The coronavirus pandemic reveals the fragile financial situations of many Georgia college students. Many Georgia students struggle to pay for basic needs like housing, food, health care and transportation. Before the pandemic:

- 42 percent of students reported not receiving any financial support from parents or guardians

- 39 percent struggled with stable housing

- 37 percent had very low or low food security

- 14 percent had an account default or go into collection

Basic Needs Insecurity Threatens Well-Being and Academic Success

Students from more secure family financial backgrounds are more likely to graduate from college. Students from families with incomes higher than $75,000 have a 70 percent college graduation rate, while students from families with incomes below $35,000 have graduation rates of 46 percent.

In Georgia, college students’ families reflect a wide range of resources. The median family income for students at the most selective colleges and universities exceeds $100,000; however, it is below $40,000 in 17 of the 26 colleges in the university system.

Several other factors may hurt students’ academic success during this time:

- Lack of internet access in rural areas challenges both K-12 and college students who now must take classes and complete assignments online. Some students report sitting in fast food restaurant parking lots to access Wi-Fi.

- With schools and most child care centers closed, college students with children might be unable to continue classes because of parenting responsibilities. Student parents are also more likely to experience food and housing insecurity.

- Mental health concerns are common for college students and were a growing concern before the pandemic. Students with poor mental health are at greater risk of dropping out. Many students now lack access to counseling services.

Current Response Inadequate to Meet Students’ Needs

Most college students did not get direct payments known as “recovery rebates” in the federal stimulus package. But the CARES federal relief package allocated a total of $406 million to Georgia private, public and for-profit colleges, with at least $203 million designated for student emergency grants. Colleges received different amounts of federal aid, but average amounts range from $500-750 per student at public and technical colleges.

College students access safety net programs like the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps) and Medicaid at low rates, even though a significant share struggle to meet basic needs. Program rules make qualifying for assistance difficult for many students. Before the pandemic, only 12 percent of food-insecure students got SNAP. SNAP rules restrict most college students from getting assistance unless they are parents of young children, disabled, participate in federal work-study, receive Temporary Assistance for Needy Families (TANF) or work at least 20 hours per week.

Many college students also lack health insurance. Nearly 1 in 4 (23 percent) of adults ages 19 to 25 years old are uninsured. Only 13 percent of students who struggle with basic needs are insured through Medicaid.[1] Because Georgia did not expand Medicaid, young adults without children cannot get Medicaid.

Recommendations

Most college students did not receive federal recovery rebates and they are often excluded from safety net programs because policymakers assume student get help from their families. But 4 of 10 students in Georgia do not receive financial support from their families. In low-income families, responsibility often flows the other direction—with students expected to provide resources to other family members. Georgia needs to leverage all available federal, state, school and private resources to support students.

- Leverage federal CARES funding and privately-raised school funds to meet students’ basic needs. Colleges have one year from receiving funds to disburse emergency grants, and Congress has not indicated that more federal help will arrive. Recognizing that the need is larger than resources available and may be long-term, colleges should make a plan to allocate funds throughout the year in a way that is simple for students. Because federal funding excludes undocumented and international students, schools should prioritize private funds to these students who struggle with basic needs and cannot access federally funded emergency grants.

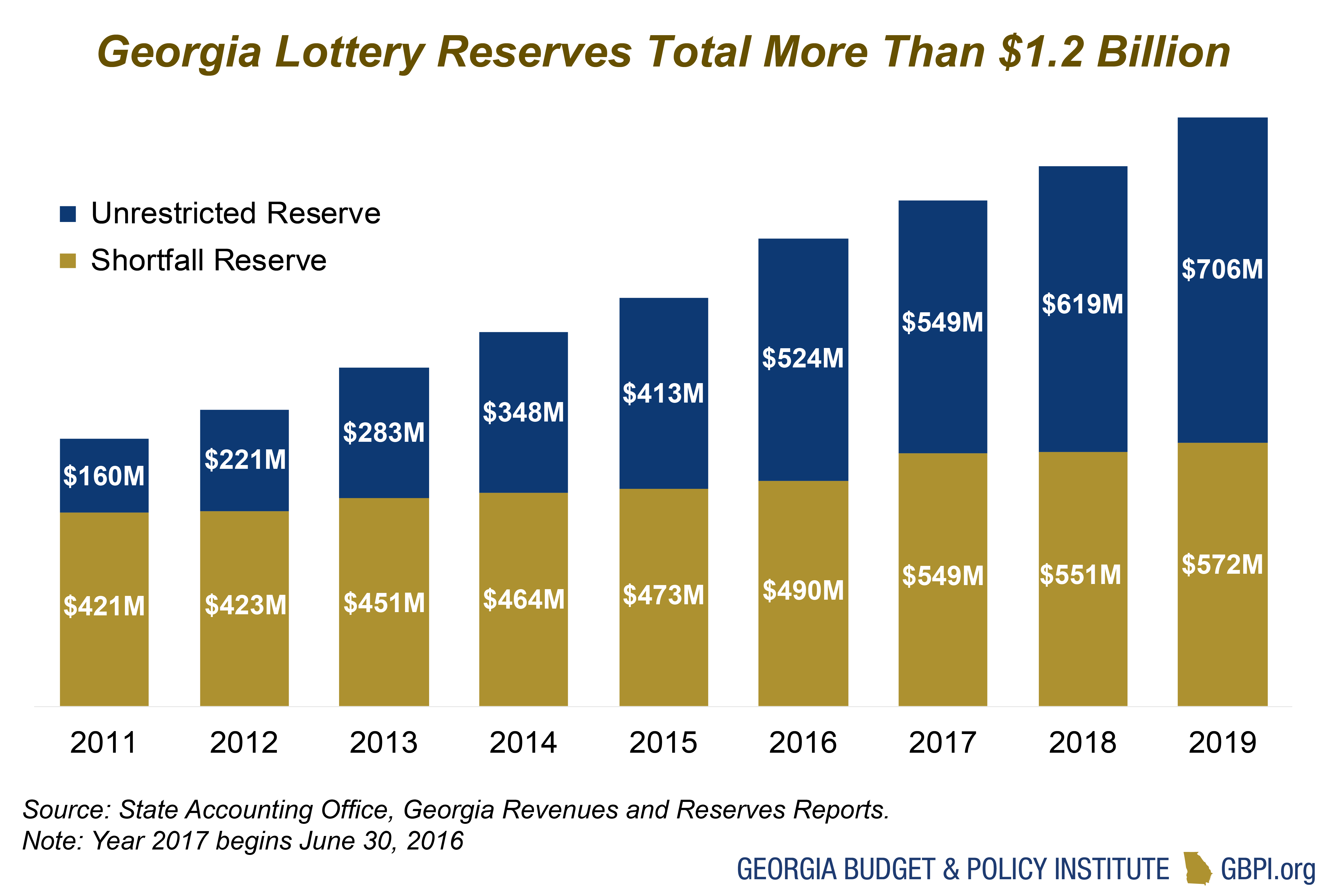

- Tap state lottery reserves for more emergency and need-based grants. Georgia has long been an outlier in its absence of need-based state financial aid. Though state and lottery revenues are projected to decrease due to the economic downturn, Georgia is fortunate to have saved more than $1.2 billion in lottery reserve funds. Though some of that money is dedicated to address any shortfalls in HOPE, lawmakers can appropriate $706 million for other educational purposes. The state should use a portion of these dollars for student emergency grants and need-based scholarships administered by the Georgia Student Finance Commission.

- Be proactive and connect students with other safety net and support services. To maximize basic needs support, colleges should direct more resources to student services that help coordinate access to benefits like SNAP, health insurance, veterans benefits, unemployment benefits, housing or utility assistance, child care subsidies or any other assistance available to meet basic needs. At a minimum, campuses should create a website that lists available supports, information and contact information.

- Expand Medicaid. Nearly one in four young adults in Georgia ages 19-25 lack health insurance. Georgians ages 19 to 64 cannot get Medicaid unless they have dependents and make below about $7,000 a year for a family of three. Expanding Medicaid would ensure more students can afford to get basic physical and mental health care, and bring millions more federal health care dollars to the state.

[1] GBPI Analysis of American Community Survey 1-Year Estimates, Table B27001, Health Insurance Coverage Status by Sex by Age.