This section is co-authored by K-12 Senior Policy Analyst Dr. Stephen Owens and Higher Education Senior Policy Analyst Jennifer Lee

Georgia’s 2022 Education Budget

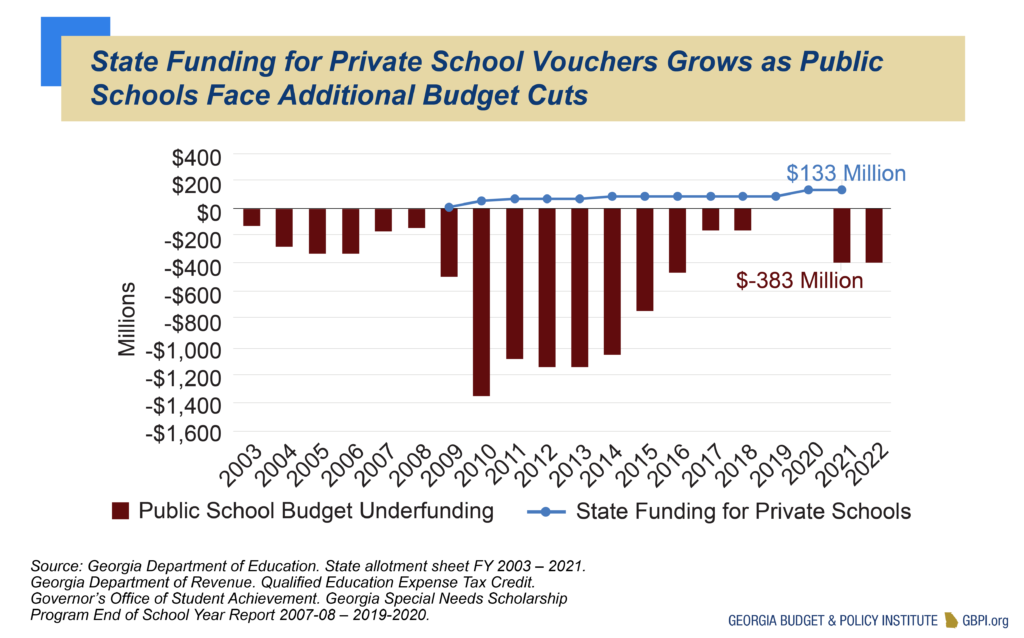

The state budget for K-12 public schools is $10.2 billion in FY 2022. In the 2020 General Assembly, state lawmakers passed a budget with $1 billion in cuts to the Department of Education. Lawmakers restored most of these reductions this session in the amended FY 2021 budget but underfunded the school funding formula by $383 million in both the FY 2021 and FY 2022 budgets. State funding for private school vouchers saw no similar budget cuts and is expected to increase; legislation passed to expand participation in one of the state’s two such programs.

The budget for the University System of Georgia and its associated programs like agricultural extension services is $2.5 billion. The budget for technical colleges and associated programs like Adult Education is $344 million. FY 2022 budgets for colleges and universities add money for two years of previously unfunded enrollment-driven formula increases but do not restore 2021’s large cuts.

Lawmakers appropriated $1.3 billion from lottery sales to fund and administer Georgia’s Pre-K, HOPE and student loan programs. The state has about $1.3 billion in lottery reserves.

K-12 public schools have also been allotted $5.9 billion in federal funds from the Coronavirus Aid, Relief, and Economic Security (CARES) Act, CARES II and American Rescue Plan Act (ARP). This money is not distributed through the same formula that dictates state funding, but rather is granted based on the percentage of students living in poverty. School districts must spend this money by varying dates over the next three years to help mitigate the harm of the pandemic.

Similarly, Georgia’s public and private colleges and universities can access federal relief funds, half of which must be regranted directly to students, and half of which can be spent on expenses and lost revenues related to coronavirus. The ARP provides up to $949 million for university system schools and $260 million for technical colleges.

A Generation of Public Underfunding While Private Vouchers Expand

FY 2022 will represent the 18th year out of the last 20 that the State of Georgia has failed to meet the minimum threshold for public school funding outlined in the Quality Basic Education formula (QBE, which dictates the majority of state education funding). The current $383 million in cuts to public schools comes after a session where lawmakers expanded an existing private school voucher during a global pandemic.

The racist history of private school vouchers paired with the lack of hard-fought protections against discrimination in private schools that do not receive federal funding makes the state’s priorities more concerning.

Federal funding will help address the needs brought about from the pandemic but is no substitute for consistent state funding for public education. School district leaders will continue to face difficult decisions around class sizes, teacher furloughs and non-core academic courses like art and music if the state cannot supply the funding for a quality education.

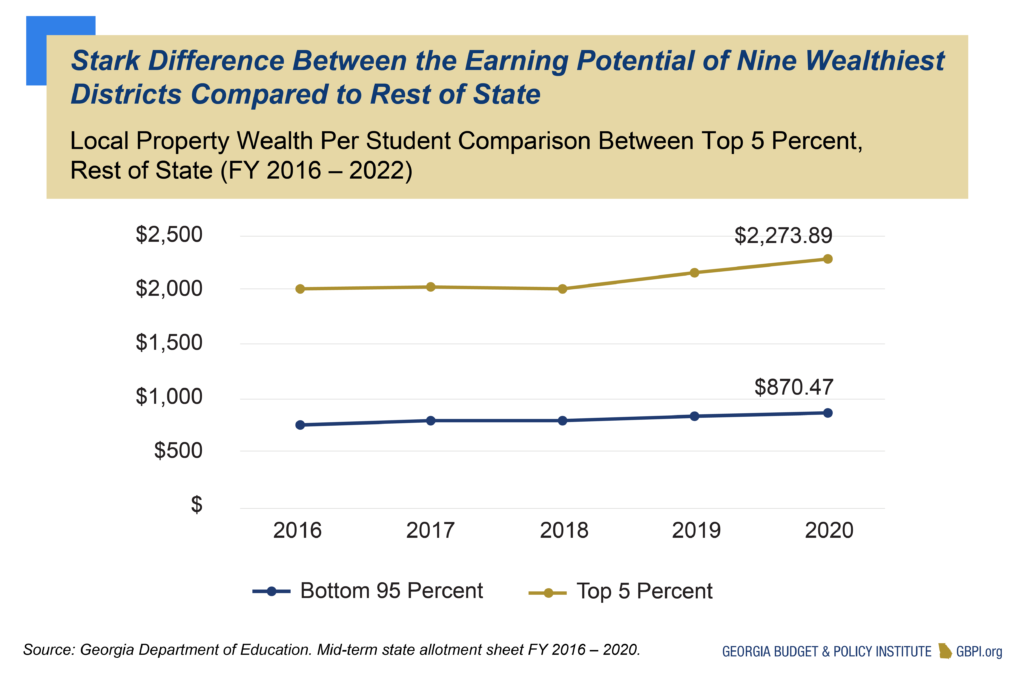

Gap is Widening Between Wealthy Districts and the Rest of the State

Since schools are primarily funded through a combination of state and local taxes, decisionmakers built provisions into the Quality Basic Education formula to prorate how much a district receives from the state by the amount they can earn in local property taxes. Georgia’s Local Five Mill Share (LFMS) and equalization grant are common educational finance measures to ensure that lower property-wealth school districts can provide similar educational opportunities to their higher property-wealth neighbors.

Before FY 2013, the state’s equalization grant was given to 75 percent of all school districts. In the wake of the Great Recession the formula was changed so that only school districts in the bottom 50 percent (after removing the top and bottom 5 percent of districts) received this funding. In FY 2022, the state allocated $798 million in equalization grants, a number that would be millions greater if the state used a true average of all district property wealth instead of taking the top and bottom districts out of the calculation. The graph below shows the stark difference between the earning potential of the wealthiest nine school districts compared to the rest of the state.

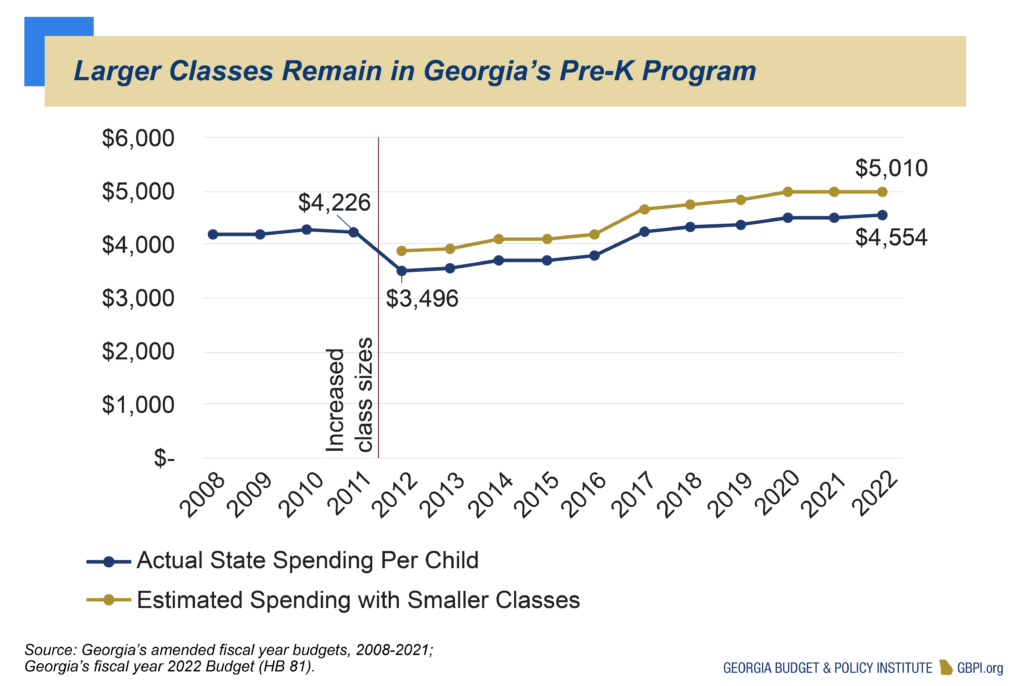

Pre-Kindergarten Remains Held Back by Low Wages, Larger Classes

Pre-Kindergarten funding increased by $3.9 million in FY 2022 due to consistent lottery proceeds during the pandemic. Funding for Georgia’s universal pre-K program has grown 28 percent since FY 2013 but is still hampered by larger class sizes and low wages for teachers. Pre-K centers are only provided $16,190 for assistant teachers’ pay regardless of the employee’s training or experience. The General Assembly increased class sizes from 20 to 22 students in FY 2012; they remain that size in FY 2022. Had classes remained at 20 students per classroom, the state would spend $455 more per child in FY 2022.

Inadequate funding keeps Georgia’s Pre-K Program from expanding and providing reimbursements to child care providers for capital improvements such as roof repair or air conditioning. In a recent survey of Georgia’s Pre-K project directors, over 60 percent stated that their center had required at least one capital improvement in the last two years.

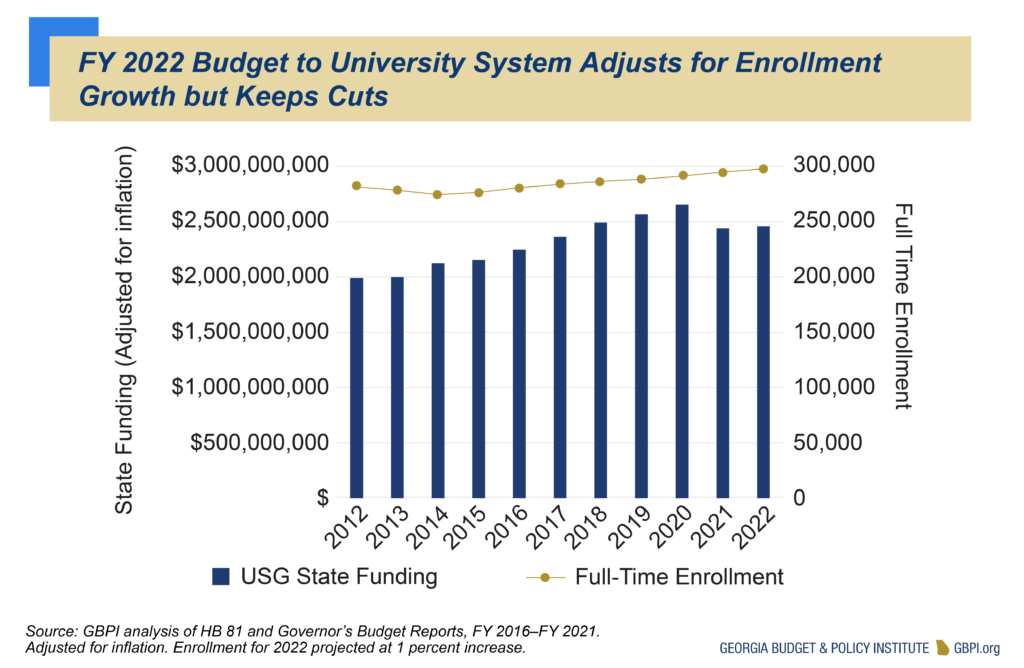

University System of Georgia

The 2022 budget for the University System of Georgia (USG), which manages 26 colleges and universities and other programs like agricultural extension services, is $2.5 billion. The vast majority, $2.2 billion, is allocated to schools for student instruction, support services and basic operations. The remaining funds go to cooperative extension services between universities and counties to support agriculture and education, public libraries and other programs.

This year’s budget adds funding for two years of enrollment-driven formula increases but does not restore past cuts. It represents a 6.8 percent increase in state funds following the 10 percent cut from last year or a $157 million increase to all programs and $138 million more for colleges. While enrollments continue to increase, current funding is still $104 million less than the pre-pandemic budget two years ago.

The state budget also recognizes up to $949 million available to schools in one-time federal ARP funds. Half of all funds must be regranted directly to students. The other half can be spent on expenses and lost revenues related to coronavirus.

Technical College System of Georgia

The technical college system includes 22 colleges that provide technical and core academic education for a wide range of students.

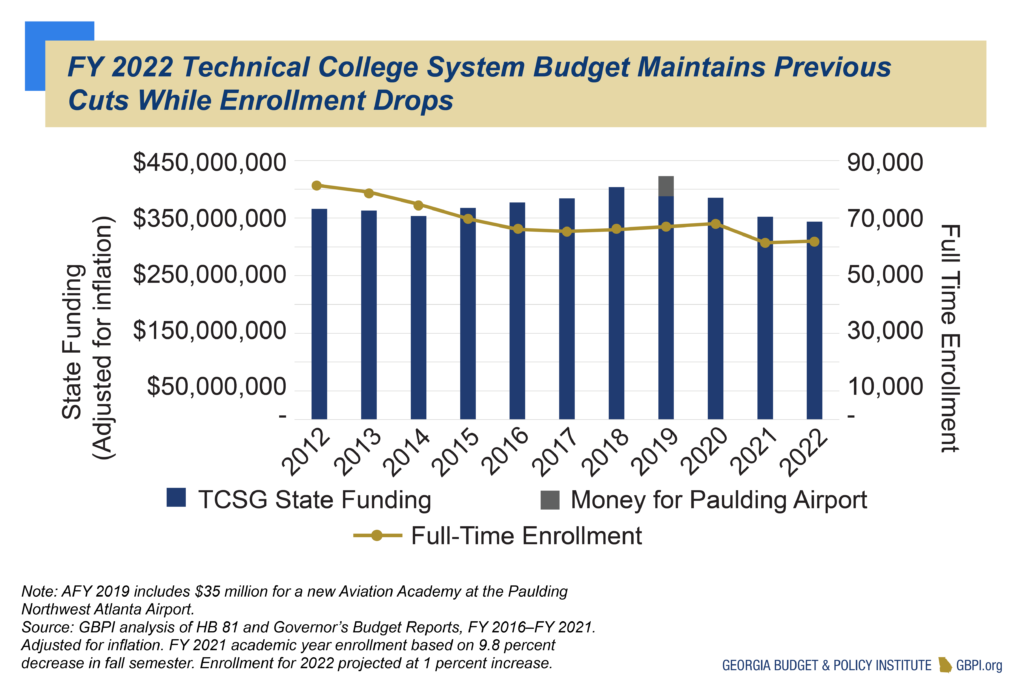

The 2022 budget for the technical college system is $344 million. About $308 million is allocated to technical education, and the remainder is for programs like Adult Education for individuals without a high school diploma and customized training for businesses.

The budget adds money for two prior years of enrollment increases but does not restore past cuts. The 2022 budget represents less than a million dollars more (0.3 percent) for technical colleges, following a $32 million budget cut from last year. However, the cut also coincided with a nearly 10 percent drop in enrollment from Fall 2019 to Fall 2020. Funding formulas lag behind actual enrollment by two years, so the impact of enrollment decreases will potentially be seen in future budgets.

The state budget also recognizes up to $260 million available for technical colleges through the federal ARP. Half of all funds must be directly regranted to students. Other funds can be used for expenses and lost revenues related to coronavirus.

Lottery Funds Support Georgia’s Pre-K and HOPE

Georgia’s lottery funds are constitutionally dedicated to supporting education programs and are accounted for separately in the budget.

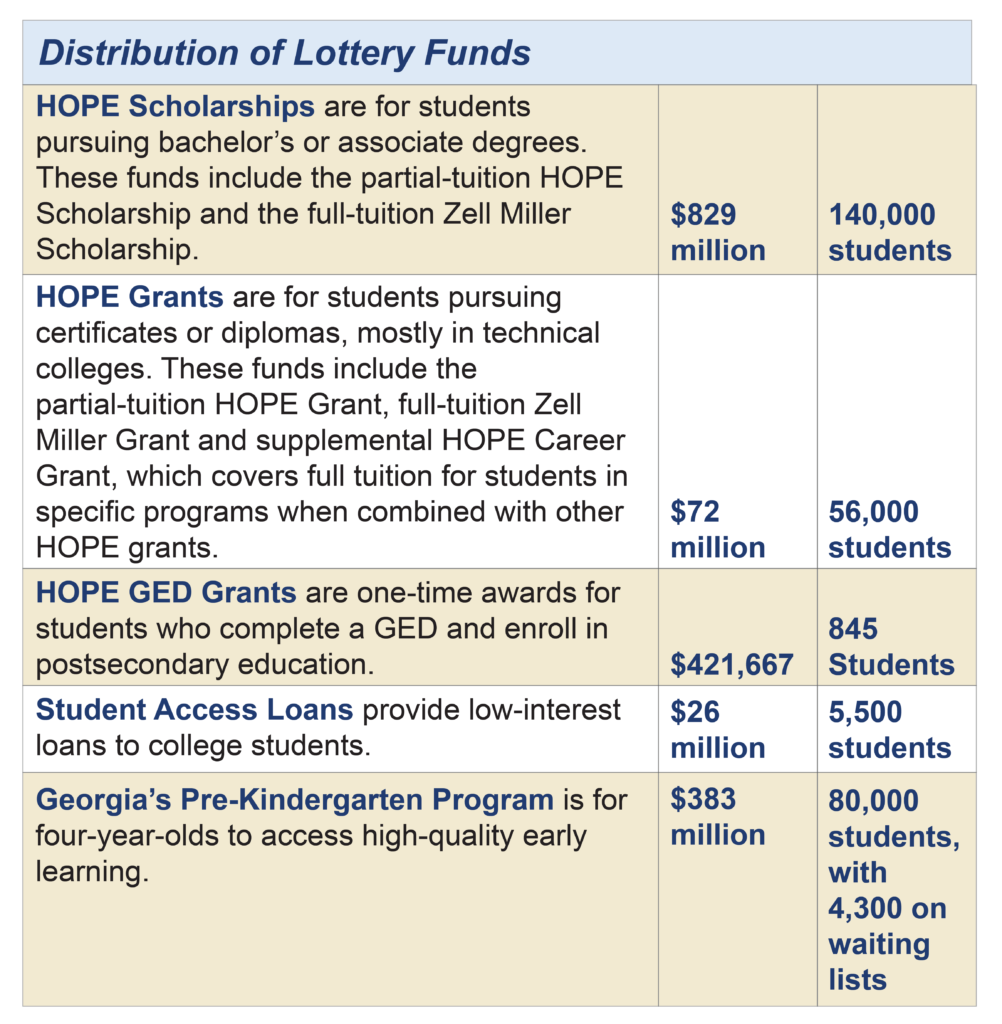

The 2022 budget maintains awards funding for HOPE scholarships and grants and increases funding for the operation of pre-K classrooms by $1.7 million. Lawmakers appropriated $1.3 billion from lottery sales to fund and administer the following education programs.

HOPE Changes Vary by Program

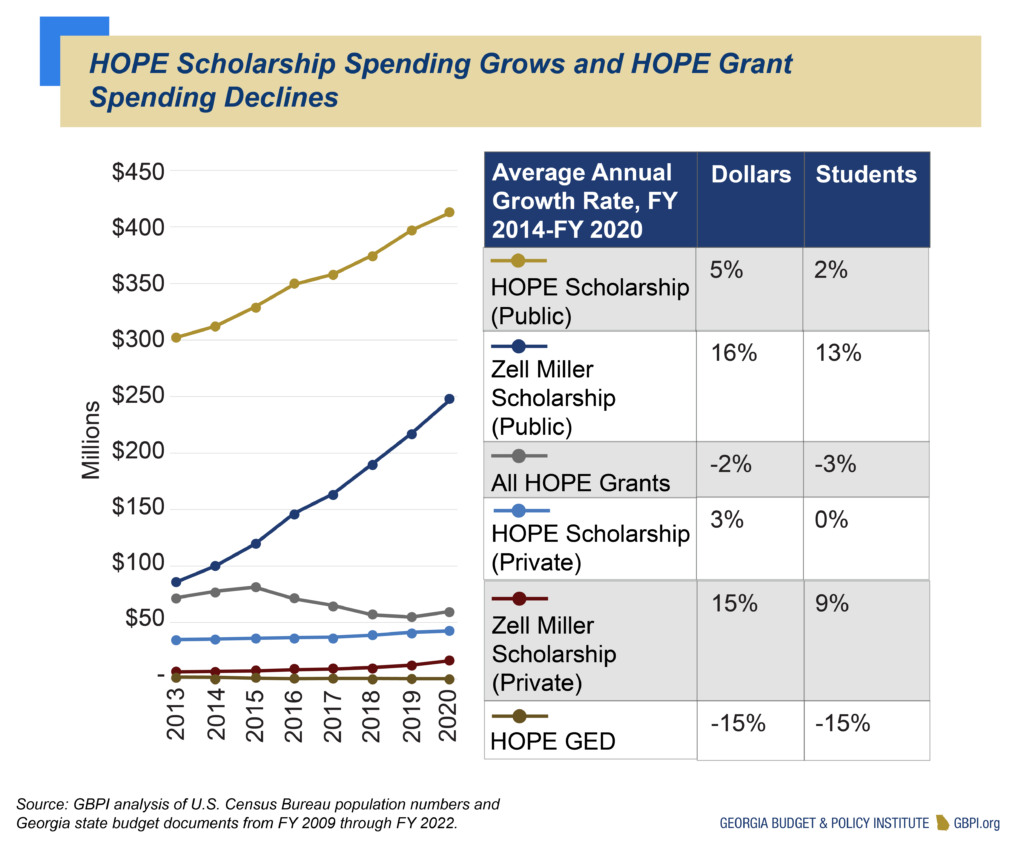

The costs of the different HOPE programs have changed at different rates. The full-tuition Zell Miller Scholarships have grown fastest as more students qualify and tuition increases. Funding for all HOPE Grants for technical college students has declined, even with the addition of the HOPE Career Grant, following enrollment decreases. The HOPE GED Grant, which helps students who earn a GED with college costs, has decreased the most.

Zell Miller Scholarship recipients at public colleges and universities are not representative of in-state undergraduates overall: 70 percent are white, 6 percent Black, 6 percent Hispanic/Latinx and 12 percent Asian, compared to total students who are 49 percent white, 29 percent Black, 10 percent Hispanic/Latinx and 7 percent Asian. Thirty-one percent of Zell Miller Scholarship recipients are from families with more than $120,000 annual income, far above the median income of $42,000. HOPE Grant recipients closely represent technical college students overall.

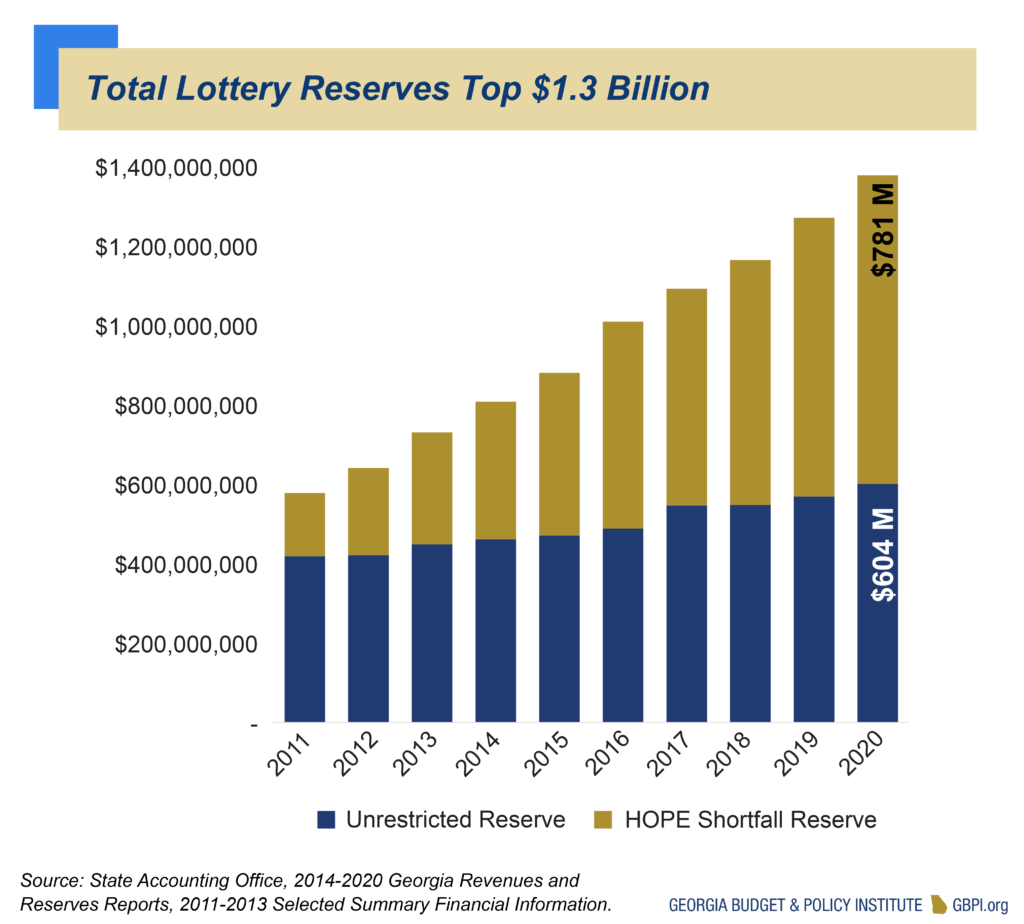

Lottery Reserves Now Exceed Lottery Proceeds

Every year unspent lottery dollars transfer to reserves managed by the State Treasury. At the end of the 2020 fiscal year, about $39 million in surplus was transferred to the lottery reserves.

Since 2011, state law requires the lottery shortfall reserve to hold an amount equal to 50 percent of the previous year’s net lottery proceeds. If lottery ticket sales underperform, the state can draw on this reserve to fund HOPE. After reaching the 50 percent target, additional reserves are considered unrestricted. At the end of FY 2020, the required Shortfall Reserve Balance was $604 million, and the state exceeded that by $781 million. Total reserves now stand at 112 percent of lottery proceeds.