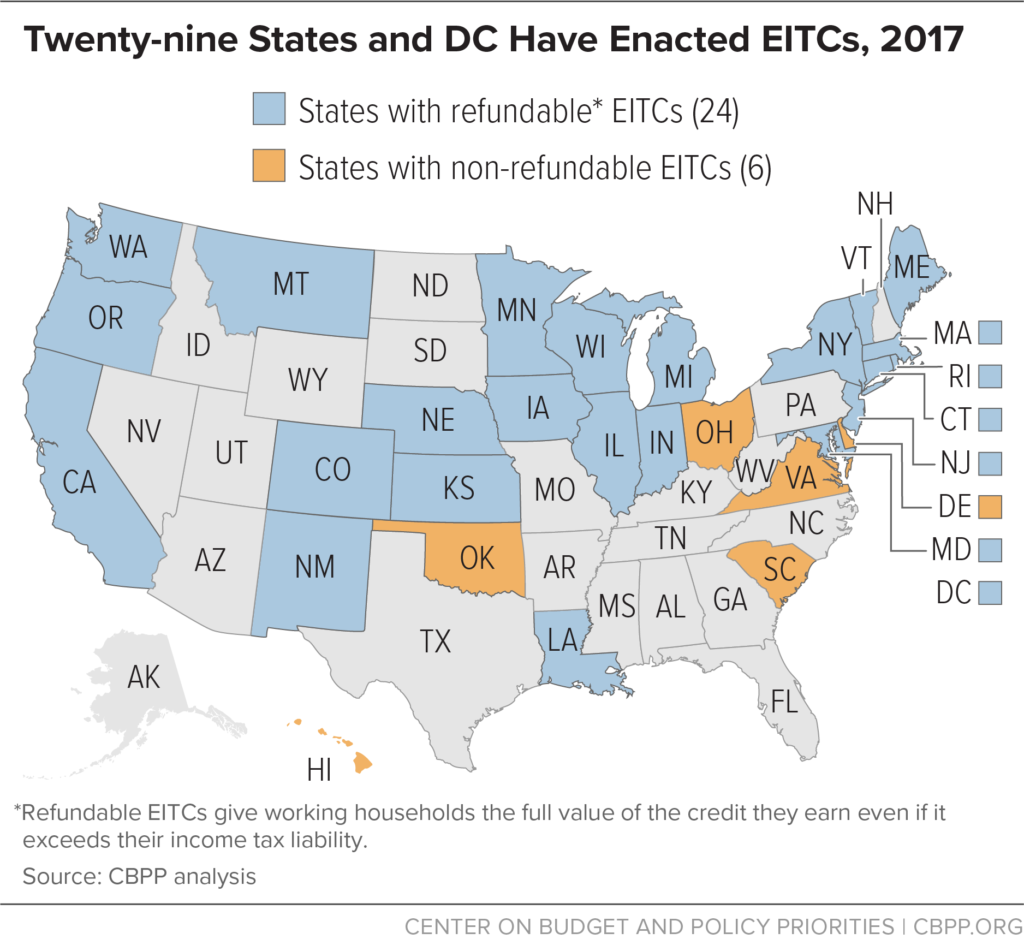

This spring significant momentum built across the country for state earned income tax credits (EITCs). In recent months, three more states adopted new state-level EITCs to support low-wage workers struggling to make ends meet. Now 29 states and the District of Columbia provide the tax credit. Six of those states offer non-refundable credits, meaning the value of the credit cannot be greater than the taxes owed by the family. The other 23 states offer a refundable credit, which allows a family to claim the full value of the credit even it spills over into a refund. South Carolina in 2017 instituted a new non-refundable state EITC worth 125 percent of the federal credit. In addition, the Montana Legislature adopted a 3 percent refundable earned income tax credit and Hawaii adopted a 20 percent non-refundable EITC.

The growing EITC momentum across the country this year extends beyond states adopting new credits. Some states enhanced their existing EITCs. The Massachusetts Legislature passed a 2018 budget that includes an unprecedented provision to expand EITC access to domestic violence survivors and abandoned spouses. A years-long budget crisis in Illinois ended with a budget compromise that gradually expands the state EITC to 18 percent of the federal credit. The California Legislature also expanded its credit by raising the income eligibility level for families. And Oregon passed a bill to raise awareness about the credits and encourage more eligible families to participate. Oregon’s EITC attracts one of the lowest participation rates in the nation.

New research adds even more evidence of the significant benefits of the earned income tax credit. The Annie E. Casey Foundation’s annual Kids Count Data Book makes a strong case for tax credits that support low-income working families. The Lifecourse Initiative for Healthy Families through the University of Wisconsin School of Medicine and Public Health published a fact sheet in June 2017 connecting the EITC to better health outcomes for children growing up in families who get the credit.

New research adds even more evidence of the significant benefits of the earned income tax credit. The Annie E. Casey Foundation’s annual Kids Count Data Book makes a strong case for tax credits that support low-income working families. The Lifecourse Initiative for Healthy Families through the University of Wisconsin School of Medicine and Public Health published a fact sheet in June 2017 connecting the EITC to better health outcomes for children growing up in families who get the credit.

Georgia lawmakers came very close to passing a state earned income tax credit during the 2017 legislative session. A bill in the state Senate and one in the House both include a state earned income tax credit. The bills are still viable for the 2018 legislative session set to convene next January. Georgia leaders can make a difference in the lives of hardworking Georgia families and join the majority of states around the country by implementing this time-tested tool.