The potential for harsher federal immigration policies under the new presidential administration poses special concern for young Georgians whose parents brought them to the United States as children. A new federal crackdown threatens to wreak havoc in the lives of tens of thousands of young Georgians who now enjoy some limited legal protections that allow them to work, go to school and avoid deportation. It also jeopardizes the levels of tax revenue collected by Georgia’s state and local governments.

An estimated 47,000 Georgians, most of them in their late teen years or 20s, are enrolled or eligible for a federal program known as Deferred Action for Childhood Arrivals (DACA). Created in 2012, DACA allows some undocumented immigrants brought here as children outside of their control to live and work in the U.S. without threat of deportation.[1] If the new administration eliminates DACA as promised on the campaign trail, these 47,000 young Georgians stand to lose their ability to work or access higher education. Federal authorities could also deport them to their native countries, even if they lived the bulk of their life in the U.S.

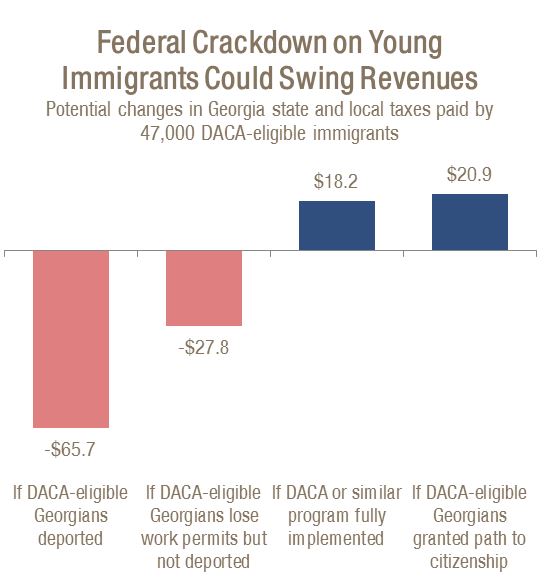

A federal crackdown on young immigrants in Georgia promises headaches for state and local budget writers. Immigrants contribute considerable tax revenue regardless of citizenship status, as detailed in a December 2015 Georgia Budget and Policy Institute report.[2] The group of Georgia immigrants covered under federal DACA protection already contributes money to communities that help pay for schools, public safety and other services. Continuing the DACA program or enhancing it with a full path to citizenship offers a chance to grow these Georgians’ contribution. Stripping their temporary lawful status or deporting them outright lessens it. Specifically, this report estimates:

- The 47,000 Georgians enrolled or immediately eligible for DACA now pay an estimated $66 million a year in state and local taxes. This includes personal income, property, sales and excise taxes.

- Taking away the ability of young Georgians brought to the country as children to work or go to school while allowing them to stay in the country is likely to reduce revenues by $28 million. If the new administration instead chooses to deport them, Georgia loses the full $66 million.

- Continuing DACA and enrolling all Georgians who are eligible for the program but not yet covered could increase revenues by $18 million, bringing the total contribution to an estimated $84 million.

- The most lucrative result for state and local lawmakers is for the U.S. Congress to replace DACA with a gradual path to citizenship, as reform-minded members of both parties have long advocated. Such a move could provide a $21 million a year revenue increase for Georgia’s state and local governments.

Varying Federal Approaches Could Harm, or Help, State and Local Services

Potential changes by the incoming administration to federal policy affecting young immigrants brought to the U.S. as children carry significant implications for Georgia’s state and local budget writers. Continuing the DACA program or enhancing it with a full path to citizenship maximizes these Georgians’ contribution to the state treasury, while stripping their temporary lawful status or fulfilling the campaign promise to deport them lessens it.

The chart below details the current tax contribution of the 47,000 Georgians eligible for DACA, along with changes under four potential scenarios: if these youth are deported; if they are stripped of their work permits but allowed to stay in the country; if instead the DACA policy or a similar program is continued and fully implemented; and if Congress replaces DACA with a gradual path to citizenship. The table illustrates the total contribution of the 28,045 Georgians currently enrolled in the DACA program, as well as the additional 18,955 Georgians who meet all eligibility requirements but have yet to enroll.

Federal Policy Changes for Young Immigrants Affect State and Local Revenues

Annual Georgia state and local tax revenue in millions, by potential federal changes to Deferred Action for Childhood Arrivals (DACA)

| Georgia State & Local Tax Contribution | Currently receiving DACA (28,045 Georgians) |

Currently eligible for DACA (18,955 Georgians) |

Combined Contribution (47,000 Georgians) |

Change from Current Contribution |

| Now | $50.1 | $15.6 | $65.7 | N/A |

| If deported | $0 | $0 | $0 | ($65.7) |

| If lose DACA work status but not deported | $22.3 | $15.6 | $37.9 | ($27.8) |

| If DACA or similar program continued* | $50.1 | $33.9 | $84.0 | $18.2 |

| If granted path to citizenship | $51.7 | $35.0 | $86.7 | $20.9 |

Sources: GBPI estimates developed using data on (a) the number of immigrants either receiving or eligible for DACA from the Migration Policy Institute; (b) the amount and share of income paid in Georgia state and local taxes by unauthorized immigrants from the Institute on Taxation and Economic Policy; (c) the estimated effects on employment of changes in legal status from the Center for American Progress; and (d) the effect on wages of temporary work permits and a legal path to citizenship from the Congressional Budget Office and Center for American Progress. *Estimate for full implementation of DACA based on assumption of eventual full enrollment of all 47,000 Georgians who are currently eligible.

The estimated effects of federal policy change range from a $66 million loss under the deportation option to a $21 million gain with a gradual path to citizenship. The two other options result in smaller though still meaningful effects. Stripping young immigrants of their legal ability to work results in an estimated $28 million loss to treasuries that pay for state and local services. Keeping the DACA program as it stands today and continuing to enroll everyone eligible leads to a $18 million gain.

The bottom line is that all residents of Georgia pay at least some state and local taxes regardless of legal status. The DACA recipients contribute to a greater degree because they’re able to earn higher wages, are likelier to work and because they pay a higher effective tax rate. And people with a protected path to citizenship are likely to contribute even more, for similar reasons.

How Changes in Immigrant Status Affect Tax Contributions

A few key facts about how changes in legal status can affect the level of taxes can help explain the variation in potential outcomes.

First, a common misconception is that people without legal status do not pay taxes at all. But everyone has skin in the game since many state and local revenue sources are collected regardless of someone’s legal status. Everyone who buys goods and services in Georgia pays state and local sales taxes. Anyone who drives a vehicle pays motor fuel taxes. And most people pay property taxes, either directly on homes they own or indirectly as renters when most landlords pass at least some of their tax bills onto tenants in the form of higher rents. Some undocumented immigrants pay state income taxes as well. In total, undocumented Georgians contributed an estimated $359 million in state and local taxes in 2013.[3]

This explains why Georgians enrolled in DACA would still contribute some revenue if the program ends, as long as they’re allowed to stay in the country. It also shows how eligible young undocumented immigrants already make a positive contribution even if they are not yet enrolled in DACA.

Next, evidence indicates immigrants with temporary lawful status or a full path to citizenship have larger incomes and higher employment rates than their undocumented peers. Because they are granted temporary work permits and a reprieve from deportation, DACA recipients are able to work more, earn more wages and gain additional skills which allow them to transition to better jobs over time. Eighty-six percent of respondents in a 2016 survey of DACA recipients reported having a job, compared to only 51 percent employed before gaining lawful status.[4] Another reputable study estimates granting temporary work permits under DACA increases the wages of recipients by 8.5 percent.[5] These benefits grow larger for immigrants with a protected path to eventual citizenship. A careful analysis conducted by the Congressional Budget Office in 2013 found that putting unauthorized immigrants on a path to citizenship raises their wages by an estimated 12 percent.[6]

This fact accounts for half of the reason why Georgia revenues would rise under the two scenarios that maintain or expand young immigrants’ legal status, or why they would fall if current DACA recipients are no longer able to legally work. The second half is immigrants with temporary lawful status or a path to citizenship pay a higher effective state and local tax rate. The DACA recipients and legal permanent residents in Georgia pay an estimated 8.6 percent of their annual income in state and local taxes, compared to 7.3 percent for their undocumented peers.[7] Put another way, immigrants with legal protection not only earn more taxable income than undocumented people, they contribute a greater share of it to state and local treasuries.

[expand title=”Additional Methodology Details”]

Methodology

This analysis generates estimates on the tax contribution of DACA-eligible Georgians under different policy options through a simple methodology based on four core pieces of information, detailed in the formula below.

- The number of people either currently enrolled or who could soon apply for DACA if it is maintained. The Migration Policy Institute estimates that 28,045 Georgians were enrolled in July 2016, the most recent data available, and another 18,955 are “immediately eligible.”

- How immigrant wages change depending on legal status. Undocumented workers earn $22,029 a year on average and granting DACA status increases wages by 8.5 percent, according to a 2014 report by the Center for American Progress. Putting immigrants on a path to citizenship would carry a larger effect, since it grants rights and protections associated with permanent residence. The Congressional Budget Office estimates a path to citizenship would boost wages by 12 percent.

- How the employment rate of immigrants changes depending on legal status. A 2016 national survey of 1,308 DACA recipients found that 86 percent of respondents were employed, compared to only 51 percent before gaining lawful status. GBPI’s analysis assumes a 51 percent employment rate for immigrants lacking any legal status and 86 percent employment for DACA recipients and people with a path to citizenship.

- The effective tax rate paid on average by people with different legal status. These data come from the Institute on Taxation and Economic Policy. Their landmark analysis on the state and local tax contributions of undocumented immigrants estimates that Georgians without lawful status pay a 7.3 percent effective rate on average, compared to 8.6 percent for both DACA recipients and legal permanent residents.

| Number of immigrants, by status, varying by policy option | x | Employment rate, by legal status | x | Average Income, by legal status | = | Total Income | x | Effective S&L Tax Rate, by legal status | = | Estimated Revenue |

For example, to estimate revenue for the scenario where all Georgians who are eligible for DACA enroll:

| 7,000 immigrants currently enrolled or eligible | x | 86.9% (vs. 51.3% for undocu-mented) |

x | $23,901 ($22,029 x 1.085) |

= | $976 million | x | 8.6% | = | $84 million |

[/expand]

Endnotes

[1] The Deferred Action for Childhood Arrivals (DACA) program was created in 2012 by federal executive action. It allows some undocumented immigrants brought here as children outside of their control to live and work in the United States for two years with a renewal period near the end of their term if they meet educational or military service requirements.

[2] “Immigrants Help Chart Georgia’s Course to Prosperity,” Georgia Budget & Policy Institute. December 2015.

[3] “Undocumented Immigrants’ State & Local Tax Contributions,” Institute on Taxation and Economic Policy. February 2016.

[4] “New Study of DACA Beneficiaries Shows Positive Economic and Educational Outcomes,” Center for American Progress. 10/18/16.

[5] “The Fiscal Benefits of Temporary Work Permits,” Center for American Progress (CAP). 9/4/2014.

[6] “Cost Estimate: Border Security, Economic Opportunity, and Immigration Modernization Act,” Congressional Budget Office. 2013.

[7] The increased effective rate overall occurs because of greater compliance with the state income tax. Between 50 and 75 percent of undocumented immigrants currently pay personal income taxes using either false social security or individual tax identification numbers. Naturalized citizens and legal permanent residents likely comply with income taxes at nearly 100 percent.