers cite links between larger EITCs and improvements in infant health indicators such as birth weight and premature birth. Expert studies also suggest receiving an expanded tax credit may improve maternal health, including positive outcomes such as lower mental stress, lower likelihood to smoke during pregnancy and higher likelihood to seek out prenatal care. Promoting healthy behavior among pregnant women and young mothers is the first possible step to giving kids a firm foundation.

Healthier from the start. Researchers cite links between larger EITCs and improvements in infant health indicators such as birth weight and premature birth. Expert studies also suggest receiving an expanded tax credit may improve maternal health, including positive outcomes such as lower mental stress, lower likelihood to smoke during pregnancy and higher likelihood to seek out prenatal care. Promoting healthy behavior among pregnant women and young mothers is the first possible step to giving kids a firm foundation.

Better school performance. Nationwide the EITC is linked to higher test scores, especially in math, for low-income students in elementary and middle-school. A credit worth around $3,000 during a child’s early years may boost performance by about the equivalent of two extra months of school.[24]

Better school performance. Nationwide the EITC is linked to higher test scores, especially in math, for low-income students in elementary and middle-school. A credit worth around $3,000 during a child’s early years may boost performance by about the equivalent of two extra months of school.[24]

Graduate high school and attend college. Rates of high school graduation and college attendance are also higher for students in EITC families, compared to young people in poor families not getting the credit. One study estimated a $1,000 boost for an EITC-eligible family with a high school senior raised the likelihood of college attendance the next fall by 10 percent.[25] For working families, even a small amount can mean the difference between affording the cost of classes or not.

Graduate high school and attend college. Rates of high school graduation and college attendance are also higher for students in EITC families, compared to young people in poor families not getting the credit. One study estimated a $1,000 boost for an EITC-eligible family with a high school senior raised the likelihood of college attendance the next fall by 10 percent.[25] For working families, even a small amount can mean the difference between affording the cost of classes or not.

Succeed in the workforce. Children in EITC families are likelier to work more hours and earn more when they enter the workforce as adults. One study says for each $3,000 a year in added income a child in a poor family receives from the EITC before age six, earnings as an adult rise by 17 percent.[26]

Succeed in the workforce. Children in EITC families are likelier to work more hours and earn more when they enter the workforce as adults. One study says for each $3,000 a year in added income a child in a poor family receives from the EITC before age six, earnings as an adult rise by 17 percent.[26]

A Georgia Work Credit is an Ambitious yet Affordable Investment

Enacting a Georgia Work Credit is an ambitious investment in more than 1 million families trying to break the cycle of poverty and ascend the economic ladder. As such, it does carry an attendant cost in lost state revenue.

A refundable Georgia Work Credit set at 10 percent of the federal EITC costs an estimated $308 million a year, while one set at a 5 percent state match costs $154 million. State lawmakers can exercise complete discretion over the size of a Georgia EITC and can control the budget impact by selecting the state match with which they’re most comfortable. In order to keep the program affordable, some other states started small and then built on the program over time. Lawmakers can also consider phasing in a refundable credit’s value over a few years, as is common with other state tax credits.

Costs of Georgia Work Credit Vary Based on Size of State Match

Revenue impact of Georgia refundable EITC at varying shares of federal credit, millions, FY 2017

A nonrefundable option also carries lower costs. But letting families keep the credit’s full value is critical to its success. Workers with very low wages pay little in state income taxes, despite significant contributions through sales taxes and various fees. Taking away the option for a refund significantly limits whether a state EITC can reach those hardworking families who need a hand the most. A better option for lawmakers concerned about potential costs is to select a lower percentage for Georgia’s state match, rather than removing refundability.

Numerous options exist for offsetting this worthy investment, such as reviewing outdated sales tax exemptions or limiting the most general income tax deductions.[27] Perhaps the most attractive way to offset the cost is for Georgia lawmakers to join the parade of states closing an unjustifiable loophole in the state’s income tax, referred to by some as the double-deduction loophole.

Closing the Double-Deduction Loophole is One Option to Pay for a Georgia Work Credit

Georgia is one of four states that allow taxpayers to claim a particularly unusual tax break which is only available to households that itemize their deductions. Oddly enough, Georgia taxpayers who choose to itemize can now write off their state income tax payments when calculating how much state income tax they owe. This circular deduction exists largely by accident. Georgia lawmakers inherited this quirk in the code because the state offers the same package of itemized deductions made available at the federal level. Forty-six states disallow this practice, including Oklahoma where Republican Gov. Mary Fallin successfully pushed for its repeal in 2016.[28] Ending the policy could net Georgia as much as an estimated $460 million a year.[29]

Conclusion

State legislators can seize the opportunity to invest in Georgia’s future prosperity by enacting a state Earned Income Tax Credit, or Georgia Work Credit. It is a targeted, ambitious and affordable way to cut taxes from the bottom-up, keep people working toward self-sufficiency and help local communities thrive. The experience from other states is clear that EITCs can help build the middle class, strengthen local economies and keep young people on the path to the workforce. It is a smart way for Georgia to chart a better course forward.

Appendix: How the EITC Keeps People Working and Helps Families with Kids

The federal EITC boosts the wages of low- and moderate-income workers and their families. It helps keep them on the job, off welfare and moving toward the middle class. The size of each taxpayer’s credit varies based on their annual income, marriage status and number of dependent children.

The EITC’s value grows up to a certain threshold based on income and family size, at which point it plateaus and then begins to phase down. The largest credit goes to families with children making about $10,000 to $24,000 a year. It gradually phases out as workers begin to earn more, decreasing to zero at about double the poverty level of income. The credit fully phases out between $39,000 and $53,000, depending on marriage status and number of children. This unique structure is designed to help families the most as they escape poverty but still provide some value as they gain a firmer economic footing.

The credit is refundable, which means a family gets the full value of the credit even if it exceeds their income tax liability. Technically referred to as refundability, this is arguably the most critical component of the policy because it allows the credit to still reward work even if workers have small state income tax bills. Without this component, the EITC does far less to reduce poverty and encourage work, particularly among workers earning the least.

EITC’s Unique Structure Rewards, Encourages Work

Federal EITC value by income, marriage status and number of children, 2015

Appendix: Georgia Work Credit Value by County

| Federal EITC Receipt and Potential Georgia Work Credit Value, by County | |||||

| Georgia COUNTY | Number of Tax Filers Claiming EITC, 2013 | EITC Returns as a Share of All Returns, 2013 | Total Dollar Amount of Federal EITC Received (Projected 2017) | Projected Value of 10% Refundable Credit to County (2017) | Projected Value of 5% Refundable Credit to County (2017) |

| Appling | 2,122 | 33.5% | $6,968,049 | $627,124 | $313,562 |

| Atkinson | 1,184 | 43.4% | $3,914,901 | $352,341 | $176,171 |

| Bacon | 1,477 | 38.4% | $4,924,472 | $443,203 | $221,601 |

| Baker | 363 | 40.0% | $1,182,300 | $106,407 | $53,204 |

| Baldwin | 5,260 | 34.2% | $17,960,977 | $1,616,488 | $808,244 |

| Banks | 1,926 | 28.5% | $5,839,459 | $525,551 | $262,776 |

| Barrow | 7,259 | 25.4% | $21,634,594 | $1,947,113 | $973,557 |

| Bartow | 10,475 | 26.7% | $31,770,027 | $2,859,302 | $1,429,651 |

| Ben Hill | 2,629 | 40.3% | $8,336,883 | $750,319 | $375,160 |

| Berrien | 2,057 | 35.4% | $6,524,678 | $587,221 | $293,611 |

| Bibb | 21,813 | 36.2% | $74,426,647 | $6,698,398 | $3,349,199 |

| Bleckley | 1,338 | 32.3% | $4,486,015 | $403,741 | $201,871 |

| Brantley | 2,048 | 34.7% | $6,542,960 | $588,866 | $294,433 |

| Brooks | 2,132 | 36.5% | $6,661,051 | $599,495 | $299,747 |

| Bryan | 3,070 | 22.2% | $9,285,205 | $835,668 | $417,834 |

| Bulloch | 6,947 | 29.8% | $21,740,658 | $1,956,659 | $978,330 |

| Burke | 3,574 | 40.6% | $12,163,156 | $1,094,684 | $547,342 |

| Butts | 2,640 | 31.8% | $8,424,793 | $758,231 | $379,116 |

| Calhoun | 786 | 42.1% | $2,703,627 | $243,326 | $121,663 |

| Camden | 5,201 | 26.4% | $15,271,442 | $1,374,430 | $687,215 |

| Candler | 1,331 | 37.5% | $4,505,738 | $405,516 | $202,758 |

| Carroll | 11,547 | 27.5% | $35,814,797 | $3,223,332 | $1,611,666 |

| Catoosa | 5,918 | 24.2% | $16,818,764 | $1,513,689 | $756,844 |

| Charlton | 1,200 | 37.0% | $3,781,079 | $340,297 | $170,149 |

| Chatham | 32,003 | 28.6% | $96,681,640 | $8,701,348 | $4,350,674 |

| Chattahoochee | 1,198 | 39.3% | $3,795,164 | $341,565 | $170,782 |

| Chattooga | 2,962 | 33.9% | $8,652,319 | $778,709 | $389,354 |

| Cherokee | 14,190 | 15.7% | $38,760,972 | $3,488,487 | $1,744,244 |

| Clarke | 10,983 | 26.3% | $32,597,854 | $2,933,807 | $1,466,903 |

| Clay | 454 | 49.0% | $1,627,194 | $146,447 | $73,224 |

| Clayton | 45,005 | 41.4% | $153,088,915 | $13,778,002 | $6,889,001 |

| Clinch | 1,026 | 44.6% | $3,389,666 | $305,070 | $152,535 |

| Cobb | 59,661 | 20.1% | $177,340,654 | $15,960,659 | $7,980,329 |

| Coffee | 5,874 | 41.3% | $19,990,393 | $1,799,135 | $899,568 |

| Colquitt | 6,330 | 39.9% | $21,472,962 | $1,932,567 | $966,283 |

| Columbia | 9,688 | 17.9% | $26,815,626 | $2,413,406 | $1,206,703 |

| Cook | 2,313 | 38.3% | $7,439,717 | $669,575 | $334,787 |

| Coweta | 11,118 | 20.3% | $34,514,027 | $3,106,262 | $1,553,131 |

| Crawford | 1,559 | 30.8% | $4,914,605 | $442,314 | $221,157 |

| Crisp | 3,528 | 45.2% | $11,933,427 | $1,074,008 | $537,004 |

| Dade | 1,435 | 25.4% | $3,907,296 | $351,657 | $175,828 |

| Dawson | 1,876 | 20.5% | $5,063,062 | $455,676 | $227,838 |

| Decatur | 4,067 | 40.7% | $14,211,400 | $1,279,026 | $639,513 |

| DeKalb | 87,721 | 29.0% | $276,791,033 | $24,911,193 | $12,455,596 |

| Dodge | 2,609 | 38.3% | $8,732,157 | $785,894 | $392,947 |

| Dooly | 1,552 | 41.7% | $5,421,147 | $487,903 | $243,952 |

| Dougherty | 14,804 | 41.9% | $52,054,825 | $4,684,934 | $2,342,467 |

| Douglas | 15,411 | 28.0% | $48,191,812 | $4,337,263 | $2,168,632 |

| Early | 1,704 | 43.6% | $6,011,322 | $541,019 | $270,510 |

| Echols | 440 | 32.8% | $1,416,025 | $127,442 | $63,721 |

| Effingham | 5,003 | 22.6% | $14,970,994 | $1,347,389 | $673,695 |

| Elbert | 2,482 | 33.8% | $7,726,437 | $695,379 | $347,690 |

| Emanuel | 3,476 | 43.4% | $12,236,759 | $1,101,308 | $550,654 |

| Evans | 1,498 | 37.5% | $5,065,709 | $455,914 | $227,957 |

| Fannin | 2,418 | 27.9% | $6,993,690 | $629,432 | $314,716 |

| Fayette | 6,315 | 13.9% | $17,626,973 | $1,586,428 | $793,214 |

| Floyd | 10,450 | 29.3% | $33,447,830 | $3,010,305 | $1,505,152 |

| Forsyth | 8,295 | 11.4% | $22,043,996 | $1,983,960 | $991,980 |

| Franklin | 2,348 | 29.1% | $6,938,803 | $624,492 | $312,246 |

| Fulton | 94,985 | 24.4% | $298,949,149 | $26,905,423 | $13,452,712 |

| Gilmer | 2,956 | 27.3% | $9,256,724 | $833,105 | $416,553 |

| Glascock | 337 | 32.4% | $1,039,339 | $93,541 | $46,770 |

| Glynn | 8,825 | 27.2% | $27,185,065 | $2,446,656 | $1,223,328 |

| Gordon | 6,505 | 31.0% | $20,225,052 | $1,820,255 | $910,127 |

| Grady | 3,253 | 35.7% | $10,715,984 | $964,439 | $482,219 |

| Greene | 2,012 | 30.9% | $6,624,799 | $596,232 | $298,116 |

| Gwinnett | 86,837 | 25.1% | $269,269,322 | $24,234,239 | $12,117,120 |

| Habersham | 3,868 | 24.4% | $11,275,567 | $1,014,801 | $507,401 |

| Hall | 18,139 | 24.6% | $56,349,413 | $5,071,447 | $2,535,724 |

| Hancock | 1,379 | 47.1% | $4,619,942 | $415,795 | $207,897 |

| Haralson | 2,957 | 29.3% | $9,182,273 | $826,405 | $413,202 |

| Harris | 2,726 | 20.3% | $8,091,542 | $728,239 | $364,119 |

| Hart | 2,684 | 29.0% | $8,131,888 | $731,870 | $365,935 |

| Heard | 1,241 | 31.4% | $3,904,278 | $351,385 | $175,693 |

| Henry | 23,665 | 27.3% | $74,582,003 | $6,712,380 | $3,356,190 |

| Houston | 15,468 | 24.9% | $48,849,912 | $4,396,492 | $2,198,246 |

| Irwin | 1,240 | 38.8% | $3,954,264 | $355,884 | $177,942 |

| Jackson | 5,432 | 22.6% | $15,986,283 | $1,438,766 | $719,383 |

| Jasper | 1,542 | 30.7% | $4,959,874 | $446,389 | $223,194 |

| Jeff Davis | 1,860 | 37.7% | $6,154,154 | $553,874 | $276,937 |

| Jefferson | 2,717 | 42.2% | $9,014,761 | $811,329 | $405,664 |

| Jenkins | 1,213 | 43.1% | $4,307,401 | $387,666 | $193,833 |

| Johnson | 1,156 | 39.1% | $3,908,472 | $351,762 | $175,881 |

| Jones | 3,207 | 29.8% | $10,374,686 | $933,722 | $466,861 |

| Lamar | 2,155 | 33.6% | $6,791,955 | $611,276 | $305,638 |

| Lanier | 1,121 | 40.8% | $3,731,068 | $335,796 | $167,898 |

| Laurens | 6,852 | 37.3% | $22,674,922 | $2,040,743 | $1,020,371 |

| Lee | 3,129 | 26.5% | $9,845,816 | $886,123 | $443,062 |

| Liberty | 9,916 | 40.2% | $33,116,061 | $2,980,445 | $1,490,223 |

| Lincoln | 897 | 30.4% | $2,673,128 | $240,582 | $120,291 |

| Long | 1,541 | 38.1% | $4,953,123 | $445,781 | $222,891 |

| Lowndes | 13,566 | 32.9% | $42,668,089 | $3,840,128 | $1,920,064 |

| Lumpkin | 2,483 | 23.2% | $6,913,535 | $622,218 | $311,109 |

| Macon | 1,806 | 43.3% | $6,196,972 | $557,727 | $278,864 |

| Madison | 2,955 | 27.8% | $8,977,978 | $808,018 | $404,009 |

| Marion | 1,010 | 37.8% | $3,403,677 | $306,331 | $153,165 |

| McDuffie | 3,138 | 37.0% | $10,131,166 | $911,805 | $455,902 |

| McIntosh | 1,430 | 33.5% | $4,519,742 | $406,777 | $203,388 |

| Meriwether | 3,064 | 35.9% | $10,378,872 | $934,098 | $467,049 |

| Miller | 789 | 37.1% | $2,582,842 | $232,456 | $116,228 |

| Mitchell | 3,318 | 42.7% | $11,437,365 | $1,029,363 | $514,681 |

| Monroe | 2,758 | 27.0% | $8,383,334 | $754,500 | $377,250 |

| Montgomery | 1,032 | 36.5% | $3,368,113 | $303,130 | $151,565 |

| Morgan | 1,912 | 26.5% | $5,983,166 | $538,485 | $269,242 |

| Murray | 4,589 | 32.9% | $13,884,777 | $1,249,630 | $624,815 |

| Muscogee | 29,312 | 35.0% | $96,722,383 | $8,705,014 | $4,352,507 |

| Newton | 13,025 | 32.7% | $42,642,141 | $3,837,793 | $1,918,896 |

| Oconee | 2,086 | 16.6% | $5,711,946 | $514,075 | $257,038 |

| Oglethorpe | 1,556 | 27.5% | $4,705,826 | $423,524 | $211,762 |

| Paulding | 13,119 | 23.7% | $39,136,773 | $3,522,310 | $1,761,155 |

| Peach | 3,158 | 30.8% | $9,789,897 | $881,091 | $440,545 |

| Pickens | 2,438 | 21.0% | $6,962,474 | $626,623 | $313,311 |

| Pierce | 2,105 | 30.8% | $6,405,340 | $576,481 | $288,240 |

| Pike | 1,652 | 25.2% | $4,902,830 | $441,255 | $220,627 |

| Polk | 4,856 | 32.2% | $15,347,408 | $1,381,267 | $690,633 |

| Pulaski | 1,100 | 32.4% | $3,494,630 | $314,517 | $157,258 |

| Putnam | 2,534 | 31.1% | $8,304,692 | $747,422 | $373,711 |

| Quitman | 416 | 43.9% | $1,358,271 | $122,244 | $61,122 |

| Rabun | 1,587 | 25.1% | $4,483,062 | $403,476 | $201,738 |

| Randolph | 1,148 | 45.8% | $3,938,943 | $354,505 | $177,252 |

| Richmond | 28,960 | 36.3% | $94,960,320 | $8,546,429 | $4,273,214 |

| Rockdale | 10,118 | 30.5% | $32,794,493 | $2,951,504 | $1,475,752 |

| Schley | 533 | 35.0% | $1,783,588 | $160,523 | $80,261 |

| Screven | 1,946 | 38.0% | $6,203,823 | $558,344 | $279,172 |

| Seminole | 1,234 | 39.1% | $4,234,330 | $381,090 | $190,545 |

| Spalding | 8,830 | 36.3% | $30,277,556 | $2,724,980 | $1,362,490 |

| Stephens | 2,835 | 29.7% | $8,480,997 | $763,290 | $381,645 |

| Stewart | 797 | 46.4% | $2,852,268 | $256,704 | $128,352 |

| Sumter | 4,524 | 39.9% | $15,323,571 | $1,379,121 | $689,561 |

| Talbot | 960 | 38.6% | $3,217,103 | $289,539 | $144,770 |

| Taliaferro | 253 | 40.6% | $757,591 | $68,183 | $34,092 |

| Tattnall | 2,952 | 34.3% | $10,097,743 | $908,797 | $454,398 |

| Taylor | 1,175 | 40.5% | $4,061,318 | $365,519 | $182,759 |

| Telfair | 1,550 | 41.1% | $5,235,806 | $471,223 | $235,611 |

| Terrell | 1,737 | 47.1% | $6,233,963 | $561,057 | $280,528 |

| Thomas | 5,835 | 33.7% | $18,391,663 | $1,655,250 | $827,625 |

| Tift | 5,733 | 37.3% | $18,651,155 | $1,678,604 | $839,302 |

| Toombs | 3,854 | 37.8% | $13,307,586 | $1,197,683 | $598,841 |

| Towns | 887 | 20.7% | $2,354,779 | $211,930 | $105,965 |

| Treutlen | 832 | 42.0% | $2,886,014 | $259,741 | $129,871 |

| Troup | 9,568 | 35.3% | $33,246,563 | $2,992,191 | $1,496,095 |

| Turner | 1,417 | 44.2% | $4,844,683 | $436,021 | $218,011 |

| Twiggs | 1,395 | 39.8% | $4,579,707 | $412,174 | $206,087 |

| Union | 1,847 | 22.0% | $5,088,928 | $458,004 | $229,002 |

| Upson | 3,443 | 34.5% | $10,809,916 | $972,892 | $486,446 |

| Walker | 6,909 | 28.7% | $19,742,815 | $1,776,853 | $888,427 |

| Walton | 8,812 | 26.0% | $27,476,275 | $2,472,865 | $1,236,432 |

| Ware | 4,640 | 36.1% | $15,085,133 | $1,357,662 | $678,831 |

| Warren | 901 | 41.8% | $2,825,455 | $254,291 | $127,145 |

| Washington | 2,884 | 38.8% | $9,781,494 | $880,334 | $440,167 |

| Wayne | 3,329 | 33.7% | $10,892,558 | $980,330 | $490,165 |

| Webster | 282 | 42.0% | $935,265 | $84,174 | $42,087 |

| Wheeler | 592 | 40.0% | $1,937,562 | $174,381 | $87,190 |

| White | 2,464 | 25.4% | $7,114,334 | $640,290 | $320,145 |

| Whitfield | 11,891 | 31.3% | $36,855,743 | $3,317,017 | $1,658,508 |

| Wilcox | 998 | 37.8% | $3,295,058 | $296,555 | $148,278 |

| Wilkes | 1,284 | 35.3% | $4,099,464 | $368,952 | $184,476 |

| Wilkinson | 1,418 | 37.5% | $4,657,787 | $419,201 | $209,600 |

| Worth | 2,983 | 37.6% | $9,642,448 | $867,820 | $433,910 |

| Georgia, Total | 1,084,452 | 27.9% | $3,422,000,000 | $307,980,000 | $153,990,000 |

| Source: GBPI analysis of 2013 IRS data on EITC receipt by Georgia county and Joint Committee on Taxation estimates of 2017 EITC nationwide cost | |||||

Endnotes

[1] Internal Revenue Service SOI Tax Stats – Historic Table 2. Georgia, 2014.

[2] “The EITC: A Powerful Savings Program for Low-Wage Workers,” CFED. July 2015. Also see Sarah Halpern-Meekin et al., “It’s Not Like I’m Poor,” 2015.

[3] “EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds,” Center on Budget & Policy Priorities. April 3, 2015.

[4] “The Earned Income Tax Credit and Transfer Programs: A Study of Labor Market and Program participation,” Tax Policy and the Economy, Vol. 9, MIT Press, 1995.

[5] 61 percent of EITC recipients from 1989 to 2006 got the credit for only one or two years at a time. Ibid.

[6] Internal Revenue Service SOI Tax Stats – Historic Table 2. Georgia, 2014.

[7] “Characteristics of the EITC-Eligible Population,” Brookings Institution. 2013. Precise estimates are 2,591,525 million people living in EITC-eligible homes, 1,183,013 of whom are children.

[8] Data provided upon request from the Washington, D.C.-based Center on Budget and Policy Priorities. More details available in the following two reports, which combine EITC recipients with parents receiving a separate federal tax benefit – the Additional Child Tax Credit – resulting in a higher overall number. “21 Million Mothers Benefit from Tax Credits for Working Families,” CBPP. May 2015. And “13 Million Fathers Benefit from Tax Credits for Working Families,” CBPP. May 2015.

[9] Data provided upon request from the Washington, D.C.-based Center on Budget and Policy Priorities. More details available in the following report, which combines EITC recipients with parents receiving the Additional Child Tax Credit, resulting in a higher number overall. “Pro-Work Tax Credits Help 2 Million Veterans and Military Families,” CBPP. June 2015.

[10] “State Estimates of People and Children Lifted out of Poverty by the EITC and CTC Each Year, 2011-2013,” Brookings Institution analysis of Supplemental Poverty Measure Public Use Data.

[11] Brookings report on local economies

[12] “States With EITCs,” Tax Credits for Working Families. Accessed 7/15/2015.

[13] A Georgia household with earnings under $16,000 in 2015 paid an average of 9.7 percent of their income in sales and property taxes, compared with 2.4 percent paid by Georgians making more than $432,000 a year. For more details, see “Who Pays?” Institute on Taxation and Economic Policy (ITEP). January 2015.

[14] “The EITC: A Powerful Savings Program for Low-Wage Workers,” CFED. July 2015. Also see Sarah Halpern-Meekin et al., “It’s Not Like I’m Poor,” 2015.

[15] For more details, see “Shifting from Income to Sales Taxes Would Raise Taxes for Many,” Georgia Budget & Policy Institute. December 2014.

[16] For more examples of the types of ways families spend their EITC, see “When Tax Credits are About More than Money,” The Atlantic. April 2015.

[17] Source: Institute on Taxation and Economic Policy. “Who Pays? 2015 Edition.” Updated Figures provided upon request and incorporate Georgia’s 2015 legislative changes, specifically the increased motor fuel taxes.

[18] The top three states for families of three with two children in 2013 were Alabama ($413), Hawaii ($272) and Georgia ($212). The top six states for families of four with two children were Alabama ($588), Hawaii ($317), Montana ($240), Illinois ($240), Oregon ($230) and Georgia ($202). For the full list of states, see “Taxing the Poor: State Income Tax Policies Make a Big Difference to Working Families,” National Center for Children in Poverty. November 2014.

[19] Low- and moderate-income families tend to spend most of their income on basic needs, whereas affluent families are more likely to save or invest. “Using the EITC to Stimulate Local Economies,” Brookings Institute. 2006.

[20] The additional local funds may also lead to slightly higher local tax revenues, which can help officials support core needs including schools and roads. The previously mentioned study in Baltimore found that about 0.4 percent of EITC were recaptured as new tax revenues.

[21] “Using the Earned Income Tax Credit to Stimulate Local Economies,” Brookings Institution. 2006.

[22] “Economic Benefits of the Earned Income Tax Credit in Michigan,” Anderson Economic Group. 2009.

[23] “The Economic Impact of the EITC in California,” California Journal of Politics and Policy. 2010.

[24] “EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds,” Center on Budget & Policy Priorities. April 3, 2015.

[25] Ibid.

[26] “Early-Childhood Poverty and Adult Attainment, Behavior, and Health,” Child Development. January/February 2010, 306-325.

[27] For more details, see “Menu of Revenue Options to Pave Way for Georgia’s Rebound: 2014 Update,” Georgia Budget & Policy Institute. June 2014.

[28] “OK Senate Passes Several Bills To Chip Away At Budget Deficit,” 5/17/2016.

[29] Estimated provided upon request by the nonpartisan Institute on Taxation and Economic Policy.

1 thought on “A Bottom-Up Tax Cut to Build Georgia’s Middle Class Update”

Pingback: Uplifting Georgia Moms this Mother’s Day | The Working Poor Families Project