State lawmakers introduced several bills in the 2019 legislative session that could significantly alter the Teachers Retirement System of Georgia (TRS) if passed in 2020. There are 390,000 current and former Georgia educators participating in the pension system as either active members or benefits recipients. Any changes to TRS have immense implications to the state’s education workforce as well as the financial health of the state of Georgia. This fact sheet explains the basic concepts of TRS, how it is funded and where it stands financially.

What is the Teachers Retirement System?

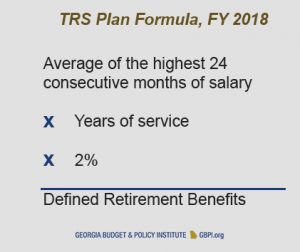

TRS administers retirement benefits to employees of local school systems, charter schools, technical colleges, county and regional libraries, Regional Education Service Agencies (RESAs), the University System of Georgia (USG) and certain state agencies. Established in 1943, TRS administers a single, defined retirement benefit that is determined by a calculation using the number of creditable years of service and final average salary multiplied by 2 percent. To receive any benefits, a member of TRS must have 10 years of service.

A complex combination of state laws, board rules and federal laws govern the management of TRS. Below is a short summary of the funding for TRS, the system’s projected liabilities and how the state of Georgia has planned to address any outstanding obligations.

- Funding – Funding for TRS, like most public pensions, comes from three contribution sources: employees, employers and investment returns. In FY 2019, the employee contribution rate in Georgia was 6 percent[1] and the employer contribution rate was 20.9 percent.[2] The majority of funding comes from returns from investments approved by the TRS board of trustees. Across the nation, investment earnings accounted for over 60 percent of all public pension revenues since 1987.[3]

- Forecasting TRS – Because pensions are offered as a benefit of employment decades before payments are disbursed, systems like TRS rely on projections of the plan’s assets and liabilities for the system as a whole. Georgia law dictates that the TRS board of trustees must work with an actuary to provide these projections at least once every five years.[4] Actuarial forecasts take into account inputs such as the expected rate of return on TRS investments and the demographic trends[5] that affect provided benefits.

- State Liability – When projected assets do not fully cover projected liabilities, the pension system has an unfunded accrued liability. The most recent data from TRS shows $71 billion in assets and $96 billion in liabilities, leaving $25 billion in unfunded accrued liability.[6] Market losses during the last two economic recessions and demographic changes both lowered the asset projection for TRS and increased projected liabilities. The Georgia Department of Audits and Accounts asserts that these two factors – market losses and demographic changes – alone contributed to over 70 percent of the unfunded accrued liability for TRS.[7]

- Meeting Projected Need – In response to the increasing projected liability, the state of Georgia added $223 million in FY 2017 and $361 million in FY 2018 on top of traditional employer contributions. Compared to other states, Georgia appears noteworthy for consistently paying 100 percent of actuarially determined contributions in support of the financial viability of TRS.[8]

Pensions in the Southeast

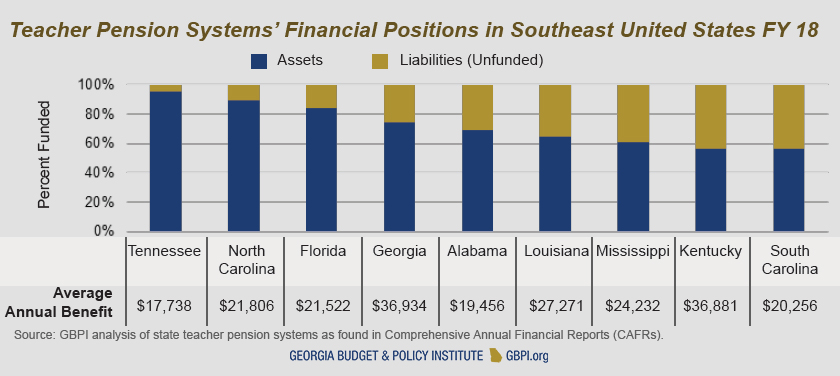

Public pensions across the United States experienced similar losses during the last economic recession. The chart below displays a survey of the percent of teacher pension system that is funded and the average annual benefit for nine southeastern states. The average annual benefit is the average amount that each retiree receives in benefits from that state’s teacher pension system.

Georgia’s teacher pension system, like many government pensions in the United States, sits at the heart of discussions about the state’s responsibility for its public servants. With assets that nearly triple the state’s yearly budget and the financial health of hundreds of thousands of retirees in the balance, TRS leadership and state lawmakers carry a considerable duty to the state. For these reasons, any deliberation of changes to the program must be undertaken with the utmost care.

Georgia’s teacher pension system, like many government pensions in the United States, sits at the heart of discussions about the state’s responsibility for its public servants. With assets that nearly triple the state’s yearly budget and the financial health of hundreds of thousands of retirees in the balance, TRS leadership and state lawmakers carry a considerable duty to the state. For these reasons, any deliberation of changes to the program must be undertaken with the utmost care.

[1] Meaning that Georgia teachers that participate in TRS contribute 6 percent of their pretax salary annually.

[2] For the purposes of this fact sheet, the state is considered the single employer for TRS-participating employees even though local school districts contribute to the employer share of annual contributions.

[3] National Association of State Retirement Administrators. Investment. Retrieved from: https://www.nasra.org/investment

[4] O.C.G.A § 47-3-23 (2017)

[5] As a defined benefits plan, vested members are guaranteed payments for their lifetime. For this reason, demographic trends such as the average life expectancy of TRS members must be considered in projections of financial liabilities.

[6] Teachers Retirement System of Georgia. (2018). Comprehensive Annual Financial Report. Retrieved from: https://www.trsga.com/wp-content/uploads/TRS_CAFR_1718.pdf

[7] Georgia Department of Audits and Accounts. (2019). Special Examination – Report No. 18-11.

[8] Brainard, K. & Brown, A. The Annual Required Contribution Experience of State Retirement Plans, FY 01 to FY 13. National Association of State Retirement Administrators.