Vouchers Overview

Georgia legislators have debated educational vouchers since the 1950s.[1] A school voucher is an amount of money provided by the state government to parents for use for private educational programs, such as tuition at private schools. There are two basic ways the state can finance school vouchers.

Georgia legislators have debated educational vouchers since the 1950s.[1] A school voucher is an amount of money provided by the state government to parents for use for private educational programs, such as tuition at private schools. There are two basic ways the state can finance school vouchers.

Tax-credit vouchers

Taxpayers can choose to pay portions of their tax obligation to “student scholarship organizations” which then provide money to parents for use for private school tuition.

State funded vouchers

These vouchers use existing state funds meant for public schools and instead redirect them for use in private education programs. Education Savings Accounts (ESAs) are a form of state funds vouchers.

Financial Impact of Vouchers

Voucher proponents make the case that these policies are revenue neutral, since the state would spend the same amount on a public school as a private one for each student. However, the effects are not neutral for individual school budgets. If a school loses three students to a voucher program, they cannot cut off three seats on a school bus or reduce the heating bill for the remaining students. These fixed costs remain regardless.

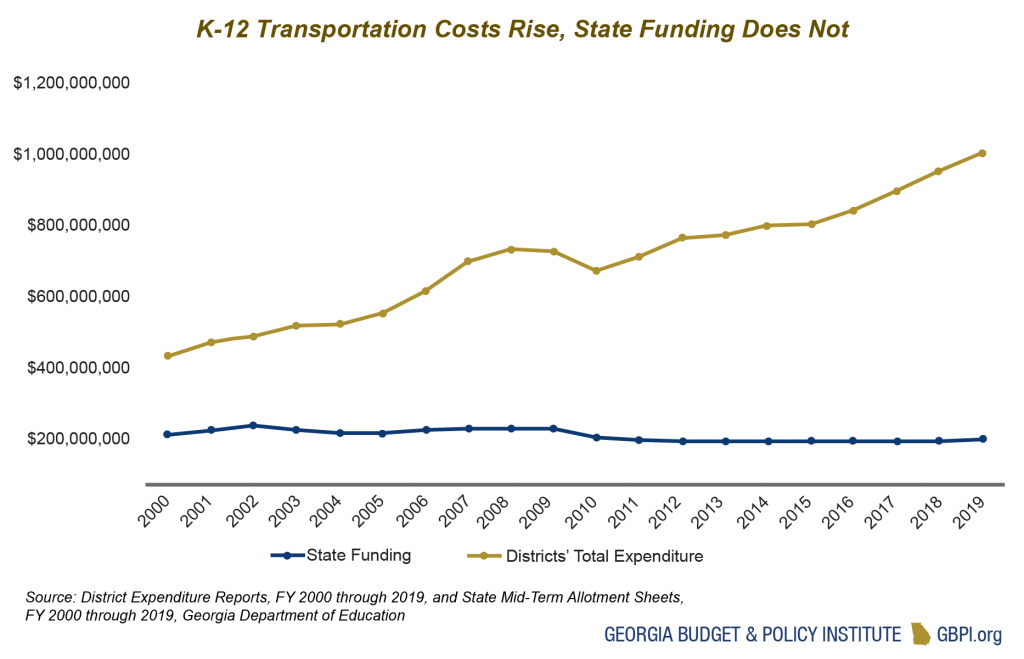

The loss of students to unaccountable private schools can have particularly disastrous effects on rural school systems that rely more heavily on state funds than the rest of the state. Georgia’s schools are already struggling to pay for costs that increase while revenue remains flat. Vouchers would exacerbate these struggles, particularly for rural Georgia.

State lawmakers who want to support Georgia’s students should resist vouchers and continue to invest in policies that are actually proven to work: adequate and fair funding for all of Georgia’s schools.

State lawmakers who want to support Georgia’s students should resist vouchers and continue to invest in policies that are actually proven to work: adequate and fair funding for all of Georgia’s schools.

Click here to download our voucher fact sheet here

[1] Johnson, R. O. (1955). Desegregation of Public Education in Georgia–One Year Afterward. The Journal of Negro Education, 24(3), 228-247