Georgia’s delegation in the U.S. House of Representatives is poised to consider a large-scale tax package next week, which in its current form provides a windfall to a few wealthy taxpayers at the top while putting the long-term well-being of regular families in jeopardy. The Tax Cuts and Jobs Act, introduced in the U.S. House on Nov. 2, comes with a price of at least $1.5 trillion in lost revenue over a decade, financed by tacking it on to the federal deficit. Backers of the effort including President Donald J. Trump continue to tout the plan as a way to boost the middle class and economic growth, yet neither claim appears grounded in the facts.

A detailed look at the House plan’s fine print of the plan by the nonpartisan Institute on Taxation and Economic Policy finds most of the benefits are likely to flow to a narrow sliver of wealthy Americans and profitable corporations, with regular families seeing only minor gains. The U.S. Senate introduced a slightly different version of the tax plan on Thursday, which includes some modest differences but appears likely to follow a similar track.

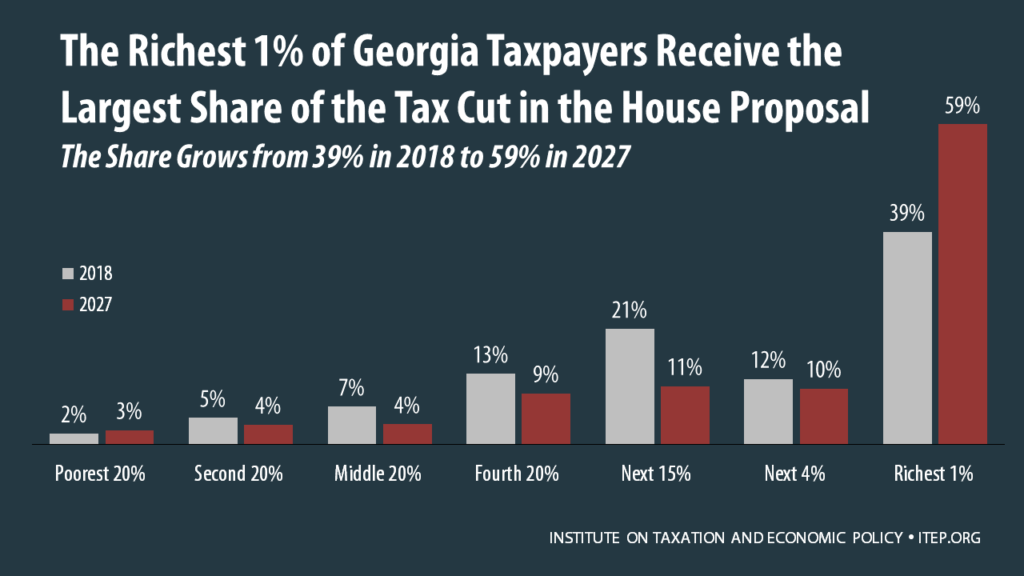

Under the House plan, the wealthiest 1 percent of Georgians, or households with annual incomes of $543,000 or more, stand to receive 39 percent of the aggregate tax cut. The share of the benefit going to the top 1 percent grows over time, rising to 59 percent by 2027. The lopsided nature of the plan means Georgians at either end of the income spectrum could expect tax cuts of very different scope. Georgia households in the top 1 percent could enjoy an average tax cut around $56,000 a year in 2018, growing to $75,000 in 2027.

Working Georgians get much smaller reductions and their tax cuts actually decline in value over the long haul, unlike their wealthy counterparts. That’s because some of the provisions in the package designed to benefit the middle-class expire or shrink in the long run, whereas provisions tailored to those better-off become more generous. The middle fifth of Georgia households, or taxpayers earning from $38,600 to $59,300 a year, could expect an average annual tax cut of $500 in 2018, falling to $220 by 2027. Households with incomes below that range would get even less, especially down the road.

How is it most of the tax plan’s benefits flow to the top? Most items in the package are policy approaches that provide more profit to wealthy people and corporations, rather than working families and small businesses.

How is it most of the tax plan’s benefits flow to the top? Most items in the package are policy approaches that provide more profit to wealthy people and corporations, rather than working families and small businesses.

The centerpiece of the plan is a corporate income tax cut of historic proportions, down to 20 percent from 35 percent. Research shows that cut will overwhelmingly profit large companies and investors at the expense of workers or small businesses, with little to no economic benefit. The plan also eliminates the federal estate tax after phasing down a few years, offering a multi-million dollar payout to the roughly 0.2 percent of fortunes large enough to be subject to the tax. And, it creates a special new income tax rate for so-called pass-through businesses, an idea that in practice would mostly serve as a lucrative loophole for groups like hedge fund owners and real estate investors, rather than Main Street businesses.

The costs of these tax breaks add up fast. House tax-writers propose to cover some of the cost by trimming or eliminating various credits and exemptions available today, such as the deduction for home mortgage interest and write-off for state and local taxes. Though scaling back tax breaks is good policy in general, trimming these deductions will lead to higher tax bills for some middle class families. An estimated 9 percent of Georgians would pay higher taxes in 2018 according to the tax policy institute, rising to 22 percent by 2027.

The revenue- raising measures don’t generate enough money to cover all the cuts though, so the remainder probably will be paid for by increasing the deficit. The amount of lost revenue is likely to be at least $1.5 trillion over the next decade, or $150 billion a year on average, potentially rising even higher according to the Congressional Budget Office. For context, $150 billion a year is equivalent to five times what the federal government spends on Pell Grants, which help 270,000 low- and moderate-income Georgians attend college. It’s also about 50 times what Congress spends annually on national parks.

Adding that amount of money to the nation’s credit card is likely to come back to haunt families in a few years. It could jeopardize near-term funding for crucial investments in education, health care, infrastructure or other services, as well as create pressure to slash them in the long run. In other words, the tax bill appears likely to give low-income and middle class Georgians very little in the short run, then turn around and hit them with cuts to crucial services later on.

Georgia families can expect even more pain if Congress acts on the president’s late-game suggestion to eliminate the federal health coverage mandate. Portrayed as a potential way to pay for even deeper tax cuts, the backdoor maneuver could cause an estimated 15 million Americans to lose health coverage and raise premiums on the individual market by as much as 20 percent.

A balanced, well-crafted revision to the federal tax system could provide a needed boost to working Georgia families. But the current plan does no such thing. It offers a massive tax break for people and companies getting a good deal in the current system, with paltry benefits for everyone else and no discernable economic gain. Rather than moving forward on the bill as is, lawmakers in Washington need to go back to the drawing board and look for a better way.