This section is co-authored by K-12 Senior Policy Analyst Dr. Stephen Owens and Higher Education Senior Policy Analyst Jennifer Lee.

Georgia’s 2023 Education Budget

The state budget for K-12 public schools is $10.7 billion in FY 2023. After years of budgets with dedicated cuts to the state’s education system, lawmakers met the school funding requirement within the Quality Basic Education (QBE) Act for AFY 2022 and FY 2023. Additionally, this year’s budget includes $287 million to provide a $2,000 raise for certified teachers and employees, starting September 1. The fact that this start date comes two months after the beginning of the fiscal year will leave districts to find the $300 gap per employee in local property taxes.

Along with strong revenue collection and federal COVID relief, the K-12 budget benefited from increased property tax collection that grew more in low-property-wealth school systems compared to high-wealth systems. Georgia’s schools are financed by a mix of state, federal and local dollars—a typical practice in the United States. The state paid $306 million less in FY 2023 due to formula requirements in the equalization and local five mill share grants.

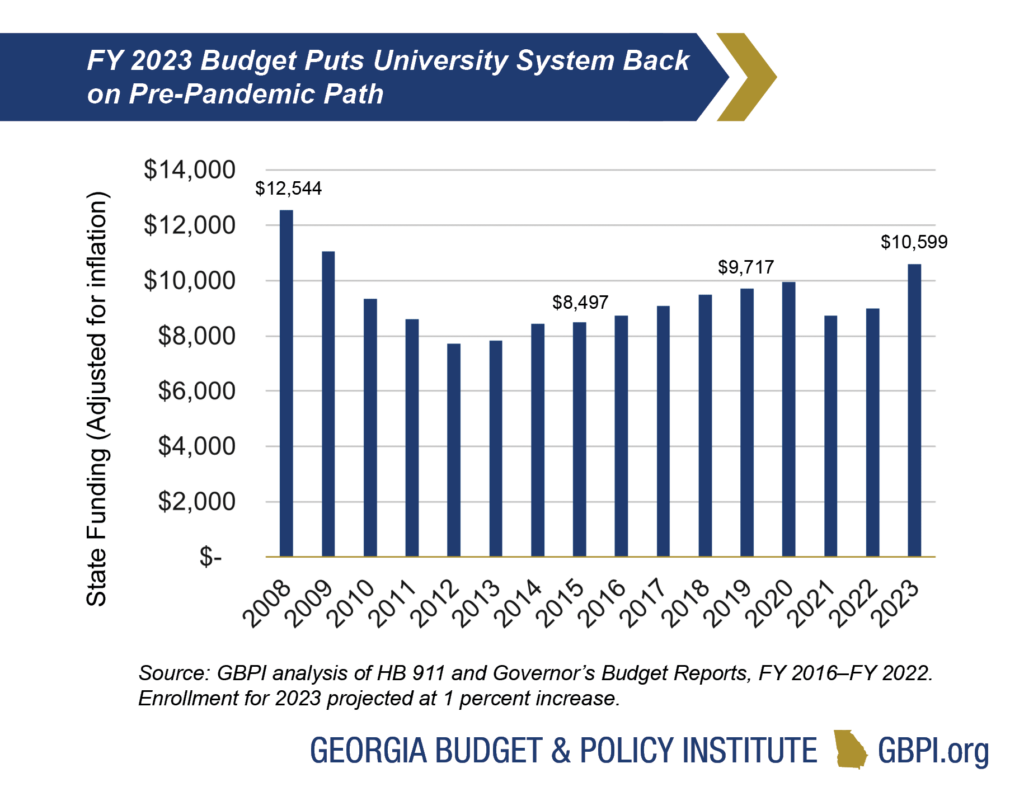

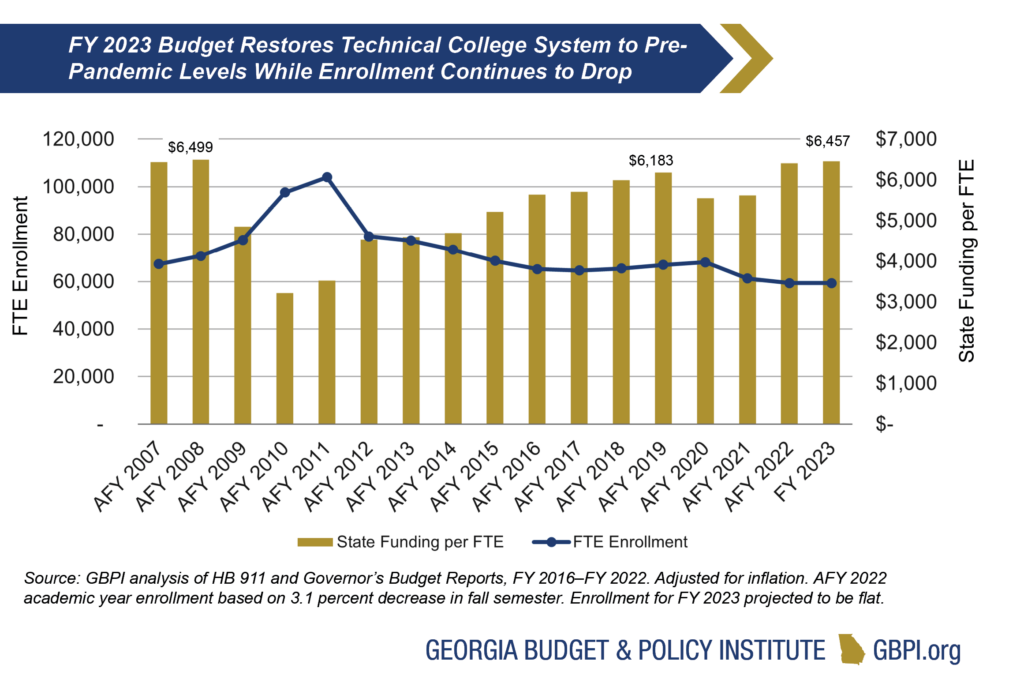

The budget for the University System of Georgia and its associated programs like agricultural extension services is $3.1 billion. The budget for the Technical College System of Georgia and associated programs like Adult Education is $444 million, with this year’s budget restoring funding to pre-pandemic levels.

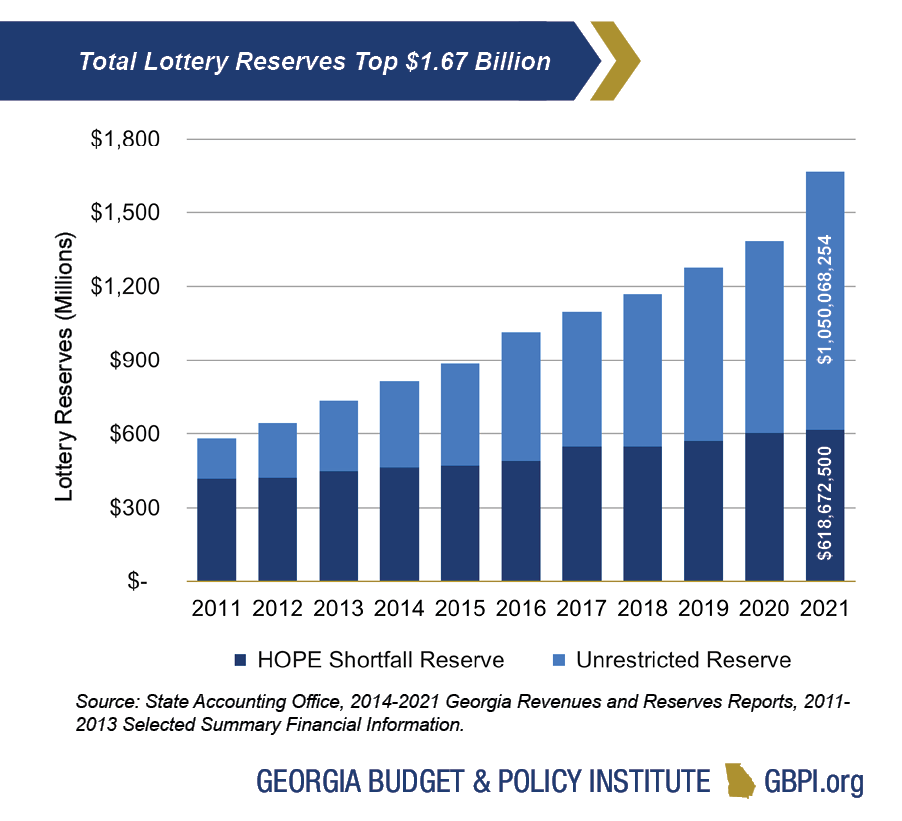

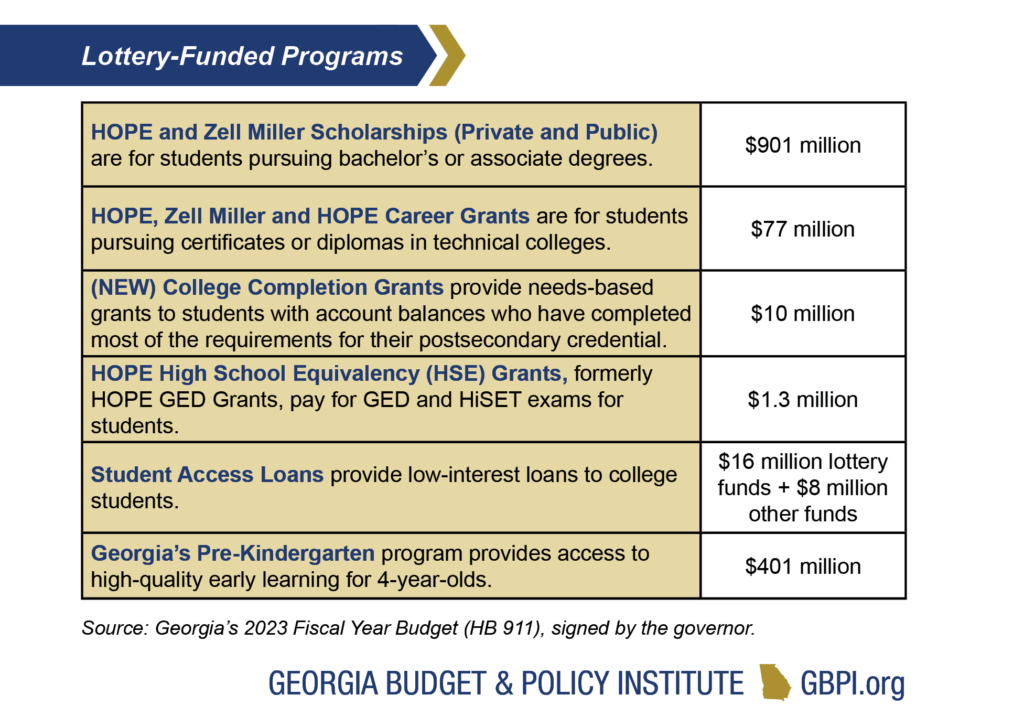

Lawmakers appropriated $1.4 billion from lottery sales to fund and administer Georgia’s Pre-K, HOPE and student loan programs. The state has about $1.7 billion in lottery reserves.

Concerning the large federal investments, state lawmakers had an opportunity to move state fiscal policy towards racial equity. The additional funds in education reversed some of the most harmful cuts of the past year but fell far short of meaningful investment for the future of the state.

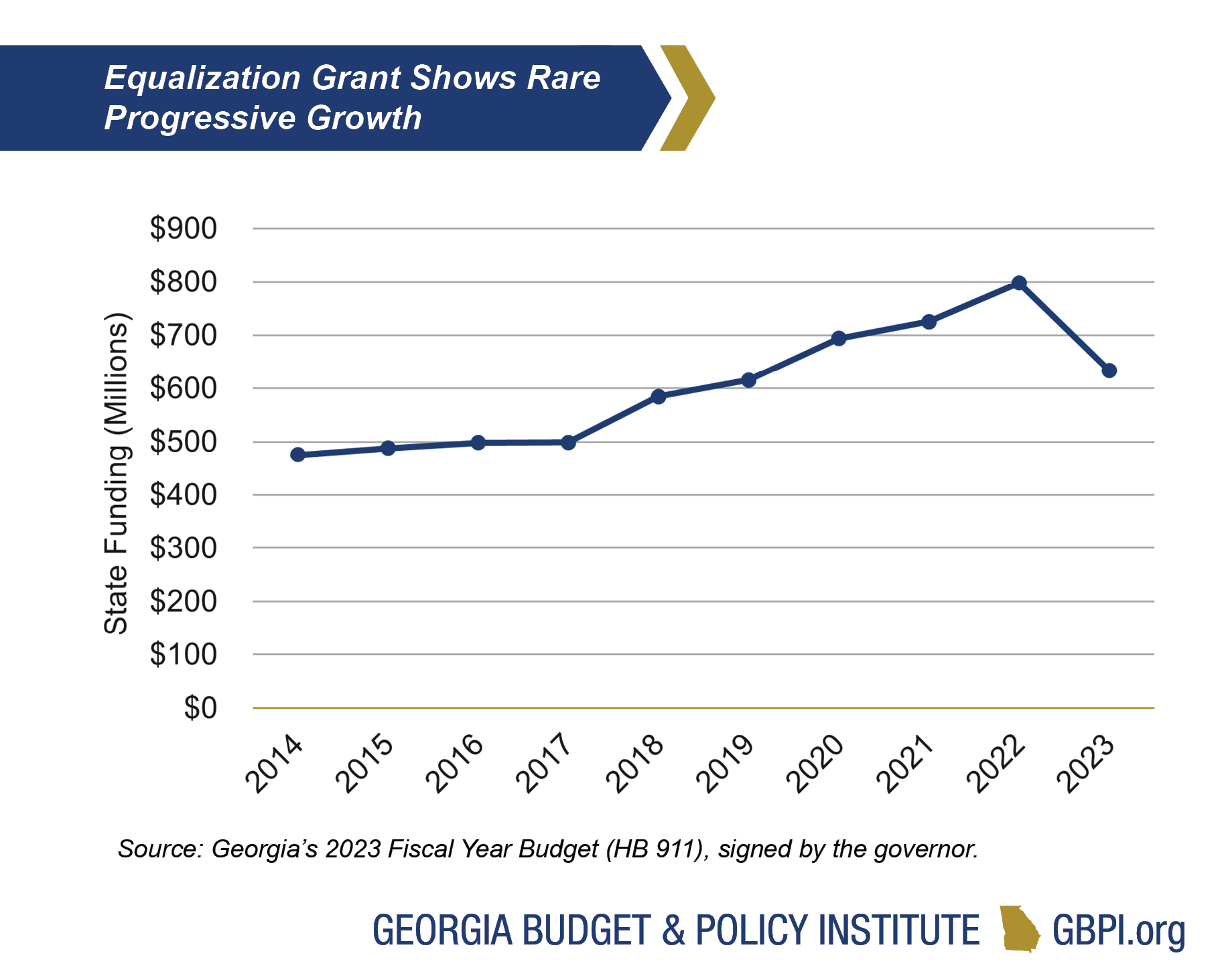

Equalization Grant Lowers for First Time in a Decade

The K-12 budget includes a formula grant for low-property-wealth districts that required $164 million less in FY 2023 than the year prior. The state has only lowered the amount provided to this grant twice since FY 2006, and both were due to budget constraints and not the formula calculation.

Since local taxes make up a significant portion of school budgets, and property values vary greatly across the state, the equalization grant provides more state funding to those districts that cannot rely on local sources. A reduction means that lower-wealth districts’ property tax collection has grown faster per student than their higher-wealth district counterparts.

Another possibility is districts have, on average, lowered property tax rates—the formula is tied to local effort. The $164 million drop in formula earnings is a 21 percent decrease—the formula had increased 7 percent annually for the nine years prior.

Private School Vouchers Cost Accelerates

This year lawmakers passed a $20 million increase to the Qualified Education Expense Tax Credit (QEETC)—a voucher that the Georgia Department of Audits and Accounts found is lacking in transparency and oversight. This program provides a tax credit to those that donate to pass-through organizations that then pay private school tuition for parents who apply. Georgians have no assurances of how students perform once they enter this program, as these schools are not held to state standards or tested to measure performance.

The QEETC is one of two state vouchers that funnel public funds to private schools—institutions that can reject students by income, ability, language proficiency, sexual orientation or religion. Georgia is projected to lose $155 million to these vouchers in 2022, with $1.3 billion diverted since 2008.

Pre-Kindergarten Program Grows, Still Lags Next Grade

The FY 2023 budget for Georgia’s Pre-Kindergarten program is $401 million, an increase of $18.3 million from the previous year. The program saved $2.1 million from formula reductions as less was needed to pay for teacher training and experience, a possible sign of teacher attrition. Lawmakers this session committed $19.4 million to raise lead and assistant teacher pay by $2,000.

With 84,000 Pre-K slots available the FY 2023 budget provides $4,773 per child, the most provided since the program’s inception. Children one grade older in public kindergarten are allotted $6,450 per student in state funds, a difference of $1,677 a child.

If Georgia were to fund Pre-K at the same rate as kindergarten, the program would need an additional $141 million annually.

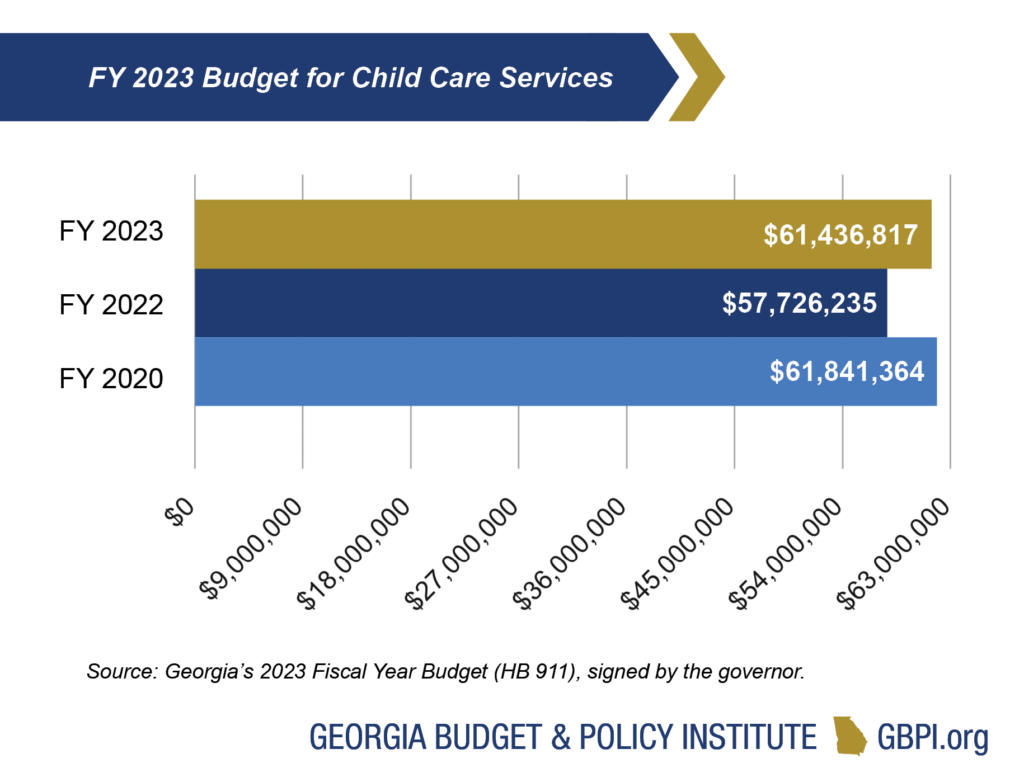

Child Care Services

Child Care Services

The FY 2023 budget includes $61 million for Child Care Services in Department of Early Care and Learning (DECAL). Child care services makes up 13 percent of the DECAL budget with Pre-K taking up the rest of the state funds. The FY 2023 Child Care Services budget is about $3.7 million more than the FY 2022 budget. However, state funding for child care is not quite where it was before the pandemic.

Much of the increase, $3.1 million, will go towards the state’s match for the federal Child Care and Development Fund (CCDF). This will allow it to draw down all available resources from the CCDF, which is a key funding resource for Childcare and Parent Services (CAPS) scholarships, Georgia’s child care subsidy program. An additional $500,000 for child care will go towards increasing provider reimbursement rates for child care providers participating in CAPS.

Federal relief legislation provided an additional hundreds of millions of dollars to stabilize the state’s child care system.

University System of Georgia/Board of Regents

The 2023 budget for the University System of Georgia (USG) is $3.1 billion. The vast majority, $2.8 billion, is allocated to USG’s 26 colleges and universities for student instruction, support services and basic college operations. The remaining funds go to cooperative extension services, public libraries and programs. This year’s budget restores the university system’s funding to its pre-pandemic trajectory. Per-student amounts are similar to FY 2009 and FY 2010 levels, adjusted for inflation. Increases include $100 million of enrollment-driven formula increases and $207 million for a $5,000 cost-of-living adjustment for full-time employees.

One of the biggest changes is a $230 million addition to eliminate the Special Institutional Fee (SIF). The university system adopted the SIF in 2009 to make up for revenue loss from state budget cuts. The SIF made up about 40 percent of student mandatory fees.

Last, the budget includes $65.9 million for capital maintenance and repairs at colleges and universities, which is normally funded through bonds.

Technical College System of Georgia

The technical college system (TCSG) includes 22 colleges that provide both technical and core academic education. The 2023 budget for TCSG is $444 million. About $383 million is allocated to technical education, and the remainder is for programs like Adult Education for individuals without a high school diploma and customized training for businesses. This year’s budget restores TCSG’s funding to its pre-pandemic trajectory. Per-student amounts are similar to FY 2007 and FY 2008 levels, adjusted for inflation, assuming a 3 percent enrollment decrease in 2021-2022 and steady enrollment in 2022-2023. A 10 percent enrollment decrease in 2020-2021 resulted in a $23 million decrease in formula funding for the FY 2023 budget.

The budget adds $25 million for a $5,000 cost-of-living adjustment for full-time, benefit-eligible employees. It also adds $33 million to expand Allied Health, Commercial Truck Driving and Manufacturing programs.

The budget includes $22.5 million for major repairs and renovations at technical colleges, which is normally funded through bonds.

Lottery Funds Support Georgia’s Pre-K and HOPE

Georgia’s lottery funds are constitutionally dedicated to support education and are accounted for separately in the budget.

Lawmakers appropriated $1.4 billion from lottery sales to fund and administer education programs. The 2023 budget increases awards funding for HOPE scholarships and grants by $78 million, or 9 percent. Pre-K funds grew by $18 million (5 percent) to fund $2,000 salary increases for certified teachers and a $5,000 cost-of-living adjustment for other full-time employees.

Lawmakers made several important policy changes to lottery-funded programs in the FY 2023 budget. $10 million transfer from Student Access Loans to a new program, College Completion Grants. HOPE Grants and Scholarships now cover 90 percent of tuition at all technical colleges and university system colleges and universities. HOPE GED is renamed HOPE High School Equivalency (HSE) and now pays for GED and HiSET exams for students, up to $200.

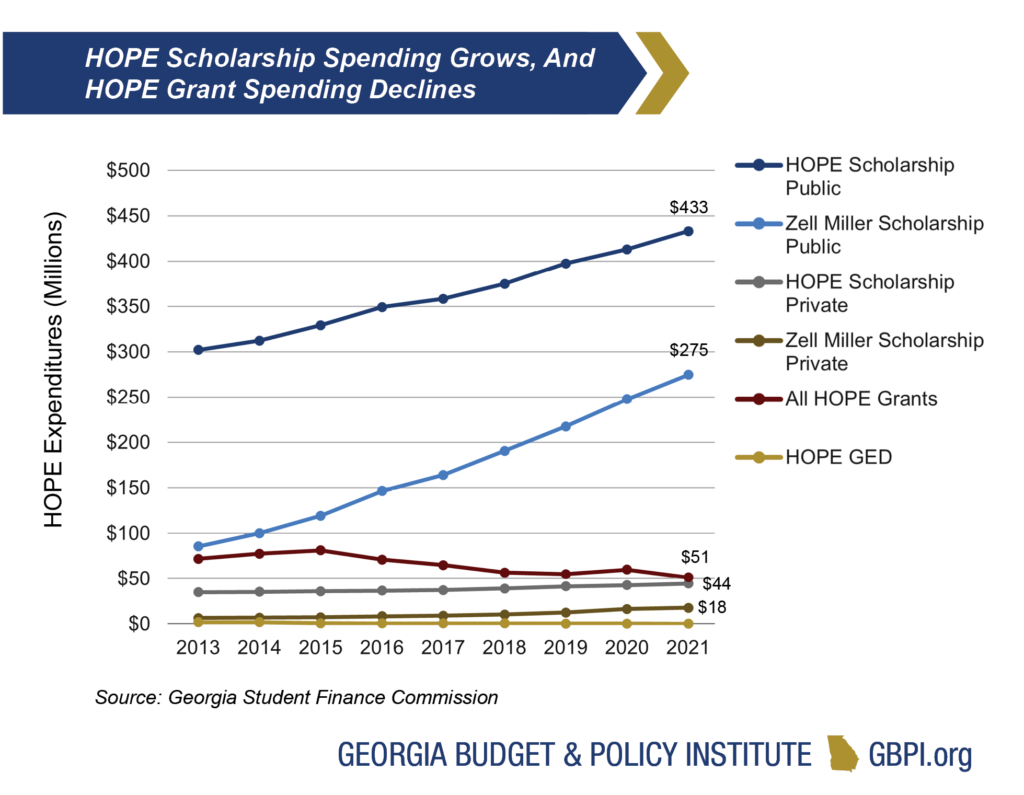

HOPE Expenditures Vary by Program

HOPE spending has changed at different rates. Zell Miller Scholarships grew fastest, averaging 16 percent annual growth from 2014-2021. HOPE Scholarships averaged 4 percent growth over the same period. HOPE Grant spending on technical college students declined by two percent annually from 2014-2021, and the HOPE GED Grant (now HOPE HSE) decreased the most, an average of 20 percent annually.

Setting HOPE Scholarships and Grants at 90 percent of tuition increases spending for these programs. It is unclear how this will affect future growth.

Zell Miller Scholarship recipients at public colleges and universities are 70 percent white, 6 percent Black, 6 percent Hispanic/Latinx and 12 percent Asian. Thirty-one percent of Zell Miller Scholarship recipients are from families with more than $120,000 annual income. HOPE Grant recipients are 46 percent white, 43 percent Black, 7 percent Hispanic/Latinx and one percent Asian.

No Cap on Lottery Reserves

Every year unspent lottery dollars transfer to reserves managed by the State Treasury. At the end of the 2021 fiscal year, about $71 million in surplus transferred to the lottery reserves.

Since 2011, state law requires the lottery shortfall reserve to hold an amount equal to 50 percent of the previous year’s net lottery proceeds. If lottery ticket sales underperform, the state can draw on this reserve to fund HOPE. After reaching the 50 percent target, additional reserves are considered unrestricted. At the end of FY 2021, the required Shortfall Reserve Balance was $619 million, and the state exceeded that balance by more than $1 billion. Total lottery reserves now stand at $1.67 billion, or 108 percent of lottery proceeds.