Budget Basics

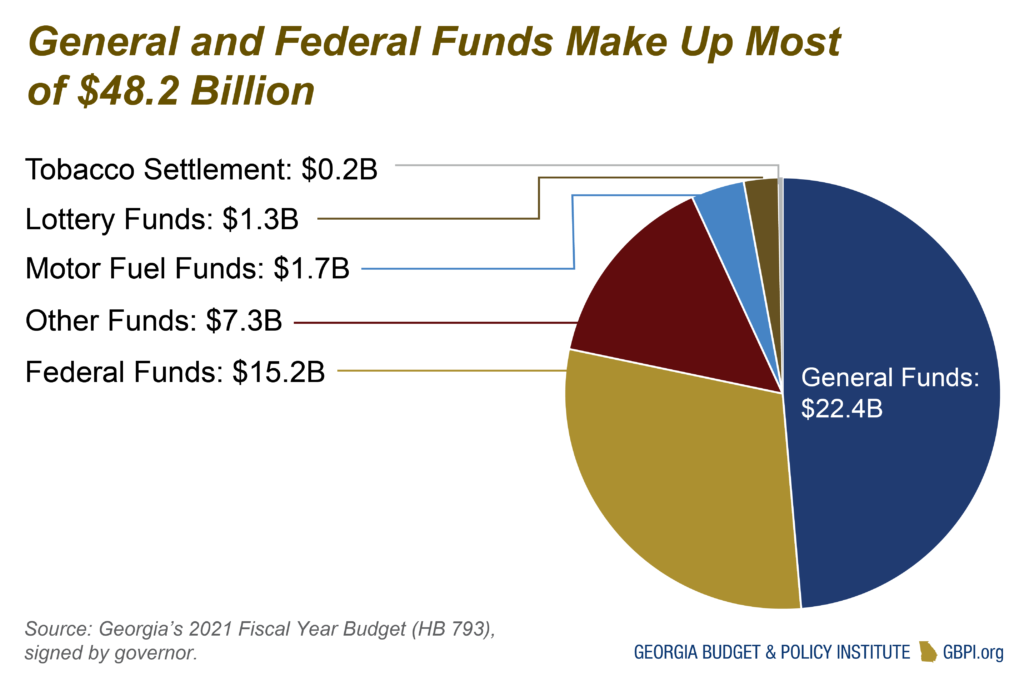

Georgia’s 2021 fiscal year runs July 1, 2020 through June 30, 2021. The total budget available to the state is $48.2 billion. That includes $25.9 billion in state funding, $15.1 billion in federal funding and $7.1 billion in agency funds. Prior to the Great Recession, in Fiscal Year (FY) 2008, the state of Georgia spent about $2,613 per person. Under the 2021 budget the state will spend $2,392 per person, about $2.4 billion less than if spending kept pace with the state’s growth in population and inflation.

The state budget outlines Georgia’s priorities, how it plans to spend money and how much revenue it expects to collect. It is the most important piece of legislation lawmakers pass. In fact, the budget is the only legislation that the General Assembly is legally mandated to pass each year. The Georgia Constitution requires the state to maintain a balanced budget, which means the government cannot spend more money than it collects in revenues.

The budget process is ongoing. Even as Georgia is implementing its current budget, it is auditing the previous year’s budget and planning for the next one. Beyond the General Assembly, many others participate in the process, including the governor, state budget director, state economists, agency leaders and budget officials, state auditors and the public.

Advocates need to engage with the budget process year-round. By reaching out to agency leaders in the summer and fall and lawmakers in the winter and spring, Georgians can inform the annual debate over the budget.

Georgia by the Numbers

- 2 million Georgians who are seniors, disabled, children or parents with low incomes receive health care coverage and services ($3.5 billion in the 2021 state budget).

- 1.76 million children enroll in Georgia’s 2,300 K-12 public schools ($9.6 billion in the 2021 state budget), and 1.2 million are eligible for Free and Reduced Price School Meals.

- 436,000 students enroll in Georgia public colleges, universities or technical colleges ($2.6 billion in 2021 state budget).

- 297,000 Georgians live under correctional control, including 224,000 on probation, 52,000 incarcerated individuals and 21,000 parolees ($1.3 billion in 2021 state budget).

- 18,000 miles of state highway are overseen by the Department of Transportation, which will also direct$179 million in FY 2021 to help maintain and improve more than 100,000 miles of county roads and city streets ($1.7 billion total in 2021 state budget).

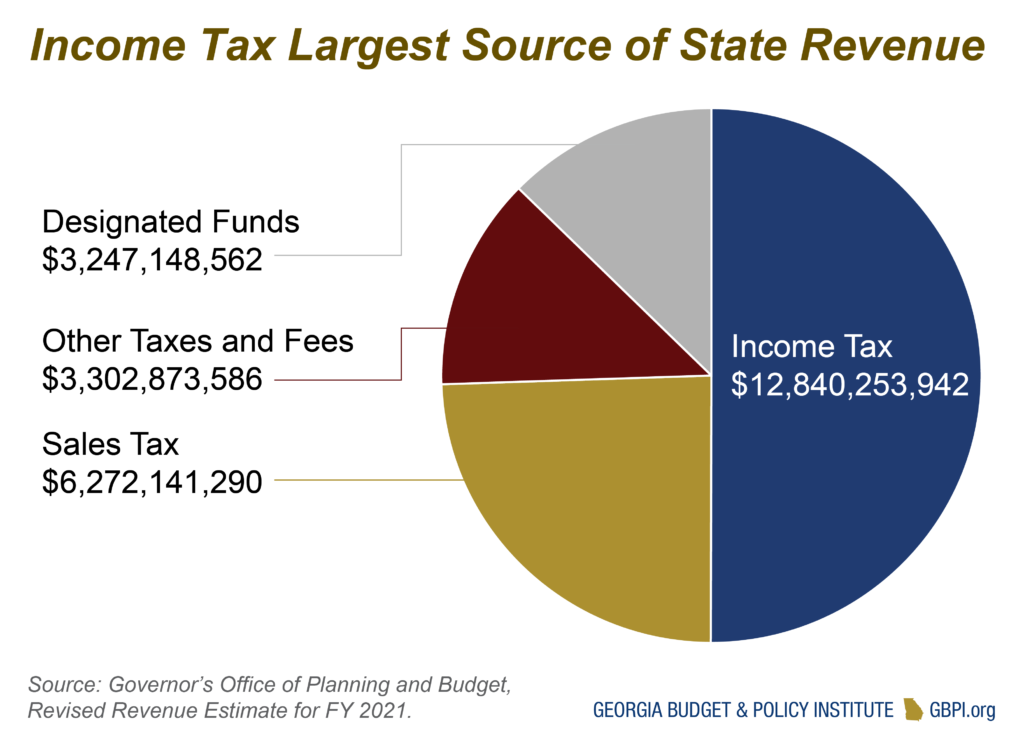

Where Does Georgia’s Money Come From?

Georgia’s fiscal health depends on the state’s ability to raise money from a variety of sources in a reliable way. Like most states, Georgia collects revenue from a mix of personal and corporate income taxes, sales taxes, gas and vehicle taxes, and various other levies and fees.

Income taxes are the cornerstone of Georgia’s revenue system, accounting for half of all state funds. Sales taxes are the second largest revenue source, representing slightly less than a quarter of annual collections. A fair and reliable revenue system requires both types of taxes. Income taxes help balance the regressive effects of sales taxes and fees by allowing the state to collect a proportionate share of revenue from the wealthiest earners and most profitable corporations. A healthy income tax is also less sensitive to economic trends, which can boost revenue growth during good times but decline sharply when recessions occur.

Sales taxes provide a less consistent source of yearly revenue, and they fall more sharply on middle-class families and people with lower incomes. Sales taxes also historically lag behind innovations that spur changes in Georgia’s economy. However, sales taxes remain a core funding source that allows the state to generate revenue from consumption and economic inputs that would otherwise be exempt from taxation.

In April 2020, a new Georgia law began requiring most online retailers to collect and remit sales taxes to the state, including marketplace facilitators like Uber’s rideshare services or retailers like eBay. The state’s sales tax, however, is not applied to most services and large parts of the Georgia’s economy, such as construction labor, the finance industry, attorneys or physicians. Some sales tax exemptions were intentionally created to avoid taxing products families rely on, such as groceries, while sales on sales of items like digital downloads are not taxed because lawmakers have not proactively updated the tax code to include them.

Georgia’s Funding Sources

Georgia’s total 2021 budget, including federal funds, is $48.2 billion and is made up of six major funding sources:

- General Funds – The state-funded portions of education, Medicaid and most other traditional state services are paid for through the General Fund, which includes money raised by income taxes, sales taxes and the motor fuel tax for transportation.

- Federal Funds – A large share of Georgia’s overall spending for health care, K-12 education, transportation and other services is paid through the administration of federal funds.

- Agency Funds – These include tuition and fees from colleges and university system research funds, in addition to regulatory fees and revenue raised directly by individual state agencies.

- Lottery Funds – These are dedicated to pre-Kindergarten programs and scholarships for higher education.

- Tobacco Settlement Funds or Grants – This ongoing annual payment, resulting from a legal settlement with the country’s four largest tobacco companies over health care costs, can be used for anything in the budget.

- Intrastate Transfers – The $4.3 billion of intrastate transfers include payments from the state health plan and are not counted in the $48.2 billion budget.

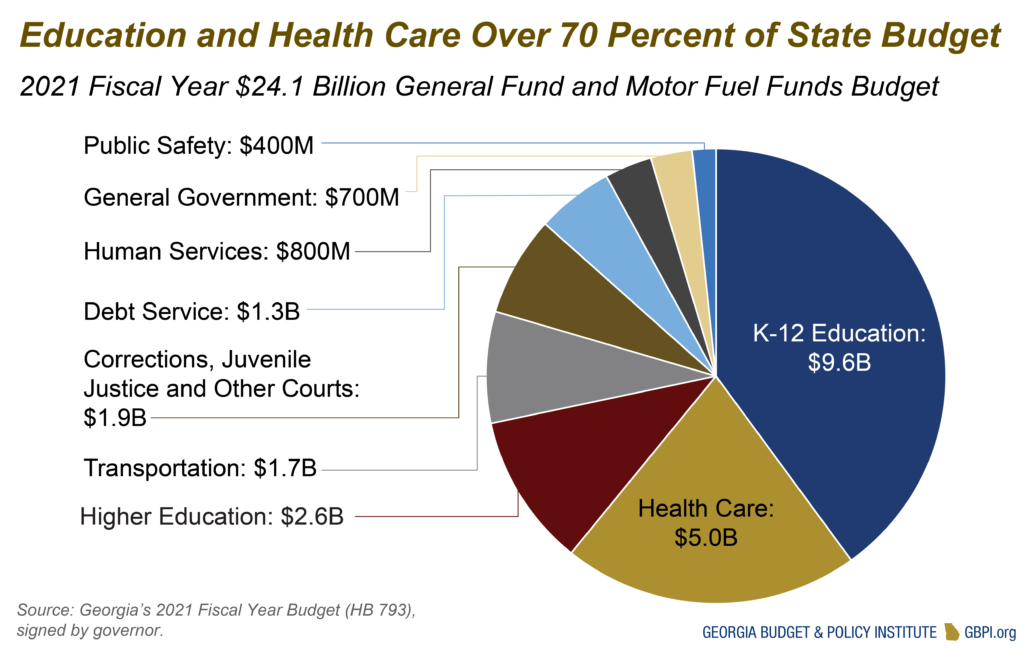

General Funds: $22.4 Billion (50 percent of Georgia’s budget)

The General Fund derives largely from income taxes on personal and corporate earnings and sales taxes on consumer transactions. The state also taxes motor fuel and assesses provider fees on hospitals and nursing homes. More than 97 cents of every dollar appropriated by the state pays for eight core priorities:

- K-12 Education (40 cents of every dollar spent)

- Health Care (21 cents)

- Higher Education (11 cents)

- Public Safety (2 cents)

- Criminal Justice and the Courts (8 cents)

- Transportation (7 cents)

- Debt Service (6 cents)

- Department of Human Services (3 cents)

The remaining General Fund spending is for state agencies, boards and commissions dedicated to state activities such as economic development, agriculture and forestry, and grant programs. The General Fund also covers costs of operating the legislative, judicial and executive branches of state government. Not included in Georgia’s General Fund are state lottery proceeds and money dedicated to the Brain and Spinal Injury Trust Fund. Lottery proceeds are not included in the General Fund and account for about 5 percent of total state funds or $1.3 billion.

Motor Fuel Funds: $1.7 Billion (4 percent of Georgia’s budget)

Georgia’s Constitution restricts spending revenue from state motor fuel taxes to roads and bridges. The money is dedicated to a mix of new construction, maintenance of existing infrastructure and debt service on past investments. Georgia’s 2020 motor fuel rates are 27.9 cents per gallon of gas and 31.3 cents per gallon of diesel, a slight uptick from last year. Recently, through an act of the governor that the state’s Department of Revenue has recognized as permanent, Georgia reinstituted a tax exemption on the sale of jet fuel, which will cost the state $36 million in FY 2021. The state’s 2021 budget includes $1.7 billion in motor fuel revenue, a decrease of about $200 million from the 2020 budget.

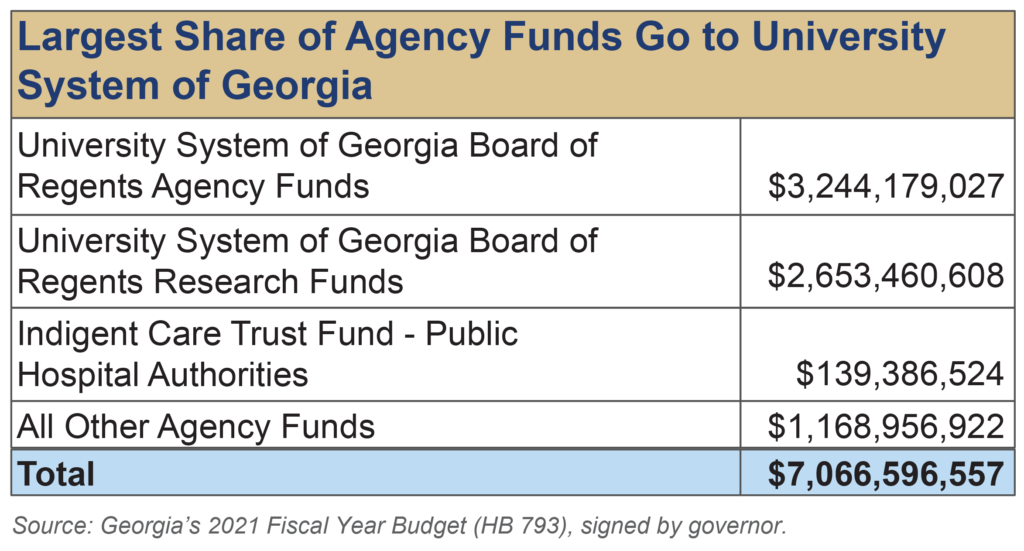

Agency Funds: $6.4 Billion (13 percent of Georgia’s budget)

Agency funds include $2.5 billion in tuition and fees collected by the University System of Georgia and the Technical College System of Georgia. The University System of Georgia accounts for $2.3 billion in research funds. The money is retained by the individual schools.

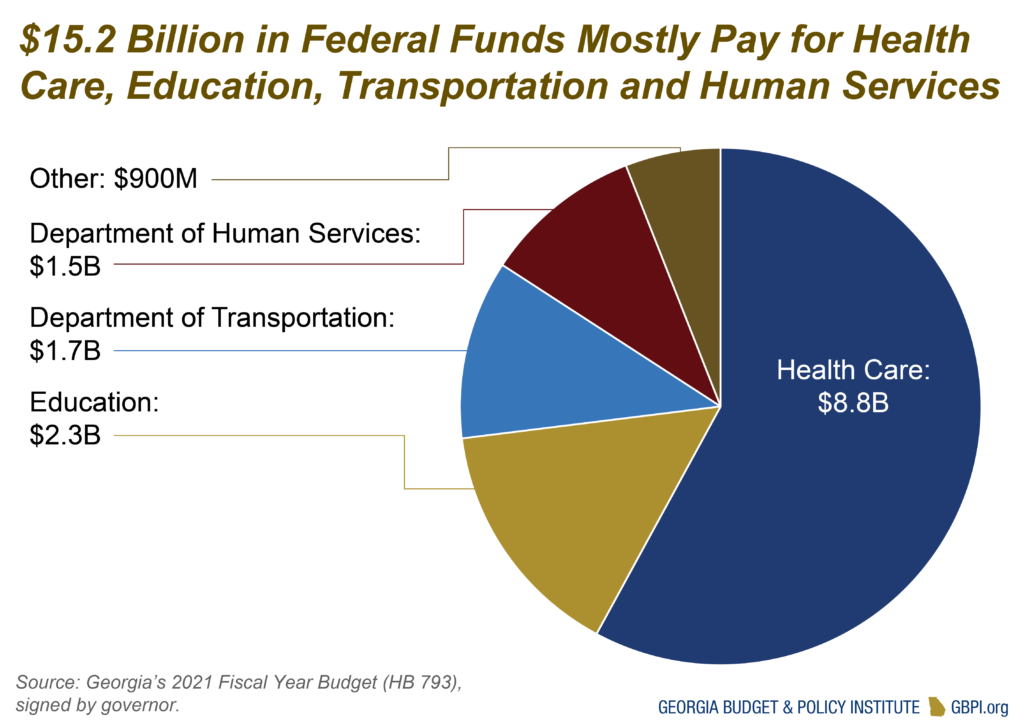

Federal Funds: $15.2 Billion (31 percent of Georgia’s budget)

Money from the federal government flows to a range of state programs and services. Georgia spends the vast majority of federal money on the following:

- $8.8 billion for Medicaid, PeachCare and other health care programs

- $2.3 billion for education, which includes school nutrition programs, services for low-income students and support for students with disabilities

- $1.7 billion for the Georgia Department of Transportation

- $1.5 billion for human services, Temporary Assistance for Needy Families and child welfare

Federal rules require the state to match federal funding for Medicaid and many other investments that benefit Georgians. As a result, changes in state funding levels typically track changes in federal funding.

Pandemic Federal Funding: $4.3 Billion

(Included for reference. Funds are distributed between state and local governments, authorities and other public entities)

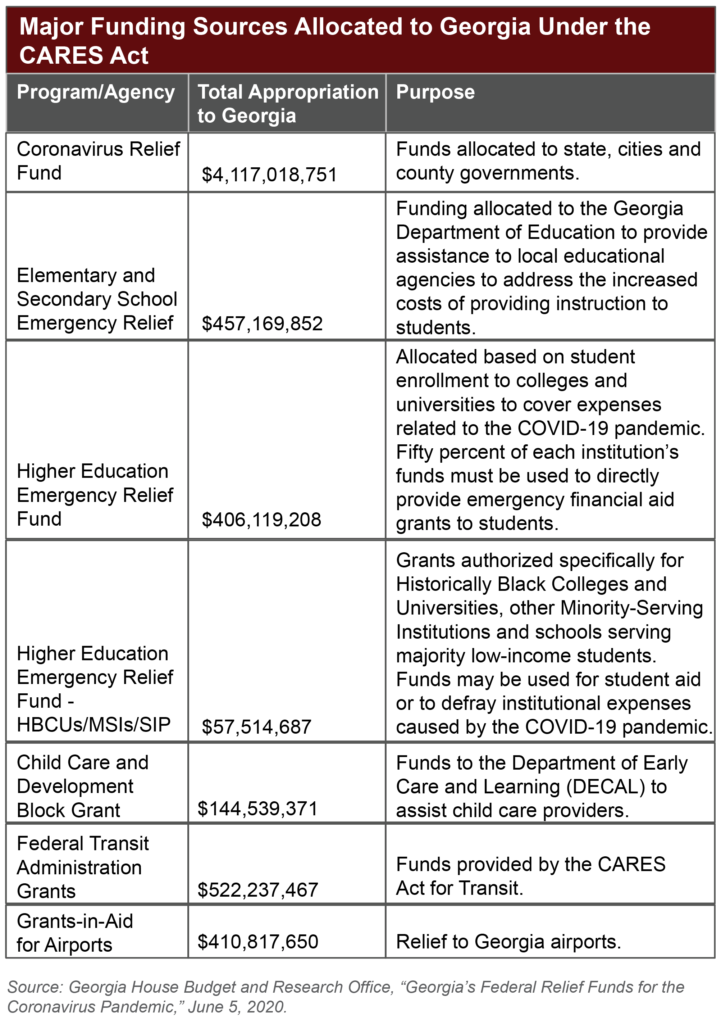

As of August 1, 2020, the federal fiscal response to the COVID-19 pandemic includes two major legislative packages: the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief, and Economic Security Act (CARES).

FFCRA funded free COVID-19 testing, enhanced unemployment insurance and suspended some burdensome requirements for recipients of the Supplemental Nutrition Assistance Program (SNAP) and the Special Supplemental Nutrition Program for Women, Infants and Children (WIC), but the centerpiece of the legislation was the $36 billion in additional Medicaid funding to enhance each state’s matching Federal Medical Assistance Percentages (FMAP) rate by 6.2 percentage points. Through this enhancement, the state received about $700 million from March through July, with approximately $154 million used to cover Medicaid costs in the state’s FY 2021 budget.

The $2.2 trillion CARES Act provided the largest share of federal assistance to the state. The legislation provided funding to help state and local governments cover the direct costs of the COVID-19 response through the Coronavirus Relief Fund, along with funding for education, child care, transportation and more. For the most part, these funds provided a temporary stopgap to help cover a few months of costs directly related to the pandemic.

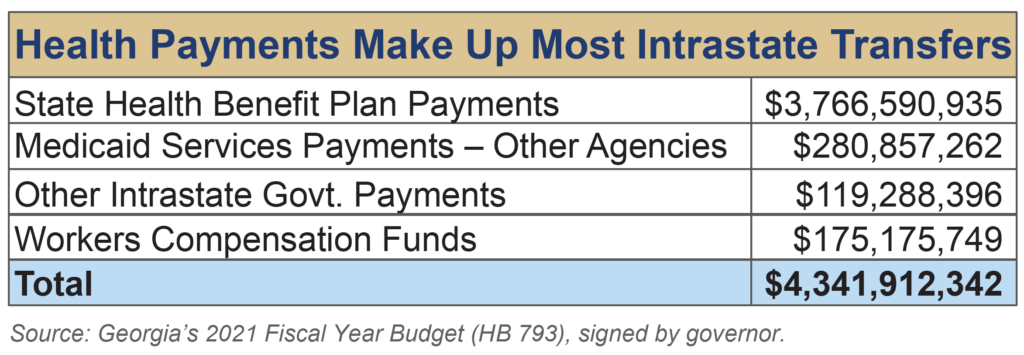

Intrastate Transfers: $4.3 Billion

(Included for reference, but not as a net increase to Georgia’s budget)

Intrastate transfers are primarily payments from the State Health Benefit Plan.

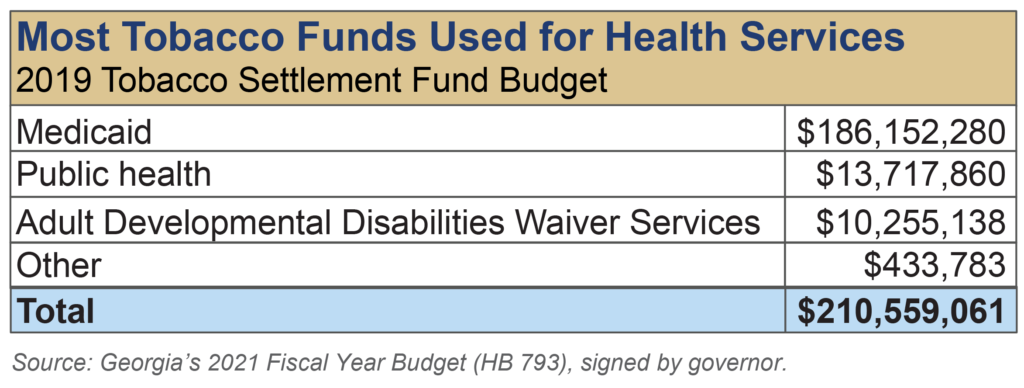

2021 Tobacco Settlement Fund Budget: $211 Million (0.4 percent of Georgia’s budget)

Georgia receives annual payments from a large settlement signed in 1998 with four of the country’s largest tobacco companies, known as the Tobacco Master Settlement Agreement. Georgia is not required to dedicate these payments for specific purposes. As a result, the use of tobacco settlement money can vary from year to year, though most of the money in recent budgets was allotted to health care.