Budget Trends

The $32.4 billion state budget signed into law by Gov. Kemp for fiscal year (FY) 2024, which starts July 1, 2023, represents a relatively flat level of spending that remains well below the state’s capacity and falls short of meeting the needs of Georgians across core areas, from access to health care to public education. Georgia started the previous fiscal year with the state government employing nearly 6,400 fewer full-time employees in FY 2022 than it did in 2018, down nearly 9.5 percent. The state also struggled in a competitive job market to combat an all-time high employee turnover rate of over 25 percent.

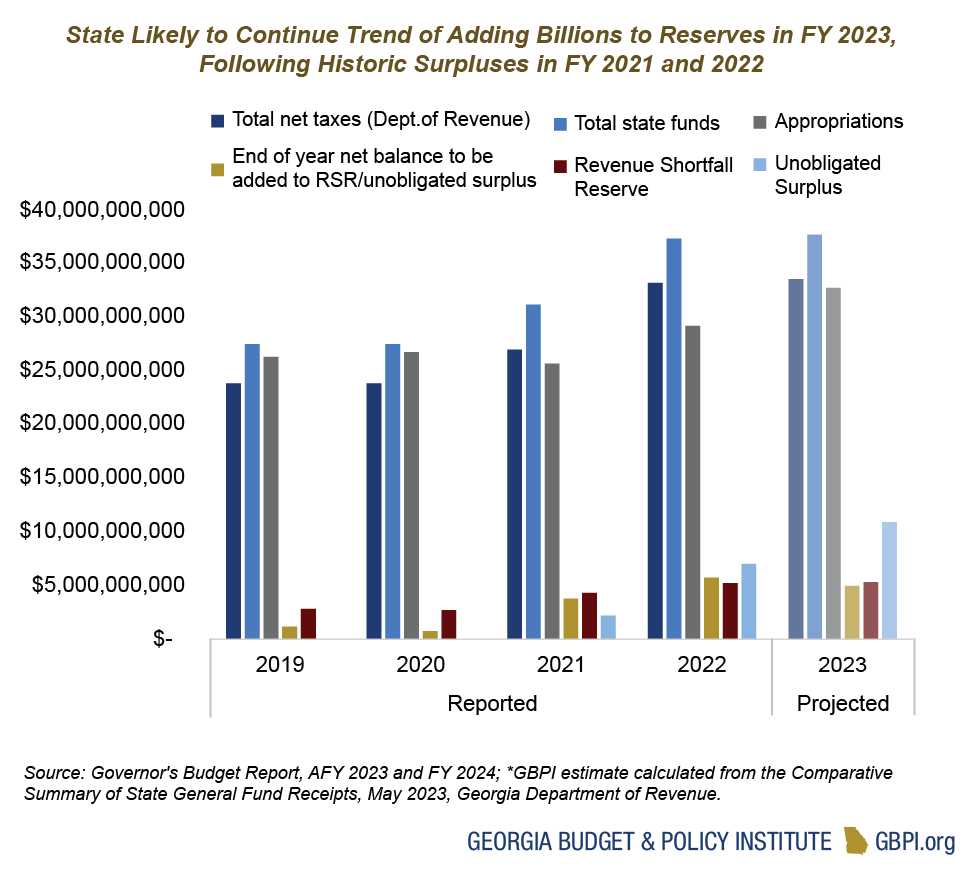

Georgia’s governor holds unilateral authority to set the state’s revenue estimate. As such, under Gov. Kemp’s direction, the state responded to the 2020 pandemic-induced downturn by cutting spending and thinning its workforce under revenue estimates that projected state revenue growth would fall well below the rate of inflation from 2020-2023. Simultaneously, the unprecedented, strong fiscal response at the federal level helped to create a rapid rebound and surge in economic activity, which was reflected in higher-than-expected state tax collections that continued from FY 2021 through 2023. The combination of these dueling responses has produced a cycle in which state revenue collections continue to significantly outpace spending, adding to an already historic level of unobligated reserves available for allocation.

Entering fiscal year 2024, Georgia stands at a key inflection point, with an unprecedented level of resources on-hand, along with a current-year revenue estimate that is significantly below prior year collections for both FY 2022 and 2023. These indicators demonstrate the clear opportunity available to state leaders to respond to long-standing needs across public education, access to health care and economic mobility during the 2023-2024 session of the General Assembly—and reinforces that state leaders are actively choosing to leave resources on the table to accrue increasingly large reserves—while making no active plans for their use, rather than deploying them to meet urgent needs.

State Savings Account Remains Full as Georgians Struggle

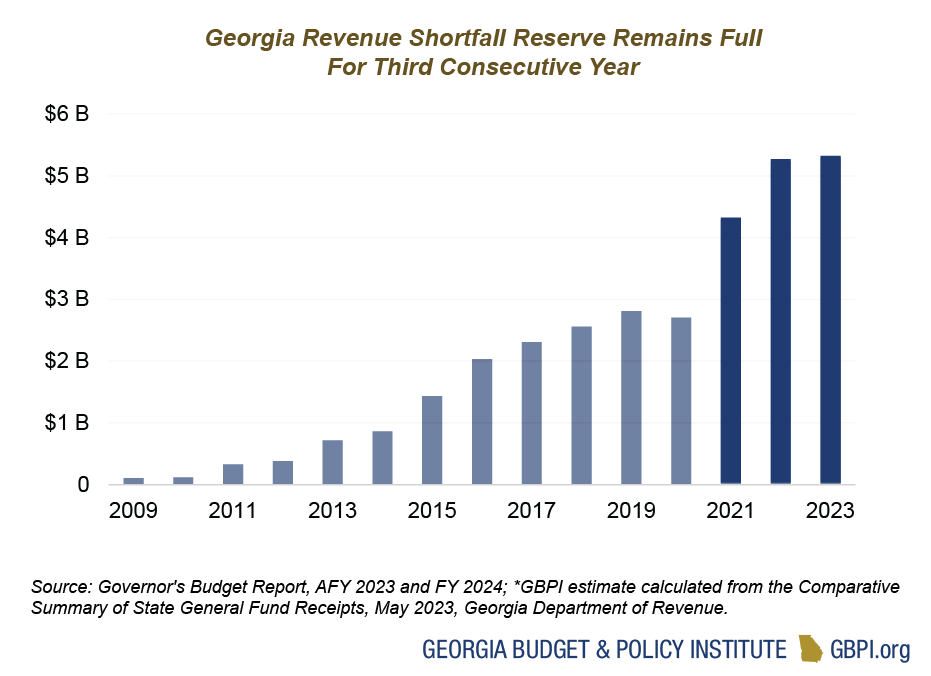

The Revenue Shortfall Reserve (RSR), Georgia’s rainy-day fund, provides stability in economic downturns. The fund is like a savings account to pay expenses and maintain services when revenues decline unexpectedly. Maintaining adequate reserve money helps Georgia keep its AAA bond rating, allowing the state to borrow on favorable terms and save millions in interest. Money is not appropriated into the RSR; the balance grows at the end of each fiscal year if there is surplus state revenue (up to 15 percent of prior year revenue). The governor is also authorized to release for appropriation any amount over the minimum balance required—4 percent of prior year revenues—in case of a fiscal emergency or if tax collections have outpaced estimates. Since the end of FY 2021, Georgia’s Revenue Shortfall Reserve has remained at its maximum level, with consistently conservative revenue estimates issued by Gov. Kemp also resulting in an additional unobligated surplus.

At the close of 2023, Georgia’s Revenue Shortfall Reserve stood at an estimated $5.2 billion, equivalent to 15 percent of prior year revenues, or enough to fund the state’s operations for approximately 75 days.

Georgia finished FY 2021 with approximately $3.8 billion in unspent revenue, filling its rainy day fund to 15 percent for the first time ($4.3 billion), and designating the remaining $2.3 billion as ‘undesignated surplus.’ At the conclusion of FY 2022, $6.7 billion in unspent revenues were distributed to grow the state’s RSR to $5.2 billion and increase the amount in undesignated surplus accounts to nearly $7 billion. GBPI estimates that Georgia will generate revenues in excess of $5 billion above what the state spends in FY 2023, which is likely to increase the amount held in unobligated reserves north of $11 billion and to raise overall state reserves above $16 billion.

Tax Breaks Erode Georgia’s Budget: Nearly $11 Billion in Foregone Revenue Collections in FY 2024

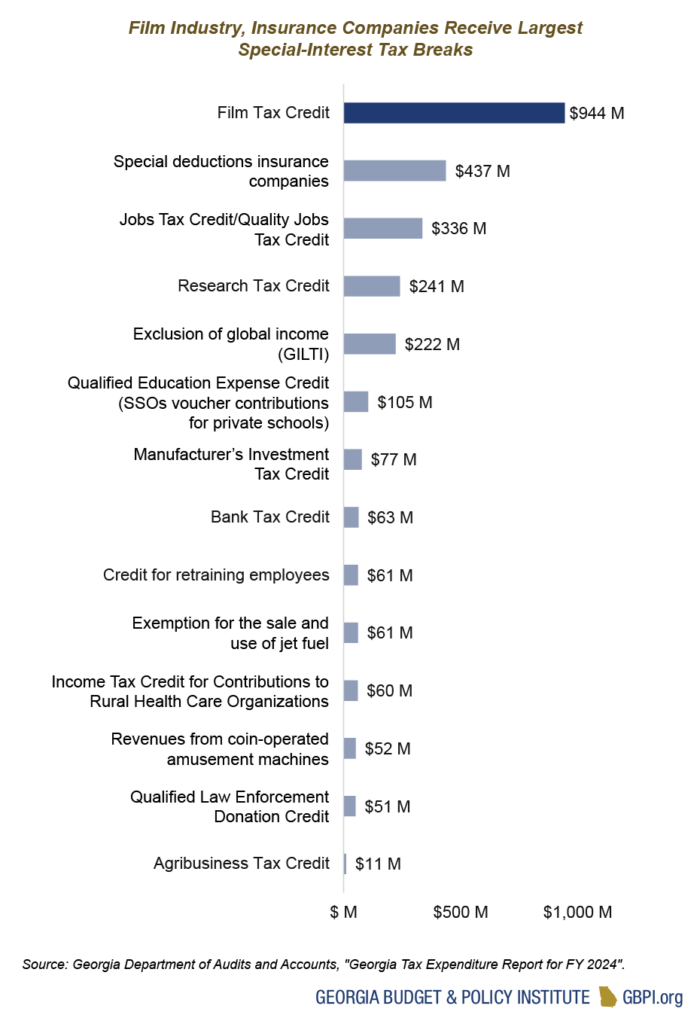

Georgia offers a wide array of tax credits, deductions and other tax breaks, also known as tax expenditures, that give preferential treatment to certain taxpayers and corporations to achieve policy goals. The tax breaks will cost the state nearly $11 billion in lost revenue in the 2024 fiscal year. Some tax breaks provide key protections for families, such as the sales tax exemption on groceries, while others provide credits or incentives to specific industries or special-interest groups. Several of Georgia’s largest tax breaks deliver outsized gains to select groups or industries—such as manufacturing, film or insurance—often with questionable benefit to the state or its people.

Georgia lacks a standardized review process to measure and compare the costs and benefits of all existing and proposed tax breaks. During the 2021-2022 session, however, the state enacted legislation that allows the chairs of the General Assembly’s tax-writing committees to request individual analyses on a limited number of tax expenditures. House Bill (HB) 1437, passed in 2022, also requires the House Ways and Means Committee and the Senate Committee on Finance to review all state tax credits, exemptions, and deductions and to produce a report to the General Assembly by December 1, 2023.

The costliest industry-specific tax break offered is Georgia’s Film Tax Credit, which is designed to attract film production by subsidizing as much as 30 percent of the costs and ranks as the largest tax subsidy of its kind nationally at an annual cost of about $1 billion annually. The state also offers major tax breaks targeted to insurance companies, multinational corporations and various industries. As state leaders commit billions in taxpayer dollars to finance an increasingly expansive ecosystem of tax credits, subsidies and indirect expenditures under the promise of accomplishing specific policy goals, such as job creation, greater transparency is urgently needed to provide a basic level of accountability and help safeguard future resources.

State Plans to Begin Risky Income Tax Shift in 2024

House Bill 1437, signed into law by Gov. Kemp after a final version emerged during the last hours of Sine Die 2022, sets Georgia on course to adopt a flat personal income tax that primarily benefits the state’s highest earners at an annual cost of $2 billion when fully implemented. This session, legislators made positive changes to the original package through the passage of Senate Bill 56, which preserves and strengthens the standard deduction, rather than shifting to a new and less equitable filing system as the previous version called for.

Although the flat tax plan requires overall revenue growth of at least 3 percent to proceed without interruption through six steps to achieve full implementation by 2030, forgoing $2 billion in annual personal income tax revenues threatens the long-term stability of Georgia’s revenue system and places a continued burden on the state’s ability to meet the needs of its residents. Already, Georgia ranks last nationally—No. 50 out of 50—in the amount of general state revenues it raises per person (FY 2020).

Due in part to historic and systemic policies that have contributed to lower levels of income and wealth for Black Georgians and people of color, these tax changes would worsen racial inequities and expand the racial wealth gap. White Georgians (55 percent of tax filers) would see 66 percent of total benefits, and Asian Georgians (3.2 percent) would gain 4.6 percent of savings, while Black Georgians (32 percent) would see just 22 percent, and Hispanic Georgians (8 percent) benefit from 6 percent of the total tax cuts.

For Georgia families earning the median income or less, these pending tax changes would offer little to lift incomes or meaningfully increase economic opportunity. Rather, the changes may redirect resources from programs and services that could otherwise support working families, thus widening disparities across income, race and ethnicity. Unless further action is taken, the tax changes will become effective beginning on January 1, 2024, and are set to be implemented over a period of at least six years.

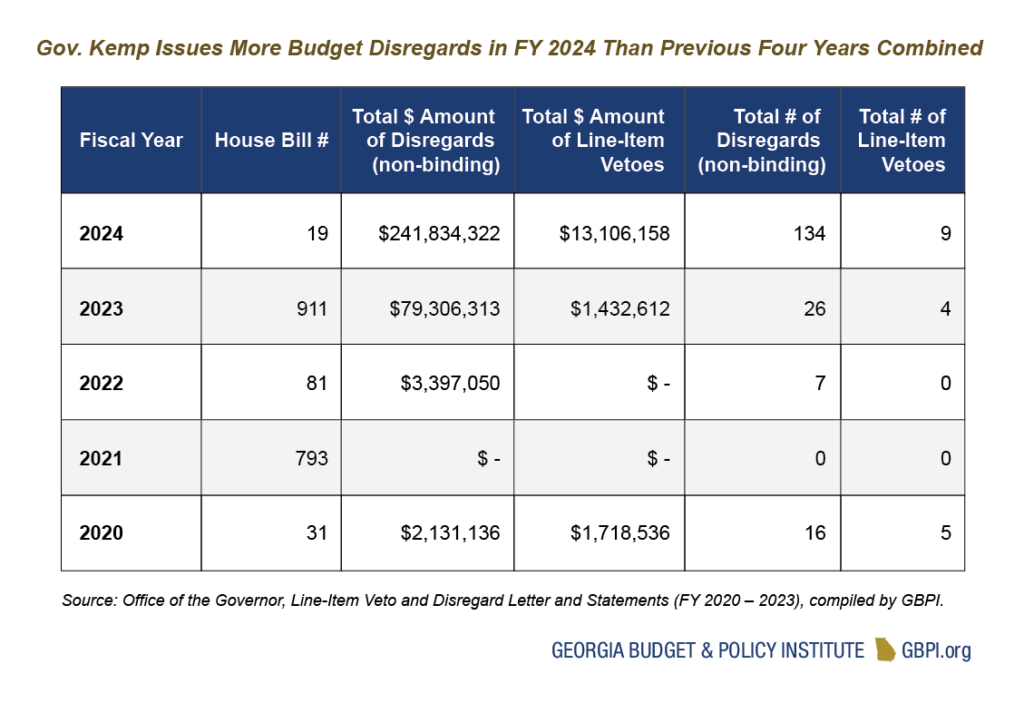

Gov. Kemp Sets New Precedent with $242 Million in Non-Binding Budget Disregards, $13.1 Million in Line-Item Vetoes

With Gov. Brian P. Kemp’s signature, Georgia’s FY 2024 budget became law ahead of the state’s next fiscal year, which begins on July 1, 2023. However, Gov. Kemp’s approval of the spending plan was accompanied by a wave of 134 non-binding orders to either fully or partially disregard budget language and appropriations comprising $242 million in state spending, along with nine line-item vetoes, which cut $13.1 million from the budget entirely. In effect, these actions will withhold tens of millions from the state’s ailing health care system and safety net, block $6.3 million in funding to the Department of Education to cover the cost of breakfast and lunch for reduce-pay students and slash a host of priorities championed by lawmakers across the aisle. Taken together, these actions are relatively unprecedented. Cumulatively, throughout the previous four years of Kemp’s governorship, from FY 2020 – 2023, 49 non-binding disregards were issued on $85 million of state spending and nine line-item vetoes were issued on $3.2 million in allocations.

Under Georgia’s constitution, the governor is entrusted with authority to veto “any appropriation” through the line-item veto. Throughout Kemp’s governorship, rather than rely primarily on the line-item veto to modify appropriations legislation, the governor has traditionally employed “non-binding disregards” and signing statements to provide additional instructions to relevant state agencies and, in some cases, to explain why funds will be withheld for provisions approved by the General Assembly. This blending of executive authority demonstrates the wide range of powers held by the state’s chief executive over state appropriations, which Gov. Kemp has expanded use of in recent years. Although described as non-binding, these orders have a similar effect to line-item vetoes in practice, while preserving the availability of state funds for other purposes or to be appropriated in subsequent amended appropriations plans.

Georgia law also enables the governor to require agencies to reserve appropriations for budget reductions and to withhold agency allotments to maintain spending within projected revenues, which the governor holds unilateral authority to set in establishing the state’s revenue estimate. In practice, this authority offers the state’s chief executive wide latitude to exercise control over funding allotted to state agencies.

Of approximately $255 million in non-binding budget disregards and line-item vetoes issued by Gov. Kemp, the lion’s share of these cuts will reduce funding for health and education programs and services. Several of these items only slightly modify the spending plan approved by the General Assembly, such as the $11 million allocated to annualize the cost of 513 NOW/COMP waiver program slots for individuals with intellectual and developmental disabilities. In this case, the governor instructed the Department of Behavioral Health and Developmental Disabilities to simply utilize funding for direct waiver expenses only, while removing the possibility of covering administrative overhead with these funds. In most cases, however, funds are withheld entirely from the programs and services approved by the General Assembly. Unless instructions state otherwise, appropriations will not be made to agencies for budget items that were disregarded, and the General Assembly will have the opportunity to reengage on these measures when the legislature convenes for its next session.