You can download and share all the images and charts in the Revenue Primer by clicking here.

Budget Basics

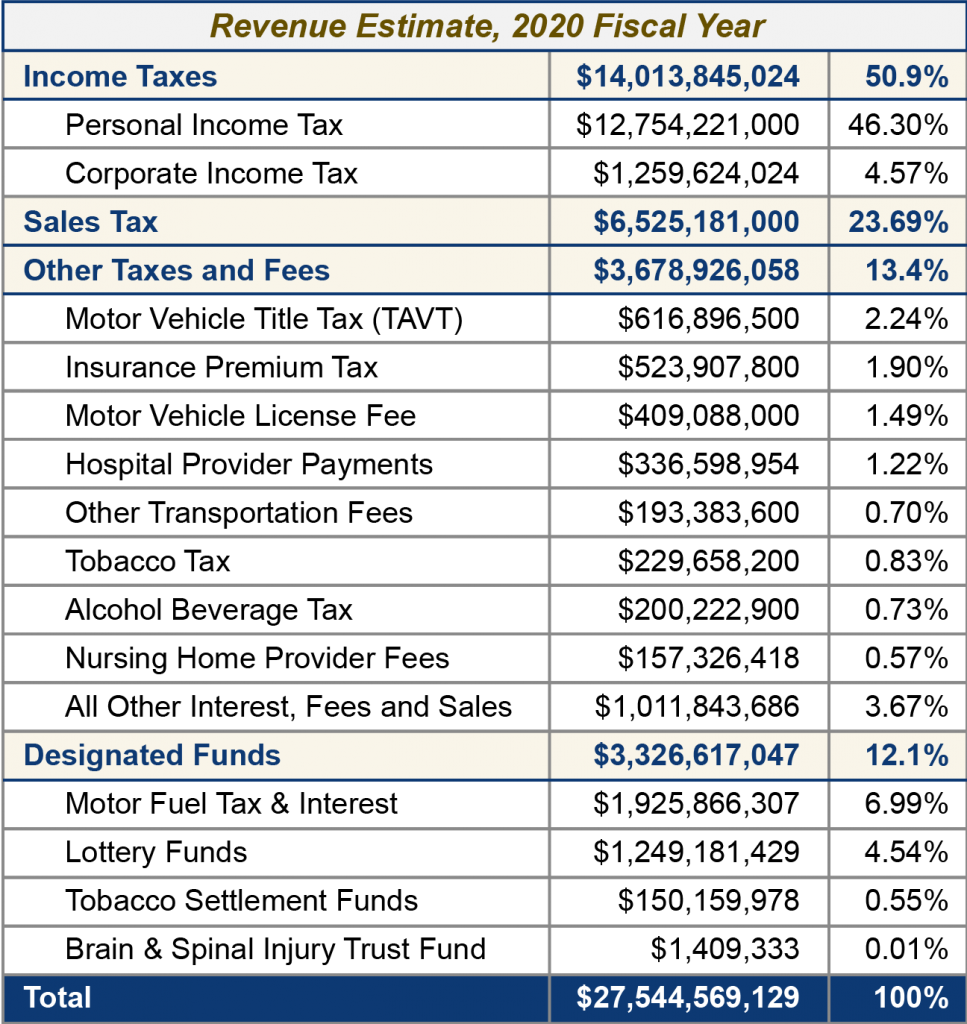

Georgia plans to spend $27.5 billion in state money raised through taxes and fees for the 2020 fiscal year. The budget plan anticipates a revenue increase of $1.3 billion, or five percent more than the prior year.

Georgia’s $27.5 billion 2020 budget is record-setting. The majority of the increase over the prior year is required to simply keep pace with growth and fund a $3,000 pay raise for Georgia’s certified teachers and public school employees. Things like the number of students in our K-12 schools and rising retirement benefits for state employees will almost always increase the cost of running the state from year to year.

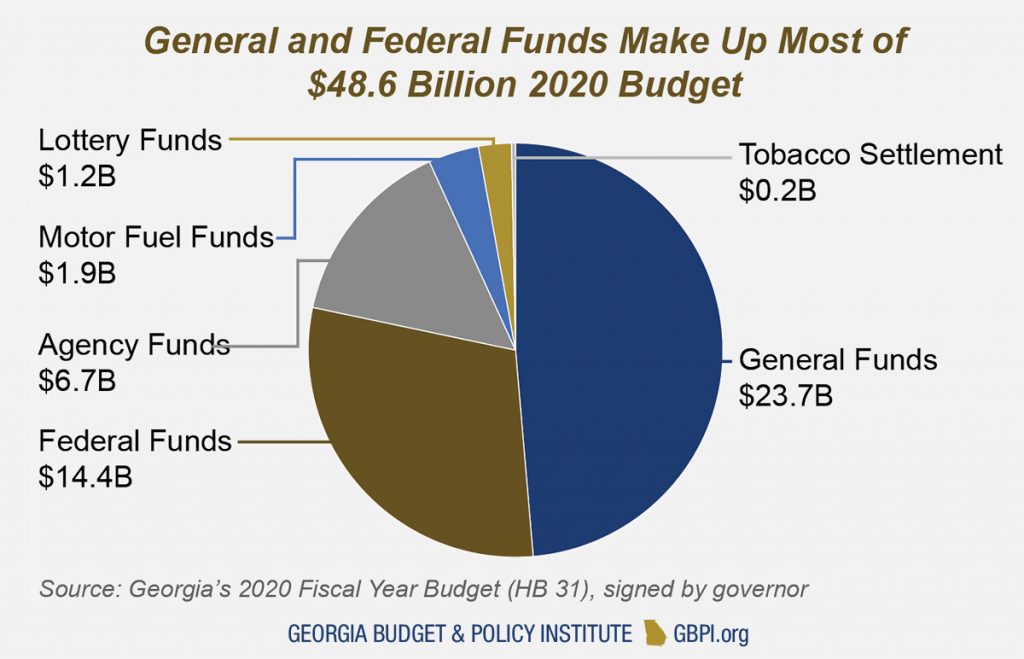

Georgia’s 2020 fiscal year runs July 1, 2019 through June 30, 2020. The total budget available to the state is $48.6 billion. That includes $27.5 billion in state funding, $14.4 billion in federal funding and $6.7 billion in agency funds.

Where does Georgia’s Money Come From?

Georgia’s fiscal health depends on the state’s ability to raise money from diverse sources in a reliable way. Like most states, Georgia collects revenue from a mix of personal and corporate income taxes, sales taxes, gas and vehicle taxes, and various other levies and fees.

Income taxes are the cornerstone of Georgia’s revenue system, accounting for more than half of all state funds. Sales taxes are the second largest revenue source, representing a quarter of annual collections. A fair and reliable revenue system requires both types of taxes.

Income taxes help balance the regressive effects of sales taxes and fees by allowing the state to collect a proportionate share of revenue from the wealthiest earners and most profitable corporations. A healthy income tax is also less sensitive to economic trends, which can boost revenue growth during good times but decline sharply when recessions occur.

Sales taxes provide a less consistent baseline of yearly revenue, and they fall more sharply on middle-class families and working people with lower incomes. Sales taxes also historically lag behind innovations that spur changes in Georgia’s economy.

In January 2019, a new Georgia law began requiring online retailers to collect and remit sales taxes to the state. Marketplace facilitators like Uber’s rideshare and Airbnb’s room rental services remain untaxed. Proposed legislation is pending for 2020 that would expand the state’s authority to apply sales taxes to those two industry categories and other marketplace brokers.

Georgia’s Diverse Funding Sources

Georgia’s Diverse Funding Sources

Georgia’s total 2020 budget including federal funds is $48.6 billion and is made up of six major funding sources:

- General Funds – Education, public safety and most other traditional state services are paid for from the General Fund, which includes money raised by income taxes, sales taxes and the motor fuel tax for transportation.

- Federal Funds – A large share of Georgia’s overall spending for health care, K-12 education, transportation and other services is through administration of federal funds.

- Agency Funds – These include tuition and fees from colleges and university system research funds.

- Lottery Funds – These are dedicated to Pre-Kindergarten programs and scholarships for higher education.

- Tobacco Settlement Funds or Grants – This ongoing annual payment, resulting from a legal settlement with the country’s four largest tobacco companies over health care costs, can be used for anything in the budget.

- Intrastate Transfers – The $4.4 billion of intrastate transfers include payments from the state health plan and are not counted in the $48.6 billion budget.

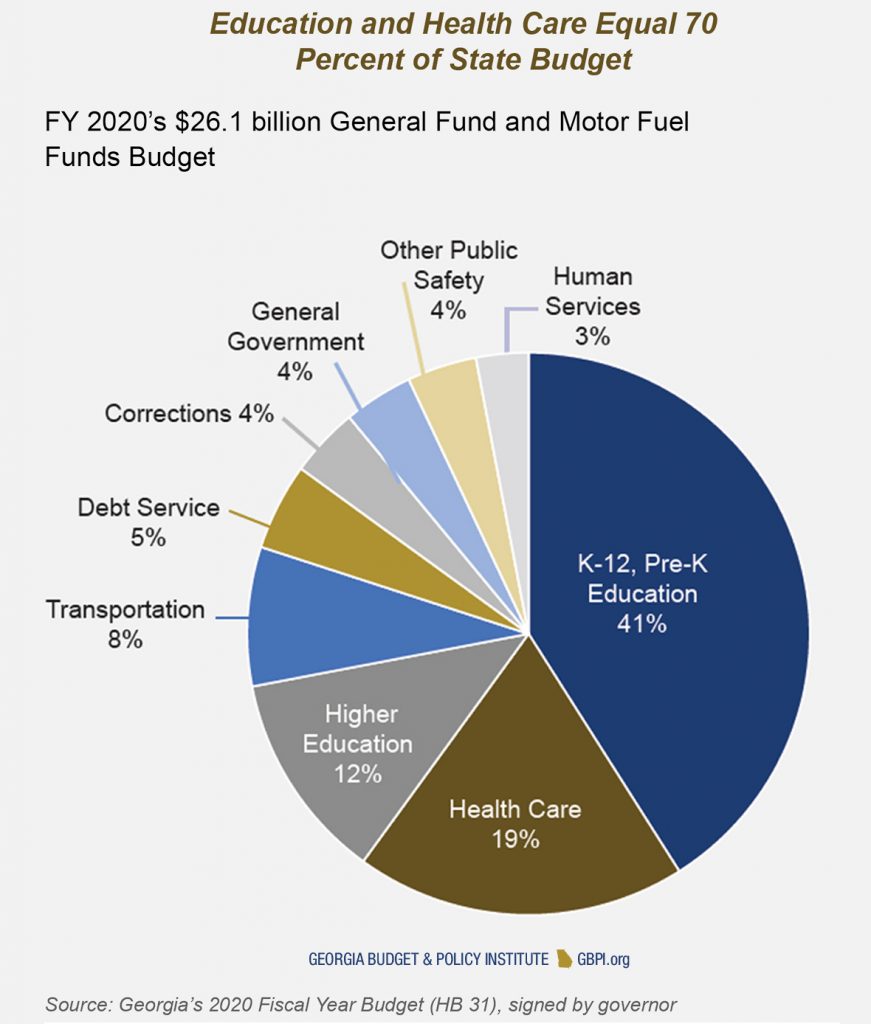

General and Motor Fuel Funds

$26,143,818,389 (54 percent of Georgia’s budget)

The General Fund derives largely from income taxes on personal and corporate earnings and sales taxes on consumer transactions. The state also taxes motor fuel and assesses provider fees on hospitals and nursing homes. More than 95 cents of every dollar appropriated by the state pays for seven core priorities:

- K-12 Education (41 cents of every dollar spent)

- Health Care (19 cents)

- Higher Education (12 cents)

- Public Safety and Corrections (8 cents)

- Transportation (8 cents)

- Debt Service (5 cents)

- Department of Human Services (3 cents)

The remaining General Fund spending is for state agencies, boards and commissions. That money includes state activities such as economic development, agriculture and forestry, and grant programs. The General Fund also covers costs of operating the legislative, judicial and executive branches of state government. Not included in Georgia’s General Fund are state lottery proceeds and money dedicated to the Brain and Spinal Injury Trust Fund. Lottery proceeds are not included in the General Fund and account for about 5 percent of state funds.

Motor Fuel Funds

Georgia’s Constitution restricts spending revenue from state motor fuel taxes to roads and bridges. The money is dedicated to a mix of new construction, maintenance of existing infrastructure and debt service on past investments. Georgia’s 2019 motor fuel rates are 27.5 cents per gallon of gas and 30.8 cents per gallon of diesel, a slight uptick from last year. The state’s 2020 budget includes $1.9 billion in motor fuel revenue, an increase of about $30 million over the 2019 budget.

Federal Funds

Federal Funds

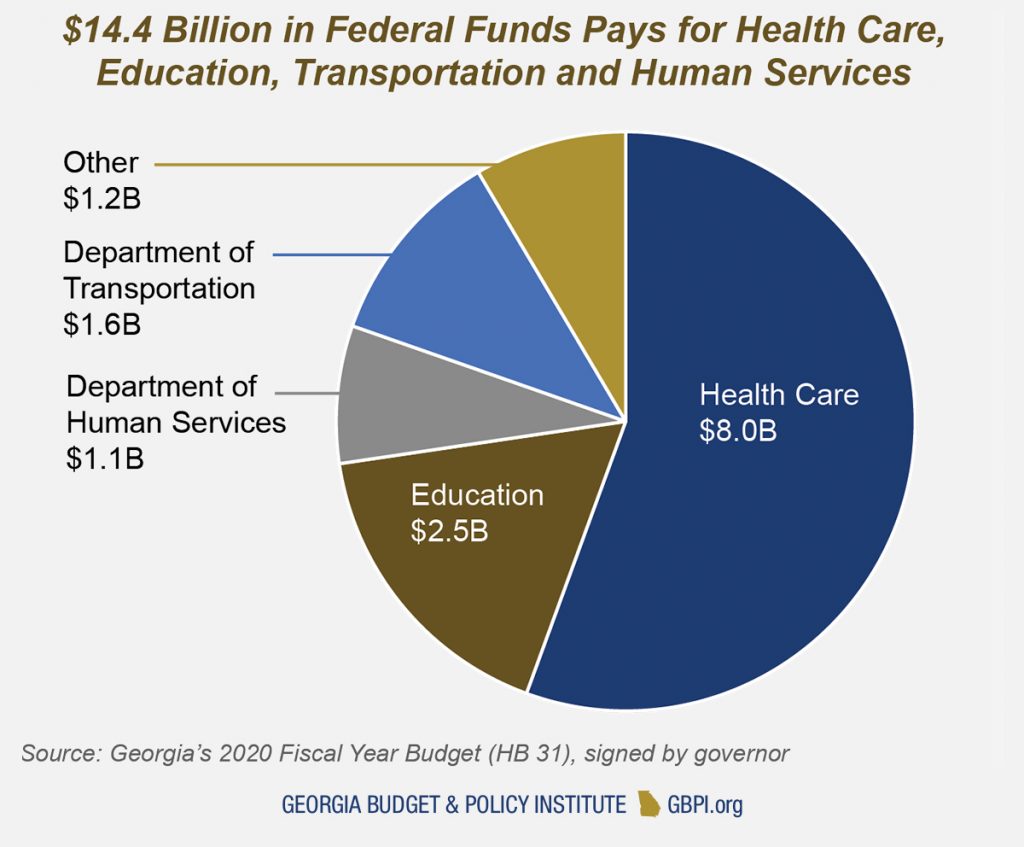

$14,352,021,866 (30 percent of Georgia’s budget)

Money from the federal government flows to a range of state programs and services. Georgia spends the vast majority of federal money on the following:

- $8 billion for Medicaid, PeachCare and health care

- $2.5 billion for education, which includes school nutrition programs, services for low-income students and support for students with disabilities

- $1.6 billion for the Georgia Department of Transportation

- $1.5 billion for human services, Temporary Assistance for Needy Families and child welfare

Federal rules require the state to match federal funding for Medicaid and many other investments that benefit Georgians. As a result, changes in state funding levels typically track changes in federal funding.

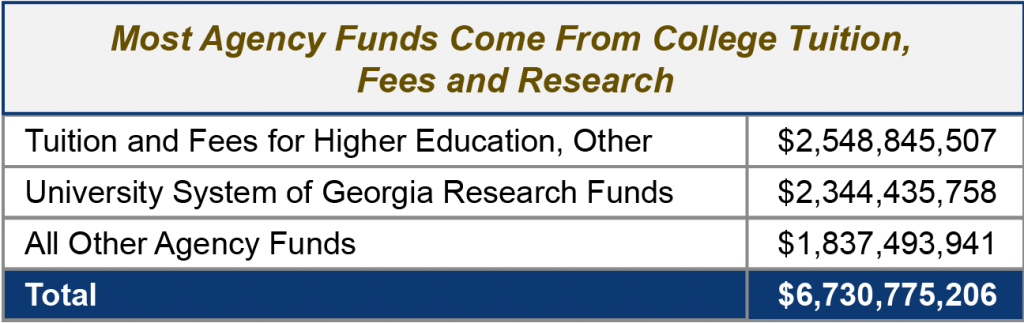

Agency Funds

$6,730,775,206 (14 percent of Georgia’s budget)

Agency funds include $2.5 billion in tuition and fees collected by the University System of Georgia and the Technical College System of Georgia. The University System of Georgia accounts for $2.3 billion in research funds. The money is retained by the individual schools.

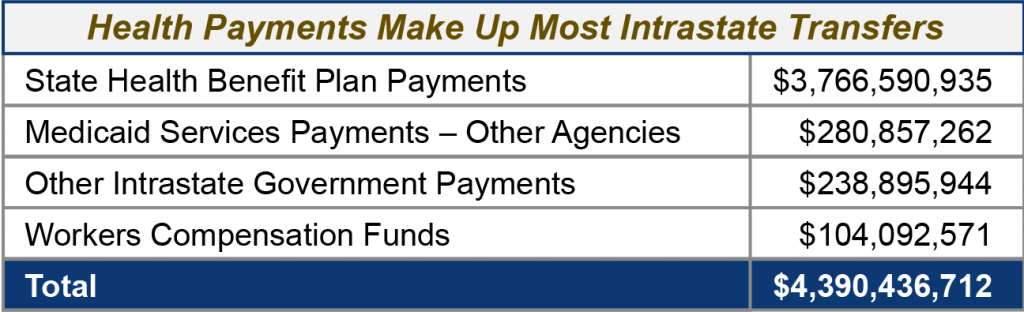

Intrastate Transfers

$4,390,436,712 (Included for reference, but not as a net increase

to Georgia’s budget)

Intrastate transfers are primarily payments from the State Health Benefit Plan.

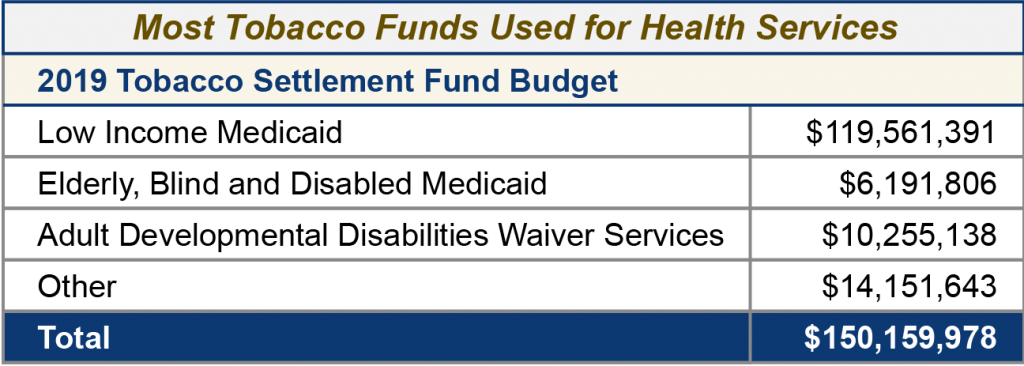

Tobacco Funds

$150,159,978 (0.3 percent of Georgia’s budget)

Georgia receives annual payments from a large settlement signed in 1998 with four of the country’s largest tobacco companies, known as the Tobacco Master Settlement Agreement. Georgia is not required to dedicate these payments for specific purposes. As a result, the use of tobacco settlement money can vary from year to year, though most of the money in recent budgets was allotted to health care.

Continue reading the 2020 Georgia Budget Primer

|

|

|

|

|

|