Introduction

The Georgia Department of Education (GaDOE) serves Georgia’s 181 kindergarten -12th grade (K-12) public school districts. GaDOE governs K-12 learning standards and is serving 1.7 million students during the 2025-26 school year.[1]

Governor Kemp’s Fiscal Year (FY) 2027 budget proposal provides Georgia’s public schools $14.2 billion, a $532.6 million increase above current funding.[2] This includes $25 million for school bus replacement and $402.6 million for pupil transportation, up $38.5 million from the original FY 2026 budget and up $253.9 million from FY 2024.[3] It also includes $199.7 million added to reflect an 8% increase in employer contribution rate for certified educators enrolled in the State Health Benefit Plan (SHBP), the health insurance program for eligible state employees.

The amended fiscal year (AFY) 2026 proposal includes $369 million to provide a one-time $2,000 salary increase to teachers and all other certified educators, in addition to bus drivers, nurses and administrative staff.

By the Numbers

Amended 2026 Fiscal Year Budget

- $369 million increase to provide one-time $2,000 salary increases for approximately 179,000 K-12 educators and staff. If school districts wish to provide $2,000 salary increases to the remaining 82,000 school employees, it would cost approximately $164 million statewide.

Quality Basic Education (QBE) Program

- $43.5 million increase for midterm enrollment growth. QBE provides formula funds to school systems based on full-time equivalent students for the instruction of students in grades K-12.

- $26.9 million increase for the State Commission Charter Schools supplement, for a total of $292.1 million, to administer competitive grants to support planning, implementation, facilities, and operations.

Student Support Services

- $1.4 million increase for grants for social work services.

- $1.3 million increase funds for mental health support grants for middle and high schools, along with $750,000 in new funding for pilot programs to reimburse mental health services.

2027 Fiscal Year Budget

Quality Basic Education Program

- $258.9 million increase in QBE Equalization Grants, for a total $1.17 billion, which provides additional resources to public school districts that rank below the statewide average in taxable wealth.

- $199.7 million increase to reflect an increase in the employer contribution rate for the State Health Benefit Plan from $1,885 to $2,028 per month.

- $44.7 million increase in formula funds for the State Commission Charter Schools supplement for a total supplement of $310 million.

- $50.2 million decrease for local Five Mill Share, the formula used to calculate local property tax contributions to help fund schools.

- $9.3 million increase in salary payments due to enrollment growth and educator training and experience. Georgia now has 1.71 million public K-12 students and over 141,000 teachers and administrators.

- $1.2 million increase in non-QBE formula funds for Sparsity Grants, which are used to help smaller, often rural, districts pay fixed overhead costs.

Other School Related Budget Highlights

- $264 million increase for construction and renovation projects for K-12 schools.

- $25 million increase to replace 270 school buses.

- $38.6 million increase for the Pupil Transportation Grants for operations and to provide additional buses to transport more students.

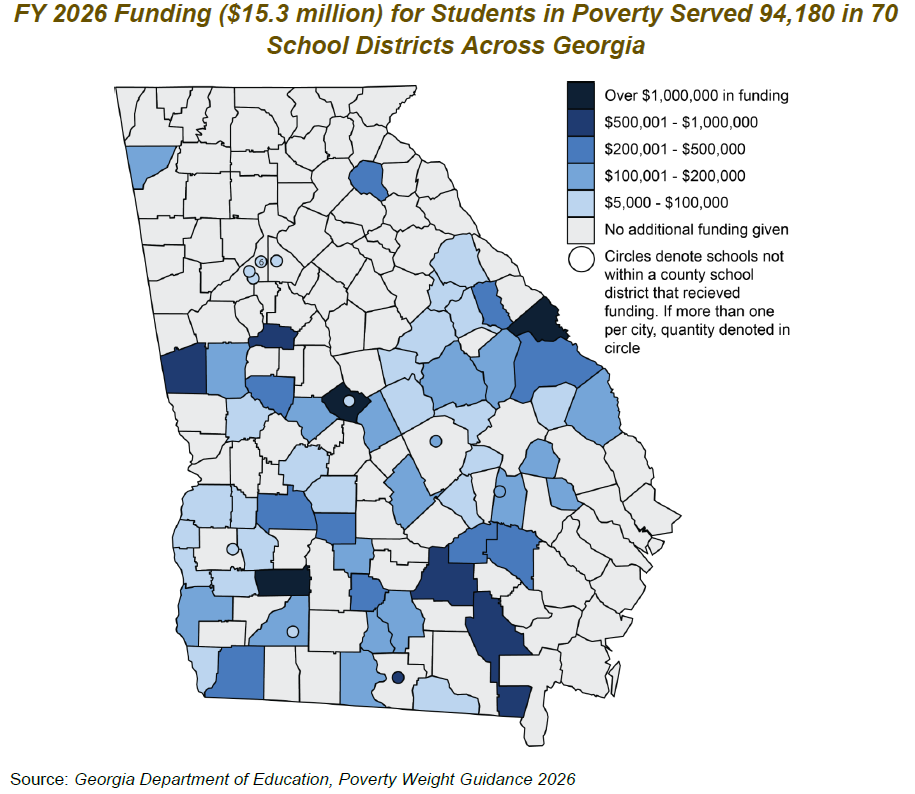

- $15.3 million decrease to eliminate one-time pilot funds to districts for targeted support to students from households with low-incomes.

After Pilot, “Opportunity Weight” Funding Missing from FY 2027 Budget

Last year lawmakers included a new budget section, called “Student Support Services” which appropriated a total of $49.7 million. This included $19.6 million for mental health support grants for middle and high school students, $12.5 million for out-of-school care grants and $2.4 million for social work services. This category also included $15.3 million in one-time pilot funds for economically disadvantaged students in the 70 school districts with the highest rates of children living in poverty. These funds were designed as a pilot “opportunity weight,” in which eligible schools received 5% more funding for each qualifying student from a low-income household. [4]

Although this pilot marked a positive step, best practices recommend creating an “opportunity weight” that enhances school funding by at least 30% and is permanently embedded into the education funding formula so that schools can reliably deploy funds to best support student needs.[5] The proposed FY 2027 budget would eliminate the $15.3 million in pilot funding for students living in poverty without creating a permanent funding mechanism to support the needs of these students. This would leave Georgia as one of seven states that do not provide recurring funding for students living in poverty. [6]

If lawmakers used the same criteria established by the pilot “opportunity weight” in FY 2026, targeting the highest poverty school districts, and increased the state’s level of enhanced funding from 5% to 30%, that would mean increasing Georgia’s annual investment to approximately $90 million per year. With additional resources, Georgia could further expand its “opportunity weight” to reach all districts by providing dedicated funding to follow each student living in poverty.

In recent years, funding gaps between Georgia’s wealthiest and poorest school districts have only grown larger due to reduced investments from the state. When Georgia’s QBE funding formula was adopted in 1985, the state equalized schools up to the 90th percentile of districts. Put simply, this means that the state gave extra funds to less wealthy districts to help them nearly reach the funding levels raised by wealthier districts. In 2000, the legislature lowered the benchmark for equalization to the 75th percentile. After the Great Recession, lawmakers further lowered the calculation to where it sits currently: the state average after removing the top and bottom 5% of districts.[7] As a result of these changes, school districts have lost billions of dollars in state funding. Restoring Georgia’s equalization formula and establishing a permanent “opportunity weight” would help to narrow Georgia’s academic achievement gap by increasing funding to support students from households with low-incomes.

Health Insurance Costs for Districts Worsen

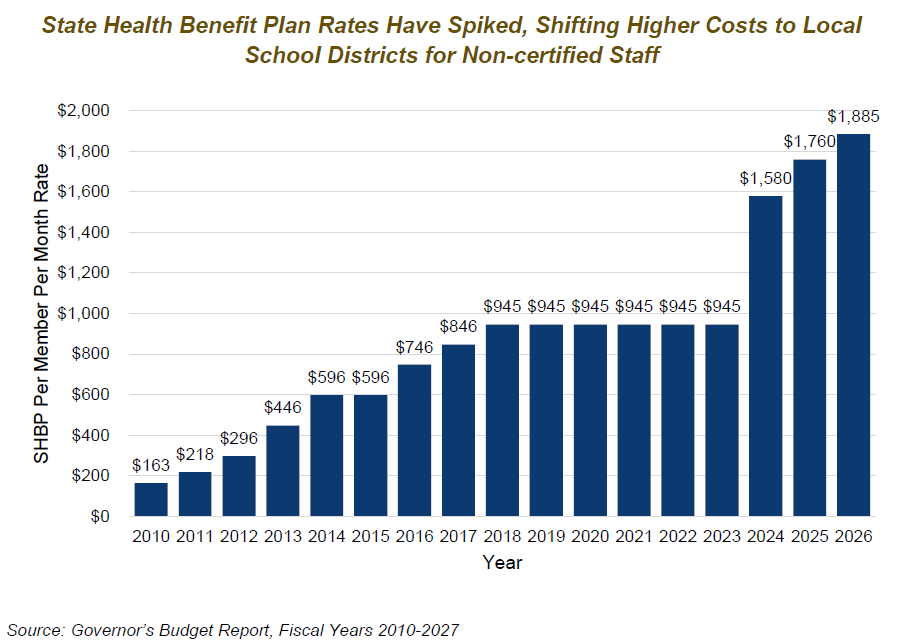

In 2011, lawmakers began significantly scaling back state funding for State Health Benefit Plan (SHBP) coverage of “non-certified” or “classified” school district employees, such as nutrition workers, bus drivers, nurses and custodians. For school districts, this policy change has caused unprecedented financial strain required to fill this financial gap amidst other budget challenges.

In FY 2027, the per member per month (PMPM) rate is set to increase by 8% from $1,885 to $2,028. Since 2010, annual district costs have increased from $1,952.64 per employee to $24,336 in FY 2027, a yearly increase of $22,383.[8] Local districts cover SHBP costs for 62,300 classified employees, along with an additional 4,900 locally paid certified employees for a total of 67,200 employees. In FY 2027, districts will pay an estimated $1.5 billion more in SHBP costs statewide due to the cumulative effect of cost increases passed on from the state since FY 2010.

Requiring school districts to cover exponential increases in SHBP costs remains at the forefront of financial concerns for district leaders. Looking ahead, lawmakers should recognize the state’s role in increasing the reliance of local governments on property taxes by shifting a considerable share of SHBP costs to school districts.

General Assembly Considers Eliminating Homestead Property Taxes

Local property taxes are critical for funding K-12 schools. In recent decades the state of Georgia has substantially reduced its funding commitments for local schools for health care costs, equalization and student transportation. These cost shifts to local districts have added upward pressure to property taxes because school districts have few other options to raise the revenues needed to educate students.

Now, leading members of the General Assembly are proposing sweeping changes to Georgia’s property tax system. Members of the state House have introduced the Georgia HOME Act, a constitutional amendment package that includes House Resolution 1114 and House Bill 1116[9]. If passed and implemented, homeowners would see property taxes on their primary residence eliminated by 2032, except at the time of purchase. Estimates from the U.S. Census demonstrate that residential property taxes on owner-occupied homes raised about $8.7 billion in 2024.[10] Data from the Georgia Department of Revenue suggests that about 62% of these revenues from property taxes on residential owner-occupied homes are directed to K-12 public schools.[11]

Alternatively, members of the Senate are advancing Senate Bill 382, which removes the option for local governments and school districts to opt out of the statewide Georgia Local Option Property Tax Exemption that was enacted in 2024. When voters approved the constitutional amendment established through House Resolution 1022 (2024) and enabled by House Bill 581 (2024) and House Bill 92 (2025), Georgia created a floating statewide homestead exemption to restrict taxable home values from increasing above the rate of inflation. However, when given the option to opt out, 68% of school districts and 30% of counties decided not to enact the measure, citing funding concerns.[12]

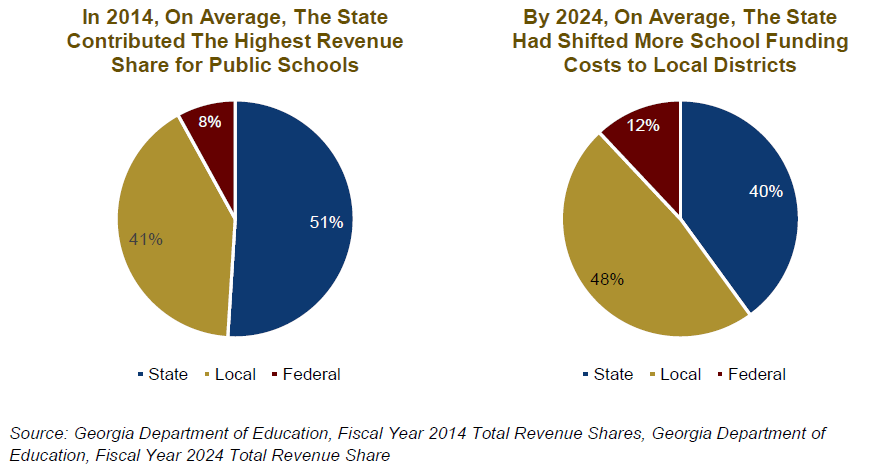

Already, the state has shifted more costs to local school districts over the last 10 years. In 2014, the state covered over 50% of the cost for public schools on average. By 2024 that share decreased to 40% of total costs. With the federal government only covering between 8-12% of costs, remaining costs are left for local school districts to pay. In just the last decade, the state’s share of K-12 education funding has decreased by 20 percentage points, while local districts have seen a similar increase.

If lawmakers significantly cut or eliminate homestead property taxes, school districts will have to navigate serious financial challenges to replace this revenue source, which could lead to layoffs, eliminating programs and activities or other measures that negatively impact students. GBPI recommends backfilling any revenues lost due to new statewide property tax reduction measures by increasing the state’s commitment to public schools and reversing changes that cut funding for employee health insurance, equalization and student transportation. Otherwise, Georgia’s public schools could see a dramatic drop in funding that causes irreparable harm to students and communities across the state.

End Notes

[1] Georgia Department of Education. (2026, February 10). About GaDOE (Who We Are). https://gadoe.org/about/

[2] Office of Planning and Budget. (2026, January). The governor’s budget report, AFY 2026 and FY 2027, Governor Brian P. Kemp; House Bill 973, as passed by the House.

[3] Office of Planning and Budget. (2024, June). Budget in brief, AFY 2024 and FY 2025, Governor Brian P. Kemp.

[4] GADOE Community. (2025, September 26). Poverty weight guidance – FY 2026. https://login.community.gadoe.org/documents/poverty-weight-guidance-fy-2026

[5] Learning Policy Institute. (2025, February 4). Funding student needs through state policies [fact sheet]. https://learningpolicyinstitute.org/product/funding-school-needs-factsheet#:~:text=What%20does%20it%20cost%20to,ranged%20from%20$6%2C473%20to%20$9%2C914

[6] Education Commission of the States. (2021, October). K-12 and special education funding: Funding for students from low-income backgrounds. https://reports.ecs.org/comparisons/k-12-and-special-education-funding-06

[7] Johnson, C. (2012, February). Bill analysis: House Bill 824. Georgia Budget & Policy Institute. https://gbpi.org/wp-content/uploads/2012/02/Bill-Analysis-HB-824.pdf

[8] Sweeny, T. (2015, February). Health plan financial challenges remain if state ends coverage for part-time school workers and their dependents. Georgia Budget & Policy Institute. https://gbpi.org/wp-content/uploads/2015/02/State-Health-Benefit-Plan.pdf

[9] House Bill 1116 (as introduced January 29, 2026). https://www.legis.ga.gov/legislation/72644

[10] U.S. Census Bureau. (2026, February 10). Mortgage status by aggregate real estate taxes paid (dollars), ACS 1-year estimates for owner-occupied housing units. https://data.census.gov/table/ACSDT1Y2024.B25090?q=B25090&g=010XX00US$0400000&y=2024&tp=true

[11] Georgia Department of Revenue. (2026, January). Property tax administration annual report: 2025 annual report. https://dor.georgia.gov/local-government-services/digest-compliance/property-tax-administration-annual-report

[12] Yushkov, A. and J. Johns. (2025, April 17). Localities opt out of Georgia’s new homestead tax exemption. The Tax Foundation. https://taxfoundation.org/blog/georgia-property-tax-reform/