Georgia could raise more than $400 million a year to make critical investments for the health and well-being of Georgia residents by raising the cigarette tax by at least $1 per pack. Georgia has the third-lowest state cigarette tax rate out of the 50 states and the District of Columbia. At 37 cents per pack, it falls far below the national average of $1.72. Over the past decade, many states have increased tobacco tax rates as a way to raise new revenue while reducing smoking rates and the health care costs associated with smoking. Georgia has not increased its cigarette tax rate since 2003.

In addition to raising revenue, higher cigarette taxes are associated with a drop in smoking rates. Nearly 1 in every 5 deaths in the U.S. can be attributed to cigarette smoking and it is the leading preventable cause of death in the country.[1] Smoking rates have declined in the U.S., from 20.9 percent among adults in 2005 to 15.5 percent in 2016.[2]

Raising tobacco prices is one of the proven strategies in this success. Georgia can build on this progress by increasing the cigarette tax rate closer to the national average. Georgia lawmakers should consider the option of raising the tobacco tax to join neighboring states such as Alabama, Louisiana and Florida in achieving the following benefits:

Lower smoking rates, especially among youth. Raising the price of tobacco products is a proven way to reduce the smoking rate and states can do this through a tax on those products. Substantial research indicates that a 10 percent increase in the price of cigarettes reduces adult smoking by 2 percent, young adult smoking by 3.5 percent and adolescent smoking by 6 or 7 percent. Increases of $1 per pack or more are especially effective at reducing smoking due to the “sticker shock” associated with hikes of that size.[3]

Reduce spending on tobacco-related health care expenses. With a decline in smoking, states can save money on health care spending associated with tobacco-related illnesses. The American Cancer Society estimates that with a $1.50 increase in the cigarette tax, Georgia’s Medicaid program would save $8.01 million in 5 years and the long-term health care savings would amount to $2.12 billion.

Raise new revenue, even when accounting for the reduction in smoking. Every state that increases its cigarette tax sees a decline in cigarette sales. But even with lower cigarette sales, every state also experiences a revenue increase. This new money can help Georgia invest in the health of the state by funding tobacco cessation services, health coverage expansions, prevention services and other health programs.

Background on Georgia’s Tobacco Tax

Like all states and the federal government, Georgia levies a special tax on cigarettes and other tobacco products. The Peach State applies an excise tax of 37 cents per pack of cigarettes, and relatively modest levies[4] on cigars and smokeless tobacco as well.[5] Georgia does not levy any additional tax on e-cigarettes used for vaping, beyond the standard 4 percent state sales tax applied to purchases of most consumer goods.[6]

Georgia’s bargain-basement tax on cigarettes is increasingly outside the norm, both nationally and in the South. At 37 cents per pack, Georgia charges the third lowest cigarette tax in the nation and the lowest rate among its neighbor states.[7] Only Missouri (17 cents) and Virginia (30 cents) levy lower tobacco taxes than Georgia.[8] The national average for state cigarette taxes is currently $1.72 per pack and the national median – where half of states tax less and half tax more – is $1.60 per pack. Each state’s cigarette tax is levied in addition to the federal tax rate of $1.01 per pack, which was last increased in 2009.[9]

Georgia’s tax on cigarettes started out at 5 cents per pack in 1955, before increasing to 8 cents in 1964 and 12 cents in 1971. State lawmakers then let it stagnate for more than 30 years, finally raising it in 2003 to the current 37 cent level.[10] Since then, a number of proposals have sought to further raise the tax though none made it over the finish line. For example, a special advisory council that convened in 2010 to examine comprehensive tax reform recommended increasing the tax by 21 cents to 68 cents a pack, which was the average of Georgia’s neighboring states at the time.[11] A 2015 proposal by a Republican state senator suggested raising the tax by $1.23 per pack[12], and another bill in 2018 proposed an increase of $1.50.[13]

In contrast, a number of states including several southeastern neighbors have increased their tobacco levies over the past decade as a way to both improve public health and generate new revenues for pro-health investments. Alabama, Arkansas, Florida, Kentucky, Mississippi, North Carolina and South Carolina are among the 32 states nationwide that raised tobacco tax rates since 2008, as illustrated in the following map.[14]

Raising Tobacco Taxes Can Help Reduce Smoking and Lower Health Costs

Smoking is the leading preventable cause of illness and death in Georgia. Between 2008 and 2013, about 10,350 annual deaths (17 percent of all deaths) among Georgians ages 35 and over were attributable to smoking.[15] Most of these smoking-attributable deaths in Georgia were due to cancer, chronic obstructive pulmonary disease, and heart disease.

|

Facts about Cigarette Smoking in Georgia

Source: Kaiser Family Foundation State Health Facts, 2018 and Campaign for Tobacco-Free Kids, 2018 |

About 1.4 million Georgia adults smoked cigarettes in 2016.[16] At 17.5 percent, Georgia’s adult smoking rate is above the national average. The U.S. Department of Health and Human Services set its Healthy People 2020 goal to reduce the nationwide adult smoking rate to 12 percent. This data suggests that further efforts to reduce smoking are needed in Georgia to promote health and prevent deaths. Raising the state’s low cigarette tax is one proven strategy states can use to reduce smoking.

States that increased their cigarette taxes have experienced drops in smoking rates. For example, Louisiana raised its cigarette tax by 77 cents between 2015 and 2016 and saw the adult smoking rate drop to 21.9 percent in 2016, from 24 percent the previous year.[17] States also see more people reach out for help to quit smoking. When Oklahoma increased the cigarette tax by $1, the state received 85 percent more calls to its tobacco cessation helpline in the first month compared to the same period in the previous year.[18]

Quitting or reducing smoking has long-term health benefits, including longer life expectancy.[19] Women who stop smoking before pregnancy also have a lower risk of having a preterm birth or a low birthweight baby.[20] After a cigarette tax increase, the greatest smoking reductions occur among young people. Adolescents respond more to price changes than adults. A 10 percent increase in cigarette prices reduces the smoking rate of among young adults by 3.5 percent and kids by 6 to 7 percent. This is compared to a 2 percent drop among adults. About 90 percent of smokers begin smoking before the age of 18.[21] Because most smokers start smoking at a young age, it is a good public health goal to pursue interventions that are effective in reducing youth smoking. Estimates show that a cigarette tax increase of $1.50 would prevent 40,600 Georgia kids from becoming smokers as adults.[22]

Fewer smokers can also mean less health care spending for states. Smoking is linked to a higher risk of stroke, cancer, heart disease and other health conditions.[23] The average health care and lost productivity costs of smoking total to about $19.16 per pack.[24] Georgia spends about $3.18 billion a year on medical costs associated with cigarette smoking, including an estimated $650.4 million in Medicaid spending. And smoking-caused productivity losses cost Georgia about $3.99 billion a year.[25] Raising the cigarette tax by $1.50 is projected to save Georgia $12.27 million in fewer lung cancer cases and $28.11 million in fewer heart attacks and strokes over 5 years.[26]

Health Impacts of Increasing the Cigarette Tax in Georgia by $1.50 per Pack

| Number of Adult Smokers Who Would Quit | Number of Kids Who Would Not Become Adult Smokers | Georgians Saved from Premature Death Caused by Smoking | Long Term Health Care Cost Savings from Reduced Smoking Rates |

| 65,500 | 40,600 | 29,200 | $2.12 billion |

| *Long-term cost savings are in 2018 dollars. Source: American Cancer Society, 2018 | |||

A Higher Cigarette Tax Can Raise Lots of Revenue for Pro-Health Investments

A higher cigarette tax could raise more revenue to help the state better meet the needs of smokers who are trying to quit, prevent more young people from starting to smoke and invest in state health services that benefit everyone. Bringing Georgia’s paltry cigarette tax in line with national norms could deliver a sizable bump in revenues over the next five years.

GBPI looked at potential tax increases of $1, $1.23 and $1.50 per pack. Based on tobacco use data from the Centers on Disease Control (CDC) and a methodology adapted from prior state estimates, GBPI finds:

- $1 per pack increase = $416 million a year on average over five years

- $1.23 per pack increase = $498 million a year on average over five years

- $1.50 per pack increase = $588 million a year on average over five years

The effect of these increases on Georgia’s tobacco tax revenues is illustrated in the following chart. Each of them could sizably increase the state’s current stagnant revenue projection to higher levels capable of supporting more robust health care investments. Because cigarette tax estimates are based on several assumptions, GBPI developed high and low estimates for each of the three scenarios, which are further detailed in the appendix. The topline estimates above are the midpoint between each respective high and low possibility.

Some critics contend that higher tobacco taxes don’t actually raise significant revenue over time, due to the resulting decline in smoking and supposed increase in interstate cigarette smuggling.[27] However, claims about cigarette smuggling across state lines are generally overblown.[28] And raising tobacco taxes consistently raised new revenues when enacted in other states, even though the total number of smokers declined.

In 2009, Florida increased its cigarette tax by $1 a pack from about 34 cents to $1.34 per pack. Over the next year the state experienced a 27.4 percent decline in cigarette pack sales, while raising revenue by about $829 million, an increase of 193 percent. West Virginia implemented a 65 cent increase in 2016, after which the state saw a 16 percent decline in cigarette pack sales and an 84 percent increase in revenue compared to the 12 months prior to the tax increase. And here in Georgia, when lawmakers raised the state tax to 37 cents from 12 cents in 2003, revenues jumped by about $168 million in the next full budget year, adjusted for inflation.

State experts have consistently concluded that increasing the tax could raise substantial revenues over time. In 2010, a state House proposal to bump the tax by $1 per pack estimated the potential revenue increase at about $366 million on average over three years. A 2015 state Senate bill that suggested an increase of $1.23 per pack resulted in an official cost estimate of about $539 million a year on average over five years. And in 2017, legislation proposing a modest 25 cent per pack increase came with a revenue estimate of about $100 million on average over five years.

When Georgia lawmakers raised the state tobacco tax to 37 cents from 12 cents in 2003, state revenues jumped by about $168 million in the next full budget year.

It is also true that tobacco taxes are a naturally declining revenue source, which lawmakers should note when deciding how to spend resulting revenue. Because the tax is levied as a flat dollar per pack and doesn’t rise with inflation, it generates the same amount of revenue for each quantity sold. This differs from income and sales taxes, which keep pace with economic changes because they are levied as a percentage of value.

Tobacco tax revenues are also declining nationwide due to changes in consumer behavior. More than 40 percent of Americans smoked in the 1960s, compared to about 15 percent today.[29] State tobacco tax increases, by design, will drive smoking rates down further, further eating into long-term revenue projections. Because tobacco tax revenues tend to grow more slowly than the cost of many public services, lawmakers should exercise caution in tying them too closely to any specific budget expenditure, rather than using them for general health needs.

Because tobacco tax revenues tend to grow more closely than the cost of many public services, lawmakers should exercise caution in tying them too closely to any specific budget expenditure, rather than using them for general health needs.

Tobacco Taxes are Regressive but Health Benefits to Low-Income People are Substantial

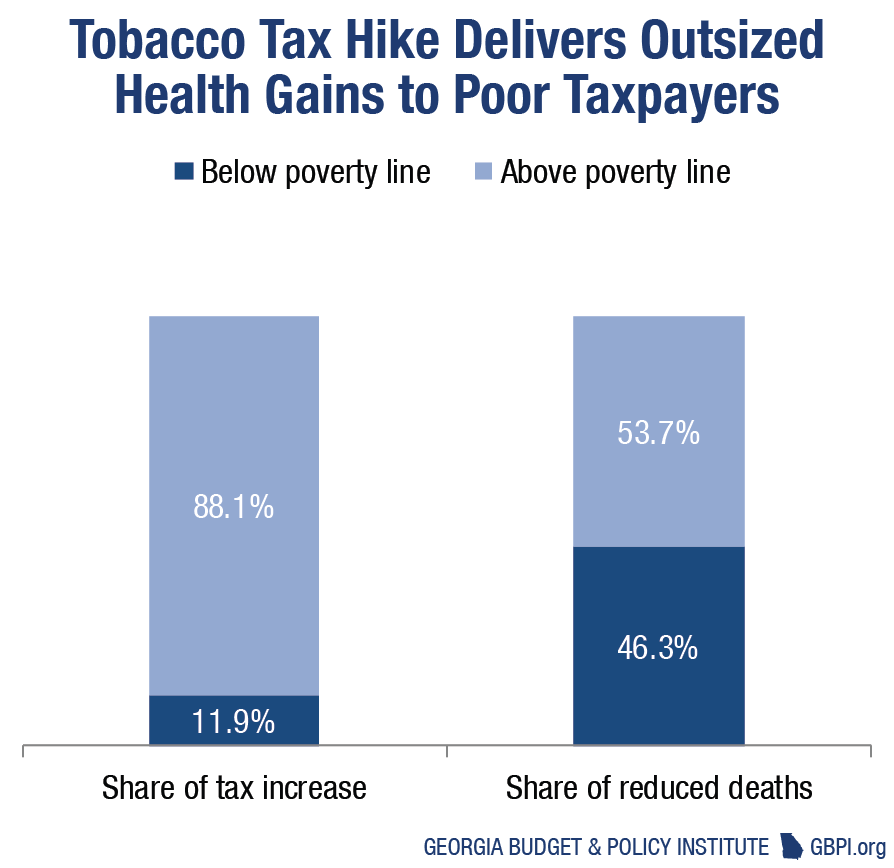

Another important consideration with raising the tobacco tax is that the tax is inherently regressive, meaning it falls more sharply on low- and moderate-income people. At the same time, working class people receive an outsized share of the resulting health benefits from a higher tax—both in terms of decreased smoking rates and increased access to vital public health services.

Cigarette taxes fall disproportionately on low-income smokers for two reasons. First, low-income people are likelier to smoke.[30] In Georgia, 35 percent of adults in households making $15,000 or less smoked, compared to 22.3 percent for households with income between $34,000 and $49,999 and 12.2 percent for incomes higher than $50,000. Second, everyone pays the same tax per pack regardless of income. As a result, lower income households pay a larger percentage of their income on the tax. In 2015, the poorest 20 percent of Americans spent 0.8 percent of their income on cigarette taxes, on average, while the wealthiest 1 percent spent less than 0.1 percent.[31]

But generally, the health benefits of the tobacco tax likely outweigh the cost burden. Under the 2009 federal cigarette tax increase, people living below the poverty line paid 11.9 percent of the increase and received 46.3 percent of the health benefits as a result of reduced deaths.[32] Lower-income people are more sensitive to the cigarette price increases, making them more likely to quit or smoke less after a tax increase.

States can further maximize the gains to low-income taxpayers by targeting additional tobacco tax revenue to important public health programs. Working class families generally receive a disproportionate gain from pro-health investments and services such as smoking cessation, substance use treatment and Medicaid. Additional tobacco tax revenues offer a sensible way to boost spending on things like smoking cessation programs, especially for lower-income smokers who are more likely to quit because of the higher tax burden. Georgia currently spends only about 3 percent of the amount recommended by the Centers for Disease Control and Prevention and it is one of only two states to spend that little on those efforts.[33] Georgia would need to invest about $102.8 million more to meet the national recommendations, according to the American Lung Association.

States can further maximize the gains to low-income taxpayers by targeting additional tobacco tax revenue to important public health programs. Working class families generally receive a disproportionate gain from pro-health investments and services such as smoking cessation, substance use treatment and Medicaid. Additional tobacco tax revenues offer a sensible way to boost spending on things like smoking cessation programs, especially for lower-income smokers who are more likely to quit because of the higher tax burden. Georgia currently spends only about 3 percent of the amount recommended by the Centers for Disease Control and Prevention and it is one of only two states to spend that little on those efforts.[33] Georgia would need to invest about $102.8 million more to meet the national recommendations, according to the American Lung Association.

Newer nicotine products like e-cigarettes present policymakers some nuanced questions

Cigarette smoking has declined nationally due to policies and programs like increased taxes, media campaigns and smoke-free laws. However the use of e-cigarettes, which deliver nicotine without burning the tobacco, is growing. Georgia taxes other tobacco products such as chewing tobacco and cigars, but not e-cigarettes. Only ten states have a tax on e-cigarettes, and it is based on a price per dose or a percentage of the wholesale price.[34] There is still a growing body of research on the safety of e-cigarettes, but there are some known health effects because they contain nicotine. The Centers for Disease Control and Prevention notes that they may be beneficial for adult smokers looking to quit smoking cigarettes, but they could be harmful for young adults and people who do not currently smoke cigarettes.[35] It is important to weigh these considerations, especially in terms of the potential of an e-cigarette to prevent young adults from starting to use nicotine.

Conclusion

Georgia lawmakers should consider increasing the cigarette tax by at least $1 per pack to bring in new revenue for pro-health investments and make further progress to reduce smoking in the state. Georgia’s rate of smoking among high schoolers is above the national average and the share of Georgia smokers who quit during pregnancy is also low compared to other states. A higher cigarette tax could help increase the number of smokers who decide to quit smoking and the number of youth who decide not to start smoking.

The cigarette tax would bring in an estimated $416 million annually at an increase of $1 per pack and $588 million annually at an increase of $1.50 per pack. This revenue would boost the state’s general funds and can be used to fund health programs like tobacco cessation, substance use services and Medicaid. Lawmakers concerned about the regressive nature of a tobacco tax increase can allay those concerns by investing most or all of the new revenue in pro-health programs and services, such as smoking cessation.

The majority of Georgians support increasing the cigarette tax. In a 2018 statewide poll commission by GBPI, 76 percent of Georgians supported raising the tobacco tax by $1 per pack.[36] It has been 15 years since the last increase in the cigarette tax and now is the time for lawmakers to raise it by at least $1 per pack to promote health in Georgia.

This report is part of an ongoing series of work tied to GBPI’s People-Powered Prosperity initiative, a comprehensive vision for how Georgia lawmakers can bolster support for education, health, child care and other investments that help all Georgians thrive. A statewide poll conducted earlier this year showed nearly two-in-three Georgians support enacting a state Earned Income Tax Credit. Learn more at gbpi.org/peoplefirst.

This report is part of an ongoing series of work tied to GBPI’s People-Powered Prosperity initiative, a comprehensive vision for how Georgia lawmakers can bolster support for education, health, child care and other investments that help all Georgians thrive. A statewide poll conducted earlier this year showed nearly two-in-three Georgians support enacting a state Earned Income Tax Credit. Learn more at gbpi.org/peoplefirst.

Appendix

The table below provides high and low estimates for each tobacco tax simulation, as well as the midpoint. The midpoint estimates for each price point are the primary estimates lifted up in the report.

The low- and high-estimates are based on price elasticities of -0.3 and -0.8, respectively, for how Georgia consumers might adjust their cigarette purchasing habits in response to higher tobacco taxes. These assumptions are based on the interpretation of tax research used in Georgia’s official state estimates for prior tobacco tax proposals, in particular the unnumbered Senate Bill LC 34 4402 from 2015. In layman’s terms, an elasticity of -0.3 means a price increase of 10 percent will lead to a drop in consumption of 3 percent, while a -0.8 elasticity means a price increase of 10 percent leads to an 8 percent drop in purchases.

Endnotes

[1] “Health Effects of Cigarette Smoking.” Centers for Disease Control and Prevention, Office on Smoking and Health. 2017.

[2] “Current Cigarette Smoking Among Adults in the United States.” Centers for Disease Control and Prevention, Office on Smoking and Health. 2018.

[3] “Health Policy Brief: Tobacco Taxes.” Health Affairs, September 19, 2016.

[4] “State Excise Tax Rates on Other Tobacco Products.” Federation of Tax Administrators. January 2018.

[5] “Tobacco Excise Taxes.” Georgia Department of Revenue. 2018.

[6] “State Excise Tax Rates for Non-Cigarette Tobacco Products.” Campaign for Tobacco-Free Kids. September 18, 2018.

[7] “State Excise Tax Rates on Cigarettes.” Federation of Tax Administrators. Cigarette tax rates as of 1/1/2018. Per pack cigarette taxes are 67.5 cents in Alabama, 45 cents in North Carolina, 57 cents in South Carolina, 62 cents in Tennessee and $1.34 in Florida.

[8] “State Excise Tax Rates on Cigarettes.” Federation of Tax Administrators. Cigarette tax rates as of 1/1/2018.

[9] “U.S. State and Local Issues: U.S. State Tobacco Taxes.” Campaign for Tobacco-Free Kids. September 19, 2018.

[10] “How Stable is Cigarette Tax Revenue.” Tax Foundation. May 10, 2017.

[11] “2010 Special Council on Tax Reform and Fairness for Georgians: Recommendations.” January 7, 2011

[12] James Salzer. “Report: Georgia could raise $585 million by upping taxes on tobacco.” The Atlanta Journal-Constitution. February 13, 2015.

[13] Jennifer Parks. “American Cancer Society report shows improvements needed in cancer prevention.” Albany Herald. August 11, 2018.

[14] “Cigarette Tax Increases 2000-2018.” Federation of Tax Administrators. January 2018.

[15] “The Toll of Tobacco in Georgia.” Campaign for Tobacco-Free Kids. November 15, 2018.

[16] “Georgia Tobacco Use Surveillance Report.” Georgia Department of Public Health. 2015.

[17] “Smoking in Louisiana in 2017.”America’s Health Rankings. 2018.

[18] “Raising Cigarette Taxes Reduces Smoking, Especially Among Kids.” Campaign for Tobacco-Free Kids. June 25, 2018.

[19] “Encouraging People to Stop Smoking.” World Health Organization, Department of Mental Health and Substance Dependence. 2001.

[20] “Smoking During Pregnancy.” March of Dimes. December 2015.

[21] “Preventing Tobacco Use among Youth and Young Adults: A Report of the

Surgeon General.” U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, National Center for Chronic Disease Prevention and Health Promotion, Office on Smoking and Health, 2012.

[22] “New Revenues, Public Health Benefits and Cost Savings From A $1.50 Cigarette Tax Increase in Georgia.” Estimates from the Campaign for Tobacco-Free Kids, Tobacconomics, and American Cancer Society Cancer Action Network. 2018.

[23] “Health Effects of Cigarette Smoking.” Centers for Disease Control and Prevention, Office on Smoking and Health. 2017.

[24] “State Cigarette Excise Tax Rates and Rankings.” Campaign for Tobacco-Free Kids. September 18, 2018.

[25] “The Toll of Tobacco in Georgia.” Campaign for Tobacco-Free Kids. November 15, 2018.

[26] “New Revenues, Public Health Benefits and Cost Savings From A $1.50 Cigarette Tax Increase in Georgia.” Estimates from the Campaign for Tobacco-Free Kids, Tobacconomics, and American Cancer Society Cancer Action Network. 2018.

[27] For example, the conservative Tax Foundation is a leading opponent of tobacco tax increases, apparently due in large part to concerns over cigarette smuggling between high- and low-tax jurisdictions.

[28] “State Options to Prevent and Reduce Cigarette Smuggling and Tax Evasion And Block Other Illegal State Tobacco Tax Evasion.” Campaign for Tobacco-Free Kids. January 18, 2018.

[29] “Cigarette Taxes: Issues and Options.” Institute on Taxation and Economic Policy. October 18, 2016.

[30] University of Colorado Anschutz Medical Campus. “Most remaining smokers in US have low socioeconomic status: Disparities among smokers widening as most vulnerable find it hardest to quit.” ScienceDaily. March 24, 2017.

[31] “Cigarette Taxes: Issues and Options.” Institute on Taxation and Economic Policy. October 18, 2016.

[32] Chuck Marr and Chye-Ching Huang. “Higher Tobacco Taxes Can Improve Health and Raise Revenue.” Center on Budget and Policy Priorities. March 19, 2014.

[33] “State of Tobacco Control 2018.” American Lung Association. January 2018.

[34] “State Excise Tax Rates for Non-Cigarette Tobacco Products.” Campaign for Tobacco-Free Kids. September 18, 2018.

[35] “Electronic Cigarettes, What is the bottom line?” Centers for Disease Control and Prevention. 2018.

[36] July 2018 poll commissioned by Georgia Budget and Policy Institute.