Key takeaways:

- The Child Tax Credit has the power to significantly reduce the racial and ethnic disparities in child poverty in Georgia, but more needs to be done to ensure immigrant families have access to the program in the near and long term.

- Families with very low income who do not have to file taxes have until November 15 to sign up for the Child Tax Credit’s advance monthly payments using the GetCTC non-filer form. Families can also file 2021 taxes next year and access the Child Tax Credit’s lump sum payment at tax time.

- Immigrant families may be unaware of eligibility or hesitant to sign up for the Child Tax Credit; public and private organizations can help.

- To help ensure the enhanced Child Tax Credit has the greatest reach, Congress should permanently extend the program and make children without an Individual Tax Identification Number

The American Rescue Plan’s (ARP) temporary expansion to the Child Tax Credit (CTC), which helps offset the cost of raising children, is an enormous opportunity to get more cash to more families raising children and reduce the racial and ethnic disparities in child poverty. Unfortunately, many immigrant families in Georgia may not understand their eligibility or may be hesitant to sign up. State and local entities, community organizations and faith-based groups should continue efforts to get families who have not filed taxes to sign up. Furthermore, as Congress considers the Build Back Better plan, they should permanently extend the enhanced CTC and include children without Social Security numbers (SSNs).

Who is Eligible for the Current Child Tax Credit?

The ARP, which passed last March, temporarily expanded the CTC by increasing benefits from $2,000 a year per child to $3,000 a year for each child ages 6 to 17 and $3,600 a year for each child under 6. This expansion also allows families to receive advance monthly payments for half of their benefit. Some of the most important CTC policies are those around eligibility. However, many immigrant families’ exclusion from previous relief benefits and political fearmongering may have contributed to their confusion over CTC eligibility or hesitation in applying for benefits in the first place. To offer clarity on the immigrant families who are eligible, here are some key facts:

- Families with very low or no earnings are eligible for the temporary CTC.

- Families who do not have to file taxes based on their income can fill out Code for America’s Internal Revenue Service-approved non-filer form (en Español). The deadline to fill out this non-filer form is November 15.

- Other families can also file 2021 taxes next year and access the CTC lump sum payment.

- Families where the children have SSNs but the parents have an Individual Tax Identification Number (ITIN) can access the program.

- This includes Deferred Action for Childhood Arrivals (DACA) recipients with children who have SSNs and DACA dependents of ITIN filers.

- Signing up for the CTC is does not negatively affect an individual’s immigration status; the Trump administration’s public charge regulations ended in March 2021.

Getting all eligible families—especially immigrant families—signed up for the CTC will help stabilize families and improve their economic security. The Social Policy Institute at Washington University’s analysis of US Census Household Pulse Survey Data found that food insecurity among Georgia families eligible for the CTC dropped from 18.3 percent to 13.7 percent after the first two CTC payments. Additional analyses from Columbia University show that nationally the monthly child poverty rate dropped from 22.2 percent to 18.4 percent for Black children, 22.9 percent to 16.8 percent for Latinx children, 14.1 percent to 11 percent for Asian children and 10.5 percent to 7.7 percent for white children.

As Congress considers the fate of the CTC, state and local agencies, community organizations and faith-based groups have a critical role to play to connect immigrant and other families to the CTC. Many are trusted resources in the community and may be the first place families turn to for questions and support. While the pandemic left many direct service organizations with limited capacity, there are still some easy ways to inform families about the CTC and help them sign up.

- Raise awareness that there is still time to sign up for the CTC. The new deadline to use GetCTC’s non-filer tool is November 15.

- Explain who is eligible for the CTC. Mixed status households with children with SSNs should be a particular focus. It’s also important to remind families that they may qualify even if they made little to no income during the year.

- For those families who are not required to file taxes, connect them to GetCTC’s non-filer portal. This portal will also help families claim missed stimulus payments.

- Families who must file can use GetYourRefund next tax season to file a full tax return and claim all eligible benefits. They can sign up now to get a notification when the site is open next year.

- Highlight GetCTC’s chat function which connects users to a virtual IRS-certified volunteer for those who need assistance. Individuals can also call 211 for live assistance with general CTC questions or look up local resources online. Note: In-person services are extremely limited.

- Community organizations and faith-based groups can learn how to directly help members of their communities through Code for America’s resources in Engsl here. Watch a demonstration on how to use the GetCTC tool in English and Español.

Necessary Federal Changes to Help Ensure the Child Tax Credit Reaches All Children

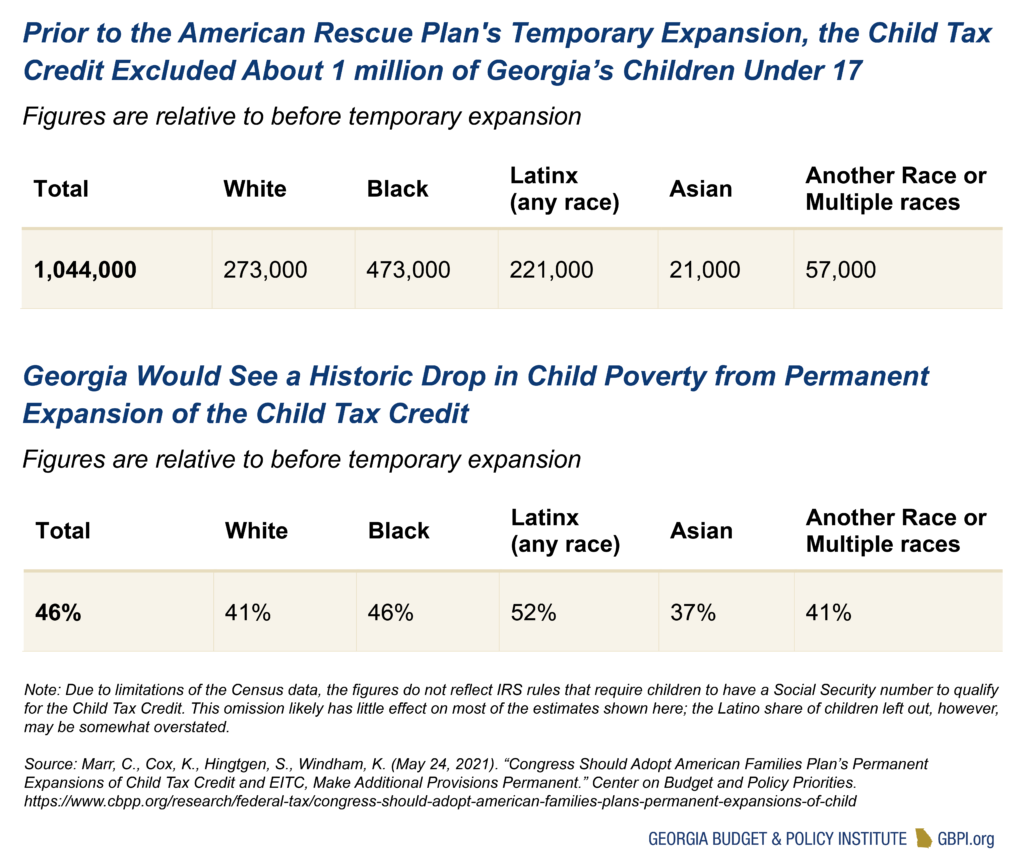

The enhanced CTC’s movement towards racial equity will be short-lived if Congress does not permanently extend the program in the Build Back Better plan. Before the ARP improvements, about one million children did not receive a CTC payment, including 473,000 Black children, 221,000 Latinx children and 21,000 Asian children. Without a permanent expansion, these children could be left out again. In addition to permanent expansion, Congress should restore access to the CTC for children with ITINs in place of SSNs. In 2017, Congress ended eligibility for children with ITINs under the Tax Cuts and Jobs Act. Without this change, at least 15,000 undocumented children in Georgia may miss out on the positive effects of the CTC.

Permanent expansion to the enhanced CTC for all children could yield a 46 percent decline in child poverty in Georgia. Children of color, including many immigrant children, would benefit the most. Child poverty for Latinx, Black and Asian children would drop by 52 percent, 46 percent and 37 percent respectively. This could mean immediate and long-term benefits for children. The National Academy of Sciences’ 2019 report on child poverty finds that increased income for families with children is associated with better childhood nutrition and stronger academic achievement. It also associated with higher earnings and better health in adulthood.