Gov. Kemp’s budget proposal for Fiscal Year (FY) 2023 provides Georgia’s public schools $10.7 billion, a $493 million increase above current funding. This addition would end budget cuts to the Quality Basic Education (QBE) funding formula, the state’s metric to determine necessary funding to K-12 public schools. The proposal includes an increase of $287 million to raise teacher pay, part of the governor’s campaign promise to raise teacher salaries by $5,000. This budget benefits from strong local property tax collection overall and specifically in those districts with lower per student local funds through Local Five Mill Share and Equalization. If passed, this budget would end cuts to QBE for FY 2023 and fill in the $383 million cut from FY 2022.

By the Numbers

Amended 2022 Fiscal Year Budget

- Significant funding to replace 1,747 buses statewide ($188 million) and provide a one-time $1,000 bonus to all bus drivers at a cost of $14 million.

- Increases in funding for nine programs to offset prior years’ budget (or “austerity”) cuts. The Quality Basic Education program would receive $383 million and would, if passed, make FY 2022 only the third year in the last 20 where the Georgia General Assembly had met the minimum threshold for funding required by law.

2023 Fiscal Year Budget

- An increase in funding in the proposed 2023 budget for the Georgia Department of Education, in up $493 million, or 5 percent, from the FY 2022 amount.

- An increase of $383 million to fill in a budget cut originally in the FY 2021 budget and carried forward to FY 2022.

- A raise to the state salary schedule for certified teachers and certified employees by $2,000 at a cost of $287 million. The proposed raise would take effect September 1, 2022, two months after the beginning of the fiscal year.

- Increases in funding for the QBE formula are partially offset by a reduction of $142 million under the formula’s Local Five Mill Share component. This is a result of climbing property values, which increased school districts’ contribution to total QBE funding.

- $164 million less in funding for the Equalization program, which provides supplemental dollars to districts with low property wealth based on a formula outlined in Georgia code. Decreases in this grant are rare and represent a leveling-off between districts in how much they can raise through property taxes.

- An increased $43 million attributed to student school enrollment growth and training/experience for teachers as calculated through the Quality Basic Education formula.

- A formula increase for the State Commission Charter School supplement of $35 million.

- An additional $13 million in state funding to reflect a slightly higher employer contribution rate to the Teachers Retirement System.

- An increase of $6.3 million to the pupil transportation grant to reflect a 5.4 percent salary increase and formula growth.

- Due to two bills from last session, increased funds for state special charter schools (SB 153) and local charter school grants (SB 59) by $4.7 million and $2.9 million respectively.

- An additional $2.9 million for the Special Needs Scholarship, a private school voucher

Teacher Raises Could Reduce Attrition in Districts with Higher Poverty, More Black Students

Gov. Kemp’s inclusion of $287 million for certified teacher and employee pay increases is a welcome addition for a workforce ranked near the bottom for wage competitiveness in the nation.[1] The governor’s proposed budget has the raises beginning two months after the beginning of the fiscal year, making it a $1,667 raise for the first year of implementation. The state QBE formula accounts for 48 percent of school budgets; local taxes and federal funding make up 41 percent and 11 percent statewide, respectively.[2] Districts are free to hire additional teachers with money earned through local taxes. School leaders also have wide flexibility on using these state funds and are not compelled to raise teacher pay with them. If the General Assembly passes the funding for pay raises in the governor’s budget, however, school budget writers will feel pressure to use local funding to increase the pay of those employees not financed through QBE and make sure all teacher’s salaries are raised.

Research suggests that teacher attrition can cost a school district as much as 30 percent of the departing teacher’s salary.[3] School districts that are majority-Black and with a majority of students living in poverty share more of this burden, as they have higher rates of teacher turnover than others across the state. For this reason, these proposed pay raises are a needed first step to strengthening Georgia’s workforce overall as well as recruitment and retainment of teachers of color.[4]

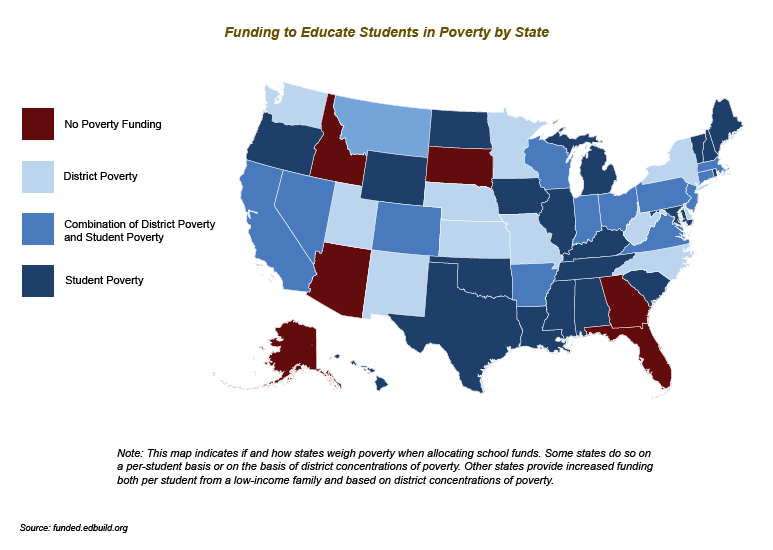

Georgia Lacks Vital Tool to Provide More Funding to the Schools that Need the Most Help

The state’s school funding formula provides money for additional teachers, counselors and other accommodations to educate students with unique needs such as disabilities or those who speak a language other than English in the home. Georgia is one of only six states nationwide that does not provide similar added support for students living in poverty.[5]

There is a clear relationship between a child’s financial situation and academic outcomes, just as there is a clear historical explanation for Black and Brown students to be more likely to live in poverty than their white neighbors. Any move to increase funding for students living in poverty would provide resources to every school district in the state and act as a tool for racial justice. Fixing the way Georgia funds schools to supply more teachers, healthy meals and mental health supports for students living in poverty will allow our public education system to recognize the unique needs of every student.[6]

Endnotes

[1] Allegretto, S.A. & Michel, L. (2020). Teacher pay penalty dips but persists in 2019. Economic Policy Institute. https://www.epi.org/publication/teacher-pay-penalty-dips-but-persists-in-2019-public-school-teachers-earn-about-20-less-in-weekly-wages-than-nonteacher-college-graduates/

[2] Georgia Department of Education. School system revenues: Fiscal year 2021 financial data collection system. https://financeweb.doe.k12.ga.us/FinancialPublicWeb/ReportsMenuPublic.aspx

[3] Borman, G.D. & Dowling, N.M. (2008). Teacher attrition and retention: A meta-analytic and narrative review of the research. Review of Educational Research. https://journals.sagepub.com/doi/abs/10.3102/0034654308321455

[4] McKillip, M., & Farrie, D. (2019). Invest in Georgia teachers: The need to attract and retain a high-quality workforce. Education Law Center. https://edlawcenter.org/research/invest-in-georgia-teachers.html#note9

[5] Education Commission of the States. (2021). K-12 and special education funding: Funding for students from low-income backgrounds. https://reports.ecs.org/comparisons/k-12-and-special-education-funding-06

[6] McKillip, M., & Farrie, D. (2019). Funding opportunity: Replacing Georgia’s Early Intervention and Remedial Programs with funding for low-income students. Education Law Center. https://edlawcenter.org/research/funding-opportunity.html