Strong and financially stable families are essential to a thriving Georgia. How Georgia’s state leaders use the Temporary Assistance for Needy Families (TANF) program to respond to the massive federal changes to our economic support programs will demonstrate their commitment to families with low income and the well-being of the state. TANF, a program meant to provide cash assistance to families with low income, is now primarily used as a flexible funding stream for other programs. Since the start of TANF 29 years ago, the caseload has declined, and the cash benefit has lost half of its purchasing power.[1] Though diminished, TANF can still be used to support families. In the face of a potential rise in the cost of living because of changes at the federal level, TANF can provide emergency or ongoing support to people with low incomes.

This summer, Congress passed, and the President signed, H.R. 1 (formerly known as the One Big Beautiful Bill Act). This reconciliation bill is historic legislation that will make major changes to the Supplemental Nutrition Assistance Program (SNAP) and Medicaid programs to partially pay for massive tax cuts for wealthy individuals and corporations.[2] In the near term, expanded SNAP work requirements and new exclusions of certain legal immigrants with humanitarian protections will create hardship for many Georgians. H.R. 1 will also shift SNAP and Medicaid costs to the states, creating a manufactured budget crisis.[3]

Between Fiscal Years (FY) 2008 and 2012, the General Assembly siphoned off funding from three key TANF spending categories to fill in budget holes elsewhere. Meanwhile, TANF reached fewer families as poverty grew. Those funds were never returned to the TANF cash program.

About 1.4 million people, including about 640,000 children, rely on SNAP to put food on the table.[4] About 1.35 million children use Medicaid or PeachCare to see a doctor.[5] Cuts to SNAP and Medicaid will mean more children going hungry or more families struggling with an unaffordable hospital bill if their child gets sick.[6]

TANF can mitigate this harm, but only if it’s used not just as a flexible funding source but also as a cash program. The state also has options that, if strategically deployed, can help maintain the state budget in the face of federal cuts. This will be the state’s test of its values. Will it find ways to help families harmed by federal changes, or will it ignore them?

TANF’s design created an incentive for states to use funds outside of cash assistance

The TANF program provides a small cash grant to families with very low income. Monthly benefits are $280 for a family of three. Parents are required to engage in strict work activities and meet other obligations. Often these requirements lead to loss of cash benefits instead of quality jobs and family stability.[7] Additionally, Families cannot utilize TANF for more than 48 months in Georgia.

TANF is funded by a fixed federal block grant and state contributions, called the Maintenance of Effort. Georgia’s federal block grant is about $331 million a year. If the state does not use all the federal resources in a given year, it can save those unspent funds for future use.[8] Furthermore, the state can use TANF federal and state funds for activities outside of the TANF cash assistance program, but the activities must fit into the four broad purposes of TANF:

- “Assist needy families so that children can be cared for in their own homes or in the homes of relatives.”

- “End the dependence of needy parents on government benefits by promoting job preparation, work and marriage.”

- “Prevent and reduce the incidence of out-of-wedlock pregnancies.”

- “Encourage the formation and maintenance of two-parent families.”[9]

Despite TANF’s flexibility, TANF funding cannot be used to cover health care like Medicaid. It also cannot cover ongoing food assistance like SNAP provides without triggering other conditions that would make it impractical.[10]

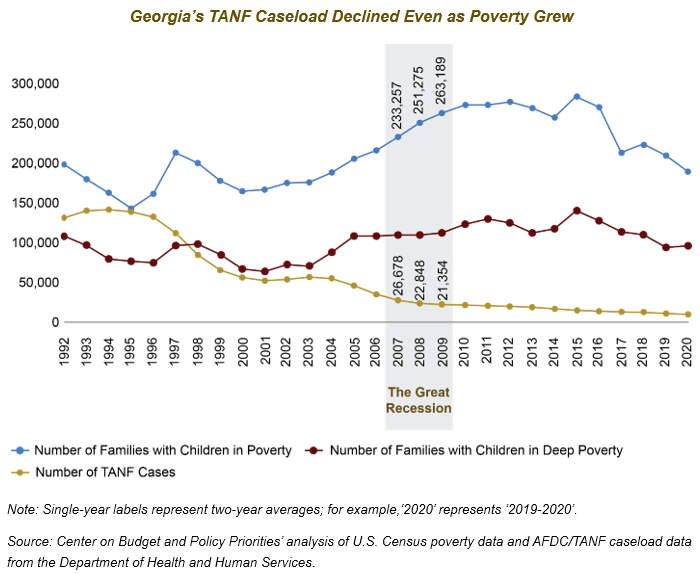

However, TANF’s design and funding flexibility create an incentive for state leaders to use TANF resources outside the cash assistance program. Despite the need in the state, TANF’s strict work requirements, low benefit levels and time limits have contributed to a significant caseload decline. TANF caseloads have dropped by 96% from 1996 to 2023.[11] Instead of reinvesting savings back into the program to improve cash support to families, Georgia, like other states, uses the resources to fill budget gaps or replace state general funds with TANF federal funds.[12]

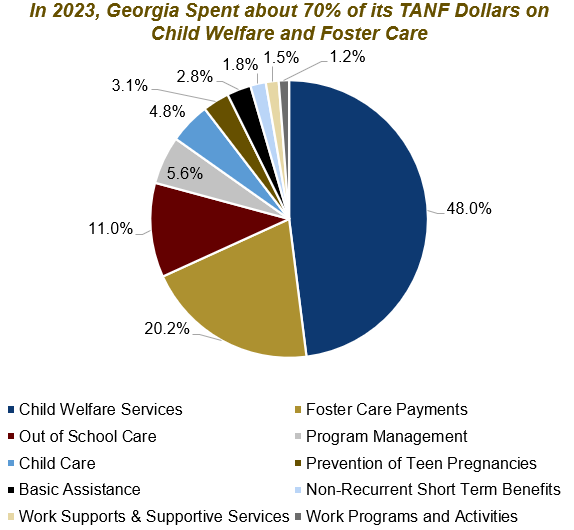

Today, the state spends most of its TANF funds in areas outside of the core TANF areas of cash assistance, work programs and supports, and child care. In 2023, almost 70% of TANF funding went to the child welfare and foster care systems. About 3% supports monthly payments to TANF families, another 3% funds work programs and supportive services, and about 15% goes to child care and after-school programs. (See pie chart).

Recession Lessons: State legislators used TANF funds to balance the budget instead of responding to the growing need during the Great Recession

The Great Recession, which lasted from December 2007 to June 2009, saw a dramatic rise in unemployment and significant increases in hardship. Across the country, state revenues plummeted. In the immediate years after the recession, 2010 to 2011, state revenues struggled to recover. Georgia leaders cut program funding across the board and used flexible resources like TANF to fill in budget holes left by reductions in state general funds or other federal funding. However, they also ignored the growing need of newly TANF-eligible families created by increases in poverty; Georgia’s TANF caseloads declined during the Great Recession. TANF resources should have been used strictly as stopgap funding to other programs until state revenues recovered. However, state leaders never brought back funds to the cash assistance program as poverty continued to grow even after the recession was over. (See graph below).

The Great Recession, which lasted from December 2007 to June 2009, saw a dramatic rise in unemployment and significant increases in hardship. Across the country, state revenues plummeted. In the immediate years after the recession, 2010 to 2011, state revenues struggled to recover. Georgia leaders cut program funding across the board and used flexible resources like TANF to fill in budget holes left by reductions in state general funds or other federal funding. However, they also ignored the growing need of newly TANF-eligible families created by increases in poverty; Georgia’s TANF caseloads declined during the Great Recession. TANF resources should have been used strictly as stopgap funding to other programs until state revenues recovered. However, state leaders never brought back funds to the cash assistance program as poverty continued to grow even after the recession was over. (See graph below).

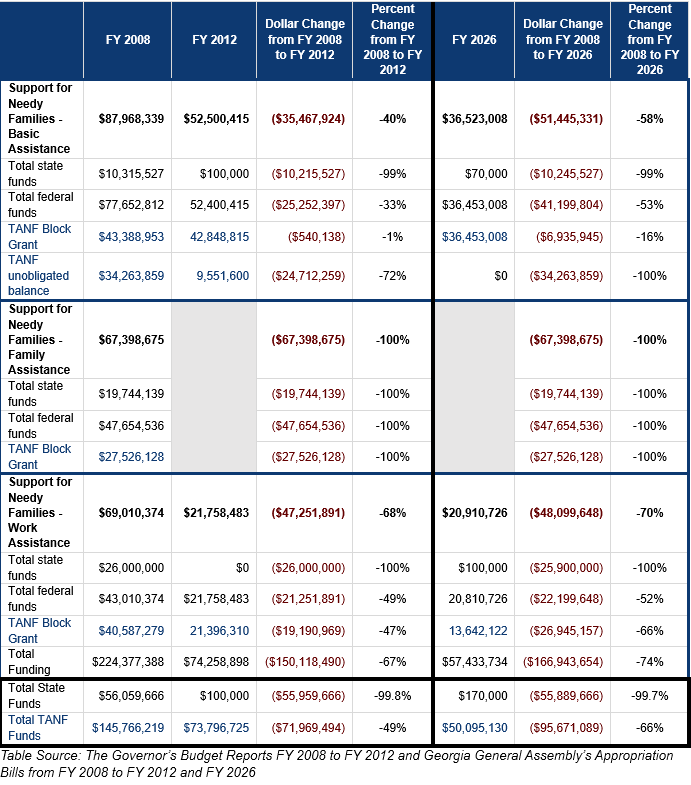

Between FY 2008 and FY 2012, three key spending categories for the TANF program, Basic Assistance, Family Assistance and Work Assistance, lost about $150 million in total funds, including nearly $56 million in state funds and about $72 million in federal TANF funds. Appropriators transferred most of the TANF state and federal funds to public benefit eligibility activities, child care services, child welfare services and foster care. Additionally, legislators cut other federal TANF funds without specifying how the funds would be used. The General Assembly eliminated the Family Assistance in FY 2011 and transferred the state funds to the new state eligibility system. Budget documents do not detail what happened to the almost $28 million in TANF federal funds for Family Assistance.[13] In FY 2010 and FY 2011, about $167 million in temporary federal relief funds from the American Recovery and Reinvestment Act provided additional support to the TANF program. Those funds expired after FY 2011.[14]

The state’s TANF cash assistance program is one of the weakest in the country in terms of support for families. Georgia reaches fewer families in poverty than it did at the start of the program 29 years ago. In 1996, TANF reached 82 families for every 100 families in poverty; the program’s reach declined during the Great Recession years, even as poverty grew. (See line graph.) In 2020, Georgia’s TANF program reached about 5 families for every 100 families in poverty.[15] Georgia legislators never restored funding to the remaining TANF spending areas, and the most recent state budget for FY 2026 shows a 74% decline in overall funding since FY 2008.

The state should use other funding options to protect the state budget against the worst harms of H.R. 1

Unlike economic downturns, which are hard to predict, state leaders know when the major SNAP and Medicaid cuts will occur which could hurt the state budget. They can start planning for options to address the federal funding cuts, and Georgia is unique in that it is in a comparatively strong fiscal position to address the cuts.

- Georgia revenues remain healthy and should be used wisely to support the budget. In recent budget cycles, state leaders have set low revenue estimates despite generating multi-billion-dollar surpluses for five consecutive years (FY 2021-25). One outcome of low revenue estimates is the forced austerity of recent budgets that fail to provide more funding to programs and services Georgians rely on and need.

- Low revenue estimates have also led to an unprecedented level of cash on hand. Georgia has about $5.5 billion in the Revenue Shortfall Reserve (the rainy-day fund) and is projected to maintain over $9 billion in unobligated surplus in FY 2026. While reserves can only be used for single-year expenses, they can be deployed strategically to shore up the budget if necessary or to make one-time investments.

- Looking ahead, state leaders can also consider ways to raise new revenue, such as by modernizing Georgia’s state taxes on tobacco products. Lifting Georgia’s cigarette tax from the second-lowest level in the nation at $0.37 per pack to the national average of $1.97 could raise over $450 million a year in new revenue. Establishing parity for vaping and other tobacco excise taxes could raise hundreds of millions in additional revenue.

TANF is still a program that can support families

With other alternatives to support the state in the face of federal budget cuts, Georgia can think beyond TANF’s uses as a flexible funding source. State leaders should do what they can to mitigate the harm that will come from H.R. 1’s changes to SNAP and Medicaid. With unspent federal funds available, they should consider creative ways TANF can support families. For example, TANF could be used to provide support to families harmed by cuts to SNAP and Medicaid. With a modest amount of resources, TANF could provide short-term assistance for a specific financial crisis. The state could use non-recurrent, short-term benefits to pay families up to four months’ worth of benefits to a TANF or non-TANF recipient (under certain income rules). This short-term assistance could help cover an unexpected hospital bill, prevent eviction or some other emergency. These short-term benefits could help a family maintain stability instead of spiraling further into hardship. Furthermore, the family does not have to be on the program long-term.

The TANF cash assistance program has had few improvements in its nearly three decades. Currently, the state underspends the block grant because of caseload decline. Fully using the block grant, Georgia can make broader changes to support more families who need more sustained cash support. State leaders could make updates to the longer-term TANF cash assistance program, like proposals included in H.B. 500.[16] The bill would increase benefits, which have not changed for more than three decades;[17] the monthly TANF benefit is still $280 for a family of three. The bill also updates the income eligibility and the asset limit so more low-income families can access the program.

Endnotes

[1] Finch Floyd, I. (2025, March 4). HB 500 would update the TANF program after 28 years and better support working families and grandparents raising grandchildren. Georgia Budget and Policy Institute. https://gbpi.org/hb-500-would-update-the-tanf-program-after-28-years-and-better-support-working-families-and-grandparents-raising-grandchildren/?_gl=1*fzkp70*_up*MQ..*_ga*MTY0ODAzNTQxNC4xNzU1NjE4NzEx*_ga_ZWZC5HZ1YJ*czE3NTU2MTg3MTAkbzEkZzEkdDE3NTU2MTg3MjMkajQ3JGwwJGgw#_edn1.

[2] Georgia Budget and Policy Institute. (2025, July 17). Historic federal tax shift benefits wealthiest, grows deficit and exacerbates Georgia’s rural challenges. https://gbpi.org/deficit-spending-regressive-revenue-and-rural-harm-how-federal-reconciliation-hurts-georgians/?_gl=1*1w1ctdt*_up*MQ..*_ga*MTQ3NDg0MTQ3MC4xNzU1MDAyNDA4*_ga_ZWZC5HZ1YJ*czE3NTUwMDI0MDgkbzEkZzEkdDE3NTUwMDQ1NjEkajM0JGwwJGgw.

[3] Ibid.

[4] SNAP data from the Georgia Department of Human Services Division of Family and Children Services.

[5] GBPI analysis of April 2025 Georgia Medicaid enrollment data from data.medicaid.gov.

[6] First Focus on Children. (2025, July 15). How H.R. 1 will harm children now and far into the future. https://firstfocus.org/wp-content/uploads/2025/07/H.R.-1-Issue-Brief-2025.pdf.

Wheaton, L., Giannarelli, L., Minton, S., and Dehry, I. (2025, July). How the Senate budget reconciliation SNAP proposals will affect families in every US state: A summary of preliminary research findings. Urban Institute. https://www.urban.org/sites/default/files/2025-07/How-the-Senate-Budget-Reconciliation-SNAP-Proposals-Will-Affect-Families-in-Every-US-State.pdf.

[7] Pavetti, L., & Azevedo-McCaffrey, D. (2023, April 26). Program administrators across the political spectrum find TANF work requirements incompatible with recipients’ needs. Center on Budget and Policy Priorities. https://www.cbpp.org/blog/program-administrators-across-the-political-spectrum-find-tanf-work-requirements-incompatible.

[8] Unspent federal funds fall into two categories: unliquidated obligations, funds designated for a specific purpose, and unobligated balances, funds not obligated for a specific purpose.

[9] U.S. Department of Health and Human Services, Administration for Children and Families, Office of Family Assistance. (2024, September 27). About TANF. https://acf.gov/ofa/programs/tanf/about

[10] If a state provides ongoing cash or food assistance through TANF, families would then be subject to TANF requirements and the time limits. Furthermore, TANF cannot be used to support adults without children.

[11] Analysis of Aid to Families with Children and TANF caseload data from the U.S. Health and Human Services, Administration for Children and Families, Office of Family Assistance. https://acf.gov/ofa/programs/tanf/data-reports.

[12] Schott, L., Pavetti, L., & Floyd, I. (2015, October 15). How states use federal and state funds under the TANF block grant. Center on Budget and Policy Priorities. https://www.cbpp.org/research/welfare-reform-tanf/how-states-use-federal-and-state-funds-under-the-tanf-block-grant

[13] General Assembly’s Conference Committee Substitute to H.B. 948. https://www.legis.ga.gov/api/document/docs/default-source/house-budget-and-research-office-document-library/previous-fiscal-years/2011_fiscalyear/fy_2011_bill_final_conf_cmte.pdf?sfvrsn=bef545e0_2.

[14] See The Governor’s Budget Report, Fiscal Year 2012. https://opb.georgia.gov/document/governors-budget-reports/fy-2012-governors-budget-report/download.

[15] Shrivastava, A., & Azito Thompson, G. (2022, February 8). TANF cash assistance should reach millions more families to lessen hardship. Center on Budget and Policy Priorities. https://www.cbpp.org/research/income-security/tanf-cash-assistance-should-reach-millions-more-families-to-lessen

[16] HB 500. 2025-2026 Regular Session of the Georgia General Assembly. (2025, February 26). https://www.legis.ga.gov/legislation/70424.

Finch Floyd, I. (2025, March 4). HB 500 would update the TANF program after 28 years and better support working families and grandparents raising grandchildren. Georgia Budget and Policy Institute. https://gbpi.org/hb-500-would-update-the-tanf-program-after-28-years-and-better-support-working-families-and-grandparents-raising-grandchildren/?_gl=1*fzkp70*_up*MQ..*_ga*MTY0ODAzNTQxNC4xNzU1NjE4NzEx*_ga_ZWZC5HZ1YJ*czE3NTU2MTg3MTAkbzEkZzEkdDE3NTU2MTg3MjMkajQ3JGwwJGgw#_edn1.

[17] Under TANF’s predecessor, Aid to Families with Dependent Children, AFDC, cash assistance benefits for a family of three were $280 a month.