Gov. Kemp’s budget proposal for Fiscal Year (FY) 2024 provides Georgia’s public schools $11.9 billion, a $1.2 billion increase above current funding. The proposal includes an increase of $290 million to give teachers a cost-of-living adjustment and $846 million to assume the increases to the employer share for certified members of the State Health Benefit Plan (SHBP)—the health insurance provided to eligible state employees. If this budget passes, individual school districts will continue to face significant financial stress, specifically while addressing school bus transportation. Matching pay raises for teacher and school staff positions not funded through the state allotment will also strain local budgets.

By the Numbers

Amended 2023 Fiscal Year Budget

- An additional $420 million to address the increase in the employer portion to SHBP for eligible certified employees.

- $115.7 million grants amounting to $50,000 per school building for operating expenses related to school security.

- Grants totaling $25 million to address “learning loss” based on the percentage of students performing below grade level on standardized tests.

2024 Fiscal Year Budget

- Funding in the proposed 2024 budget for the Georgia Department of Education will increase by $1.2 billion, or 11 percent, from the FY 2023 amount.

- Nearly three-fourths of the increase (72 percent) is due to the $846 million needed to fund the state share of SHBP increases on certified educators.

- A raise to the state salary schedule for certified teachers and employees by $2,000 at a cost of $290 million. The proposed raise would take effect September 1, 2023—two months after the beginning of the fiscal year.

- Increases in funding for the Quality Basic Education (QBE) formula are partially offset by a reduction of $257 million under the formula’s Local Five Mill Share component . This is due to climbing property values, which increased school districts’ contribution to total QBE funding.

- Formula funding for the Equalization program, which provides supplemental dollars to districts with low property wealth based on a formula outlined in Georgia code, increased by $122 million. Increases in this grant represent a growing inequality in the property tax collection between low-wealth and high-property-wealth districts.

- An increase of $155 million is attributed to student school enrollment growth and training/experience for teachers as calculated through the QBE formula.

- In fulfillment of House Bill 283 (2013), an increase of $27 million to fully fund one school counselor for every 450 students.

- The pupil transportation grant would increase by $5.9 million to reflect a 5.1 percent salary increase and formula growth.

Health Plan Increases Overshadow Teacher Raises

Gov. Kemp’s inclusion of $290 million for certified teacher and employee pay increases is a welcome cost of living adjustment during record inflation. This pay adjustment comes, however, at a time when the SHBP requires $635 more per member per month from the employer portion—equaling $7,620 annually. School districts saw this increase on certified employees (e.g., teachers) begin the first of this year. The health plan increase for classified employees (e.g., bus drivers/monitors, custodians) will take effect on January 1, 2024. The state does not pay the employer portion for SHBP, leaving districts to find this additional money in local tax dollars. Currently, 96,000 classified employees work in Georgia’s public schools.[1]

Additionally, the governor’s proposed budget (like the FY 2023 budget before it) has pay raises beginning two months after the beginning of the fiscal year, making it a $1,667 raise during the first year of implementation. The state QBE formula accounts for 48 percent of school budgets, local taxes and federal funding make up 41 percent and 11 percent statewide, respectively.[2] Districts are free to hire additional teachers with money earned through local taxes. If the General Assembly passes the pay raises in the governor’s budget, districts will feel pressure to use local funding to increase the pay of those employees not financed through QBE. Pair this pressure with the cost burden of the SHBP increases for classified employees, and districts will be put in a difficult position with more needs than resources. As 64 cents of every dollar spent in education goes directly to instruction (e.g., teacher salaries), budget writers may be forced to raise class sizes to meet the moment.[3]

Pupil Transportation Budgets Groan Under Inflationary Pressure

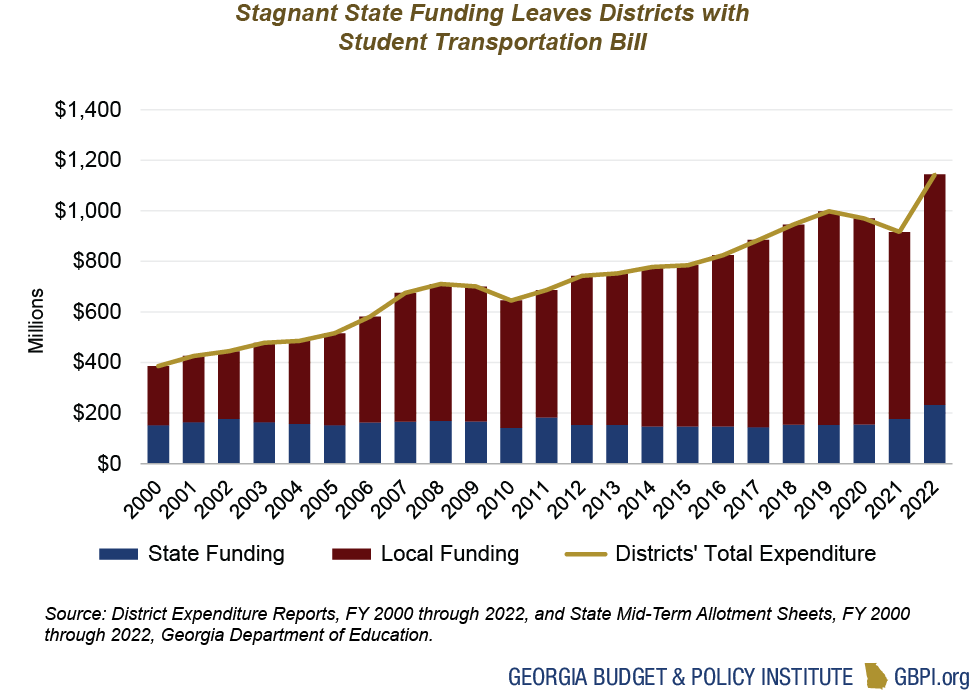

The FY 2024 budget allotted $4.3 million for a 5.1 percent salary increase for bus drivers and monitors and bonded $23 million to buy school buses. These allocations make no major change to a program that has seen steady growth for the past two decades without the state increasing investment. Failure to adequately fund student transportation continues a pattern of shortchanging school districts in an area that triggers safety concerns and significant costs.[4]

Georgia paid over half of all the pupil transportation costs in 1991, and only 20 percent in 2022.[5] School leaders saddled with higher transportation costs are then forced to take local dollars meant for other programs. Class sizes, language accommodations, wraparound supports, etc. cannot get the funding needed if districts use every available dollar to make sure that students arrive to school, as required by state law.

End Notes

[1] Georgia Department of Education. Certified/classified personnel summary, system level (CPI application report CP002).

[2] Georgia Department of Education. School system revenues: Fiscal year 2021 financial data collection system. https://financeweb.doe.k12.ga.us/FinancialPublicWeb/ReportsMenuPublic.aspx

[3] Ibid.

[4] Suggs, C. (2018). Shrinking state funds trigger student bus safety concerns. Georgia Budget & Policy Institute. https://gbpi.org/2018/shrinking-state-funds-trigger-student-bus-safety-concerns/

[5] Ibid.