Budget Trends

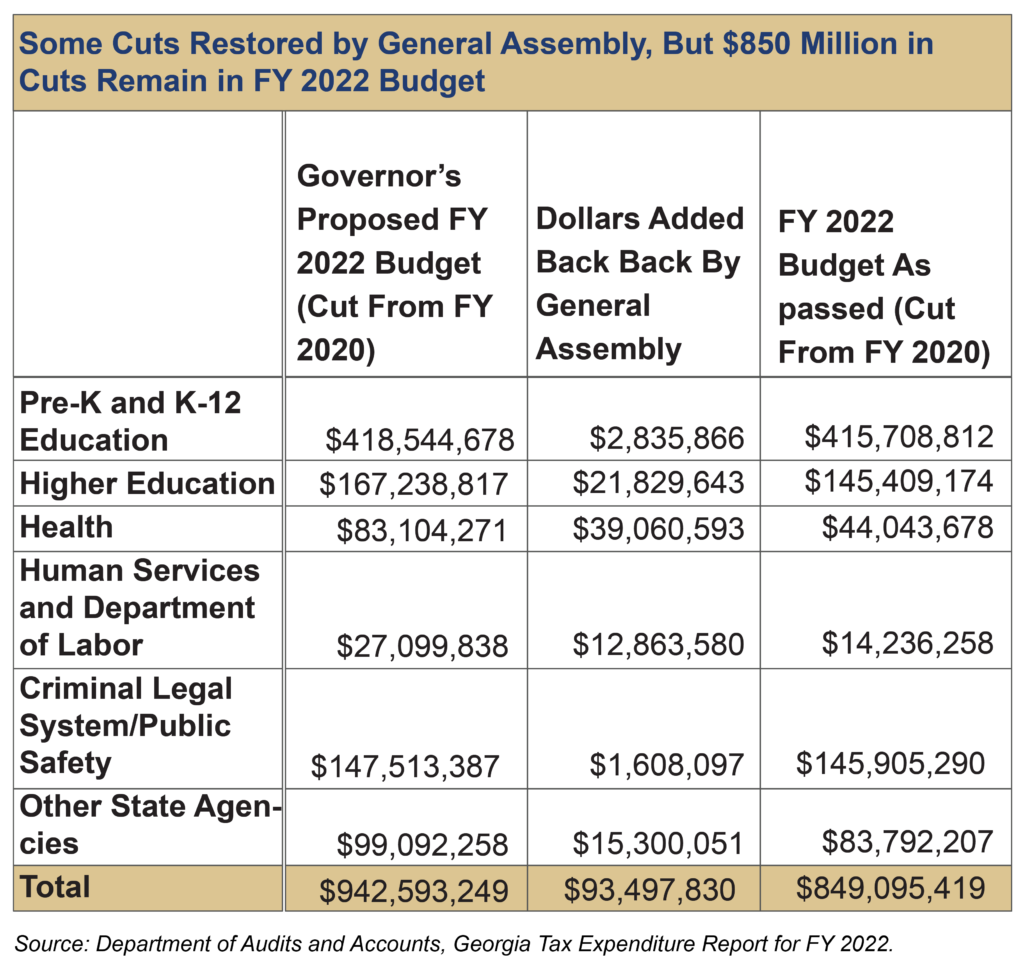

The $27.3 billion state budget signed into law by Gov. Kemp for FY 2022, which started July 1, 2021, represents an $849 million decrease in state spending from the state’s 2020 budget that was enacted two years prior—that is, compared to pre-pandemic levels—without adjusting for changes in population and inflation. The FY 2022 budget represents a third consecutive year of austerity, which began when appropriators made cuts to eliminate more than 1,000 vacant state jobs even before COVID-19 led state leaders to respond to revenue shortfalls with deep spending cuts.

Georgia’s FY 2022 budget includes approximately 4 percent in cuts to state spending from pre-pandemic levels, with the largest reductions made to education and health care. Considerable federal resources were made available to finance the state’s response to the COVID-19 pandemic, and the federal government offered significant state savings by paying a higher-than-usual share of the cost of Georgia’s Medicaid program through the duration of the national public health emergency declaration. Nevertheless, the state’s primary response to the ongoing crisis has been to rely on deep spending cuts to balance its budget, with little to no state resources mobilized to relieve the hardship experienced by millions of Georgians.

Compared to pre-pandemic levels, Georgia’s FY 2022 budget underfunds pre-K through 12th grade by $416 million, maintains $145 million in cuts to higher education, continues $44 million in cuts to health services and programs, cuts $14 million from the Departments of Human Services and Labor and reduces funding for other state agencies by $230 million.

Lawmakers could address Georgia’s fiscal shortfall using funds allocated to the state through the federal American Rescue Plan and ensure these funding levels are sustained by raising revenue or eliminating existing tax breaks and loopholes to avoid further passing on the costs of deep budget cuts to local school districts, health care providers and communities across the state.

State Savings Account Grows as Georgians Shoulder Cost of COVID-19 Pandemic

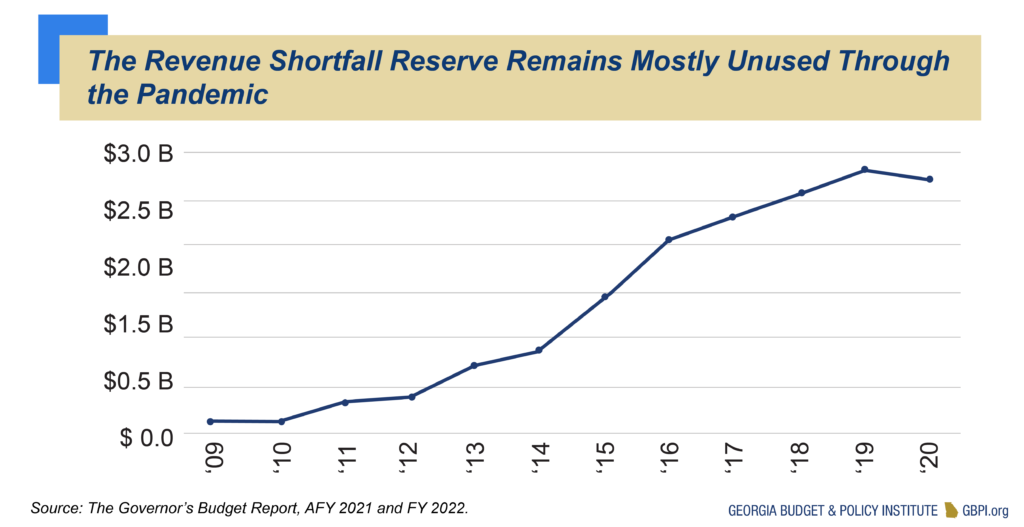

The Revenue Shortfall Reserve (RSR), Georgia’s rainy day fund, provides stability in economic downturns. The fund is like a savings account to pay expenses and maintain services when revenues decline unexpectedly. Maintaining adequate reserve money helps Georgia keep its AAA bond rating, allowing the state to borrow on favorable terms and save millions in interest. Money is not appropriated into the RSR; the balance grows at the end of each fiscal year if there is surplus state revenue (up to 15 percent of prior year revenue). The governor is also authorized to release for appropriation any amount over the minimum balance required—4 percent of prior year revenues—in case of a fiscal emergency. At the current level, as of FY 2021, $1.7 billion in state reserves could be otherwise appropriated.

State leaders, led by Gov. Kemp, have largely rejected using any of the resources the state has accrued to its healthy RSR, and instead, chose to rely on budget cuts alone to balance Georgia’s spending plan. As the state closes FY 2021, it is highly likely that it will again pad its reserves as the RSR approaches the legal limit of 15 percent of prior year general fund revenues, despite continuing to maintain steep cuts to state spending that will underfund K-12 schools for a second consecutive year. At the close of FY 2020, Georgia’s Revenue Shortfall Reserve stood at $2.7 billion, equivalent to 11 percent of prior year revenues, or enough to fund the state’s operations for approximately 39 days.

During the 2021 Legislative Session, lawmakers leveraged $90 million in additional savings due to the federal government’s decision to pay a higher-than-usual share of Georgia’s Medicaid program, along with $22 million in funding for other state agencies and $15 million from capital projects to restore a total of about $127 million in cuts initially proposed in Gov. Kemp’s executive budget. Still, Georgia’s FY 2022 budget includes $849 million in cuts from the state’s 2020 funding levels, notwithstanding the growth of Georgia’s population and increased need for programs and services caused by the COVID-19 pandemic.

As part of the federal government’s pandemic response legislation, bolstered by multi-year funding authorized by the ARP, state agencies such as the Department of Education and Department of Behavioral Health and Developmental Disabilities have received direct funding that is being used to fill the gaps caused by state budget cuts.

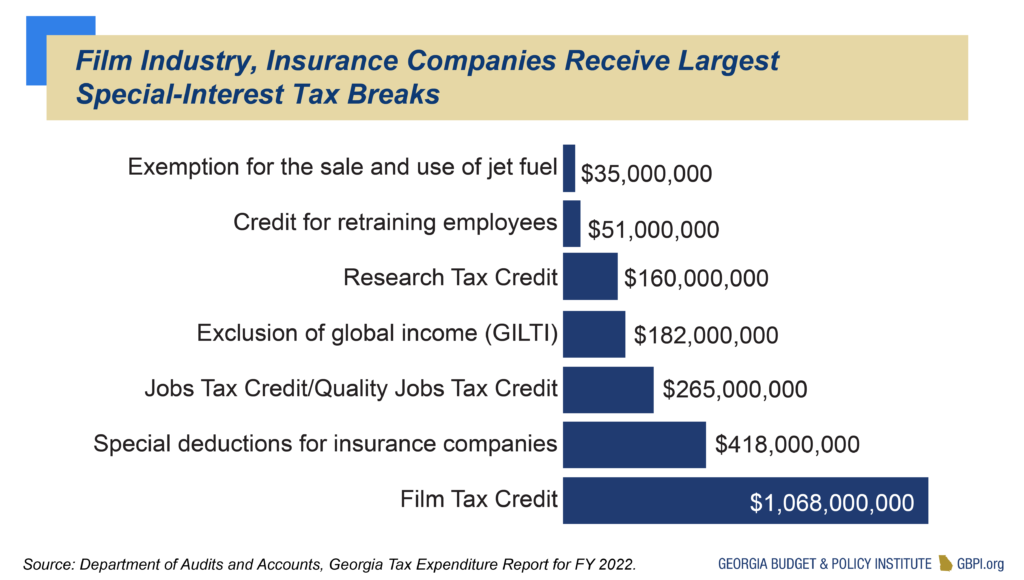

Tax Breaks Erode Georgia’s Budget: $10 Billion in Foregone Revenue Collections in FY 2022

Georgia offers a wide array of tax credits, deductions and other tax breaks, also known as tax expenditures, that give preferential treatment to certain taxpayers and corporations to achieve policy goals. The tax breaks will cost the state an estimated $10 billion in lost revenue in the 2022 fiscal year—a new record cost.

Even by a more conservative estimate that excludes many of the tax expenditures commonly found in other states, Georgia’s tax breaks for corporations and the wealthiest earners still yield an annual cost of more than $4 billion. In the 2019 tax year, out of a total of 230,838 corporate income tax returns filed, 94 percent, or more than 217,000 corporations, reported taxable income of $0 or less to the state.

Some tax breaks provide key protections for families, such as the sales tax exemption on groceries, while others provide credits or incentives to specific industries or special-interest groups. Several of Georgia’s largest tax breaks deliver outsized gains to select groups or industries—such as manufacturing, film or insurance—often with questionable benefit to the state or its people.

Georgia lacks a formal review process to measure and compare costs and benefits of tax breaks, although proposals to improve transparency and accountability in the tax code have passed the state Senate with unanimous support in recent years.