The federal government passed a relief package that will send $4.7 billion in direct funding to Georgia. In addition to the state aid, the American Rescue Plan Act (ARPA) extends the Pandemic Unemployment Assistance program and Pandemic Emergency Unemployment Compensation to September 6 of 2021, expands the federal Earned Income Tax Credit for adults not currently raising children, extends the 15 percent increase to SNAP benefits until June 2021, sends some funding to K-12 school districts and local governments and offers more financial incentives for Georgia to expand Medicaid. Georgia has until 2024 to use these funds.

How Georgia Can Use This Funding Well

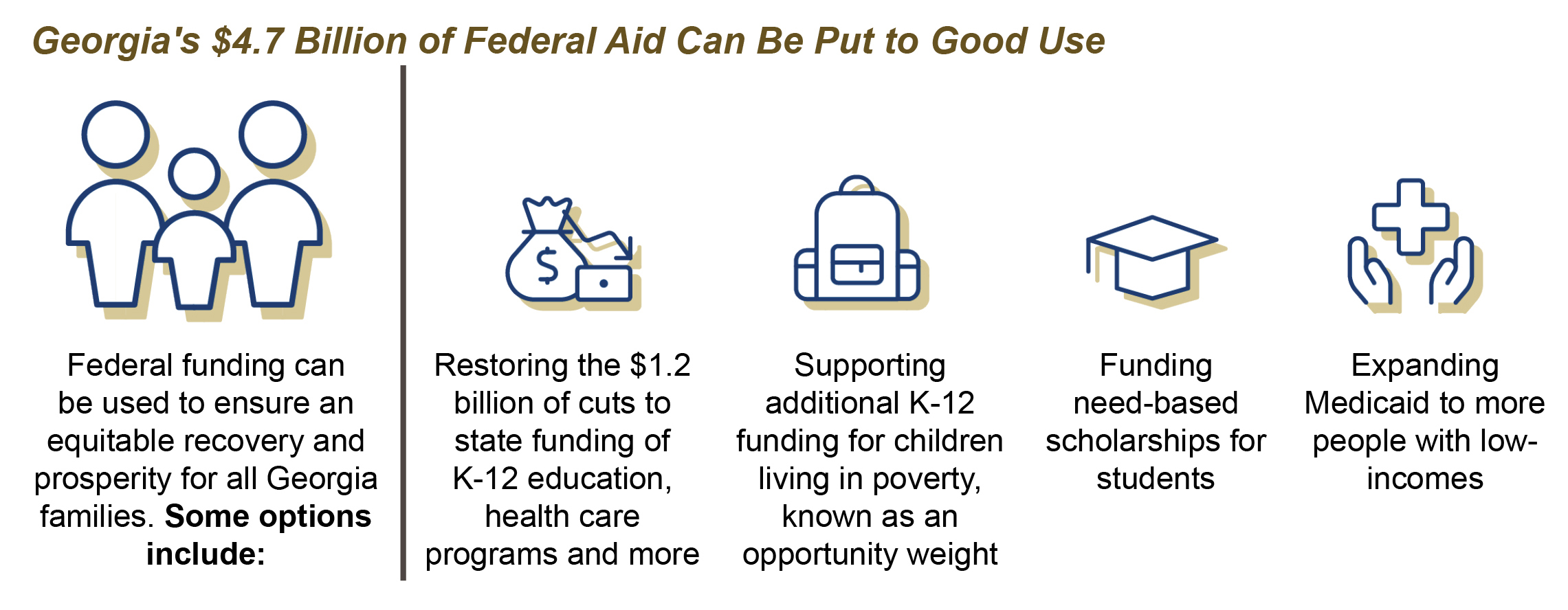

Georgia has a history of underfunding critical programs and services. Even before COVID-19, the state still had not fully restored the budget to pre-Great Recession levels. It is critical state leaders use this funding to adequately fund programs and services, address inequities in our state and support long-term recovery for all Georgia families. With these funds, lawmakers can support additional funding for school students living in poverty, need-based aid for college students or Medicaid expansion. In order to do any of this, Governor Kemp must revise the Revenue Estimate immediately. Lawmakers cannot create a budget where projected spending exceeds the revenue estimate, so they will be unable to restore any cuts until Gov. Kemp makes this change.

How Georgia Could Lose Federal Aid

The federal aid offered by the U.S. Government has an important provision: states can not pass tax cuts using this funding. The provision means that if any state changes its laws in a way that reduces net tax revenue any time after March 3, 2021, and before the state has spent its entire federal allocation (or by 2024), the U.S. Department of Treasury may deduct an equivalent amount from the aid received by the state. This ensures that the federal relief targets families that need aid and prevents states from using the short-term federal resources to enact costly tax cuts. The money can be used, however, for direct economic payments, similar to the federal stimulus checks.

Georgia lawmakers are have already passed certain bills and are considering more that could cost the state over $420 million of federal aid:

- HB 593 raises the standard deduction for tax filers but provides a maximum of only $63 in relief to married couples by 2023, which, while meaningful, is not enough to deliver true relief. This bill, which has been signed into law, could cost the state $199 million in revenue over the next two years plus an additional $199 million in federal relief.

- HB 587 enacts a convoluted tax scheme known nationally as CAPCO. It fails to meet its stated goal—creating jobs—and comes at high cost to the state. It would cost $150 million and also cause the state to potentially lose another $150 million in federal funds.

- HB 586 includes provisions to create or extend some state sales tax exemptions, including the exemption for yacht repairs. This would cost the state $25 million over the next two years.

- HB 469 increases the state cap on historic rehabilitation tax credits from $25 million to $50 million per year. This would cost the state $46 million over the next two years.

Other Options for Tax-Based Relief

Lawmakers seeking to jumpstart recovery in Georgia and deliver true relief to families should enact a Georgia Work Credit. This credit reduces the amount that low- to middle-income Georgia families owe. It could offer up to $500 of meaningful relief to these families, helping them buy groceries, afford rent or save for emergencies. If we model this credit as a direct payment, it would be exempt from the federal relief penalty, so Georgia would not lose any federal relief dollars. Although Crossover Day has passed, this measure could be enacted this year by attaching it to other legislation that has already passed out of one of Georgia’s legislative chambers, like bills that seek to equitably raise revenue or deliver economic relief to Georgia families or the budget.

How Georgia Can Maintain Funding for Programs

The financial relief from the federal government can give Georgia a temporary boost to help us put programs in place that help facilitate equity and eradicate issues like generational poverty. Georgia would be able to keep those programs even after the federal relief money is gone by using commonsense measures to raise revenue, like lifting the tobacco tax to the national average or rolling back tax credits and closing loopholes to large corporations. These actions would provide long-term relief to ensure that Georgia fully recovers from the pandemic and that Georgians have a better support system moving forward.