Introduction

Georgia plans to spend $30.2 billion in state money raised through taxes and fees for the 2023 fiscal year. This budget largely reflects a restoration of previous COVID-era budget cuts and represented a unique opportunity to invest in state fiscal policies that advance racial equity and economic opportunity, and to help Georgia families from the Black Belt to Blue Ridge make ends meet.

Georgia received unprecedented federal funding and saw a rare revenue surplus this year. Lawmakers then faced a choice: they could build a more resilient state by addressing systemic barriers that have left Black women, communities of color and other Georgians behind or they could further skew the tax code further in favor of the wealthy, risking Georgia’s long-term potential.

The governor proposed the 2023 state budget in January 2022. State lawmakers then modified it before Governor Kemp signed the budget into law in May 2022. Lawmakers will amend the 2023 state budget after the next Legislative Session starts in January 2023.

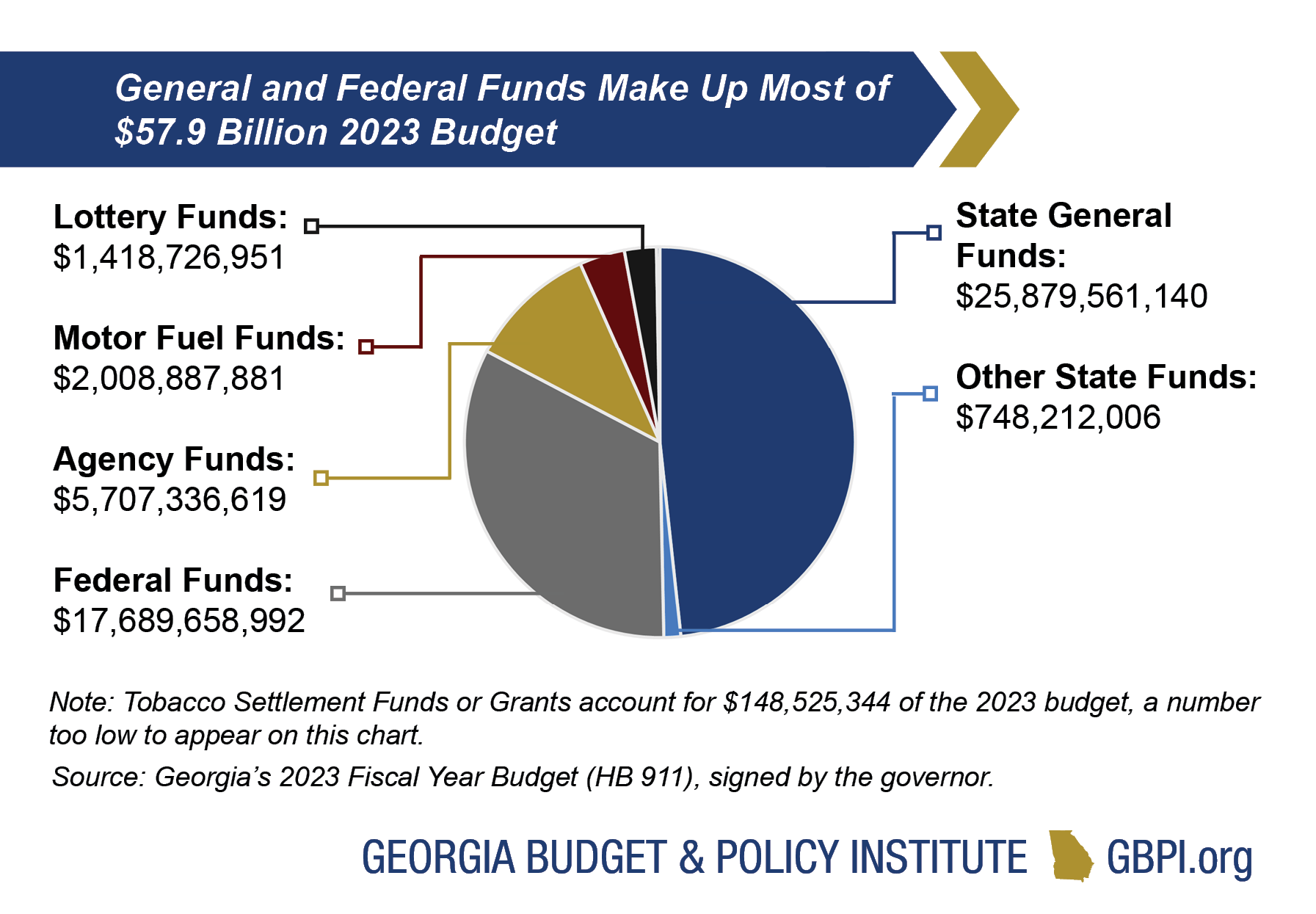

The total available funding to the state is $57.9 billion. That includes $30.2 billion in state funding, $17.7 billion in federal funding and $10 billion in agency funds and state employee benefit plan transfers. Before the effects of the Great Recession took hold, adjusting for inflation, the state of Georgia spent about $2,918 per person in FY 2008. Under the 2023 budget, the state will spend about $121 less per person, a total of about $1.3 billion less than if spending kept pace with growth.

Georgia by the Numbers

Each day, Georgia’s budget for 2023 touches the lives of millions of people across the state. The spending plan directly affects the quality of life for all 10.8 million Georgians across the state’s many diverse communities. The lion’s share of that money is allocated to core investments in the state’s economic future, including education, health care and transportation.

Here are some examples of the way the state budget affects the lives of Georgians:

- 2.3 million+ Georgians who are seniors, disabled, children or parents with low incomes receive health care coverage and services ($4.1 billion in the 2023 state budget)

- 1.73 million students, supported by 132,000 teachers and administrators, enroll in Georgia’s 2,300 K-12 public schools ($10.7 billion in the 2023 state budget)

- 434,000 students enroll in Georgia public colleges, universities or technical colleges ($4.7 billion in the 2023 state budget)

- 246,500 adult Georgians live under correctional control, including 181,000 on probation, 47,000 individuals who are incarcerated and 28,500 Georgians on parole ($1.5 billion in 2023 state budget)

- 18,000 miles of state highway are overseen by the Department of Transportation, which will also direct $201 million in FY 2023 to help maintain and improve more than 100,000 miles of county roads and city streets ($2 billion total in 2023 state budget)

Georgia’s Revenue System Shaped by History of Racist Policies

The structure of Georgia’s modern revenue system—which determines how much money the state can use to fund Georgia’s budget—developed during the turbulent decades of the 1930s through 1960s, a period during which the state was largely governed by segregationists who resisted New Deal-era federal assistance and struggled to finance basic government programs

and services.

At the beginning of the twentieth century, Georgia generated most of its revenue from a state property tax, which in the intervening decades was weaponized to systematically disenfranchise, intimidate and economically harm Black Georgians. The property tax was implemented alongside the state’s poll tax—which was maintained until 1945. Property tax assessors were given wide latitude to favorably value white landowners’ property while leveraging tax assessments to push Black land and business owners into poverty and, in many cases, eventually seize their property. In 1929, the state adopted corporate and individual income taxes, and in 1937, established the relatively flat individual income tax bracket structure that continues to form the basis for the current tax code. In 1951, the state enacted a sales and use tax at a rate of 3 percent, which was increased to its current level of 4 percent in 1989.

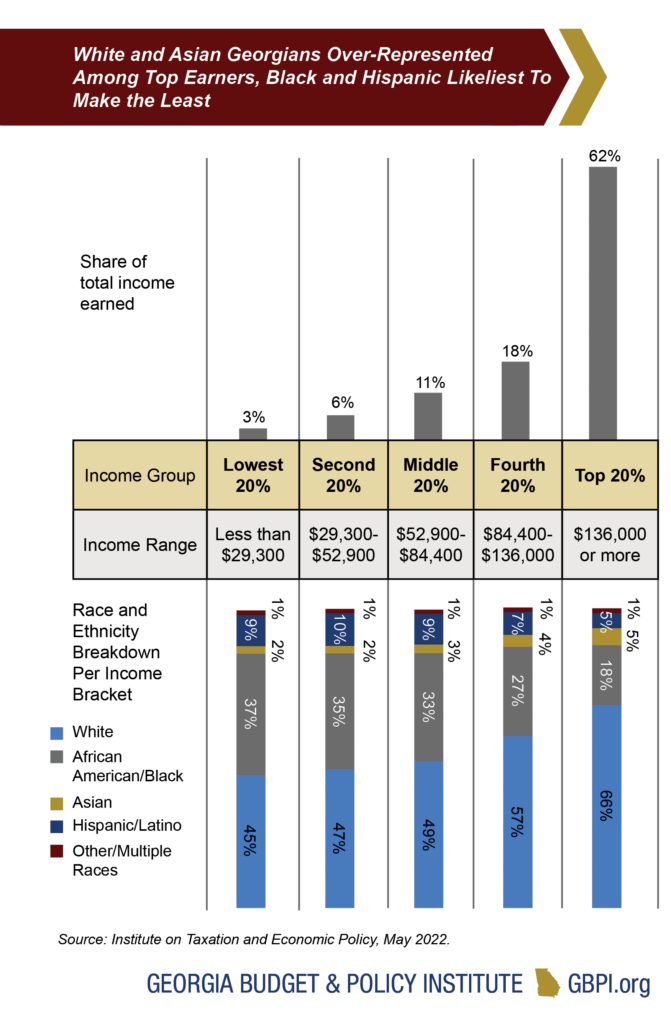

As revenues from income and sales taxes increased, the state phased out its property tax and eliminated it in 2016; local property taxes remain. Historic injustices and harmful policy choices have resulted in vast disparities in income across race and ethnicity in Georgia. Regressive tax policies at the state and local level worsen those disparities by asking those making the lowest incomes to pay the largest share in taxes.

Where Does Georgia’s Money Come From?

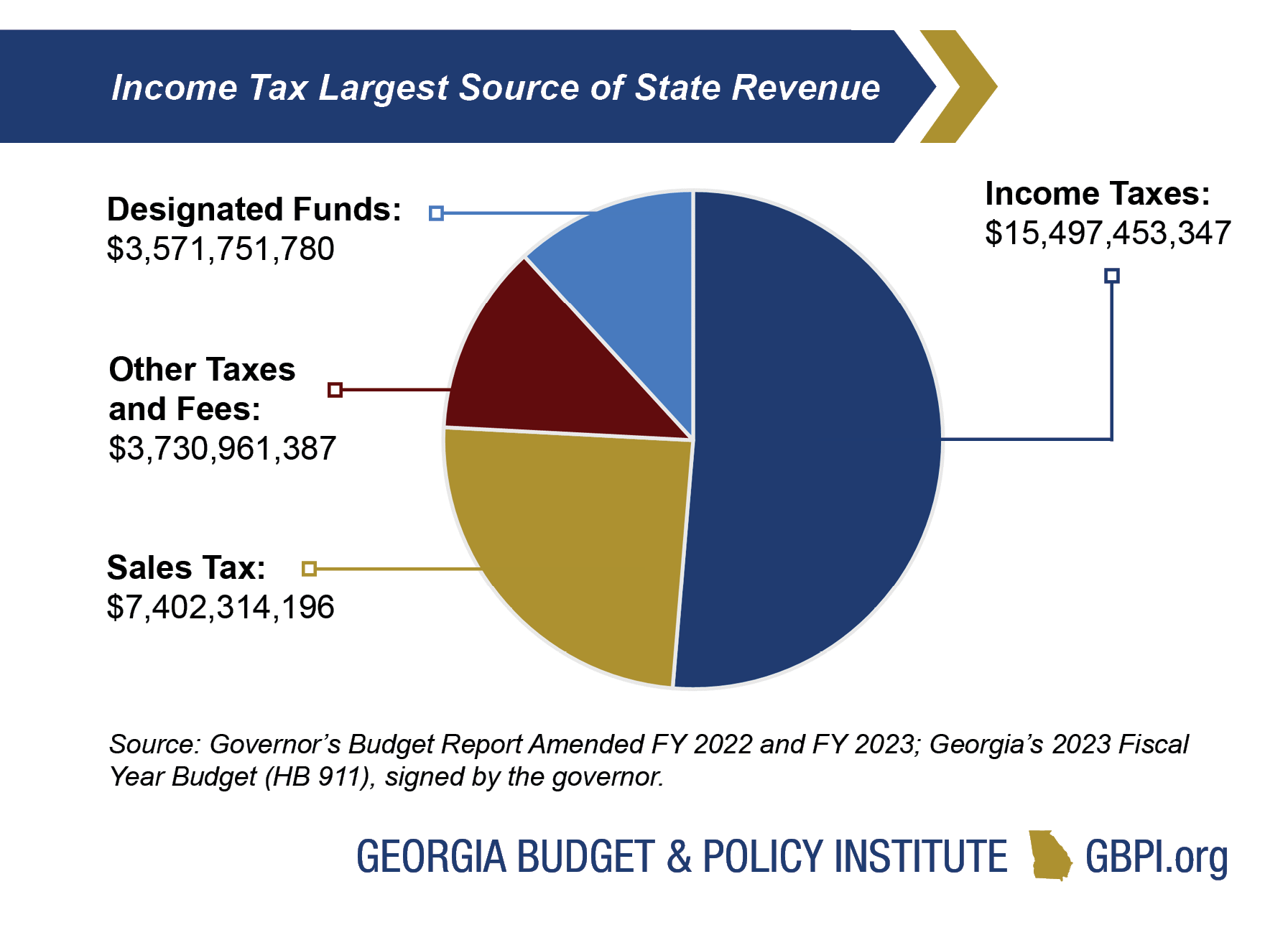

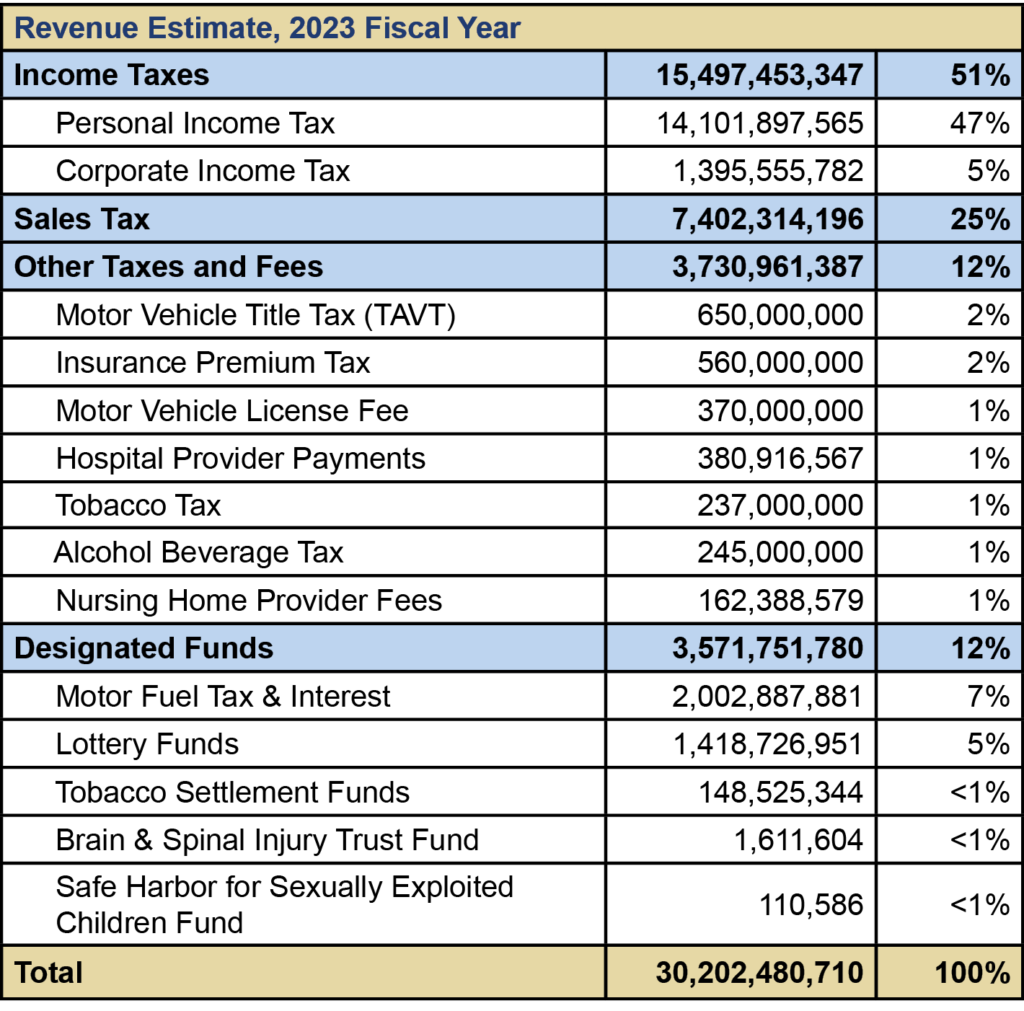

Georgia’s fiscal health depends on the state’s ability to raise money from a variety of sources in a reliable way. Like most states, Georgia collects revenue from a mix of personal and corporate income taxes; sales taxes; gas and vehicle taxes as well as various other levies and fees. Income taxes are the cornerstone of Georgia’s revenue system, accounting for half of all state funds. Sales taxes are the second-largest revenue source, representing slightly less than a quarter of annual collections. A fair and reliable revenue system requires both types of taxes.

Income taxes help balance the regressive effects of sales taxes and fees by allowing the state to collect a proportionate share of revenue from the wealthiest earners and most profitable corporations. A healthy income tax is also less sensitive to economic trends, which can boost revenue growth during good times but decline sharply when recessions occur.

Sales taxes provide a less consistent source of yearly revenue, and they fall more sharply on middle-class families and people with lower incomes. However, sales taxes remain a core funding source that allows the state to generate revenue from consumption and economic inputs that would otherwise be exempt from taxation.

In recent years, lawmakers have enacted several measures to ensure sales taxes are applied to online marketplaces. The state’s sales tax, however, is not assessed on the purchase of most services and large parts of Georgia’s economy, such as construction labor, the finance industry, attorneys or physicians. Some sales tax exemptions were intentionally created to avoid taxing products families rely on, such as groceries, while sales of items like digital downloads are not taxed because lawmakers have not proactively updated the tax code to include them.

Georgia’s Funding Sources

Georgia’s total 2023 budget, including federal funds, is $57.9 billion and is made up of six major funding sources:

- General Funds–The state-funded portions of education, Medicaid and most other traditional state services are paid for through the $25.9 billion General Fund, which includes money raised by income taxes, sales taxes and a variety of other taxes and fees.

- Federal Funds–A large share of Georgia’s overall spending for health care, K-12 education, transportation and other services is paid through the administration of $17.7 billion in federal funds.

- Agency Funds–These $5.7 billion in revenue include tuition and fees from colleges and university system research funds, in addition to regulatory fees and revenue raised directly by individual state agencies.

- Lottery Funds–These $1.4 billion in revenue are dedicated to pre-Kindergarten programs and scholarships for higher education.

- Tobacco Settlement Funds or Grants–This ongoing annual payment, $149 million in FY 2023, resulting from a legal settlement with the country’s four largest tobacco companies over health care costs, can be used for anything in the budget.

- Intrastate Transfers–The $4.3 billion of intrastate transfers include payments from the health benefit plan for state employees.

General Funds

$25.9 Billion (45 Percent of Georgia’s Budget)

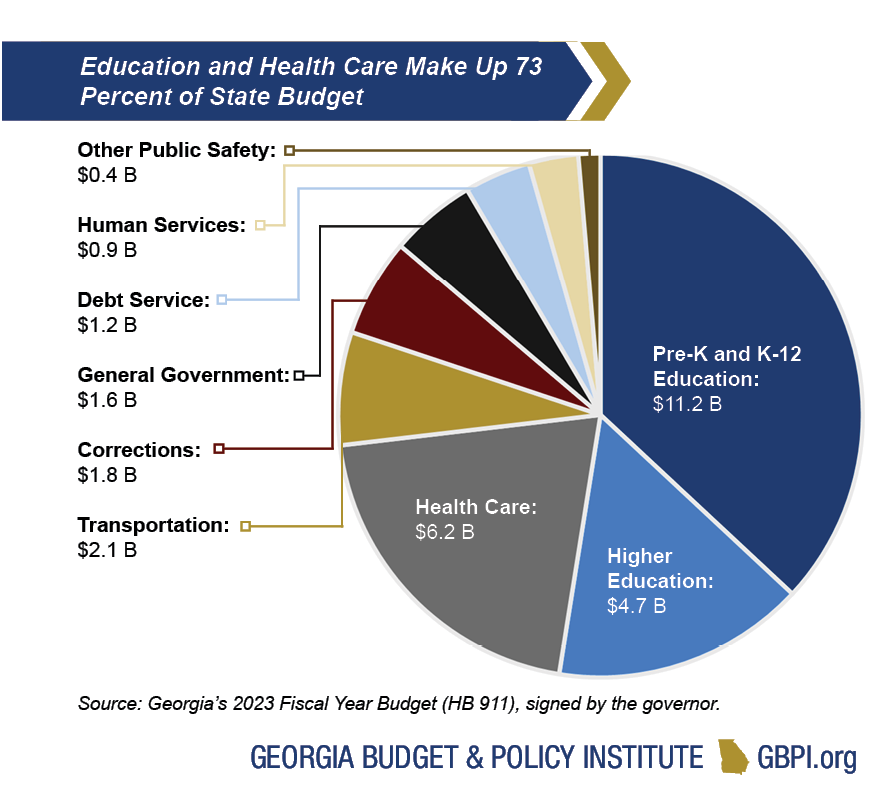

Georgia’s General Fund derives largely from income taxes on personal and corporate earnings and sales taxes on consumer transactions. The state also taxes motor fuel and assesses provider fees on hospitals and nursing homes. More than 94 cents of every dollar appropriated by the state pays for eight core priorities:

- Pre-K-12 Education (37 cents of every dollar spent)

- Health Care (21 cents)

- Higher Education (16 cents)

- Transportation (7 cents)

- Corrections, Juvenile Justice and Re-entry (6 cents)

- Debt Service (4 cents)\

- Department of Human Services (3 cents)

The remaining General Fund spending is for state agencies, boards and commissions dedicated to activities such as economic development, agriculture and forestry as well as grant programs. The General Fund also covers the costs of operating the legislative, judicial and executive branches of state government. Not included in Georgia’s General Fund are dedicated taxes and fees that are collected into several other funds. Lottery proceeds are also not included in the General Fund and account for about 5 percent of total state funds or $1.4 billion.

Motor Fuel Funds

$2 Billion (3 Percent of Georgia’s Budget)

Georgia’s Constitution restricts spending revenue from state motor fuel taxes to roads and bridges. The money is dedicated to a mix of new construction, maintenance of existing infrastructure and debt service on past investments. Georgia’s 2023 motor fuel rates are 29.1 cents per gallon of gas and 32.6 cents per gallon of diesel, a slight uptick from last year. As of July 1, Gov. Kemp has suspended Georgia’s gas tax via executive order through at least August 13, 2022, to offer relief to consumers facing recent spikes in energy prices. While the state taxes aviation gasoline at 1 cent per gallon, the state’s Department of Revenue has recognized a permanent tax exemption on the sale of jet fuel, which will cost the state an estimated $50 million in FY 2023. The state’s budget includes a total of $2 billion in motor fuel revenue.

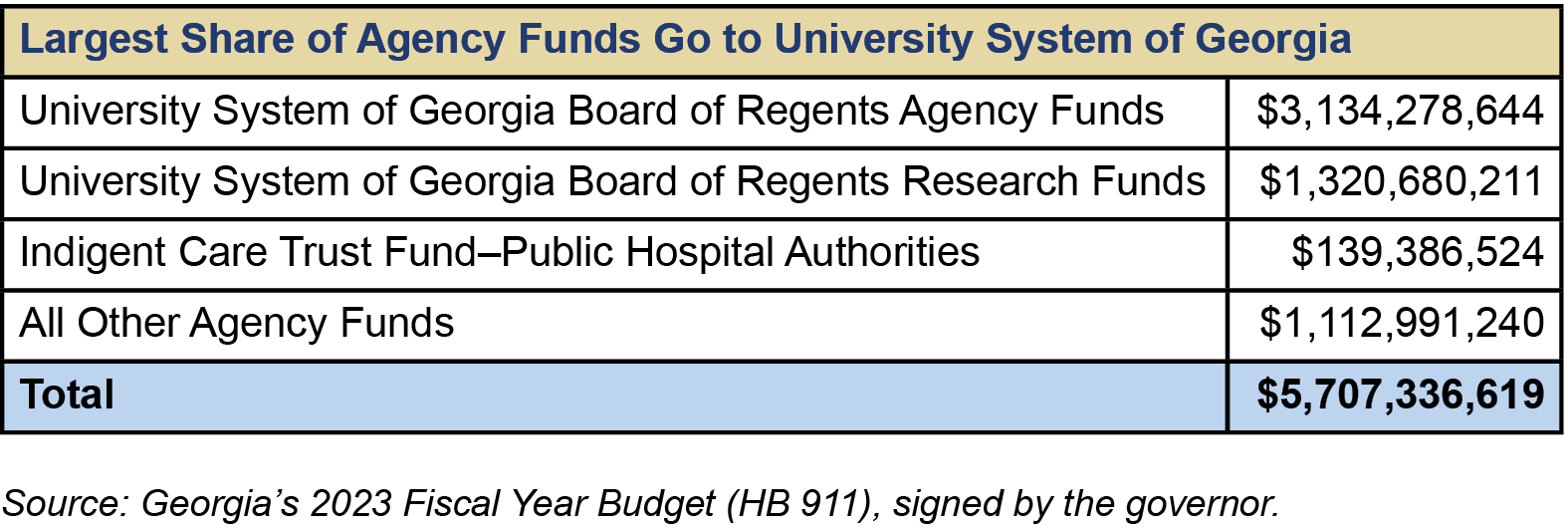

Agency Funds

$5.7 Billion (140Percent of Georgia’s Budget)

Agency funds include $3.5 billion in tuition and fees collected by the University System of Georgia and the Technical College System of Georgia. Overall, the University System of Georgia accounts for $4.5 billion in Agency and Research funds. The money is retained by the individual schools.

Federal Funds

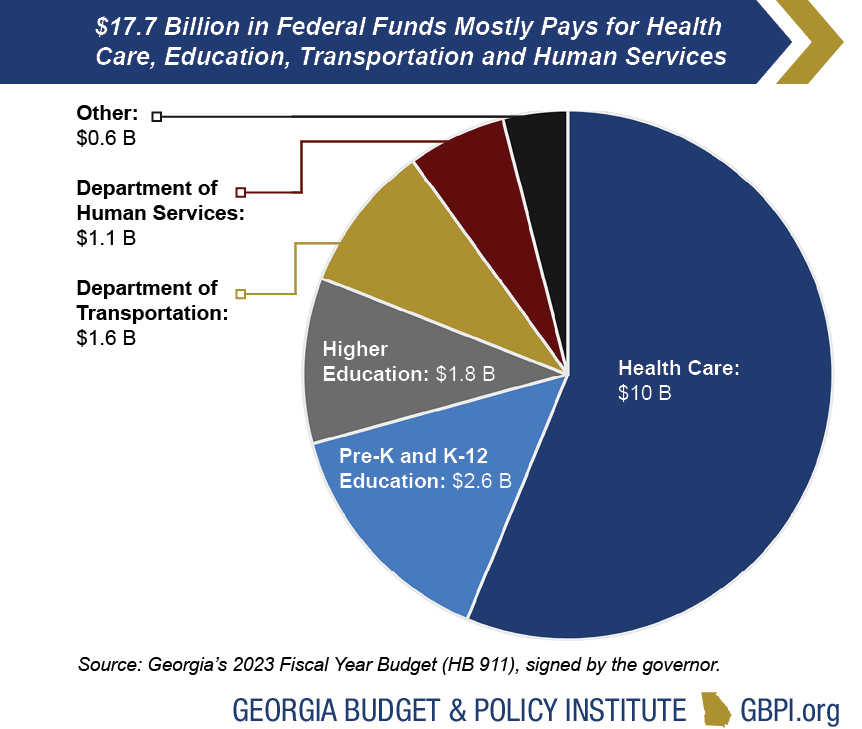

$17.7 Billion (31 Percent of Georgia’s Budget)

Money from the federal government flows to a range of state programs and services. Georgia spends the vast majority of federal money on the following:

- $10 billion for Medicaid, PeachCare and other health care programs

- $2.6 billion for Pre-K-12 education, which includes school nutrition programs, services for students from families with low incomes and support for students with disabilities

- $1.8 billion to support Georgia’s Universities and Technical Colleges

- $1.6 billion for the Georgia Department of Transportation

- $1.1 billion for human services, Temporary Assistance for Needy Families (TANF, or cash assistance) and child welfare programs

Federal rules require the state to match federal funding for Medicaid and many other investments that benefit Georgians. As a result, changes in state funding levels typically track changes in federal funding.

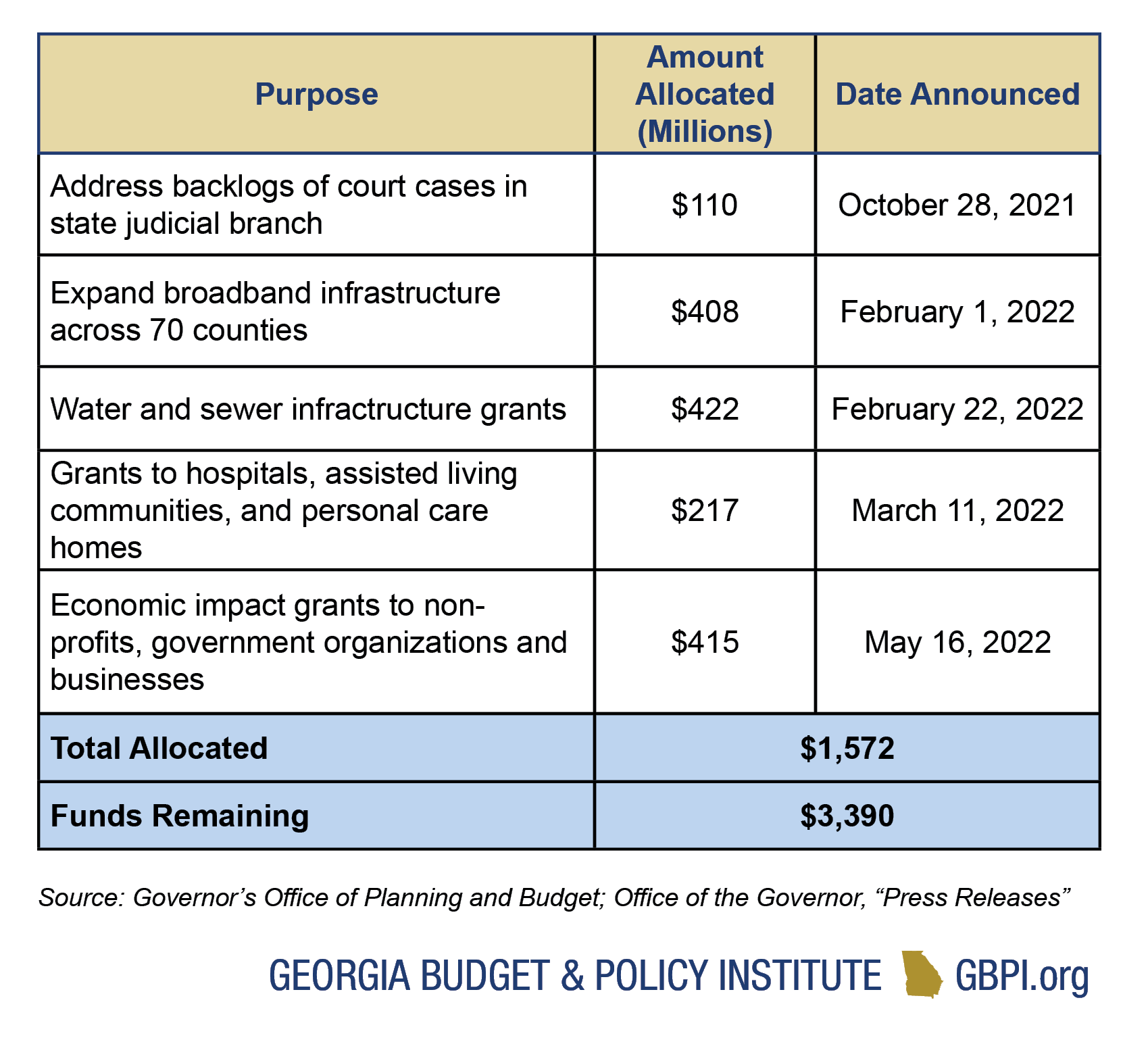

American Rescue Plan Act Funds

$5 Billion (State Fiscal Relief Fund and Capital Fund Project)

Enacted as part of the sweeping ARP legislation that was signed into law by President Biden in March 2021, Georgia is set to receive nearly $5 billion in federal funding. The funding includes $4.7 billion in flexible relief funding, along with $262 million in aid for capital projects to stimulate the state’s economy and address long-overdue needs like rural broadband. This federal aid can be used from the point when it is received until December 31, 2024.

Through the beginning of FY 2023, Georgia has allocated approximately $1.6 billion of these funds and retains about $3.4 billion in its State Fiscal Relief and Capital Fund Project accounts. Going forward, Georgia’s Governor retains full authority and wide latitude to allocate these funds across four core areas set forward by the ARP:

“(A) to respond to the public health emergency with respect to [COVID–19] or its negative economic impacts, including assistance to households, small businesses and nonprofits, or aid to impacted industries such as tourism, travel and hospitality;

“(B) to respond to workers performing essential work during the COVID–19 public health emergency by providing premium pay to eligible workers of the State…government that are performing such essential work, or by providing grants to eligible employers that have eligible workers who perform essential work;

“(C) for the provision of government services to the extent of the reduction in revenue of such State…government due to the COVID–19 public health emergency relative to revenues collected in the most recent full fiscal year…; or

“(D) to make necessary investments in water, sewer, or broadband infrastructure.”

In addition to providing for on-going needs related to the COVID-19 pandemic, state funding could go towards priorities like improving outcomes for public school students living in poverty or providing direct payments to low-and-moderate income families. The state could also allocate funds to help jump-start efforts to address gaps in access to health care services or address other long-standing inequities.

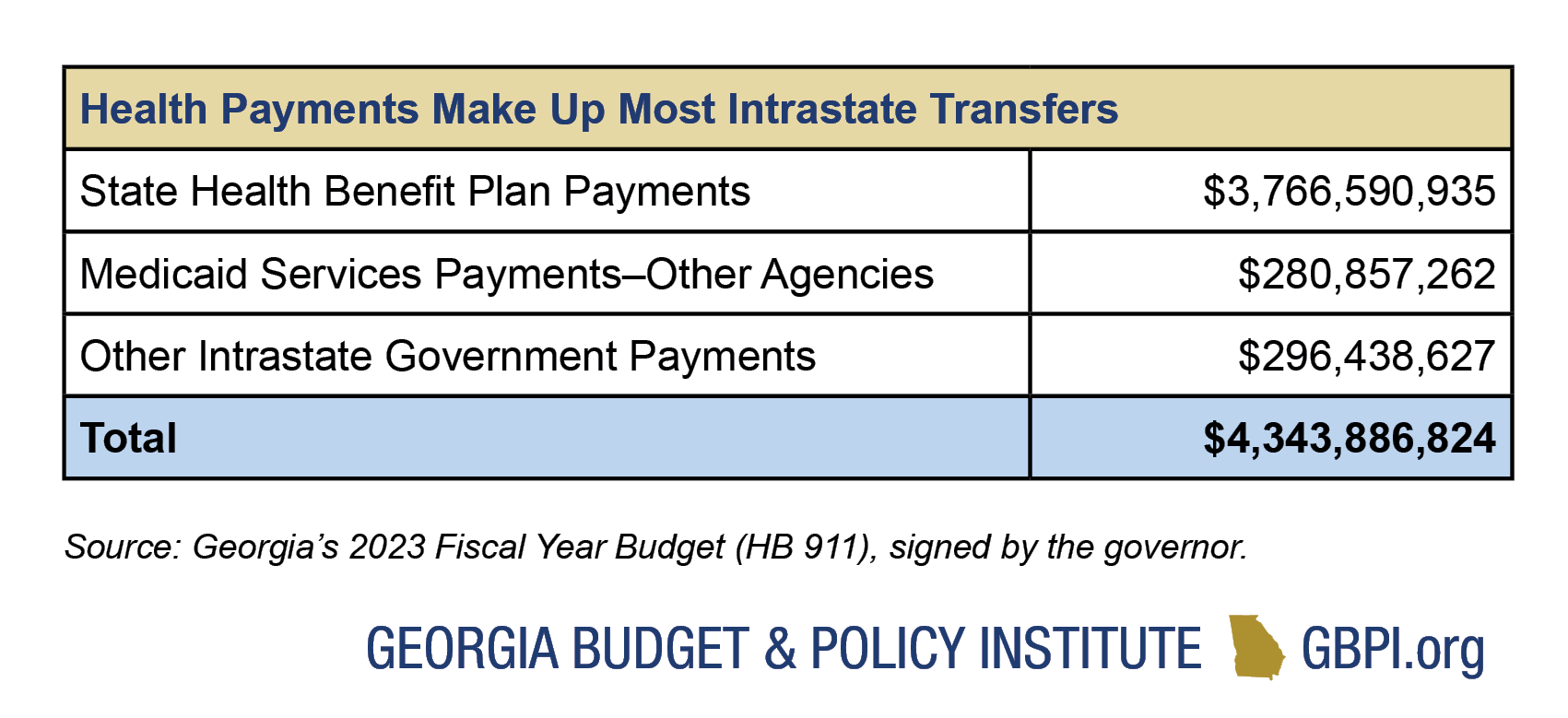

Intrastate Transfers

$4.3 Billion (Included for Reference)

Intrastate transfers are primarily payments from the State Health Benefit Plan, which insures about 625,000 Georgians.

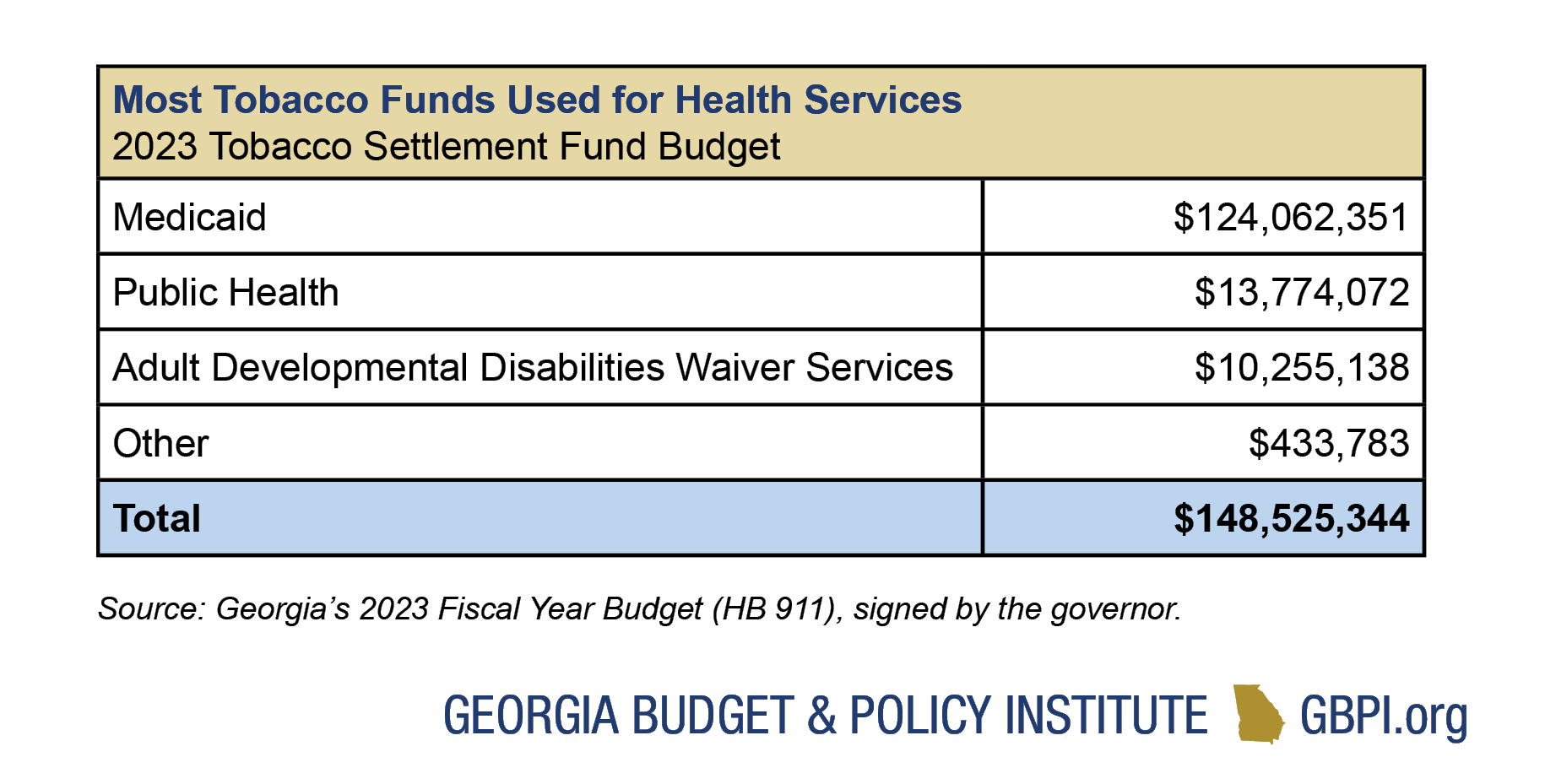

2023 Tobacco Settlement Fund Budget

$149 Million (0.2 Percent of Georgia’s Budget)

Georgia receives annual payments from a large settlement signed in 1998 with four of the country’s largest tobacco companies, known as the Tobacco Master Settlement Agreement. Georgia is not required to dedicate these payments for specific purposes. As a result, the use of tobacco settlement money can vary from year to year, though most of the money in the current year budget is allocated to health care.