This section is co-authored by Director of Education Dr. Stephen Owens, Director of Economic Justice Ife Finch Floyd and Education Analyst Ashley Young.

Georgia’s 2024 Education Budget

The state budget for K-12 public schools is $11.9 billion in fiscal year (FY) 2024, an increase of $1.2 billion from FY 2023. Seventy-two percent of the additional dollars ($840 million) reflect an increase in the State Health Benefit Plan for certified school employees. The employer costs for non-certified employees, including bus drivers, paraprofessionals and custodians, will also increase. The state stopped paying the employer portion of health insurance for these positions in 2012. Individual districts pay this cost today. The budget also includes $290 million to provide a $2,000 raise for certified employees starting September 1, 2023 and $27 million to provide schools with the funds to hire one school counselor for every 450 full-time equivalent students.

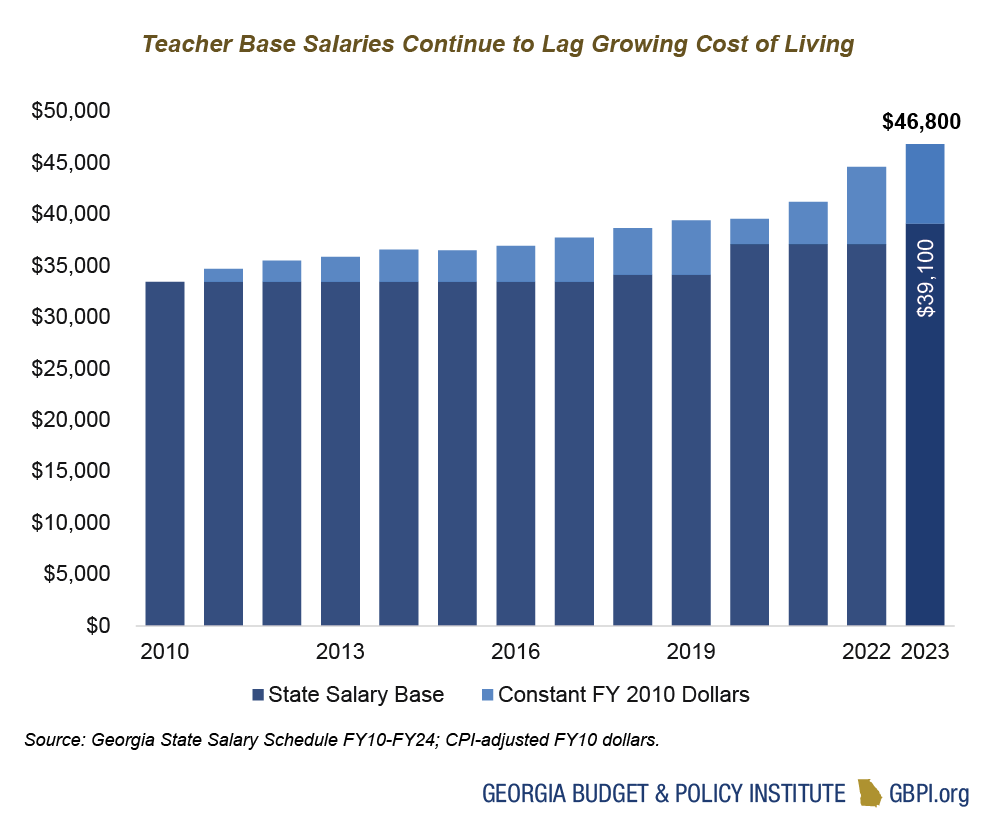

Rapid inflation in the past year has highlighted a longstanding problem in the state’s allocation for education funding: cost-of-living increases are not built into the state formula. Periodic raises, for one, have not kept up with the consumer price index, leaving schools to make up the difference with local property tax collection. School districts vary greatly in the amount of local taxes that can be collected, leaving a system of haves and have-nots. Without additional state investment, districts with lower property wealth will not be able to offer the opportunities students deserve.

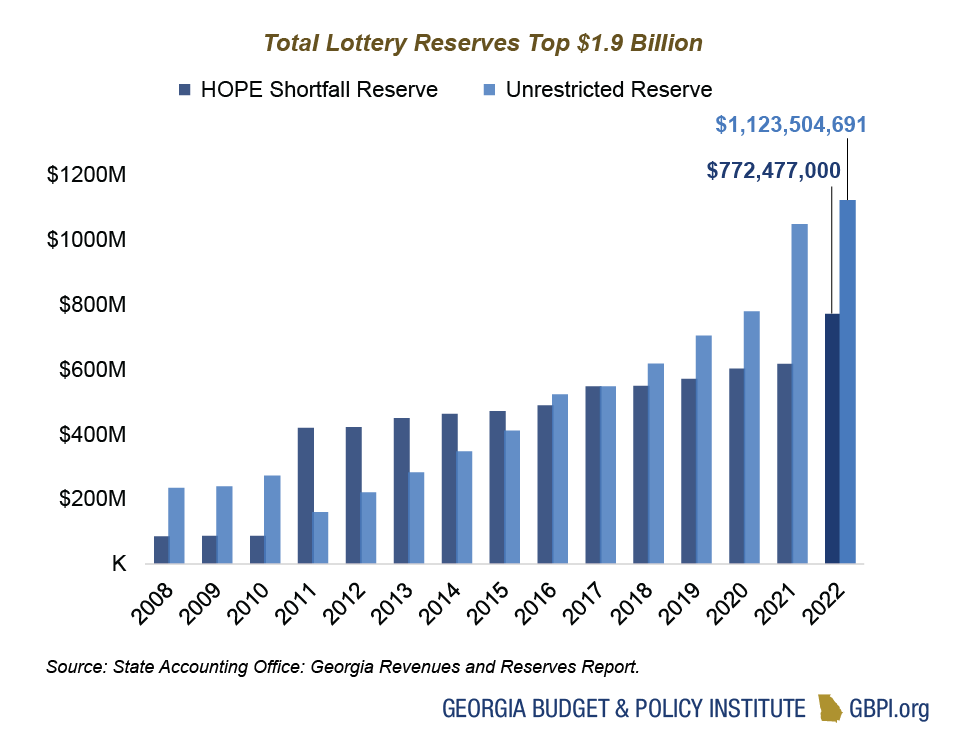

Alongside K-12 public schools, Georgia’s Child Care Services and Pre-Kindergarten programs provide critical support to families and their children. In FY 2024, $62.5 million was allocated for Child Care Services, which included a pay boost for state workers. The Pre-K program’s budget was $444 million, with legislators missing a critical opportunity to tap over $1 billion in unrestricted lottery reserves to boost Pre-K assistant teachers’ base pay—even with the $2,000 pay raise in the current budget, Georgia Pre-K providers are only reimbursed $20,190 for each of these professional’s salaries. Lottery reserves fund Georgia’s Pre-K, HOPE and student loan programs.

The budget for the University System of Georgia is $3.1 billion, despite sustaining a significant budget cut of $66 million dollars spread across all 26 institutions. The budget for the Technical College System of Georgia includes programs like adult education, workforce development and a $2,000 cost-of-living increase for eligible staff, totaling $444 million. The lottery funds support higher education programs such as College Completion grants and the HOPE Scholarship. There are currently $1.1 billion in unrestricted reserves and $1.9 billion in total education lottery reserves. To appropriately utilize lottery funds, in the 2023 Legislative Session, lawmakers proposed House Resolution 281 to study lottery revenues and reserves to serve the needs of students in Georgia who are marginalized and cannot afford rising college costs.

Private School Vouchers Drain Rural Georgia

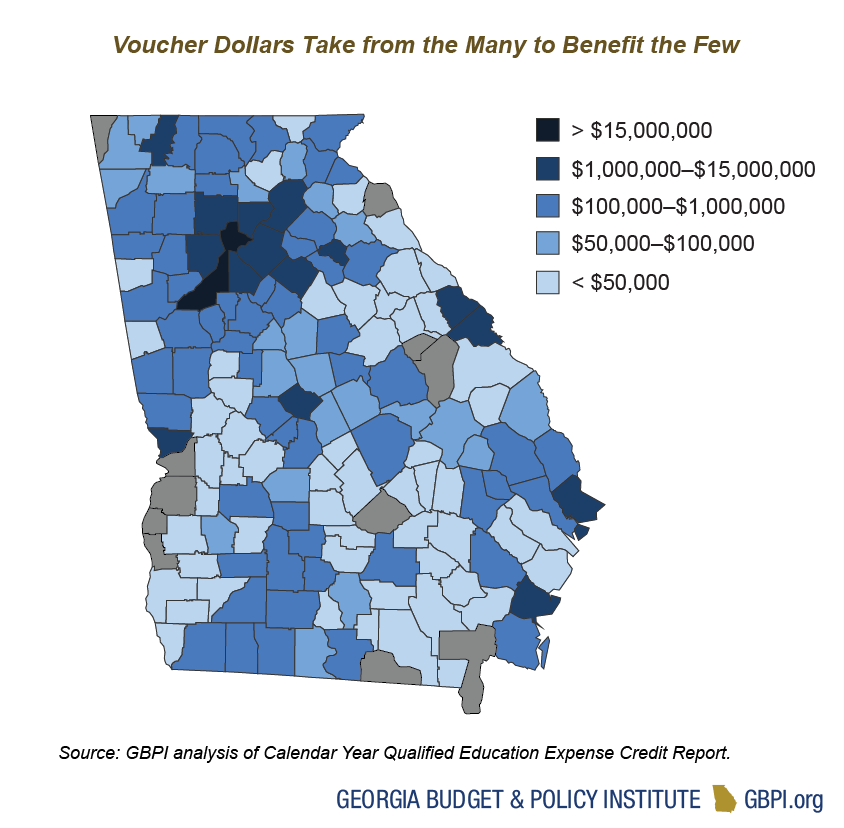

This year, the Qualified Education Expense Tax Credit (QEETC)—a voucher that the Georgia Department of Audits and Accounts found lacks transparency and oversight—will divert $120 million from the state’s budget. This program provides a tax credit to those donating to pass-through organizations that pay private school tuition for parents who apply. Georgians have no assurances of how students perform once they enter this program, as these schools are not held to state standards or tested to measure performance.

The QEETC is one of two state vouchers that funnel public funds to private schools—institutions that can reject students by income, ability, language proficiency, sexual orientation or religion. A review of the county-by-county QEETC usage shows that a few wealthier counties are benefiting from a program that the entire state subsidizes. Thirty-one percent of the voucher dollars last year were funneled to just two counties: Fulton and DeKalb.

Inflation Swallows Recent Teacher Salary Increases

This year, lawmakers passed a $290 million increase to the state salary schedule for certified teachers and certified employees in Georgia public schools. The base salary for FY 2024 is $41,092 for 10 months of employment.

Governor Kemp has made teacher pay raises a primary education policy goal and successfully led the General Assembly in allocating raises of $3,000 in FY 2020, $2,000 in FY23 and $2,000 for this next year’s budget. These additions are welcome to a profession that saw stagnant state funding in the years following the Great Recession. The cost of living has increased at a rate that, even with the pay increases, the buying power of the teacher base salary is thousands of dollars less than it was 15 years ago. If salaries kept pace with inflation, teachers paid the base salary in 2023 would have made $7,700 more annually—$385 more per pay period.

Teacher shortages—in rural schools or those serving more students in poverty, as well as for specific positions such as special education—will only increase if districts do not have the funding to ensure competitive wages. Further, any attempts to recruit more teachers of color, a must-have to address the needs of Georgia’s students, will fall flat while public school employees incur a financial penalty for entering the classroom.

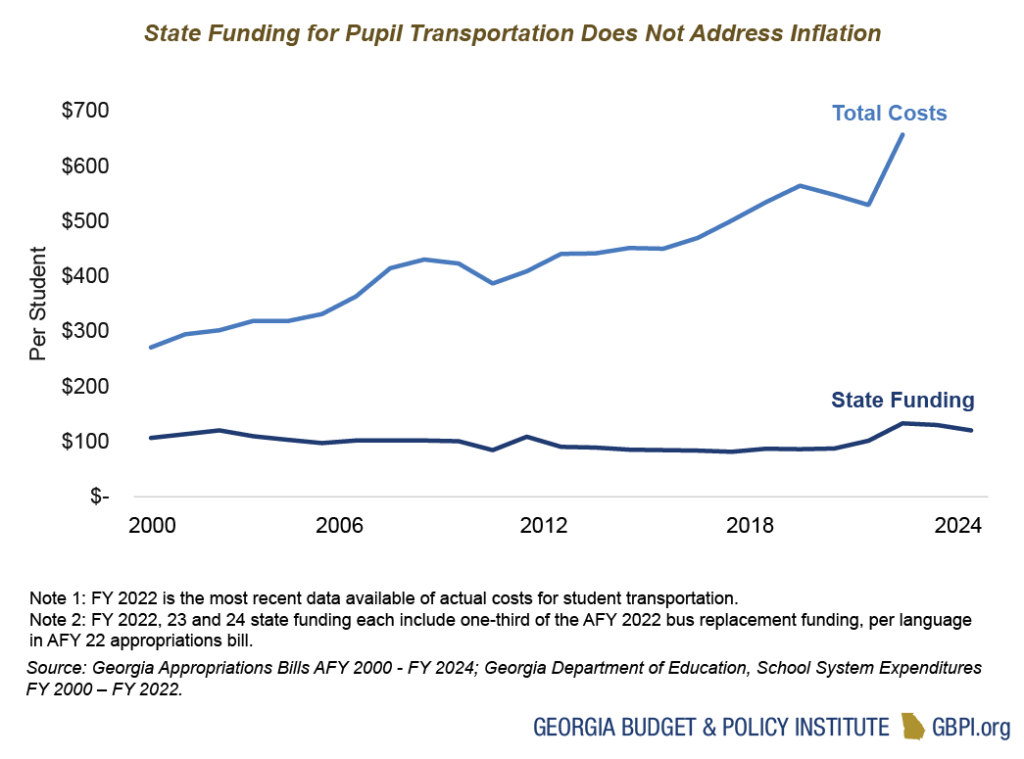

Pupil Transportation Funding Continues to Ignore Cost of Living

The K-12 budget includes a grant specifically to address student transportation needs—school buses, drivers, monitors, etc.—funded at $149 million for FY 2024. Lawmakers added $4.7 million to provide transportation personnel a 5.1 percent salary increase. This year’s budget does not include any additional money for school bus replacement but did include $188 million for this purpose in the amended fiscal year (AFY) 2022 budget with instructions for it to be used for the next three years.

Even with the raise and AFY 22 infusion included, the state spent less per student in FY 2023 ($117.33) than FY 2002 ($120.73), over two decades prior, not even counting the impact of inflation. Over this 22-year span, the cost of labor, fuel and vehicles have increased—a trend especially stark in FY 2022. School districts, which are required to provide school bus services to students by state law, must find additional funding in other areas. When the state does not adequately fund pupil transportation, the result is longer school routes, safety concerns due to older buses and less money for the classroom.

Child Care Gained Little Ground Over the Past Decade

The Department of Early Care and Learning (DECAL) administers Child Care Services, the Pre-Kindergarten Program, Nutrition Services and Quality Initiatives. State resources only support the Pre-K program and Child Care Services. The FY 2024 budget includes $506 million for the agency.

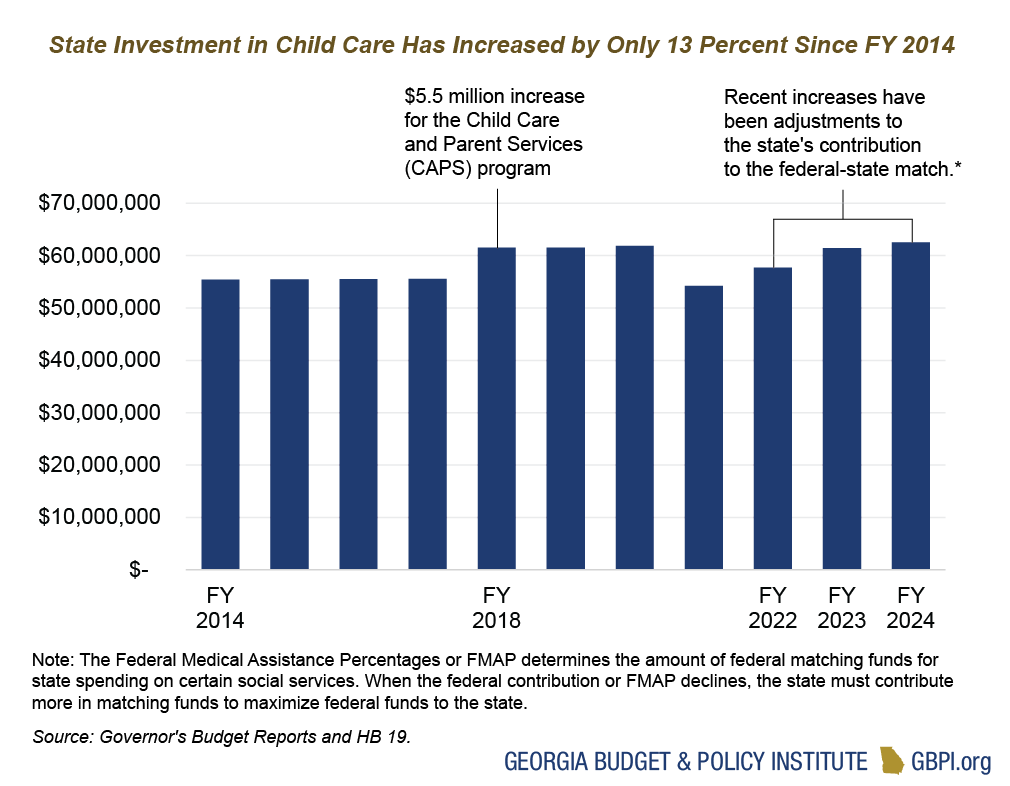

For FY 2024, the legislature and the governor approved about $62.5 million for Child Care Services, up from $61.4 million in FY 2023. Child Care Services includes the Childcare and Parent Services (CAPS) program, the state’s child care subsidy and support to child care providers. The $1.1 million in additional funds to Child Care Services includes a $2,000 pay increase for state workers in the division and an adjustment for the state match to draw down all available federal funding. Georgia has never adequately funded the CAPS program, even though the poverty rate for children five and under has been at least 20 percent since 2011. Funding for Child Care Services has only increased by about 13 percent over the past decade while child care costs have grown and workers are leaving the profession for higher wages elsewhere.

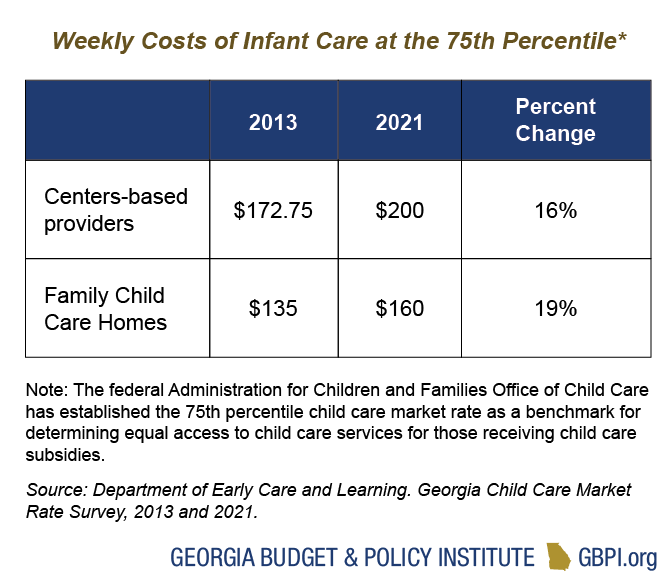

Georgia does the bare minimum to draw down all available federal resources, and it is inadequate given the needs of families and child care providers. The growing costs add greater economic pressure on women, who are often the primary caregivers, even if they are working. Women of color tend to have lower incomes than their white counterparts and are less likely to be able to afford the high cost of child care. Only about 15 percent of eligible Georgia children receive child care subsidies. Moreover, before the additional federal funds provided during the pandemic, the state’s CAPS reimbursement rates to providers trailed market rates at the 75th percentile, which made it hard for many child care businesses to invest in their staff. The pandemic has only made the crisis more visible. Federal resources from COVID relief packages protected Georgia’s child care system from the greatest harm, but these resources will expire in fall of 2024, creating a massive decline in the overall resources for child care.

Although the state cannot make up for the hundreds of millions Georgia received in federal relief payments for child care, it must offer more than modest bumps or flat spending. For example, the state can increase its funding to CAPS by $20 million to add more subsidized slots for children and increase resources to child care centers. Additionally, the state missed the opportunity this year to use the $6.6 billion budget surplus to support staff who work in child care and early learning facilities. Georgia should have, as it did last year with federal money, made additional $1,000 bonus payments to early childhood educators and staff who are not part of the state’s Pre-K Lottery program and did not receive a pay increase this year.

Pre-Kindergarten Teachers and Providers Get a Bump; Base Pay for Pre-K Assistant Teachers Needs More Attention

The FY 2024 budget for the Georgia Pre-Kindergarten program increased to about $444 million, up from $401 million the previous fiscal year. The increases included:

- $20.9 million for a $2,000 increase in base salaries for state workers, Pre-K teachers and assistant teachers.

- $14 million for Pre-K classroom operations so Pre-K programs can redirect resources to increase pay for lead teachers.

- $8 million to increase the employer contribution for the State Health Benefit Plan.

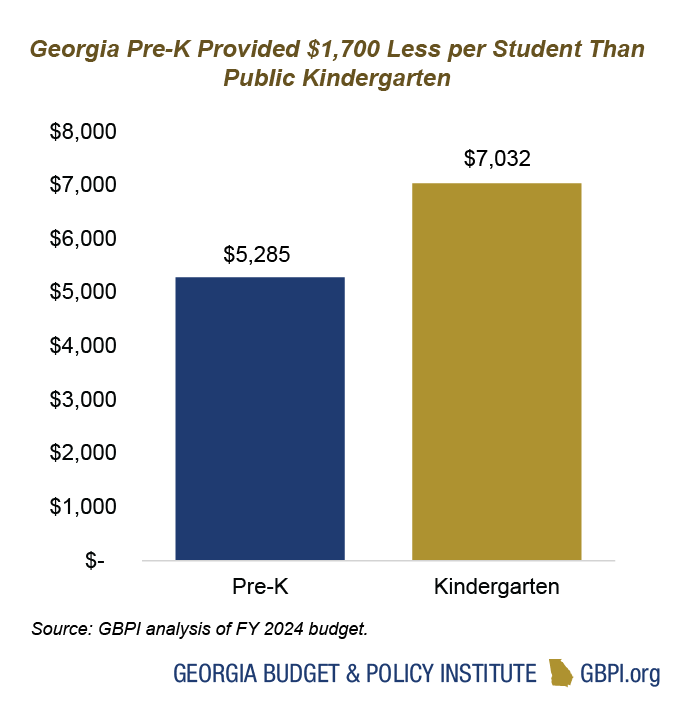

Georgia’s lottery-funded Pre-K program can serve up to 84,000 4-year-olds at about $5,285 per student, the most provided since inception. However, children one grade older in public kindergarten are allotted $7,032 per student in state funds, a difference of $1,747 per child. If Georgia were to fund Pre-K at the same rate as kindergarten, the program would need an additional $147 million annually.

Georgia’s Assistant Pre-K Teachers Need Bigger Pay Increase

One way state legislators could have increased per-student spending for Pre-K and improved assistant teacher retention was to increase their base pay. Pre-K assistant teachers have some of the lowest base pay among early childhood educators. Even with the $2,000 pay bump, the base salary for a Pre-K assistant teacher is $20,190 regardless of credentials; that’s about $11.47 an hour in a 40-hour week over the school year. Legislators ignored the resources available to help close the pay gap. Georgia has about $1.9 billion in lottery reserves, and the state requires only about $772 million in case of a shortfall in the net proceeds. Increasing assistant teacher pay helps keep workers in the role as they gain enough experience and/or credentials to become lead teachers, improving staff retention and classroom quality.

University System of Georgia / Board of Regents

The 2024 budget for the University System of Georgia (USG) is $3.1 billion. The vast majority, $2.9 billion, is allocated to USG’s 26 colleges and universities for student instruction, support services and basic college operations. The remaining funds go to cooperative extension services, public libraries and special funding initiatives. The FY 2024 budget represents a total net increase of $65.67 million, or 2.11 percent.

The FY 2024 budget includes $2,000 cost-of-living increases for full-time, benefit-eligible employees totaling $83 million, and $7.6 million in new enrollment funding. Dual Enrollment experienced a $7 million cut, with a total budget of $76 million for FY 2024. The total budget for capital projects for the Board of Regents is $198.2 million.

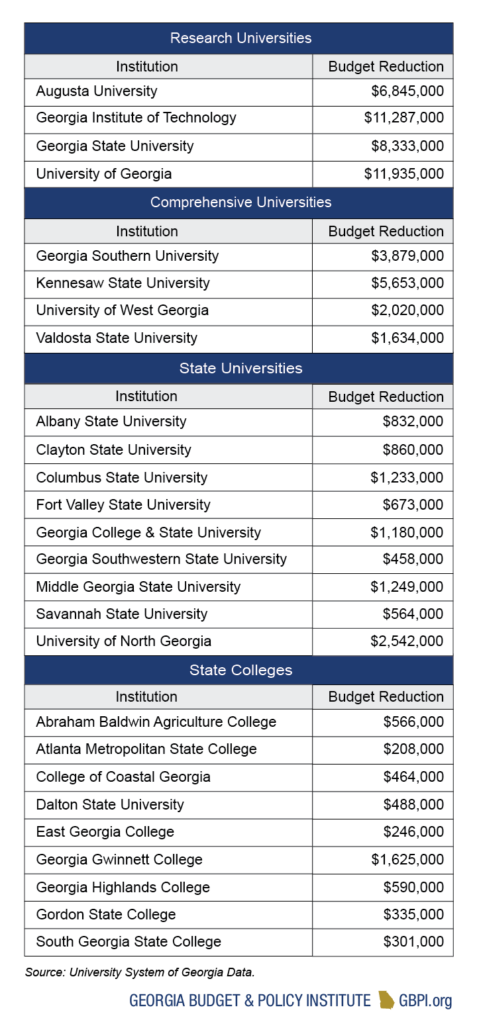

One of the most impactful budget implications is the $66 million reduction in the teaching program state funds for FY 2024 due to decreased enrollment at 20 institutions. The reduction is allocated across all 26 institutions to minimize disproportionate impacts on students and operations. Despite this decrease, the Board of Regents has held tuition flat at most institutions for five of the last seven years.

Technical College System of Georgia

The Technical College System of Georgia (TCSG) includes 22 colleges that provide both technical and core academic education.

The FY 2024 budget for TCSG is $444 million. About $383 million is allocated to technical education, and the remainder is for programs like Adult Education for individuals without a high school diploma and business initiatives, such as Quick Start—a workforce training program designed to promote job creation and retention for start-ups and support business expansion. The Quick Start budget for FY 2024 is $22 million.

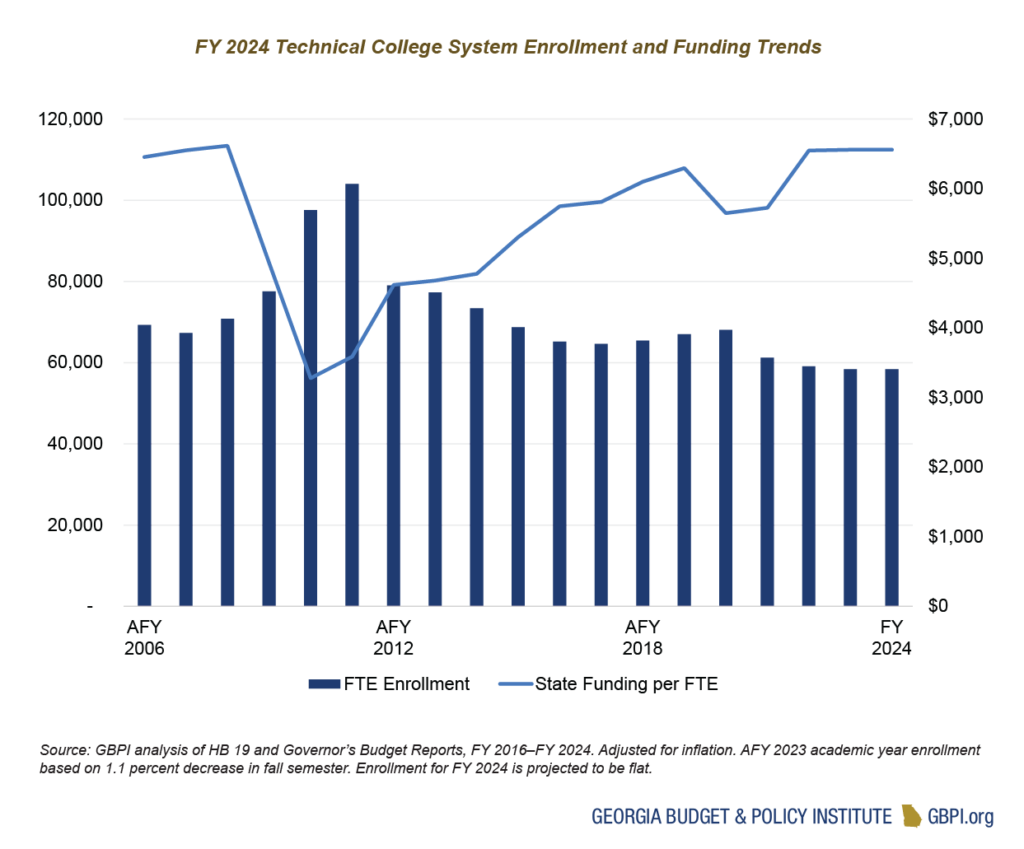

The Technical Education FY 2024 budget includes $2,000 cost-of-living increases for full-time, benefit-eligible employees totaling $11 million and a $9 million reduction in funds due to decreased student enrollment in TCSG during the pandemic’s height. Additionally, an $8 million increase was allocated for high-demand and high-cost careers, including aviation, commercial driver’s license (CDL) and nursing programs.

Despite decreased enrollment during the pandemic’s height, TCSG saw a 2.3 percent enrollment increase from 2021 to 2022. This increase was reflected in both credit hour completion and full-time equivalent (FTE) student enrollment.

Lottery Funds Support Georgia Pre-K & HOPE Scholarship

Georgia’s lottery funds are constitutionally dedicated to support education and are accounted for separately in the budget. Lawmakers appropriated $1.4 billion from lottery sales to fund and administer education programs. Pre-K funds grew by $43 million, 10.7 percent, with nearly half of that increase going to fund $2,000 salary increases for certified teachers and assistant teachers.

Lawmakers made several important policy changes to lottery-funded programs in the FY 2024 budget.

- HOPE Scholarships total $875 million for USG and $91 million at private institutions, and HOPE Grants amount to $81 million at TCSG.

- The HOPE Career Grant award amount increased from $1,000 to $1,250 to meet the projected 100% for students in Commercial Driver’s License and Law Enforcement programs at the Technical College System of Georgia.

- HOPE Grants and Scholarships now cover 100 percent of the prior year’s tuition at all TCSG and USG colleges and universities. In contrast, the Zell Miller Scholarship will cover the current year’s tuition rate at all TCSG and USG institutions.

- Increasing HOPE Scholarship coverage to 100 percent of the prior year’s tuition, according to the Georgia Student Finance Commission, will impact at least 50,000 students. USG’s four research institutions—Augusta University, the Georgia Institute of Technology, Georgia State University and the University of Georgia—will experience the greatest benefit due to the policy change.

- The FY 2024 budget increases funds for private HOPE and Zell Miller award amounts. HOPE private awards increased from $2,977 to $2,985 and the Zell Miller award increased from $2,282 to $2,946, totaling $91 million for the FY 2024 budget for HOPE and Zell Miller awards at private institutions.

- Tuition Equalization Grants (TEG) provide grant aid to Georgia residents who attend eligible private postsecondary institutions. Funds from the Engineer Scholarship program were transferred to Tuition Equalization Grants to increase the award amount from $900 to $1,000 per year, totaling $24 million in FY 2024.

- The Inclusive Postsecondary Education Grants (IPSE) program was established with a total budget of $955,830 to provide financial aid to students with intellectual and developmental disabilities who are currently enrolled in the IPSE program at a postsecondary institution in Georgia.

Post-Secondary Affordability Barriers

Lottery-supported programs provide students in Georgia with assistance to prepare and complete their post-secondary goals; however, college affordability for Georgians has remained a challenge. The Board of Regents decided to keep tuition flat for the 2023-24 academic school year for the University System of Georgia, but data shows students require additional resources.

By the year 2000, the USG higher education formula covered 75 percent of the college costs in Georgia. The state’s share now covers just 57 percent, leaving students responsible for 43 percent of the cost of college. As such, Georgia ranks third in the nation for average student loan debt per borrower. Although lawmakers voted to fund HOPE at 100 percent of the prior year’s tuition rate, there is room for improvement to ensure that students have access to post-secondary options, beginning with need-based financial aid.

College Completion Grants

Georgia is one of two states that does not offer comprehensive need-based financial aid that would support students financially in the first year of college. To address this issue, in 2022, lawmakers passed HB 1435 to establish College Completion grants, a $10 million transfer from Student Access Loans that began rollout in the fall of 2023. The College Completion grants budget remains flat at $10 million for FY 2024.

Under the new program, institutions across the state were allotted various amounts of College Completion grants to disburse as needed. Students experiencing need and who complete at least 80 percent toward their post-secondary credentials at USG and TCSG are eligible for College Completion grants of up to $2,500.

During the 2023 Legislative Session, the General Assembly passed HB 249 to increase the award amount from $2,500 to $3,500. In addition, the eligibility toward degree completion requirement decreases from 80 percent to 45 percent for students enrolled in two-year programs, and from 80 percent to 75 percent for students enrolled at four-year colleges.

HB 249 was vetoed by Governor Kemp. Although $10 million remains for College Completion grants, $2 million was disregarded for FY 2024. The stated reason for the veto was that the College Completion grants were established in FY 2023 and have not had a full year of activity to assess usage and need.

College Completion Grant First Year Highlights

- In FY 2023:

- A total of 4,808 College Completion grants invoices were requested across USG and private institutions.

- The average award amount for all institutions was $1,150.

- Out of the $10 million budget, $5.5 million was spent to serve 4,254 students.

- Within TCSG and USG, most institutions utilized the College Completion grants, except for Augusta Technical College, Savannah Technical College, Gordon State College and Savannah State University.

Education Lottery Reserves

Every year, unspent lottery dollars transfer to reserves managed by the State Treasury. The beginning reserve for the education lottery on July 1, 2021, was $1.7 billion.

At the end of the 2021 fiscal year, about $71 million in surplus was transferred to the lottery reserves, along with an additional $5 million in interest earned by the end of the 2022 fiscal year.

Since 2011, state law has required the lottery shortfall reserve to hold an amount equal to 50 percent of the previous year’s net lottery proceeds. If lottery ticket sales underperform, the state can draw on this reserve to fund HOPE. After reaching the 50 percent target, additional reserves are considered unrestricted. At the end of FY 2022, the required Shortfall Reserve Balance was $772 million, and the state exceeded that balance by more than $1 billion. At the conclusion of FY 2022, the total education lottery reserves were $1.9 billion, or 129 percent of lottery proceeds.