Fund State Government Transparently, Equitably and Responsibly

The Priorities

Georgia should raise revenue and should budget that revenue equitably. The state maintains approximately $11 billion in undesignated reserves—funding that is available for investments in our state’s future. The current structure of Georgia’s tax system also causes those with the lowest incomes to pay a larger share of their earnings in state and local taxes than those with the highest incomes. In pursuit of greater budget and tax equity, GBPI analyzes state budget proposals (FY 2026 and AFY 2025) and prioritizes the following fiscal policies:

- Responsibly spend down the state’s $11 billion undesignated surplus to implement long-term, strategic investments such as a child care trust fund.

- Pass a state-level Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), which would boost take-home pay and cut taxes for families with low- and middle-incomes.

- Increase the Child and Dependent Care Tax Credit to 100 percent of the federal level and make it fully refundable.

- Lift Georgia’s cigarette tax to the national average of $1.96 per pack (currently ranked 49/51 at $0.37) and establish parity in taxation on other tobacco products.

- Georgia maintains the nation’s largest film tax credit program, which is estimated to reduce state revenue by more than $1 billion in FY 2025. We advocate for reforms to cap the total amount of film tax credits issued annually, to add greater transparency and guardrails to credits being transferred or sold, and to restrict credits claimed for hiring out-of-state workers.

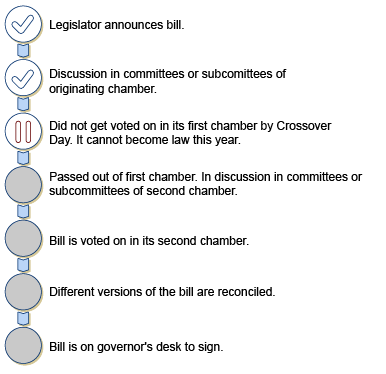

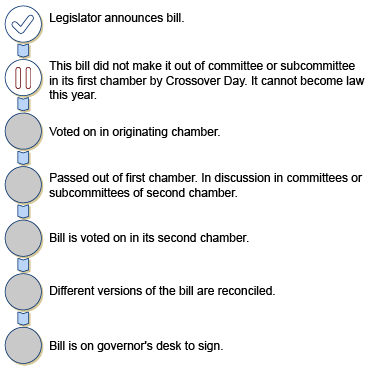

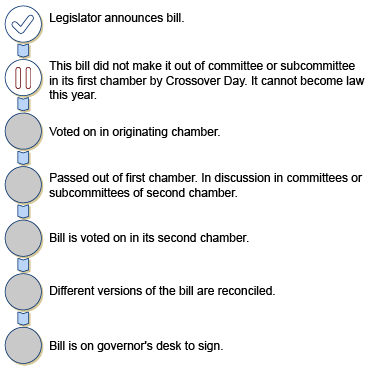

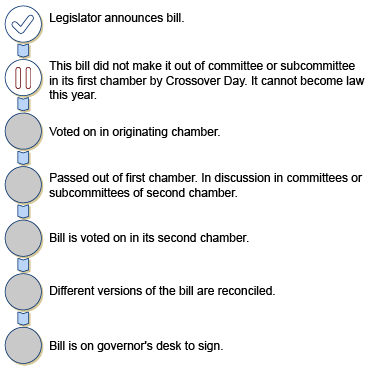

Bill Tracking

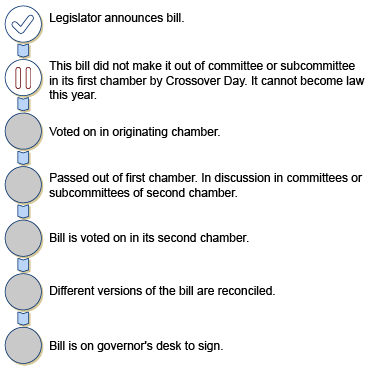

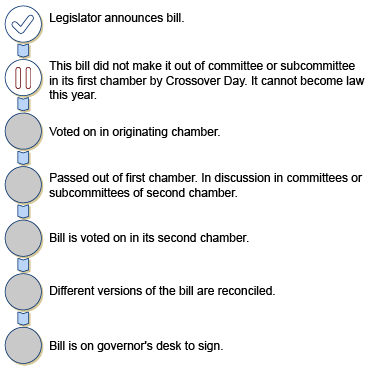

This page was updated on April 4th, 2025. April 4th was Sine Die, and any bill that did not make it out of Georgia Legislature by this day can not become law this year.

House Bill 83

House Bill 84

House Bill 95 & Senate Bill 67

House Bill 96

House Bill 98

House Bill 99

House Bill 111

House Bill 67

Senate Bill 89 / House Bill 136

Creates a non-refundable Child Tax Credit, valued at $250 per child, and increases the state's existing non-refundable Child and Dependent Care Tax Credit from 30% to 50% of the federal level

House Bill 68

State Budget for Fiscal Year 2026

House Resolution 304