When parents have money in their pockets to make ends meet and to save or invest in their families’ future, the overall economy gains. Policies such as stronger child care assistance and targeted tax breaks for families can help parents contribute more to the workforce by better balancing career and caregiving responsibilities, while also creating a more stable home environment for children’s future success.

Help more working parents afford child care.

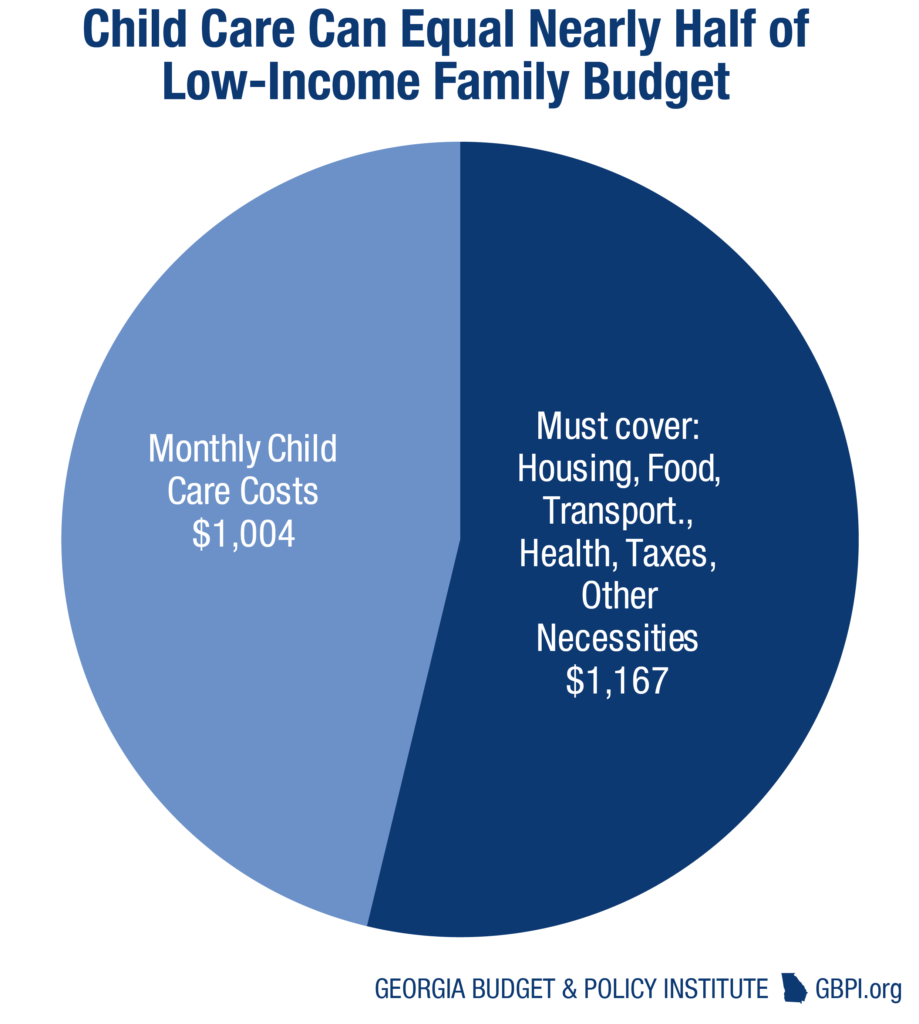

Georgia’s economy relies far more than in decades past on the workforce contributions of both adults in married households, as well as single parents.[72] That means affordable, quality child care is a more crucial link in the economic chain than it used to be. Yet the cost of infant child care is comparable to more than two semesters of tuition at many state universities. In Georgia, the average annual price of child care for a toddler in a child care center is $7,311, while the average price for before and after-school care for a school-aged child in a child care center is $2,751.[73] These costs can easily consume nearly half of a working family’s income.

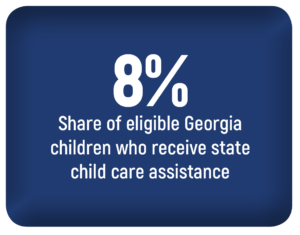

Georgia helps a select few families shoulder the burden, but state support falls well short of need. Georgia’s Childcare and Parent Services program assists with the care of 54,000 children weekly, out of the 623,000 low-income children under 13 years old in working families who likely need care.[74]

Helping parents with the high costs of child care can boost the state’s economy by removing a barrier to families’ full economic participation. About 14 percent of women nationwide ages 25 to 54 who are not in the workforce cite home responsibilities as their leading reason for not working, compared to only 1 percent of men. Research also shows that parents who receive help paying for child care are more likely to stay employed, put in more hours and avoid child-related disruptions such as missed days.[75]

An ambitious ramp-up of the state’s child care assistance program would take advantage of an opportunity to reinforce Georgia’s working families, stabilize the workforce available to companies and bolster the state’s economy. Ensuring that all Georgia children up to four years old can afford high-quality, center-based child care could cost about $500 million a year.[76] More modest investments, such as $7 million a year to help technical college parents in the HOPE Career Grant program afford care,[77] are viable starting points.

An ambitious ramp-up of the state’s child care assistance program would take advantage of an opportunity to reinforce Georgia’s working families, stabilize the workforce available to companies and bolster the state’s economy. Ensuring that all Georgia children up to four years old can afford high-quality, center-based child care could cost about $500 million a year.[76] More modest investments, such as $7 million a year to help technical college parents in the HOPE Career Grant program afford care,[77] are viable starting points.

More details: “Invest in Child Care to Tap Families’ Economic Potential,” GBPI, January 2018.

Enact a Georgia Work Credit

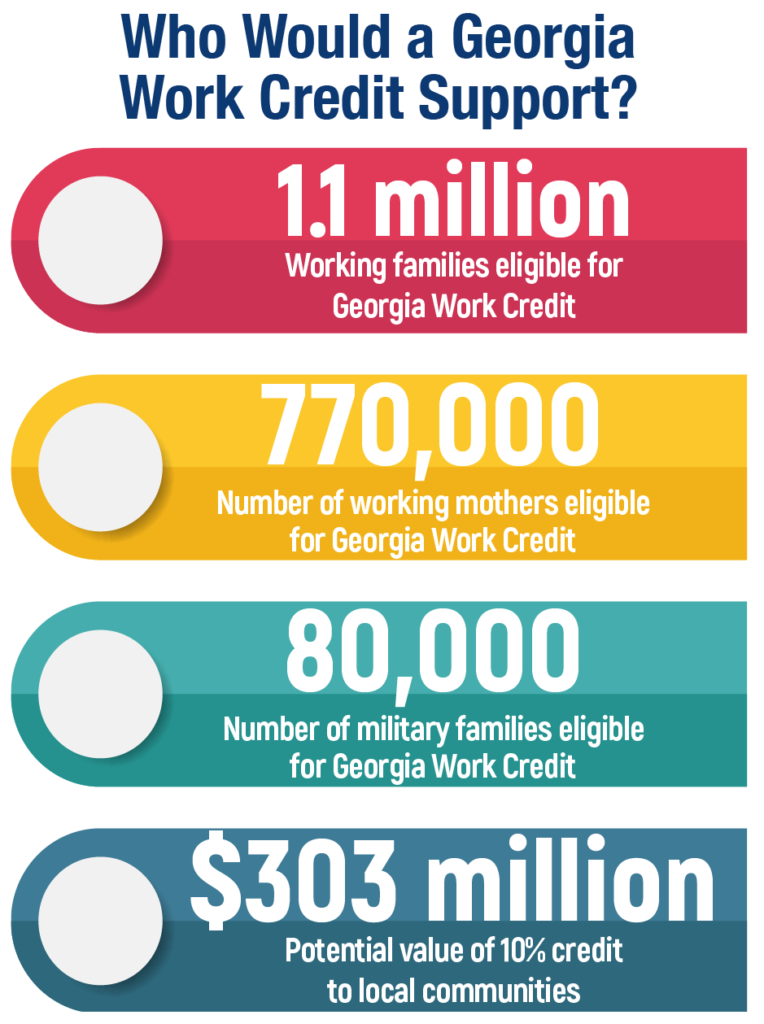

One of the best tools to help ensure that all Georgians share in the state’s prosperity is a state-level Earned Income Tax Credit (EITC), or Georgia Work Credit. Created in 1975 and expanded under presidents from both parties, the federal EITC is perhaps the nation’s most effective tool to help working families reach the middle class. Available only to people who work, it cuts federal taxes for modest-wage people like cashiers, mechanics and nurses. About 1.1 million Georgia families, or 25 percent of all Georgia households, already receive the federal credit.

One of the best tools to help ensure that all Georgians share in the state’s prosperity is a state-level Earned Income Tax Credit (EITC), or Georgia Work Credit. Created in 1975 and expanded under presidents from both parties, the federal EITC is perhaps the nation’s most effective tool to help working families reach the middle class. Available only to people who work, it cuts federal taxes for modest-wage people like cashiers, mechanics and nurses. About 1.1 million Georgia families, or 25 percent of all Georgia households, already receive the federal credit.

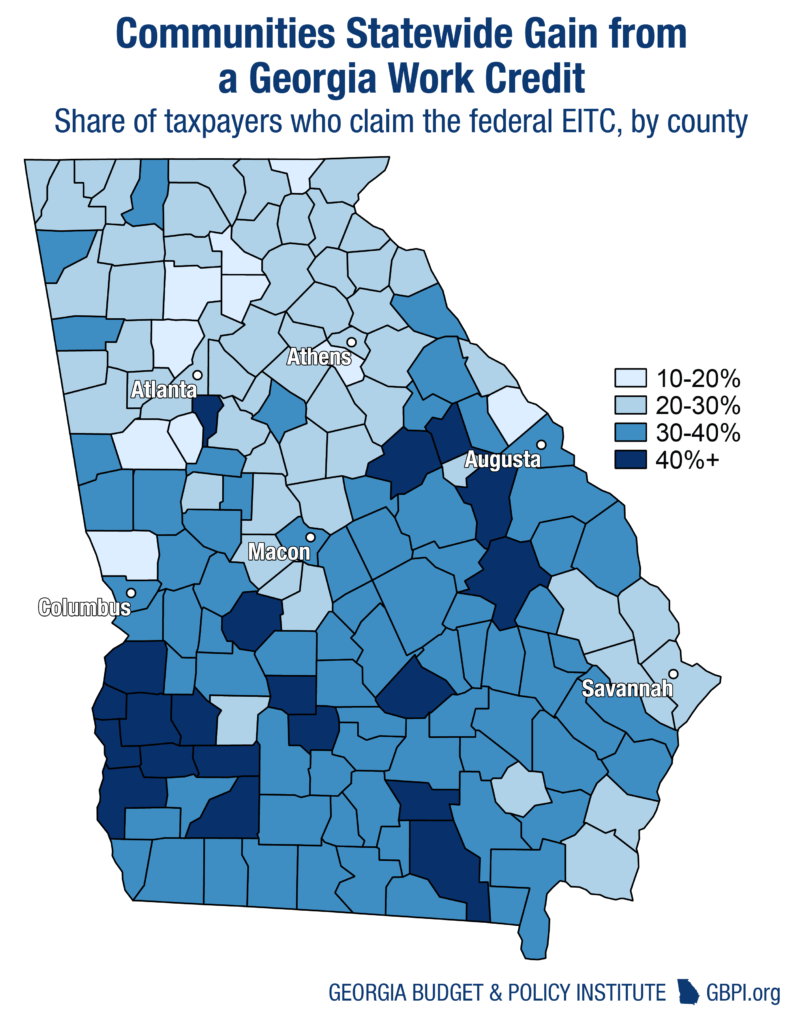

Twenty-nine states, including neighboring South Carolina, build on the EITC’s track record of success by providing a similar credit against state and local taxes. Following their lead by creating a refundable Georgia Work Credit set at 10 percent of the federal version could provide eligible families a few hundred dollars a year, up to a ceiling of around $630.

The extra money can deliver a booster shot to Georgia’s economy, both today and in the long run. In the short-term, a new state credit would pump millions of dollars into local communities by giving families more disposable income to spend at small businesses, pay bills or save for the future. Studies of the federal credit indicate that every $1 claimed by local taxpayers generates up to $2 of local economic activity.

The credit’s economic impact continues into the future by putting children on a firmer pathway to future success. Decades of research and evidence from other states show that children whose families receive more income from the EITC are likelier to grow up in stable home environments, excel in school, graduate high school, attend college and earn more as adults.[78]

Creating a Georgia Work Credit is a bold investment to break the cycle of poverty, strengthen rural[79] and urban communities and help working families get ahead. A refundable Georgia Work Credit set at 10 percent of the federal EITC costs an estimated $303 million a year.

More details: “A Bottom-Up Tax Cut to Build Georgia’s Middle Class,” GBPI, November 2017.