The Institute on Taxation and Economic Policy (ITEP) recently released a report that destroys the myth that states without an income tax perform better economically than the states with high income tax rates.

ITEP’s Executive Director Matthew Gardner is our guest blogger this week:

Reality Check: “High Rate” Income Tax States are Outperforming No-Tax States

By Matthew Gardner, Executive Director, The Institute on Taxation and Economic Policy (ITEP)

For state lawmakers seeking to cut or repeal the personal income tax, there is no talking point quite as effective as the claim that doing so will lead to surefire economic prosperity. Often embedded in these claims is an assumption that states without income taxes are booming, and that any state can enjoy that same success if they just get rid of their tax as well.

As it turns out, however, the reality is exactly the opposite. My organization, the Institute on Taxation and Economic Policy (ITEP), recently released a report showing how the nine states without income taxes are faring relative to the nine states with the highest top personal income tax rates. Given all the rhetoric we’ve seen in Georgia and around the nation about the “job-killing” nature of state income taxes, there are more than a few lawmakers and advocates that should find the results shocking.

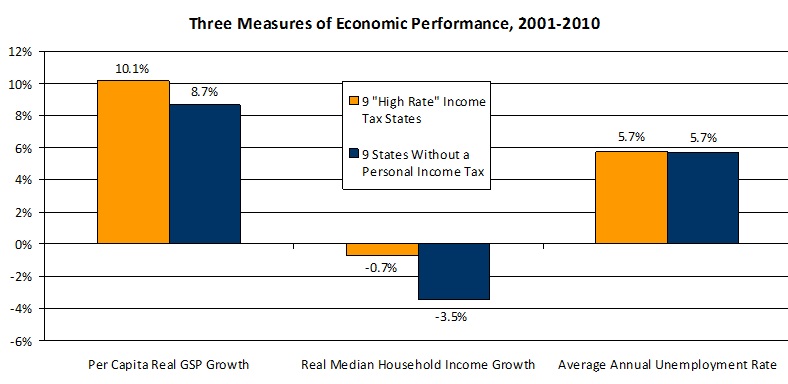

Over the last decade, economic output per person has grown significantly faster in the nine states with the highest top income tax rates than in the nine states without an income tax at all. And while “real” (inflation adjusted) median income levels have declined in most states, the drop has been much smaller in “high rate” states than in no-tax states. To top things off, unemployment rates have been virtually identical across both types of states, which would undoubtedly surprise the countless lawmakers promising that an improved job climate will come hot on the heels of income tax repeal.

Georgia’s place in the overall picture is a bit of a mixed bag. Unfortunately,Georgia is at or near the bottom in terms of the first two measures: growth in economic output per person and median income levels. But in terms of the average unemployment rate between 2001 and 2010, Georgia is actually out performing six of the nine non-income tax states.

The bigger takeaway, however, is that lawmakers wanting to join the non-income tax club are simply idolizing the wrong states. Most states without income taxes are doing worse than average on all three measures just described, and the states with the highest top tax rates are actually outperforming them.

So where is the myth about booming no-tax states coming from? Many of the most recent claims are based on a misleading analysis generated by Arthur Laffer, long-time spokesman of a supply-side economic theory that President George H. W. Bush once called “voodoo economics” because of its bizarre insistence that tax cuts often lead to higher revenues.

This time around, Laffer has chosen to ignore key measures of economic success like unemployment rates and income levels, and to instead focus on more clumsy aggregate numbers like total growth in economic output and employment. But the aggregate numbers are heavily skewed by ongoing regional population shifts driven by a slew of factors like the housing market, population density, birth rates, immigration, and even climate. Moreover, Laffer makes no effort to account for the natural resource advantages buoying many no-tax states’ economies. As it turns out, three of the six states with the largest mining sectors, relative to their economies, don’t levy an income tax. These states have thrived economically over the past decade for the same reason they were able to get along without an income tax in the first place—because they’re sitting on huge endowments of oil and natural gas.

In terms of the economic factors that matter most to Georgia families – income levels, and whether or not they can find a job – the states with the highest top income tax rates are matching or exceeding the no-tax states. It might take a while for the rhetoric on this issue to catch up with reality, but in the meantime I encourage you read ITEP’s new report: “High Rate” Income Tax States Are Outperforming No-Tax States.