Each year, the Georgia Budget and Policy Institute analyzes tax legislation considered by the General Assembly and tallies estimated costs and revenues in our two-part Adding Up the Fiscal Notes series. This analysis is a snapshot of the legislative state of affairs as of March 26, 2020. Watch for the second part of the series after the governor’s deadline to sign or veto bills passed by the 2020 Legislature.

The Georgia General Assembly approved 22 tax bills between January and “Crossover Day,” the deadline for legislation to clear at least one chamber to be eligible for final passage this legislative session. The Legislature has paused this year’s session due to the ongoing public health emergency stemming from the spread of COVID-19. When they return, the Senate will consider 14 changes to Georgia’s tax code. On the other side of the Capitol, members of the House will examine six Senate bills that propose to make changes to the state’s tax code, legislative process and constitution.

Two measures reached final passage and arrived at Gov. Brian Kemp’s desk, including a long-awaited measure requiring most online retailers and apps to collect and remit sales taxes and a bill primarily written to benefit Georgians devastated by Hurricane Michael. Members of the General Assembly can continue debating these bills and other legislation until the session is adjourned for the year.

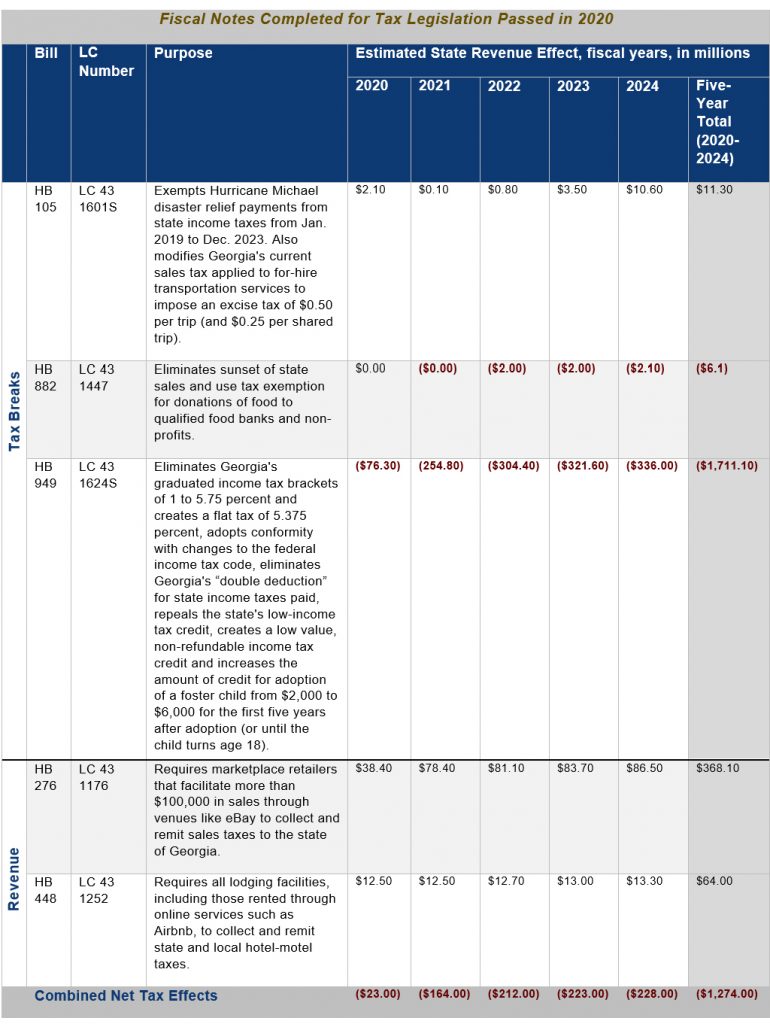

The vast majority of tax bills passed this session are not accompanied by a fiscal note to assess the potential costs to the state either because the fiscal impact was determined to be too low to require an analysis, there was significant uncertainty around how legislation would be implemented or because lawmakers simply did not request one. Of the 22 measures that passed at least one chamber, only five bills were accompanied by fiscal notes.

Increasing Economic Uncertainty Accompanies Passage of Risky Tax Legislation

With Crossover Day of the 2020 legislative session coinciding with the indefinite suspension of session due to the global COVID-19 pandemic, members of the Georgia General Assembly left at the midpoint of the state’s legislative process after passing 22 tax bills. After a hasty rollout, members of the House advanced HB 949, legislation to abandon the structure of Georgia’s largest and most dependable source of revenue in favor of a flat tax that would raise taxes on many low- and middle-income earners, like teachers and nurses, and almost exclusively benefit high-income earners. Moreover, House lawmakers took the extraordinary step of attaching the flat tax to the state’s annual revenue code update that brings the state into conformity with changes to federal tax code, which is traditionally passed without much fanfare.

This bill would negatively affect hundreds of thousands of families across the state by raising their taxes from the bottom-up through eliminating Georgia’s existing graduated tax brackets. The bill’s flat tax provisions also threaten to upend the state budget by reducing revenue collections by up to $383 million per year when fully implemented. With state revenues expected to sharply drop in the midst of an unprecedented economic shutdown caused by the coronavirus, the momentum that rapidly carried HB 949 through the state House appears to have quickly faded.

For the most part, Georgia taxpayers with annual incomes below $108,000 per year would not benefit—and may experience tax increases—as a result of the flat income tax structure created under the legislation. Overall, 88 percent of the $458 million in net tax cuts would go solely to filers earning over $108,000 per year. This fiscal impact is partially offset by $75 million in net tax increases that would be shared by 538,000 low- and middle-income households. Advancing a measure that would almost exclusively benefit the state’ highest earners at the expense of low- to middle-income families at a time of increasing economic anxiety and uncertainty carries significant risks to the state’s bottom line, but few benefits for the vast majority of Georgians.

Lawmakers Propose Tax Breaks, Revenue Raisers

Members of the House and Senate advanced legislation to exempt Hurricane Michael relief funds from state income taxes; eliminate the sunset provisions, which give an end date to a set of minor sales tax breaks and to move forward a patchwork of measures that would make relatively few changes to the state’s tax code.

Out of the gate, members of both chambers agreed to send House Bill 276 to the governor’s desk to begin collecting long-overdue revenues from so-called “marketplace facilitators,” which include retailers that list items on sites like eBay or Walmart.com. This measure follows last year’s House Bill 182 and 2018’s House Bill 61, which initially sought to require tax collections after the U.S. Supreme Court upheld the state’s authority to require online retailers to collect and remit sales and use taxes.

Relatedly, the House advanced House Bill 448, which would require all lodging facilities, including those rented online through services like Airbnb, to collect and remit hotel motel taxes to the state and local governments. Members of the General Assembly also revised the state’s system for taxing ride-sharing services and taxis, adopting a flat excise tax in place of standard state and local sales taxes. Georgia’s sales tax revenues have significantly underperformed expectations throughout FY 2020. Consequently, while these sales tax measures are not expected to significantly alter the state’s bottom-line, they should help stem the trend that has caused state sales tax collections to decline, year-over-year, in three out of the first eight months of the 2020 fiscal year as more retail sales move to online purchases.

The state Senate advanced a key priority that could help maximize the state’s return on investment when considering future tax expenditures. Senate Bill 302, sponsored by Senator John Albers, seeks to improve the decision-making process for investments made through the state’s tax code. If advanced by the House and signed into law by Gov. Kemp, this measure would increase the legislature’s authority to review existing and proposed tax breaks in order to more deliberately consider the impact of changes to the tax code.

Overview of Tax Bills Passed Through Crossover Day

Unless otherwise noted, the bills below will be considered by the Senate when session resumes:

House Bill 105 (reached final passage, awaiting the governor’s signature): Exempts Hurricane Michael disaster relief payments from state income taxes from January 2019 to December 2023. Also modifies Georgia’s current sales tax applied to for-hire transportation services to impose an excise tax of $0.50 per trip (and $0.25 per shared trip).

House Bill 276 (signed by the governor, effective April 1, 2020): Requires marketplace retailers and apps that facilitate more than $100,000 in sales through venues like eBay to collect and remit sales and use taxes to the state of Georgia.

House Bill 378: Requires marketplace facilitators that offer five or more vehicles for rent or lease to collect and remit excise taxes.

House Bill 448: Requires all lodging facilities, including those rented through online services such as Airbnb, to collect and remit state and local hotel-motel taxes.

House Bill 779: Revises the local distribution of Title Ad Valorem Tax (TAVT) for motor vehicles between cities and counties.

House Bill 807: Makes minor changes to tax filing procedures.

House Bill 815: Authorizes tax exemptions for local authorities providing public water or sewer service.

House Bill 829: Constitutional amendment to revise the process for calling local referenda on residential homesteaded property assessments.

House Bill 846: Makes changes to tie interest on refunds for tax overpayments and past due taxes to the bank prime loan rate.

House Bill 882: Eliminates the sunset provision of state sales and use tax exemption for donations of food to qualified food banks and nonprofits.

House Bill 949: Eliminates Georgia’s graduated income tax brackets of 1 to 5.75 percent and creates a flat tax of 5.375 percent, adopts conformity with changes to the federal income tax code, eliminates Georgia’s “double deduction” for state income taxes paid, repeals the state’s low-income tax credit, creates a low-value, non-refundable income tax credit and increases the amount of credit for adoption of a foster child from $2,000 to $6,000 for the first five years after adoption (or until the child turns age 18). If enacted, this bill would raise taxes on many middle-income families, and 88 percent of the benefits would go solely to filers earning over $108,000 per year.

House Bill 1035: Eliminates the sunset provisions for several exemptions to sales and use taxes, including: sales of property to nonprofit health centers ($1 million per year), sales of property and services to nonprofit volunteer health clinics ($1 million per year), sales of property or services to nonprofit blood banks ($2 million per year), sales of food and beverages to qualified food banks ($1 million per year), prepared food and food ingredients donated to qualified nonprofits ($3 million per year), food and food ingredients donated for disaster relief and sale of written materials by nonprofits ($8 million per year).[1]

House Bill 1037: Requires all film projects to undergo audits before claiming Georgia’s film tax credit, makes changes to allow some sound recordings used in the production of feature movies and television programs to qualify for tax credits.

House Bill 1102: Authorizes counties currently imposing a Homestead Option Sales Tax (HOST) to put forward a replacement sales and use tax with the petition of 10 percent of that county’s voters from the previous election. If enacted, 99 percent of the proceeds from the county’s new HOST must be used to roll back property taxes.

House Resolution 164: Constitutional amendment to authorize the dedication of revenues generated from taxes or fees. Currently, revenue from state fees is collected into the General Fund. Importantly, this legislation includes an exemption if the state experiences three consecutive months of declining revenues or through an executive order of the Governor and an act of the General Assembly .

House Resolution 962: Constitutional amendment to revise the process for calling local referenda on residential homesteaded property assessments.

Unless otherwise noted, the below bills will be considered by the House when session resumes:

Senate Bill 289: Makes changes to the state’s requirement for mobile homes owners to procure permits and display decals.

Senate Bill 302: Authorizes the chairperson of the Senate Finance Committee and House Ways and Means Committee to each request up to five independent economic analyses of proposed or existing tax measures to determine the return on investment for the state of Georgia.

Senate Bill 369: Requires electronic transmission of tax returns by public utilities.

Senate Bill 375: Adds additional penalties for the retail of tobacco products to Georgians under 21 years of age and provides for a regulatory process for the sale of vapor products.

Senate Bill 388: Makes changes to clarify the statutes governing false or fraudulent submissions of state income tax returns.

Senate Bill 480: Authorizes the Georgia Department of Revenue to pay for data analytics services to improve the procedures and processes related to the collection of Georgia sales and use taxes.

Conclusion

Casting the fate of many of the riskier and more costly tax measures considered into further doubt, lawmakers quickly reconvened after Crossover Day for a brief Special Session to ratify Gov. Brian Kemp’s executive order to declare a State of Emergency and authorize the use of $100 million from the state’s Revenue Shortfall Reserve in order to fund Georgia’s response to the growing COVID-19 pandemic.

They should also consider better-targeted measures to benefit working families affected by the state’s near economic shutdown. There are opportunities for tax reform in Georgia that would allow the state to increase revenue collections, while simultaneously reducing the amount of taxes owed by many low- to middle- income taxpayers. For example, the state continues to maintain an exceptionally low standard deduction, which is not indexed to inflation and remains at one of the lowest levels in the nation despite estimates showing that more than 86 percent of taxpayers use the standard deduction rather than itemizing.

Notably, in addition to raising taxes on most of the middle-class families that would experience an observable tax change under the proposal, the thresholds proposed for HB 949’s non-refundable tax credit would exacerbate the existing marriage penalty, which is created by the state’s low standard deduction and causes married couples to pay a larger percentage of their income in taxes, on average, than single filers. To further help low- and middle-income families, lawmakers can look to a Georgia Work Credit, a state-level earned income tax credit.

Georgia also offers an array of relatively generous itemized deductions, tax credits and loopholes that most Georgians cannot access. In addition to establishing a review process for future tax breaks, lawmakers should begin a thorough review of Georgia’s tax code to identify provisions that offer a poor return on investment and consider ways to repurpose those revenues to help avoid significant budgetary shortfalls, while also ensuring that Georgians with the lowest incomes do not pay a higher share of their take-home pay in state and local taxes than those who earn the highest incomes.

Methodology

GBPI’s research on HB 949 relies on data produced by Georgia State University’s Fiscal Research Center, estimates prepared by the Institute on Taxation and Economic Policy (ITEP) and GBPI’s analysis of other available information and data sources.

Unless otherwise noted, the specific effects to taxpayers—in the form of net-tax effects or offsetting tax cuts and tax increases—are sourced from ITEP estimates generated in March 2020. ITEP’s analysis simulates the effects of these legislative tax changes on approximately 5 million Georgia tax filers to produce estimates for the average tax change across quintiles of income.

For consistency, GBPI’s estimates for the fiscal impact of HB 949 (LC 43 1624S) are based on parallel growth assumptions considered in the state fiscal note produced by Georgia State University’s Fiscal Research Center. These estimates project that Georgia’s baseline revenue will grow by 1 percent in FY 2020, 2.9 percent in FY 2021, and 3.5 percent from FY 2022-2024. As the state experiences significant economic headwinds resulting from the global coronavirus pandemic, these estimates will likely require downward revisions as more data becomes available.

GBPI’s research reveals that when fully implemented, HB 949’s flat tax provisions would cost the state a total of $383 million in lost revenue over the current Fiscal Year 2022 baseline, significantly more than the $224 million projected under the fiscal note attached to the legislation, which was prepared for the Department of Audits and Accounts by Georgia State University’s Fiscal Research Center (FRC). This difference means that GBPI’s research on HB 949 projects that a lower level of offsetting tax increases will take effect for low- and middle-income families than what is projected in the state fiscal note attached to the current version of the legislation, although the FRC’s analysis does not include estimated effects for taxpayers by income group.

For components of income that are subject to income taxes, ITEP relies on information from the Internal Revenue Service’s “Statistics of Income” publication, which provides detailed state-specific information on components of income at different income levels. For components of income that are either fully or partially tax-exempt, ITEP uses data from the Congressional Budget Office and the Current Population Survey to estimate income levels in each state.

Endnotes

[1] Cost estimates are sourced from the Georgia Tax Expenditure Report for FY 2021, which is prepared by Georgia State University on behalf of the Department of Audits and Accounts.