Governor Kemp’s budget proposal for fiscal year (FY) 2021 provides Georgia’s public schools $10.9 billion, a $272 million increase above current funding. The largest single addition provides funding for pay raises for teachers and some non-certified school personnel that make less than $40,000 per year. Costs tied to student enrollment growth make up the bulk of the remaining additional dollars. Although Georgia’s mechanism for financing public schools will be fully funded, individual school districts will continue to face significant financial stress, specifically while addressing student transportation. Matching pay raises for teacher and school staff positions not funded through the state allotment will also strain local budgets.

By the Numbers

Amended FY 2020 Budget

- Funding for the Georgia Department of Education (DOE) will go up $138 million if lawmakers approve the changes to the revised 2020 spending plan proposed by Gov. Kemp.

- The additional $138 million is a combination of $146 million added primarily for midterm adjustments to the Quality Basic Education Program and $7 million in cuts to 17 programs. Most of the agency cuts come from removing vacant positions and reducing funds for travel and computer services.

FY 2021 Budget

- Funding in the proposed 2021 budget for the Georgia Department of Education will increase about $272 million, or 2.6 percent, from the original FY 2020 amount.

- Gov. Kemp allocated $362 million to increase the base salary schedule for certified teachers and personnel by $2,000 and fund a $1,000 pay increase for non-certified personnel that make less than $40,000.

- A proposed boost of $144 million covers student enrollment growth and routine adjustments in teachers’ salaries through the Quality Basic Education (QBE) formula, the state’s method for calculating K-12 funding.

- Increases in funding for the QBE formula are partially offset by a reduction of $151 million under the Local Five Mill Share component of the formula. The Local Five Mill Share is a requirement that Georgia’s schools are partially funded by local property taxes. This reduction is a result of climbing property values in some areas of the state, which increased school districts’ contribution to total QBE funding.

- The state will experience savings of $192 million to reflect a lower employer contribution rate to the Teachers Retirement System. Every year, an actuary determines the employer contribution rate to state leaders. The proposed budget reflects the first actuarially-determined lowered contribution rate since FY 2002.[1]

- Funding for the Equalization Program, which provides supplemental funds to districts with low property wealth, would increase $32 million.

- Georgia’s Special Needs Scholarship, a voucher created in 2007 for students with specific disabilities, will see an increase of $9.7 million in the Amended Fiscal Year (AFY) 2020 budget that will continue in the FY 2021 budget. Enrollment has grown significantly since a 2015 law requiring local public schools to provide information on the program.

- An additional $5.3 million is allocated for pupil transportation. This amount will pay for a 5 percent increase to the state base salary for transportation employees and includes $927,000 for natural enrollment growth. School districts will receive $7.5 million less in bonds for school bus replacement than in FY 2020.

- $1.2 million is meant to support school turnaround efforts will be transferred from the Chief Turnaround Officer to the DOE School Improvement program.

- $2 million will be cut from the budget to fund grants for Career, Technical and Agricultural Education, and Technology (CTAE) program. CTAE programs will also receive $2.5 million less in bonds for equipment purchases from FY 2020.

Teacher Raises and Enrollment Growth Drive Funding Increases

The inclusion of $362 million for teacher and personnel pay raises combined with the $534 million allocated for the same purpose in FY 2020 will result in $896 million in additional funding in two years for public education—if approved by the General Assembly. These raises translate to an addition of $506 per student in state funding year-over-year.[2] As with any state increase to the salary schedule, school districts have wide flexibility on whether this funding is attached to teacher pay or is used for other school needs.

Gov. Kemp’s 2021 budget proposal accounts for student enrollment growth of 0.3 percent from FY 2020. In spite of this small overall growth, the AFY 2020 budget adds $114 million for midterm increase in enrollment, and the FY 2021 budget adds $144 million for the same. School districts are paid differing amounts depending on the courses that each student participates in, and enrollment in programs that command more funding has increased significantly in the last decade. Programs such as Gifted, Vocational and Early Intervention are allotted higher dollar amounts than general education classes. Participation in the elementary school Early Intervention Program (EIP) alone grew 6.8 times faster than overall student enrollment from FY 2012 to FY 2018.

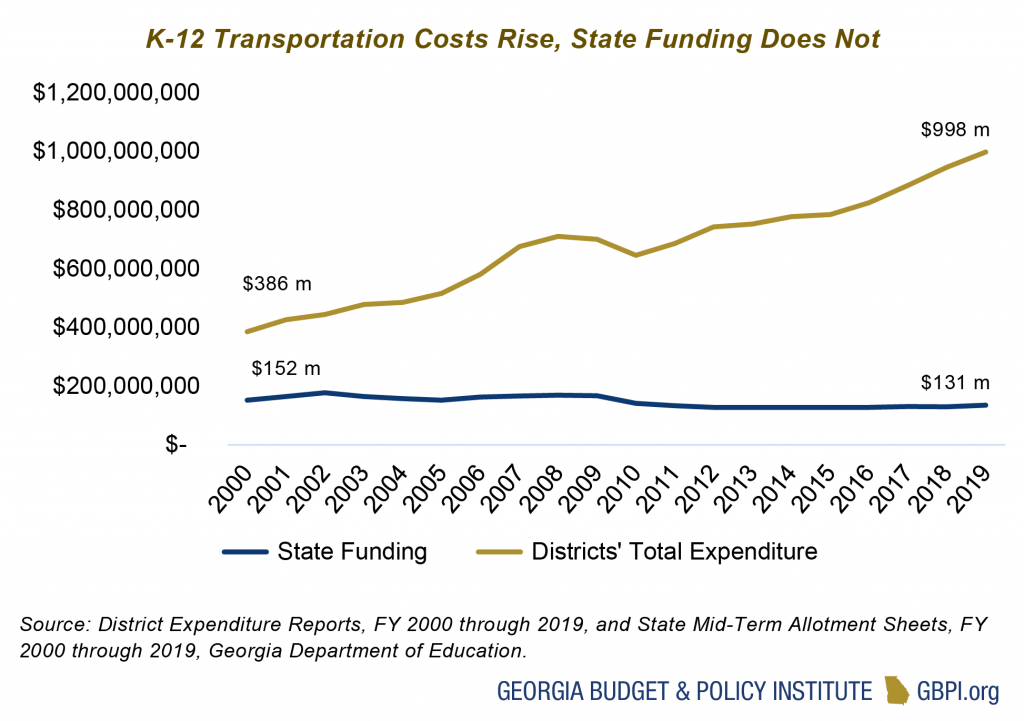

Student Transportation Funding Continues to Languish

The FY 2020 budget allotted $1.7 million for a 2 percent salary increase for bus drivers and monitors and bonded $20 million for school bus replacement. The governor’s proposed budget for FY 2021 provides $4.4 million for a 5 percent increase to the state base salary and $12.5 million in bonds to purchase school buses. This net $4.8 million loss for student transportation continues a pattern of shortchanging pupil transportation that triggers safety concerns and significant costs for local school districts.[3]

Georgia’s public school districts are on pace to spend more than $1 billion on student transportation during the 2019-2020 school year, while state funding has remained practically unchanged in the last two decades. School leaders saddled with higher transportation costs are meeting this need by tapping money once used for other school programs.

Georgia’s public school districts are on pace to spend more than $1 billion on student transportation during the 2019-2020 school year, while state funding has remained practically unchanged in the last two decades. School leaders saddled with higher transportation costs are meeting this need by tapping money once used for other school programs.

Endnotes

[1] Teachers Retirement System of Georgia. (2020). Contribution Rates. Retrieved from: https://www.trsga.com/employer/contribution-rates/

[2] Based on a GBPI analysis of student enrollment. Student enrollment data retrieved from: https://oraapp.doe.k12.ga.us/ows-bin/owa/fte_pack_enrollgrade.entry_form

[3] Suggs, C. (2018). Shrinking State Funds Trigger Student Bus Safety Concerns. Retrieved from https://gbpi.org/2018/shrinking-state-funds-trigger-student-bus-safety-concerns/