Introduction

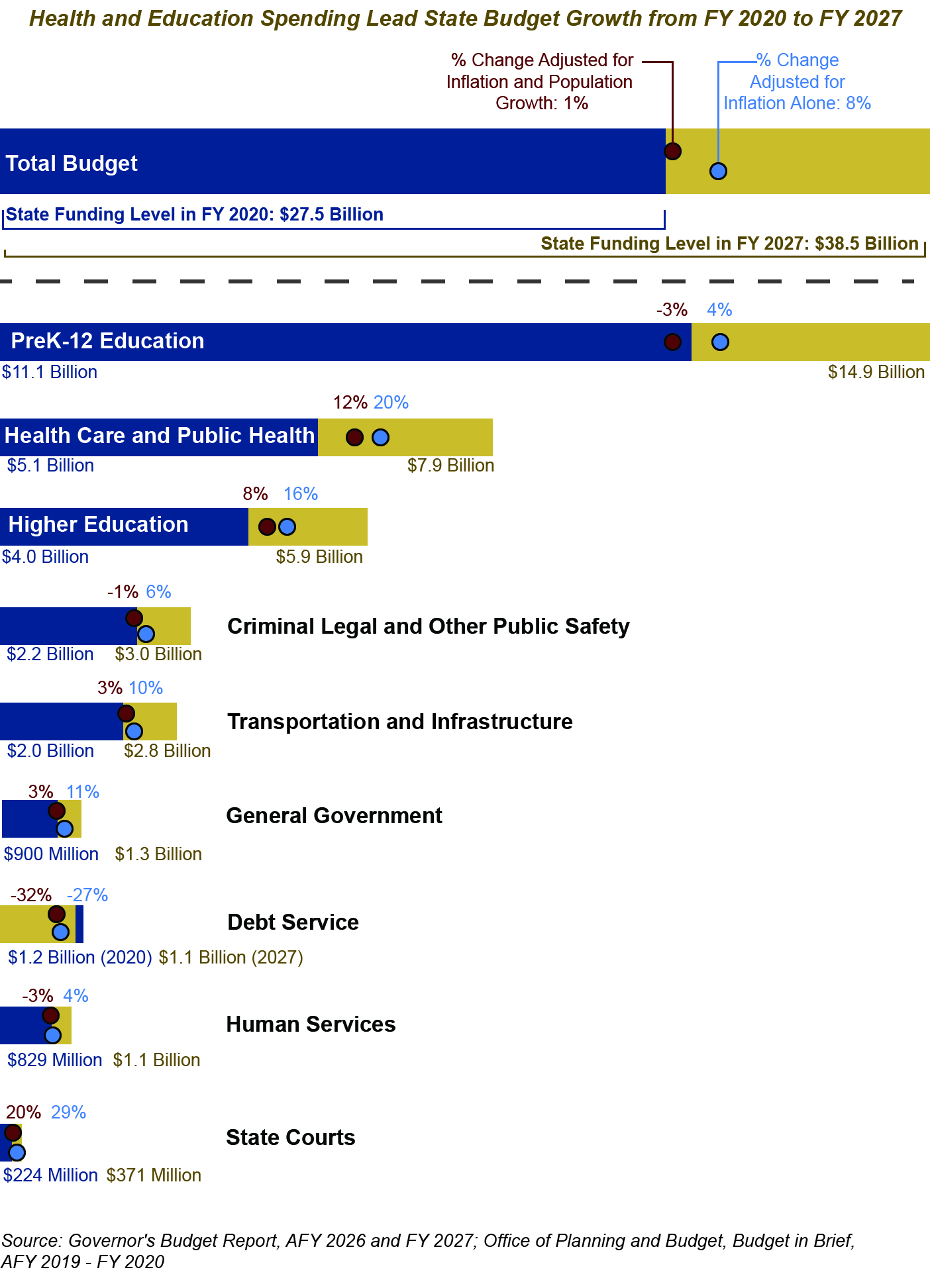

Between Gov. Brian P. Kemp’s first full fiscal year (FY) budget as governor and his eighth and final budget for FY 2027, state spending has increased by nearly $11 billion to $38.5 billion. However, when accounting for the 774,000 new residents added to Georgia’s population (+7%) as well as the 29% cumulative increase in inflation between January 2019 and 2026, per-person state spending has grown at a real annual rate of just 0.2% over the seven years from FY 2020 to FY 2027.[1]

Between Gov. Brian P. Kemp’s first full fiscal year (FY) budget as governor and his eighth and final budget for FY 2027, state spending has increased by nearly $11 billion to $38.5 billion. However, when accounting for the 774,000 new residents added to Georgia’s population (+7%) as well as the 29% cumulative increase in inflation between January 2019 and 2026, per-person state spending has grown at a real annual rate of just 0.2% over the seven years from FY 2020 to FY 2027.[1]

This year, Gov. Kemp’s budget recommendations are led by a historic $325 million investment to endow a need-based scholarship for higher education with state general funds. The FY 2027 executive budget also allocates an additional $46.4 million to fully fund Supplemental Nutrition Assistance Program (SNAP) administration, along with $18.2 million for efforts to reduce SNAP’s payment error rate between AFY 2026 and FY 2027. This increase in funding comes in response to the first major cost shift to the state caused by H.R. 1, which Congress approved last year, initiating the deepest cuts to food assistance and Medicaid in modern history. Filling this gap marks a critical step before the state begins sharing SNAP program costs with the federal government, which could range from $162 million to $487 million depending on the state’s error rate.

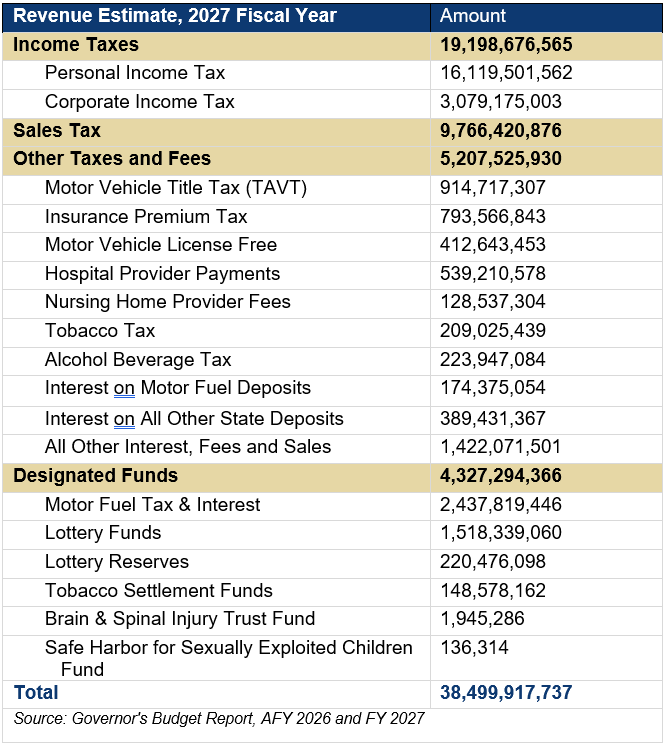

With Georgia’s undesignated surplus still near its peak balance at $9.3 billion, Gov. Kemp’s Amended Fiscal Year (AFY) 2026 executive budget plans to spend down approximately $4.3 billion, including up to $1 billion for a fourth one-time non-refundable income tax rebate of $250 to $500. After allocating $4.1 billion in cash payments for long-term infrastructure projects between FY 2024 and AFY 2026, Kemp’s FY 2027 budget returns to the state’s traditional practice of selling bonds to finance capital projects. This change helps to provide for $1.5 billion in net spending increases for other programs, even as Georgia anticipates a $778 million reduction in revenues from lowering its flat personal and corporate income tax rate from 5.19% to 4.99%.[2] Despite carrying a significant cost to the state, the rate cut will save most Georgia households less than $80 per year, with 73% of savings going to those in the top 20% who earn over $159,000 annually.

Since 2020, 78% of $11 billion in new resources added to Georgia’s budget ($8.6 billion) has gone to PreK-12 grade education (35% of total), higher education (18%), health care and public health (26%). At the same time, Georgia is projected to forego $2.3 billion in personal and corporate income tax revenue due to the cumulative costs of gradually shifting from maintaining a graduated income tax system with a top rate of 5.75% to a flat personal and corporate income tax rate of 4.99% between 2022 and 2026.[3]

Since 2020, 78% of $11 billion in new resources added to Georgia’s budget ($8.6 billion) has gone to PreK-12 grade education (35% of total), higher education (18%), health care and public health (26%). At the same time, Georgia is projected to forego $2.3 billion in personal and corporate income tax revenue due to the cumulative costs of gradually shifting from maintaining a graduated income tax system with a top rate of 5.75% to a flat personal and corporate income tax rate of 4.99% between 2022 and 2026.[3]

Kemp’s budget does not contemplate how to address Georgia’s skyrocketing uninsured rate, as congressional inaction has caused massive cost spikes in Georgia’s ACA health care marketplace. Major questions also loom over the future of Georgia’s decades-old Quality Basic Education (QBE) funding formula for public schools as $15.3 million in pilot funding expires for an “opportunity weight” designed to account for the higher costs of educating students living in poverty. Nevertheless, members of the General Assembly continue to debate proposals to eliminate the state’s largest source of revenue, the income tax, and as well as whether to eliminate property taxes on owner-occupied primary (homesteaded) residences.

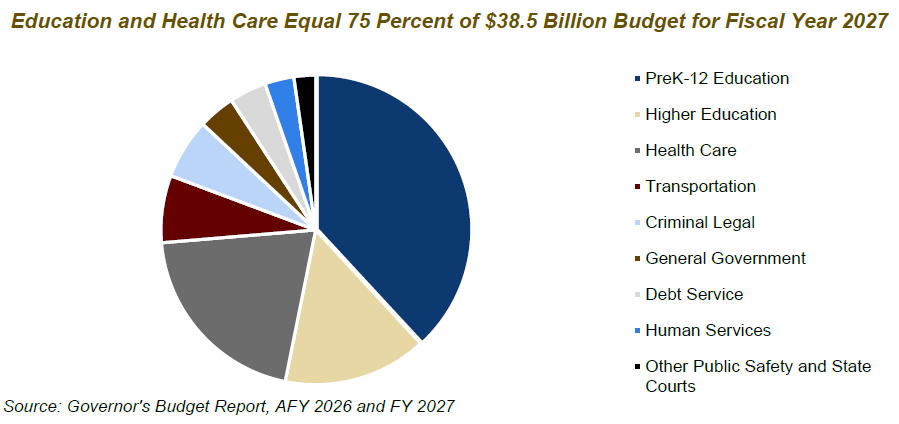

Education and Health Care Equal 75% of $38.5 Billion Budget for Fiscal Year 2027

Total appropriations for AFY 2026 have increased by $4.5 billion (11.9%) from the original budget to $42.3 billion, while spending for FY 2027 is up 2% to $38.5 billion. In FY 2027, Georgia will allocate three-quarters of every dollar in the state budget to health and education.

Overall, PreK-12 grade education comprises 39% of state spending, followed by health care and public health at 21%, higher education at 15%, Georgia’s criminal legal, public safety and courts at 9%, transportation at 7%, human services at 3% and debt service at 3%. All other functions of government comprise the remaining 3% of state spending.

Across the board, state agencies will save $241.7 million by contributing less to the State Health Benefit Plan (SHBP) in FY 2027, as the employer contribution rate decreases from 29.454% to 20.264%. This change is partially offset by an increase in the rate assessed to school employees enrolled in SHBP. Financing $654 million in capital projects with $81 million in bonds also helps to make available an additional $635 million, allowing for a cumulative increase of $2.1 billion in new net spending for FY 2027.

Out of this total, $615.6 million in proposed additions (30%) are for PreK-12 public education, while $533.6 million in new funding (26%) is for higher education, dual enrollment and HOPE scholarships. Approximately $353 million in new funding (17%) is added for Georgia’s three major health agencies, along with $83.7 million (4%) for human services.

The FY 2027 executive budget includes an 11% increase in funding for pupil transportation ($38.5 million) and $25 million to replace 270 school buses. However, this addition is made as $15.3 million in funds used to pilot an “opportunity weight” for students living in poverty are allowed to expire. As lawmakers consider potential updates to Georgia’s QBE funding formula, which was enacted in 1985, adopting an “opportunity weight” would be among the highest-return ways to improve how Georgia funds schools. Although QBE has not been comprehensively rewritten in more than four decades, the state has reduced its funding commitment over time for transportation, employee health coverage and equalization between high and low wealth districts.

As lawmakers express concerns over rising property taxes, Gov. Kemp’s executive budget proposals are likely to add greater financial pressure to local districts. Despite K-12 enrollment decreasing by about 34,000 students to start the 2025-26 school year with a total of 1.7 million public school students, fixed costs for schools continue to increase. Effective July 1, 2026, school districts are set for an 8% increase in the per member per month (PMPM) rate for employees enrolled in the SHBP, increasing from $1,885 to $2,028. The state stopped paying the employer health insurance contribution for non-certified employees in 2012, leaving individual districts paying the cost. Local districts are required to cover the employer SHBP share for an estimated 118,000 school employees enrolled statewide.[4] If the state’s estimate of $199.7 million to fund its share SHBP increases for certified school employees offers any indication, local districts are likely to shoulder a similar expenditure.

Moreover, the state has allocated an additional $286.6 million in AFY 2026 to provide a one-time $2,000 pay supplement to K-12 employees paid through the QBE formula. If schools want to extend these bonuses to all their employees, it will require additional resources from districts beyond those already needed for rising health insurance costs.

Notable additions recommended as part of the FY 2027 budget include:

PreK-12 Grade Education:

- $264.1 million for K-12 construction and renovation projects

- $199.7 million to fund the state share of SHBP cost increases for certified school employees, as the PMPM increases from $1,885 to $2,028 effective July 1, 2026

- $44.7 million for growth in State Commission Charter Schools

- $38.6 million to increase the Pupil Transportation Grant and $25 million to replace 270 school buses

- $12 million for year three of a four-year phase-in to reduce PreK classroom sizes from 22 to 20 students

Higher Education:

- $218.6 million for the University System of Georgia (USG) to reflect a 4.9% increase in credit hour enrollment and a 0.56% increase in square footage

- $113.1 million for USG capital projects

- $62.1 million for Technical College System of Georgia (TCSG) capital projects

- $58 million in additional lottery funds to meet projected need for HOPE scholarship and grants

- $34.1 million to reflect a 9.4% increase in TCSG credit hour enrollment

- $27.6 million to meet projected need for Dual Enrollment

- $9.5 million to support the expansion of graduate medical education at the University of Georgia School of Medicine

Health:

- $321 million for Medicaid and PeachCare to continue providing health care for over 2 million Georgians

- $55 million for the Department of Corrections to health contracts to increase staffing ratios, per diem and to reflect the opening of new beds

- $9.3 million for the Department of Behavioral Health and Developmental Disabilities for 404 additional housing vouchers to comply with the state’s Department of Justice Settlement Agreement and $5.3 million to support the state’s mental health crisis system

Human Services:

- $46.4 million to adjust the state-to-federal ratio of funding for SNAP administration from 50% to 75% to reflect a reduction in federal outlays beginning in October 2026.

- $21.3 million for utilization growth and increased costs of care in the Out-of-Home Care program

- $12 million to reduce the SNAP payment error rate

Amended Fiscal Year 2026 Budget Includes $4.5 Billion in Funding Increases, Spends Down 29% of Georgia’s Surplus Balance

For three years, between FY 2024 and AFY 2026, Gov. Kemp has made it among his core fiscal priorities to reduce bonded debt by paying for the full cost of capital investments in cash. Including $1.3 billion in AFY 2026, Georgia will have allocated $4.1 billion to the Georgia State Financing and Investment Commission for this purpose. As a result, adjusting for inflation, Georgia’s per-resident debt payments for capital projects will have decreased by 32% between FY 2020 and FY 2027.

Moreover, in 2026, Georgia’s use of debt will reach a historical low of just 3% of prior year revenues, which falls well below its constitutional limit of 10% and is down from 4.9% in FY 2020. Beyond Georgia’s prized AAA bond rating, this low level of debt is another indication of the state’s strong fiscal position as it resumes issuing bonds for capital projects in FY 2027. If Georgia eliminated its income tax, it would risk jeopardizing its AAA bond rating, potentially raising future borrowing costs.

To help retain Georgia’s workforce, the AFY 2026 executive budget proposes $611.8 million for a one-time pay supplement of $2,000 for all full-time state and USG employees, along with PreK-12 employees recognized as part of the state’s QBE formula. After reaching an all-time high turnover rate of 25.3% in FY 2022, Georgia’s workforce has since stabilized. In FY 2025, the system-wide turnover rate among state employees declined to 17.3%, down from 18% in FY 2024, as the number of full-time employees increased by 1.1% year-over-year.[5]

Aside from infrastructure and transportation projects, the most significant proposal in Gov. Kemp’s AFY 2026 budget is to jump-start a need-based higher education scholarship by endowing USG with $325 million in general funds. While Georgia’s student borrowers have the second-highest average student loan balance in the nation, only about 1% of state grant aid is currently need-based.[6] Recent assessments have found that 1.7 million student borrowers in Georgia owe a total loan balance of $69.83 billion, with a median debt of $22,300.[7] Although details of how the need-based aid program would operate remain undefined, closing the gap in higher education affordability with need-based aid could significantly expand economic opportunity to the next generation of Georgians.

As part of $4.5 billion in new spending for AFY 2026, Gov. Kemp’s recommendations include:

- $1.8 billion for the extension and bi-directional expansion of I-75 express lanes in Clayton and Henry County

- $325 million to endow a need-based higher education scholarship called Georgia DREAMS

- $250 million for local maintenance and improvement grants through the Department of Transportation’s local road assistance program

- $200 million for improvements to SR 316

- $174.3 million for the Department of Corrections for statewide security enhancements

- $100 million for the rehabilitation and replacement of rural bridges

- $92.8 million for Medicaid and PeachCare to continue providing health care for over 2 million Georgians

- $88.2 million for the design and construction of the new School of Aerospace Engineering building at the Georgia Institute of Technology

- $50 million for the State Housing Trust Fund to establish a homelessness grant program

- $43.5 million for the midterm adjustment in the QBE program

- $41.5 million for the Department of Human Services for utilization growth and increased costs of care in the Out-of-Home Care program

- $35 million for the Technology Empowerment Fund to continue the Department of Community Health Integrated Eligibility System modernization

- $6.2 million for Gateway system modifications to reduce the SNAP payment error rate

- $750k to fund a pilot grant for mental health services reimbursement for K-12 public schools

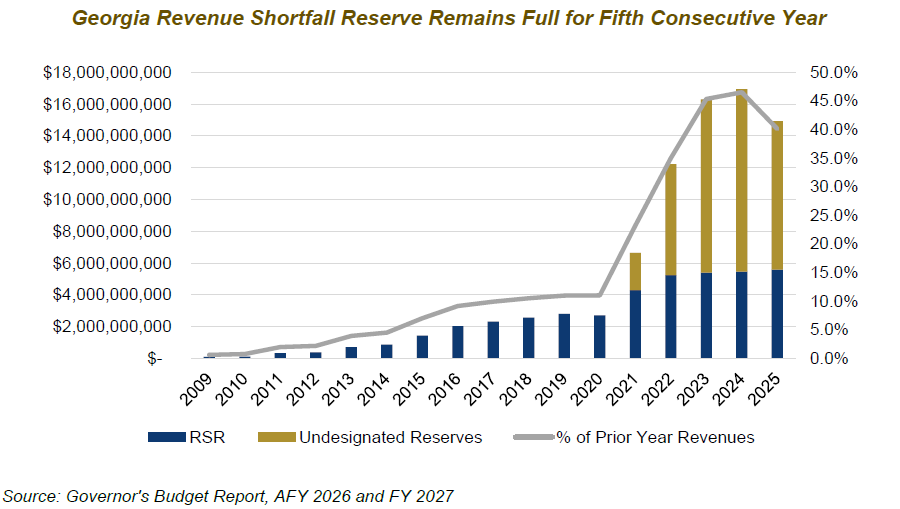

Governor’s FY 2027 Revenue Estimate Anticipates Income Tax Rate Cut, H.R. 1 Conformity Considerations Also on the Horizon

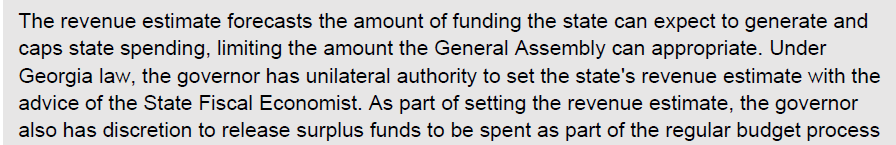

Through the first six months of FY 2026 (July to December 2025), Georgia’s tax collections have increased by 2.2%, or $364 million, year over year.[8] Next year, the state projects that it will raise $16.1 billion from the personal income tax and $3.1 billion from the corporate income tax for a total of $19.2 billion, or one half of all state revenues. Georgia’s next largest source of revenue, the sales tax, represents 25% of total collections or $9.8 billion. Overall, the state expects to raise $38.5 billion in FY 2027, down slightly from the $38.95 billion it generated in FY 2025.

This session, Gov. Kemp has proposed accelerating the state’s planned reduction of its flat income tax rate to 4.99%, retroactively effective as of January 2026. Under this proposal, the state’s personal and corporate income tax rate would both shift from 5.19% to 4.99% at an estimated cost of $778 million per year. Approximately 73% of these benefits ($568 million) would go to those with incomes in the top 20% of Georgia households (over $159,000 per year), while most Georgians see less than $80 in savings per year. The governor has also proposed a fourth one-time non-refundable income tax rebate of $250 to $500 at a cost of approximately $1 billion in surplus funds.

During the 2026 legislative session, Georgia lawmakers will also face the choice of whether to conform the state tax code to match both existing (but recently renewed) federal tax measures and provisions created this year.[9] New federal tax provisions include tax exemptions for businesses, an expansion of 529 accounts for private K-12 tuition and higher education expenses, “Trump Accounts” for newborns, an increase to the Child and Dependent Care Tax Credit and a variety of other measures that could affect Georgia.

H.R. 1 also includes temporary exemptions on some income earned from tips and overtime from 2025 to 2028, which Georgia lawmakers could also include in the state tax code. In 2027, adopting these exclusions for tip and overtime income would reduce state revenues by approximately $469 million.[10] Accepting a broader array of the recent federal changes could lead to additional revenue losses that weaken the state’s fiscal position in advance of further changes to the state’s tax code.

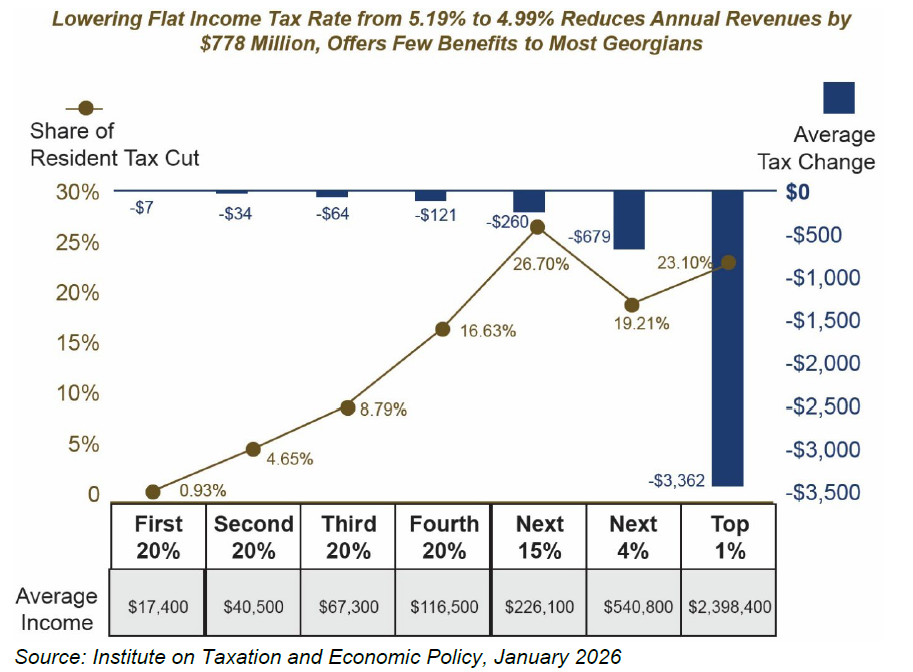

As Lawmakers Begin Appropriations Process, Kemp Proposes Major Allocation of Undesignated Reserves

If lawmakers support Gov. Kemp’s proposal to spend down $4.3 billion in undesignated surplus funds, FY 2026 would mark the second consecutive year since 2020 that Georgia has dipped into its reserves. Spending down these reserves also would reduce the state’s projected revenues from interest by $446 million, down from $1 billion estimated in AFY 2026 to $564 million in FY 2027.

In FY 2025, after Georgia’s undesignated surplus reached a peak balance of $11.5 billion, lawmakers spent down $2.14 billion on a combination of infrastructure projects and one-time rebates. Gov. Kemp’s AFY 2026 proposal follows a similar formula and would reduce the balance of Georgia’s undesignated reserves down to $5.1 billion. Nevertheless, Georgia would also retain $5.6 billion in its RSR, which remains full at 15% of prior year revenue collections.

As shown above, prior to FY 2021 Georgia had never exceeded the 15% maximum threshold for the RSR. Even as state leaders consider the largest non-emergency spend-down of Georgia’s reserves in history, legislators can take comfort in the fact that Georgia’s reserves would remain well above historical norms at $10 billion. These resources are equivalent to the cost of operating state government for nearly five months. This leaves lawmakers considerable flexibility to continue considering ways to further leverage the state’s surplus such as by creating a dedicated Child Care Trust Fund or planning additional infusions into Georgia’s new need-based aid scholarship.

Amidst Push to Eliminate Income Tax, FY 2027 Tax Expenditure Report Shows Limited Alternatives

Last year, Lt. Gov. Jones created the Georgia Senate Special Committee on the Elimination of Georgia’s Income Tax. After holding several meetings, a majority of the committee’s members supported a framework to eliminate Georgia’s personal income tax through four steps. First, members would take the same recommendation issued by Gov. Kemp and reduce the state’s flat personal and corporate income tax rate from 5.19% to 4.99%. At that point, the rates would be decoupled, and the corporate rate would remain at 4.99%. This change would reduce revenues by $778 million per year and 73% ($568 million) in tax cuts would go to those in the top 20% who earn more than $159,000 per year.

Next, at a cost of roughly $6 billion per year, Georgia’s standard deduction would increase from $12,000 for single filers to $50,000 and from $24,000 to $100,000 for married couples filing jointly. This change would be worth a maximum tax savings of $1,896 for single filers and $3,792 for married couples, who would continue to qualify for the state’s existing exemption of $4,000 per dependent, along with its retirement exclusion of up to $65,000 per person. After increasing the standard deduction and eliminating income taxes for more than two-thirds of Georgians, the next step would reduce the state’s flat personal income tax rate from 4.99% to 3.99%. Approximately 69% ($2.3 billion) of $3.3 billion in annual tax cuts would go to those in the top 20%, while most Georgians would see a tax cut of less than $320 per year. Lastly, the final step would see Georgia’s 3.99% flat personal income tax rate reduced to 0% at an additional cost of $8.8 billion by 2032.

Although raising the standard deduction is a far more balanced and equitable policy than cutting the income tax rate from the top down, the Senate special committee’s central recommendation demonstrates why its stated purpose of eliminating the income tax would almost invariably leave most Georgians worse off. The committee’s report explains its recommendation by noting that, “71% of Georgia tax filers have an [Adjusted Gross Income] below $100,000 and pay total individual income tax liability of approximately $3.98 billion.”[11] However, this statistic reveals that about 75% of the benefits from eliminating the personal income tax, about $12 billion, would go to Georgians earning six figures or more annually.

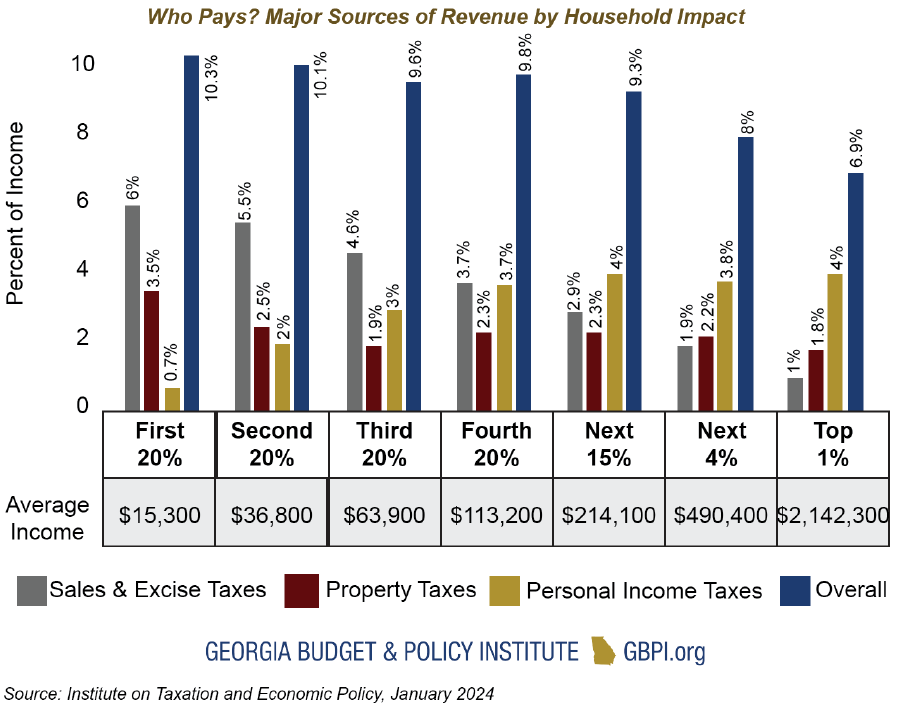

Already, Georgia maintains a relatively flat revenue system, in which most households pay a combined overall state and local tax rate that is equivalent to 9-10% of their annual income.[12] However, those who earn the least are likeliest to pay the greatest share of their earnings in total state and local taxes at 10.3%, while those in the top 1% currently pay the lowest effective rate of 6.9%.

Sales and property taxes hit low-and middle-income families the hardest by consuming a larger share of their economic resources, while income taxes help to ensure higher income households and corporations pay their fair share. This adds balance to the revenue system so that low- and middle-income families are not disproportionally taxed. Importantly, income taxes also generally keep pace with economic growth, helping to fund key public services like education and health care (75% of all state spending in FY 2027) and to avoid the sharp dips that could otherwise occur during an economic downturn. Without income tax revenue, Georgia’s healthy fiscal outlook could rapidly turn upside down.

Just 14% of all personal income tax revenues are collected from the first 60% of Georgia earners, who make up to $88,000 annually.[13] Although working- and middle-class families pay less in income taxes, they more than make up for their fair share through existing sales taxes, property taxes, fines and fees. These figures demonstrate why revenue proposals centered on cutting the income tax offer relatively few potential benefits to most Georgians, while inevitably skewing the state’s revenue system toward the wealthiest.

Looking at the effects of eliminating Georgia’s personal income tax alone, without considering the tax increases that would replace it, demonstrates that 43% of all savings ($7.3 billion annually) would go to those among the top 5% of earners, who make more than $363,000 per year. About 69% of all tax reductions from eliminating the personal income tax, or about $11.9 billion, would go to those earning more than $159,000 annually.

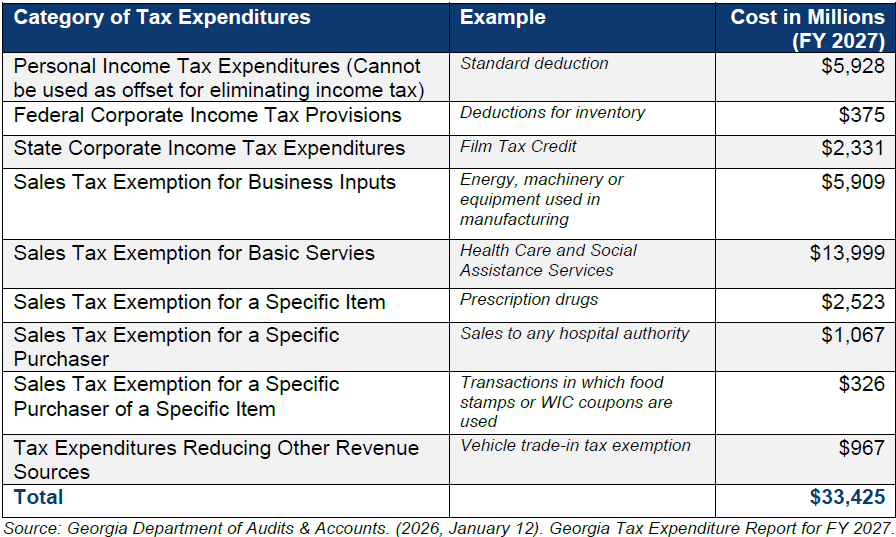

Importantly, the committee charged with formulating a plan to eliminate Georgia’s largest source of revenue did not name any potential sources of revenue to replace the more than $16 billion in personal income tax revenues that the state relies on to balance its budget. Each January, Georgia releases its annual Tax Expenditure Report, which estimates the cost of all state tax exemptions, exclusions, deductions and credits applied to state taxes. The following chart categorizes the $33.4 billion in total tax expenditures reported for FY 2027. This figure includes $5.9 billion in state personal income tax expenditures, which could not be used to raise revenue to help offset the costs of eliminating the personal income tax.

Of the remaining $27.5 billion in tax expenditures, $375 million are corporate tax measures the state has adopted in conformity with the federal tax code and $2.3 billion are state corporate income tax breaks. However, even within this group of $2.3 billion in corporate tax breaks, the state estimates that $946 million of them will be claimed for the purpose of offsetting personal income taxes. While some of this activity could be expected to shift to corporate income taxes in the event of the elimination of the personal income tax, it is not likely that Georgia could recoup the full value of these incentives.

After accounting for about $945 million in tax expenditures that reduce revenues from the insurance premium tax, motor fuel tax, alcoholic beverage tax, financial institutions business license tax and motor vehicle title fee, the remaining $23.8 billion in FY 2027 tax expenditures apply to Georgia’s sales tax. This figure includes $5.9 billion in commonly defined business inputs that are currently taxed at the final stage of production, rather than being taxed repeatedly through the manufacturing process, along with nearly $14 billion in services that range from waste management to health care. Georgia also offers $2.5 billion in sales tax exemptions for specific items, such as prescription drugs or school lunches. The state’s tax code includes $1.1 billion in sales tax expenditures for specific purchasers, such as hospital authorities, the university system or data centers. Finally, the sales tax also includes $326 million in exemptions for specific purchasers of specific items such as food banks, Girl Scout cookies or recipients of food assistance.

Although there are valid reasons to express concern that Georgia has gone too far in subsidizing film production, data centers, insurance companies or other tax-advantaged industries, the vast majority of Georgia’s tax expenditures result in lower prices for consumers by exempting products and services from sales taxes. Combined, all state and federal corporate income tax breaks total less than $2.7 billion for FY 2027. On the other hand, sales tax expenditures for health care (including prescription drugs and related products), schools, groceries, business inputs and construction amount to more than $16 billion.

Without specificity on which sources of revenue proponents would increase to replace the income tax, Georgians are left to use their common sense. Beyond the fact that most of Georgia’s state tax expenditures affect the sales tax, the most commonly cited states without income taxes are Florida, Tennessee, and Texas. All three raise between 75% to 86% of state general fund revenues from sales taxes.[14]

If Georgia replaced its existing personal income tax with sales taxes, the first 80% of households, about 3.9 million filers who make up to $159,000 annually, would experience comparably large tax increases, reducing their take-home earnings between 1% to 5%, with the average net tax increase estimated at about $1,000 per year. To see a tax cut equivalent to at least 1% of annual income, households would generally need to earn mid-six figures per year, with the largest share of savings directed to those earning over $943,000 per year. Those in the top 1%, with an average annual income of $2.4 million, would see a net benefit of about $60,000 per year, underscoring how skewed Georgia’s tax system would become if the state traded income taxes for higher sales taxes. Simply put, replacing Georgia’s income tax with sales taxes would initiate the largest transfer of wealth from working and middle-class families to high-income individuals and corporations in Georgia history.

Conclusion

Governor Kemp’s AFY 2026 and FY 2027 budget proposals recognize that Georgia can use its historic level of resources to fill long-awaited gaps. Notwithstanding positive strides in establishing a need-based scholarship for higher education and in fully funding SNAP administration to prepare for greater cost shifts in the years ahead, Georgia faces critical needs in health care and public health that only continue to become more urgent.

With the nation’s second highest uninsured rate in 2024 and the fourth largest marketplace of ACA enrollees at 1.5 million Georgians last year, Georgia is poised for a sharp spike in its share of uninsured residents.[15] However, the federal government continues to offer to cover 90% of the cost of insuring Georgians earning up to 138% of the federal poverty level if Georgia joins 40-other states in the nation by expanding Medicaid.

Simultaneously, as policymakers express concern over the rising cost of homeownership and rent, the state continues to ask local school districts to cover higher costs. Georgia is long overdue for a modernization of its public education funding formula that appropriately considers the costs of poverty, student transportation and employee health coverage. Without addressing the root causes of financial pressure on school district budgets, the state will face difficult choices for how to enable schools to equitably raise the level of revenue they require.

Major decisions loom as the General Assembly takes up Governor Kemp’s AFY 2026 and FY 2027 budget proposals. The decisions lawmakers make will set the direction for Georgia’s tax and budget system for years to come, while shaping the future of the state’s broader economy.

End Notes

[1] Governor’s Office of Planning and Budget. (2026, January 20). State Residential Population, 2025-2060, average of 2026-2027 population; U.S. Bureau of Labor Statistics. (2026, January 20). Inflation Calculator, July 2007 to December 2025; Office of the Governor. (2026, January 15). Governor’s Budget Report, AFY 2026 and FY 2027; Office of Planning and Budget. (2019). Budget in Brief, AFY 2019 – FY 2020.

[2] Institute on Taxation and Economic Policy. (2026, January 7).

[3] Georgia Department of Audits and Accounts. (2024, February 6). Fiscal note, House Bill 1015 (LC 50 0620EC); Georgia Department of Audits and Accounts. (2024, February 21). Fiscal note, House Bill 1023 (LC 50 0662); Georgia Department of Audits and Accounts. (2025, February 26). Fiscal note, House Bill 111 (LC 59 0028-EC); Institute on Taxation and Economic Policy. (2026, January 7).

[4] Georgia Department of Audits & Accounts: Performance Audit Division. (2023, January). State Health Benefit Plan: Requested Information on Plan Stability.

[5] Department of Administrative Services. (2026, January). State of Georgia Fiscal Year 2025 Workforce Report.

[6] Senate Office of Policy and Legislative Analysis. (2025, December). Final Report of the Senate Study Committee on Higher Education Affordability (SR 474). https://www.legis.ga.gov/api/document/docs/default-source/senate-study-committees-document-library/2025-sr-474-higher-ed-affordability-final-report.pdf?sfvrsn=20de0220_2

[7] Ibid.

[8] Georgia Department of Revenue. (2026, January 9). Comparative Summary of State General Fund Receipts for the Month Ended December (FY 26).

[9] H.R. 1 (2025) makes a variety of changes to the federal tax code. Each legislative session, Georgia lawmakers traditionally consider whether to “conform” to adopt these changes as part of the state tax code. This process aligns federal and state tax policies but also has corresponding effects on revenue collections. These changes include an expansion of the tax exclusion for Qualified Small Business Stock (QSBS) gains, which allow companies with assets of up to $75 million to exclude certain capital gains from taxation. If Georgia adopts conformity with this change, it would reduce state revenues by an estimated $26.1 million in 2026. (See Austin, S., and N. Johnson. (2025, October). Quite Some BS: Expanded ‘QSBS’ giveaway in Trump tax law threatens state revenues and enriches the wealthy. Institute on Taxation and Economic Policy). Other business tax changes include 100 percent “bonus depreciation” for machinery and equipment (Title VII, Section 70301), up from 40% in 2025; as well as a return to the pre-TCJA rules for deductions of domestic research and experimental expenditures (Title VII, Section 70302). This is a shift from the post-2022 tax rules, in which businesses could only deduct one-fifth of these expenditures in the year incurred and another one-fifth for the subsequent four years. H.R. 1 also allows businesses to deduct greater amounts of interest expenses (Title VII, Sections 70303 and 70342), along with reduced effective federal tax rates on “Foreign-Derived Intangible Income” and “Global Intangible Low-Taxed Income” (Title VII, Sections 70321-70323). The legislation also renews the Opportunity Zones Program (Title VII, Section 70421), which allows individuals and corporations to defer or exempt capital gains taxes on the sale of most types of investments if they are rolled into Qualified Opportunity Funds. Other changes include an expansion of 529 accounts to cover additional private K-12 school expenses (Title VII, Section 70413), doubling the annual tax exclusion from $10,000 to $20,000. H.R. 1 also creates new “Trump accounts” (Title VII, Section 70204), which offer tax advantages for contributions made to these accounts for children born between January 2025 and December 2028. These are just a few of the significant provisions that lawmakers will decide whether to accept as part of the state’s tax code when considering conformity provisions during the 2026 legislative session.

[10] Georgia Department of Audits & Accounts. (2026, January 7). Fiscal Note House Bill (LC 50 1275).

[11] Georgia Senate Special Committee on the Elimination of Georgia’s Income Tax. (2026, January). Final Report and Recommendations, p. 11.

[12] Institute on Taxation and Economic Policy. (2024, January). Georgia: Who Pays? 7th Edition. https://itep.org/georgia-who-pays-7th-edition/

[13] Institute on Taxation and Economic Policy. (2026, January 7).

[14] U.S. Census Bureau. (2025, April). 2024 annual survey of state government tax collections and state intercensal population estimates, estimates as calculated by author. https://www.census.gov/programs-surveys/stc/data/datasets.html “STC_Historical_DB (2024)”; https://www.census.gov/data/tables/time-series/demo/popest/2020s-state-total.html

[15] KFF. (2026, January 21). Marketplace Enrollment, 2014-2025. https://www.kff.org/affordable-care-act/state-indicator/marketplace-enrollment/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Number%20of%20Individuals%20Who%20Selected%20a%20Marketplace%20Plan%22,%22sort%22:%22desc%22%7D; U.S. Census Bureau. (2025, September). Health Coverage in the United States: 2024. https://www.census.gov/library/publications/2025/demo/p60-288.html