|

Federal health care waivers allow states to “waive” or be exempt from certain federal health program requirements. States can try new approaches to managing health programs if they meet certain requirements for federal approval.

|

The Affordable Care Act of 2010 has played a significant role in helping Georgians access health care coverage by introducing consumer protections and creating the individual and small group markets. About 800,000 Georgians buy their health insurance through these marketplaces. Georgia’s uninsured rate dropped from 20 percent in 2010 to 13 percent in 2017, but the state still has the fourth-highest uninsured rate.[1]

Some uninsured people could be eligible for assistance to buy coverage, but cuts to outreach programs make it difficult to get them enrolled. Others cannot afford to enroll and keep their coverage due to rising premiums and high deductibles. Federal health care waivers can be used to help alleviate these challenges. In 2019, the Georgia Legislature passed legislation allowing the state to explore two types of health care waivers. The 1332 waiver relates to the marketplace; the 1115 waiver focused on Medicaid. This report will focus on the 1332 waiver. For information on the 1115 Medicaid waiver, see our other report.

States have successfully used 1332 waivers to fund programs that help lower health care premiums in the individual market. However, new federal guidance may allow states to pursue potentially harmful policies. Georgia can take the best step toward improving health by using the Section 1332 waiver to:

- Create a reinsurance program that captures federal savings and uses those funds to reduce premiums in the individual marketplace;

- Provide additional financial support and outreach assistance to help people who make less money enroll in the marketplace and afford to use their coverage; and

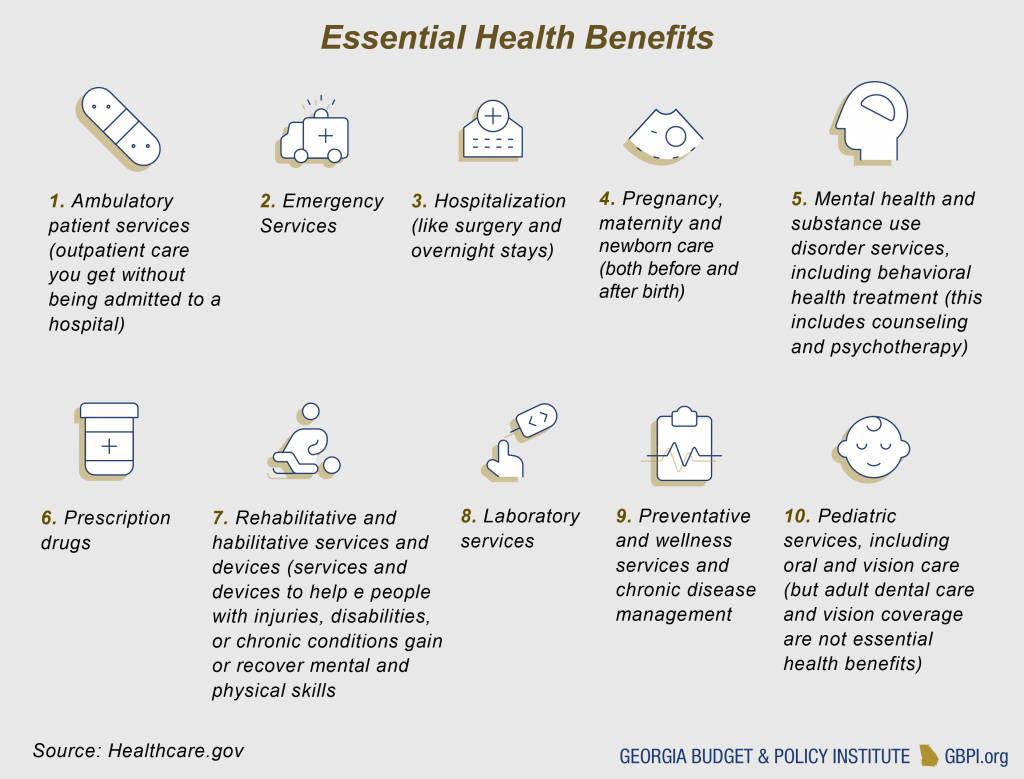

- Strengthen the market and protect consumers by ensuring plans cover all essential health benefits and maintain the premium tax credit structure.

Background on the Patients First Act

The Georgia General Assembly passed Senate Bill 106, the “Patients First Act,” on March 25, 2019, and Governor Kemp signed the bill into law effective March 27, 2019. The first part of the bill authorizes the state’s health agency to submit an 1115 waiver to propose changes to the Medicaid program (see our waiver report for more information). The second part of the bill allows the governor to submit one or more 1332 waiver requests. The 1332 waiver is used to make changes to the individual and small group markets created under the Affordable Care Act. The bill does not list any requirements for what must be included in this waiver, but it does include examples of what states can do with the waiver, such as reinsurance programs, changes to the premium tax credits, and the redefinition of essential health benefits. It authorizes the state to implement the 1332 waiver or waivers on or after January 1, 2020, upon federal approval.

The 1332 waiver was initially meant to work with an 1115 Medicaid waiver. Due to circumstances outlined in this report, these two waivers will no longer be able to work together in the way intended. Both types of waivers will follow their own separate process for submission.

Process for Submitting the 1332 Waiver (based on most current information)

The state is spending $1.92 million for Deloitte Consulting LLP to develop the request for the waivers. The 1332 waiver will have two 30-day public comment periods, one at the state level and one at the federal level. The 1332 waiver is also required to have public hearings. The state is required to respond to general themes from these comments and has the option to change the waiver application based on these suggestions. The state is currently planning to submit by December 31, 2019 (date is subject to change).

Affordable Care Act’s Section 1332 Waiver

The Section 1332 waiver, also known as a state innovation waiver or a State Relief and Empowerment Waiver, allows the state to change some regulations related to the individual and small group insurance market. The waiver plan must cover a similar number of residents as would be covered without the waiver, and the coverage must be at least as affordable and comprehensive as it would be without the waiver.

The Section 1332 waiver, also known as a state innovation waiver or a State Relief and Empowerment Waiver, allows the state to change some regulations related to the individual and small group insurance market. The waiver plan must cover a similar number of residents as would be covered without the waiver, and the coverage must be at least as affordable and comprehensive as it would be without the waiver.

The small group insurance market is available for businesses with 100 or fewer employees to purchase plans. About 350,000 Georgians are in the small group health insurance market.[2] The individual marketplace is found online at healthcare.gov; about 450,000 Georgians purchase their health insurance via this marketplace. Consumers making between 100 percent of the poverty line and 400 percent of the poverty line—such as individuals with income between $12,490 and $49,960 or families of three with income between $21,330 and $85,320—can receive federal tax credits to offset premiums costs (known as “premium tax credits” or “premium subsidies”). People making between 100 percent and 250 percent of poverty are also eligible for “cost-sharing reductions,” which require insurers to lower the deductibles, co-payments and out-of-pocket limits. Eighty-eight percent of marketplace enrollees receive federal tax credits to offset premium costs, and 65 percent receive the cost-sharing reductions. The ACA was designed to also provide affordable coverage to people below the poverty line through Medicaid expansion, but Georgia has thus far refused this option.

Even with 88 percent of enrollees receiving premium tax credits to mitigate premium increases, rising premiums in the individual market can put a strain on family budgets and make it harder to access care. Most states with 1332 waivers use them to reduce marketplace premiums by implementing a reinsurance program, which uses public funding to subsidize the costs associated with patients who have high health care expenses. Seven of the eight states with 1332 waivers use them for this purpose. However, states can also use this waiver to make changes to essential health benefits, limits on out-of-pocket costs and the premium tax credits. These types of changes could weaken the market and result in higher premiums or less robust coverage for some enrollees.

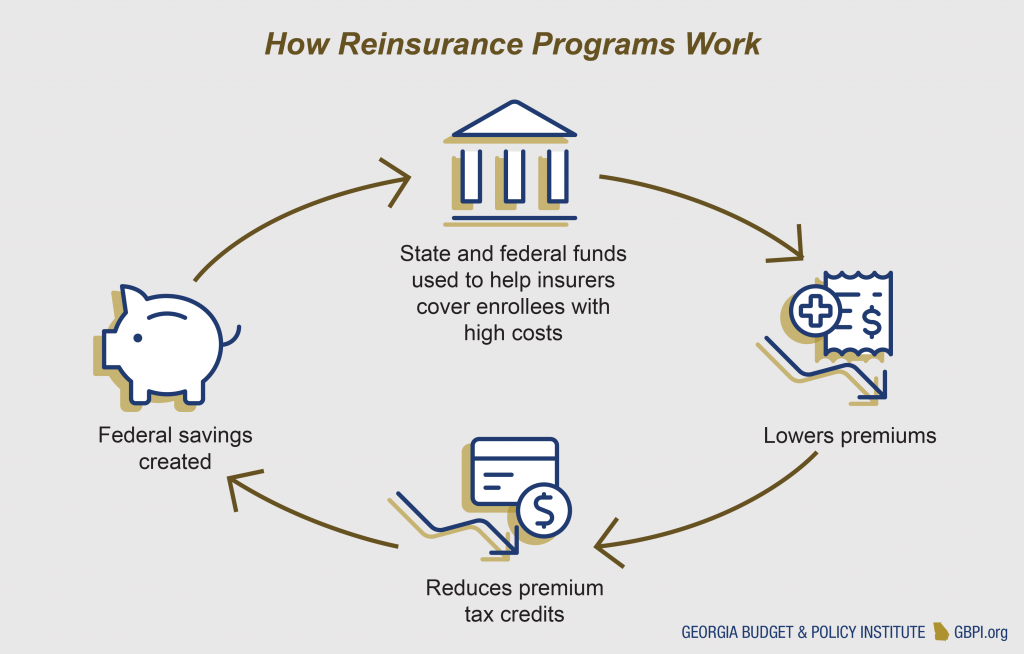

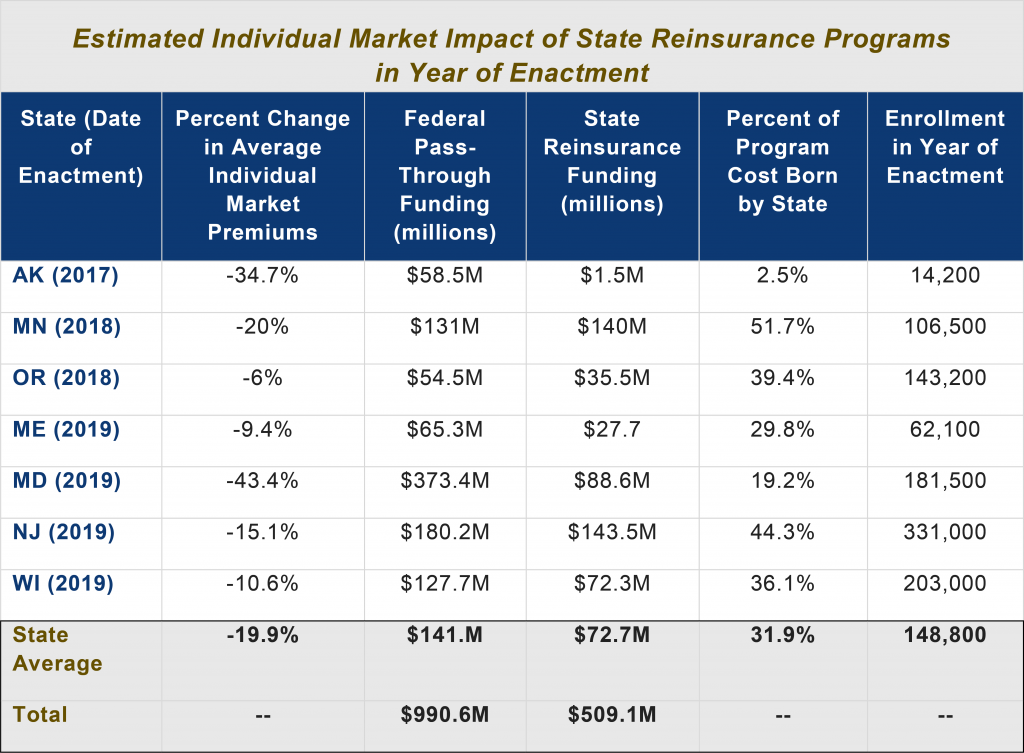

Recommendation 1: Use Federal Pass-Through Funding for a Reinsurance Program

Reinsurance programs use public funding to help cover some costs associated with people who have high health care expenses. By reducing the claims expenses for the highest-cost enrollees, insurers are protected from losses and can reduce their overall premiums. Because reinsurance programs reduce premium costs, the federal government would spend less on tax credits. These savings, known as federal pass-through funding, can be passed on to states, which can then use the funding to help pay for the costs of running the reinsurance program. Alaska was the first state to receive approval for a 1332 reinsurance waiver. Since then, six other states received approval. Reinsurance programs reduce individual market premiums by an average of 20 percent in the first year[3] A recent analysis estimates a reinsurance program in Georgia would reduce premiums by about $500 per year and result in $200 million in federal savings due to reduced premiums.[4]

Any reinsurance program Georgia pursues should reduce premiums and include targeted strategies for putting more of the money toward rural areas where premiums are higher. Colorado is helping to reduce premiums in rural areas by reducing a higher share of claims in areas with higher premiums.

Any reinsurance program Georgia pursues should reduce premiums and include targeted strategies for putting more of the money toward rural areas where premiums are higher. Colorado is helping to reduce premiums in rural areas by reducing a higher share of claims in areas with higher premiums.

Because the average state share of running a reinsurance program is 31 percent, cost is a challenge for states considering these efforts. Most states use general funds to pay for their share. New Jersey, however, is using funding from its penalty on residents who do not have health insurance, and Pennsylvania is using savings from its transition to a state-run marketplace.[5]

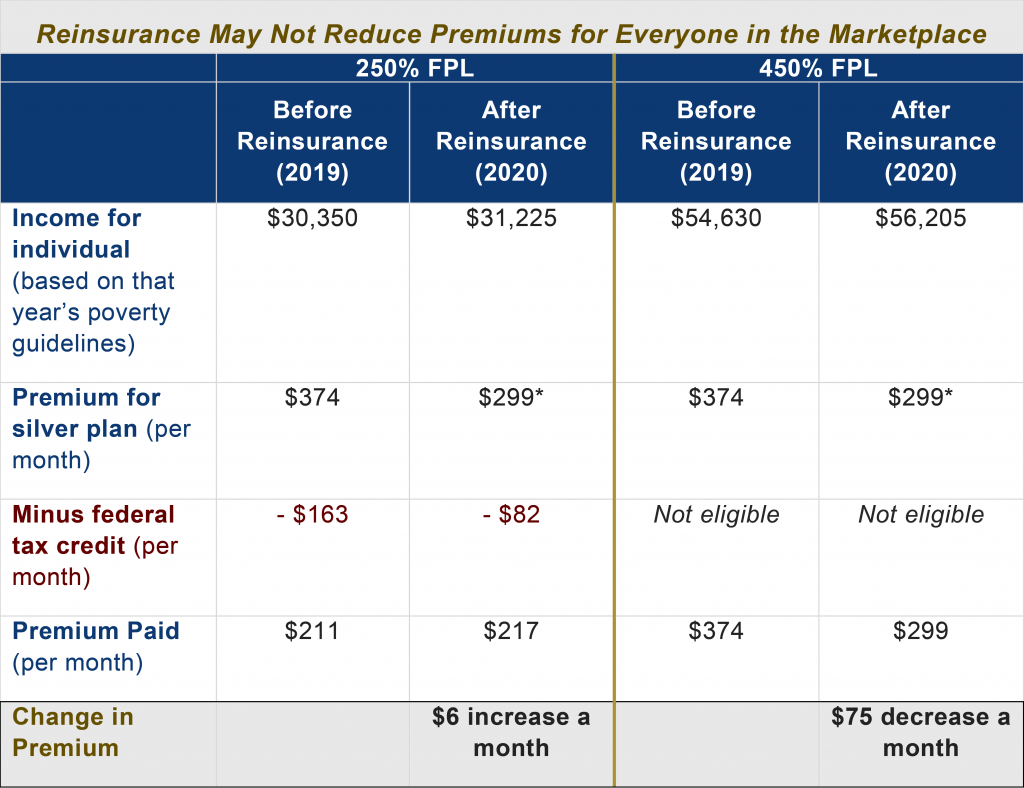

In addition to the state cost, Georgia should consider the effect the program will have on people at different income levels. Most of the reinsurance program benefits do not go to the low- and moderate-income people who receive premium tax credits.[6] A reinsurance program is a great way to help reduce premiums for the small share of marketplace enrollees with incomes too high for premium tax credits. However, even enrollees who receive premium tax credits may not see lower costs because they pay a premium that is based on their income.

Recommendation 2: Provide Enhanced Outreach Efforts and Cost-Sharing Assistance

Because of the uneven benefits of reinsurance for low-to-moderate income Georgians, reinsurance is not the only answer to reduce premiums or increase available marketplace options. Other options include supplementing the premium tax credits or creating an option to buy in to Medicaid.[8],[9]

While reinsurance works to reduce premiums for higher-income enrollees, increasing the amount of premium and cost-sharing assistance can help reduce costs for low- and moderate-income enrollees. Some states are also considering additional subsidies for people who make too much for the premium tax credits—over about $50,000 a year for an individual—to help to smooth the benefit cliff at which income rises and the subsidy is no longer available. However, given the much higher uninsured rates for Georgians at lower incomes, any additional subsidies should focus on getting more Georgians enrolled who make 100 percent to 400 percent of the federal poverty line.

Get More Eligible Georgians Enrolled in Marketplace Through Targeted Outreach and Enrollment Assistance

Get More Eligible Georgians Enrolled in Marketplace Through Targeted Outreach and Enrollment Assistance

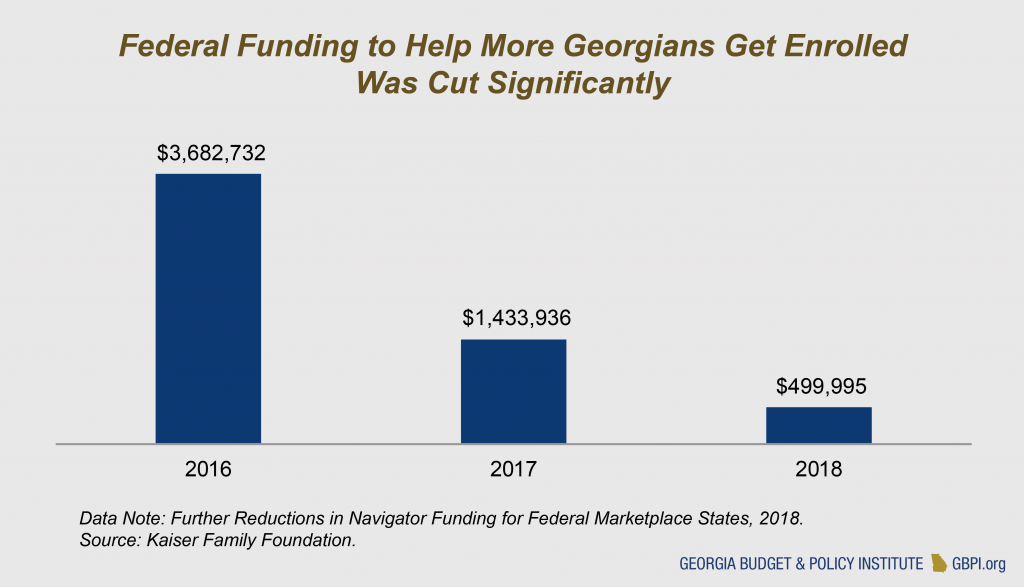

Under partial Medicaid expansion, which the state is currently considering, people with incomes between 100 percent and 138 percent of the poverty line would not be eligible for Medicaid, but they are eligible for premium subsidies on the individual marketplace. While people in this income range have access to marketplace coverage, Medicaid coverage better meets their needs as it offers significantly lower premiums and cost sharing, more benefits and the option to enroll at any point during the year. Although they have been able to receive help to pay for premiums through federal tax credits since 2014, there are still about 190,000 Georgians in this income range without health insurance.[10] When looking at the full income range in the marketplace (100 percent to 400 percent of poverty), there are 838,563 uninsured Georgians who could be eligible for premium assistance. However, the federal government cut outreach and enrollment assistance by 86 percent from 2016 to 2018, making it harder to get more of these residents enrolled.[11]

Georgia can help more uninsured Georgians already eligible for marketplace subsidies get enrolled by investing state funds in outreach and enrollment assistance. Additional outreach efforts must also be paired with financial assistance to make sure that coverage is affordable for Georgians with low-to-moderate incomes.

Georgia can help more uninsured Georgians already eligible for marketplace subsidies get enrolled by investing state funds in outreach and enrollment assistance. Additional outreach efforts must also be paired with financial assistance to make sure that coverage is affordable for Georgians with low-to-moderate incomes.

Recommendation 3: Ensure Plans Cover All Essential Health Benefits and Maintain Premium Tax Credit Structure

The 1332 waiver cannot be used to change some key Affordable Care Act provisions like pre-existing condition protections or the ban on annual and lifetime coverage limits for most plans. But these waivers can include new changes that could have negative effects for people with pre-existing conditions. New guidance from the federal administration may allow states to apply the premium tax credits to plans that do not comply with the benefits and protections under the Affordable Care Act. These include short-term plans and association plans, which are not required to cover all 10 essential benefits outlined in the Affordable Care Act.

Short-term plans were designed for people with temporary gaps in health coverage, providing a more limited range of services for a limited term up to a year. None of the short-term plans in Georgia offer maternity benefits. Only 37 percent offer prescription drug benefits, 37 percent offer substance abuse benefits and 53 percent offer mental health benefits.[12] They are also not subject to limits on cost-sharing, can require lifetime or annual limits and can charge premiums or deny coverage to people based on their health conditions, gender, age and other factors.

Short-term plans were designed for people with temporary gaps in health coverage, providing a more limited range of services for a limited term up to a year. None of the short-term plans in Georgia offer maternity benefits. Only 37 percent offer prescription drug benefits, 37 percent offer substance abuse benefits and 53 percent offer mental health benefits.[12] They are also not subject to limits on cost-sharing, can require lifetime or annual limits and can charge premiums or deny coverage to people based on their health conditions, gender, age and other factors.

If Georgia uses the 1332 waiver to allow tax credits to be used for short-term plans, people with fewer health concerns could be steered towards these plans because they are typically cheaper. This would drive up costs for people with pre-existing conditions who are likely to stick with the plans compliant with ACA standards because they do not deny coverage or charge more based on medical conditions. These plans also provide more comprehensive benefits. The redistribution of enrollees out of the ACA-compliant market and to short-term plans would reduce market stability.

New guidance may also allow states to make changes to their premium tax credits. These credits are currently based on income and the cost of premiums in the geographic area, but there is interest in basing them on other factors such as age. This idea was proposed as part of the efforts to repeal and replace the ACA in 2017. GBPI’s analysis found that this change would leave older Georgians and rural Georgians most at risk for premium increases.[13] Georgia’s 1332 waiver should not allow premium credits to be used for short-term plans and should maintain the premium tax credit structure based on income and geographic area.

Summary of Recommendations

The Patients First Act envisioned the Medicaid 1115 waiver working together with the 1332 waiver to address the needs of Georgians making below 138 percent of the poverty line. These are the Georgians who would be eligible for coverage under a full Medicaid expansion. The partial Medicaid expansion outlined in the legislation was meant to target people making below 100 percent of the poverty line, and the 1332 waiver included people making between 100 percent and 138 percent of poverty line. But with recent news confirming the state will not receive a 90 percent federal match to pay for the partial Medicaid expansion, Governor Kemp’s team may take a greater interest in the 1332 waivers because the partial expansion is not financially viable. The state can still make the Medicaid waiver plan viable by fully expanding Medicaid.

With a full Medicaid expansion, the 1115 and 1332 waivers can still work together to increase coverage for Georgians and reduce cost barriers to accessing care. Georgia can best use the 1332 waivers by pairing a reinsurance program targeted at rural areas with additional outreach and financial assistance for low-to-moderate-income Georgians. The state can also ensure plans provide comprehensive coverage and sufficient tax credits based on income and geographic area.

In summary, Georgia lawmakers can create a plan to increase access to care, promote better health and build on protections for health care consumers by pursuing the following recommendations for the 1332 waiver:

- Recommendation 1: Use Federal Pass-Through Funding for a Reinsurance Program

- Recommendation 2: Provide Enhanced Outreach Efforts and Cost-Sharing Assistance

- Recommendation 3: Ensure Plans Cover All Essential Health Benefits and Maintain Premium Tax Credit Structure

Endnotes

[1] The Kaiser Family Foundation State Health Facts (2017). Health Insurance Coverage of the Total Population. Retrieved from https://www.kff.org/2fdbf6d/

[2] The Kaiser Family Foundation State Health Facts (2018). Market Share and Enrollment of Largest Three Insurers- Small Group Market. Retrieved from https://www.kff.org/ebf4ccb/

[3] Sloan, C., Rosacker, N. & Carpenter, E. (2019). State-Run Reinsurance Programs Reduce ACA Premiums by 19.9% on Average. Retrieved from https://avalere.com/press-releases/state-run-reinsurance-programs-reduce-aca-premiums-by-19-9-on-average

[4] Anderson, P.L., Betz, B. & Mixon, S. (2019). Healthcare Innovations in Georgia: Two Recommendations. Retrieved from https://www.andersoneconomicgroup.com/healthcare-innovations-in-georgia-two-recommendations/

[5] Tolbert, J., Diaz, M., Hall, C. & Mengistu, S. (2019). State Actions to Improve the Affordability of Health Insurance in the Individual Market. Retrieved from https://www.kff.org/89ee119/

[6] Aron-Dine, A. & Broaddus, M. (2019). Improving ACA Subsidies for Low- and Moderate-Income Consumers Is Key to Increasing Coverage. Retrieved from https://www.cbpp.org/research/health/improving-aca-subsidies-for-low-and-moderate-income-consumers-is-key-to-increasing

[7] Kaiser Family Foundation (2018). Health Insurance Marketplace Calculator. Retrieved from https://www.kff.org/25d415a/

[8] American Hospital Association (2018). State Marketplace Stabilization Strategies. Retrieved from https://www.aha.org/system/files/2018-01/state-marketplace-stabilization-strategies-white-paper.pdf

[9] Tolbert, J., Diaz, M., Hall, C. & Mengistu, S. (2019). State Actions to Improve the Affordability of Health Insurance in the Individual Market. Retrieved from https://www.kff.org/89ee119/

[10] Garfield, R., Orgera, K. & Damico, A. (2019). The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand Medicaid. Retrieved from https://www.kff.org/ffd4ccc/

[11] Pollitz, K., Tolbert, J. & Diaz, M. (2018). Data Note: Further Reductions in Navigator Funding for Federal Marketplace States. Retrieved from https://kff.org/a1bf174

[12] Pollitz, K., Long, M., Semanskee, A. & Kamal, R. (2018). Understanding Short-Term Limited Duration Health Insurance. Retrieved from https://www.kff.org/c26b22b/

[13] Harker, L. (2017). Gutting Federal Health Law Imperils Georgia Families, Hospitals, State Budget. Retrieved from https://gbpi.org/2017/gutting-federal-health-law-imperils-ga-families-hospitals-state-budget/