Introduction

Georgia’s 2024 fiscal year (FY) runs from July 1, 2023, through June 30, 2024. The total available funding to the state is $55.9 billion. That includes $32.4 billion in state funding, $17.9 billion in federal funding and $11 billion in agency funds and state employee benefit plan transfers. Before the Great Recession, adjusting for inflation, the state of Georgia spent about $2,987 per person in FY 2008. Under the 2023 budget, the state will spend about $46 less per person, a total of about $509 million less than if spending kept pace with growth.

The state budget outlines Georgia’s priorities, how it plans to spend money and how much revenue it expects to collect. It is the most important piece of legislation lawmakers pass. In fact, the budget is the only legislation that the General Assembly is legally mandated to pass each year. The Georgia Constitution also requires the state to maintain a balanced budget. If it raises more than it spends, remaining funds are automatically added to the state’s Revenue Shortfall Reserve savings account until it reaches 15 percent of prior year collections, at which point the funds shift to an ‘undesignated surplus’ account that can be tapped under the governor’s authority to set Georgia’s revenue estimate.

The budget process is ongoing and requires year-round engagement from advocates. Even as Georgia implements its current budget, it is auditing the previous year’s budget and planning for the next one. Beyond the General Assembly, many others participate in the process, including the governor, state budget director, state economist, agency leaders and budget officials, state auditors and the public.

Georgia By the Numbers

Georgia’s budget for FY 2024 directly affects the quality of life for all 11 million Georgians across the state’s many diverse communities. The lion’s share of that money is allocated to core investments in the state’s economic future, including education, health care and transportation. Here are some examples of the way the state budget impacts Georgians:

- 3 million+ Georgians who are seniors, disabled, children or parents with low incomes receive health care coverage and services through Medicaid and PeachCare. As the state redetermines eligibility for all Medicaid enrollees over the next fiscal year, an estimated 540,000 Georgians could lose their health coverage under these programs ($4.4 billion in the FY 2024 state budget).

- 1.74 million students, supported by 136,000 teachers and administrators, enroll in Georgia’s 2,300 K-12 public schools ($11.9 billion in the FY 2024 state budget).

- 430,000 students enroll in Georgia public colleges, universities or technical colleges ($4.9 billion in the FY 2024 state budget).

- 247,000 Georgians live under correctional control, including 175,000 on probation, 49,000 individuals who are incarcerated, 17,000 Georgians on parole and 6,000 youth in the Juvenile Justice system ($1.5 billion in the FY 2024 state budget).

- 18,000 miles of state highway are overseen by the Department of Transportation, which will also direct $201 million in FY 2024 to help maintain and improve over 100,000 miles of county roads and city streets ($2.3 billion total in the FY 2024 state budget).

Georgia’s Revenue System Shaped by History of Racist Policies

The structure of Georgia’s modern revenue system—which determines how much money the state can use to fund Georgia’s budget—developed during the turbulent decades of the 1930s through 1960s, a period during which the state was primarily governed by segregationists who resisted New Deal-era federal assistance and struggled to finance basic government programs and services.

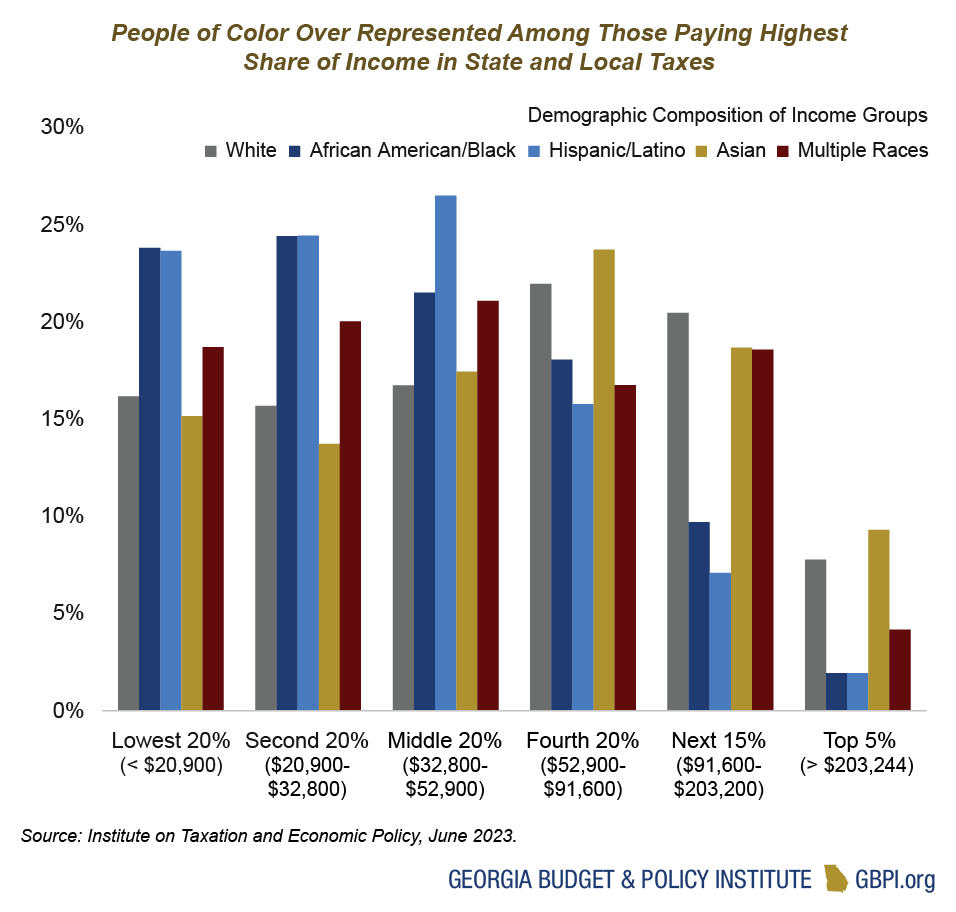

At the beginning of the twentieth century, Georgia generated most of its revenue from a state property tax, which in the intervening decades was weaponized to systematically disenfranchise, intimidate and economically harm Black Georgians. Property tax was implemented alongside the state’s poll tax, which was maintained until 1945. Property tax assessors were given wide latitude to favorably value white landowners’ property while leveraging tax assessments to push Black land and business owners into poverty and, in many cases, eventually seize their property. In 1929, the state adopted corporate and individual income taxes and, in 1937, established the relatively flat individual income tax bracket structure that continues to form the basis for the current tax code. In 1951, the state enacted a sales and use tax of 3 percent, which was increased to its current level of 4 percent in 1989.

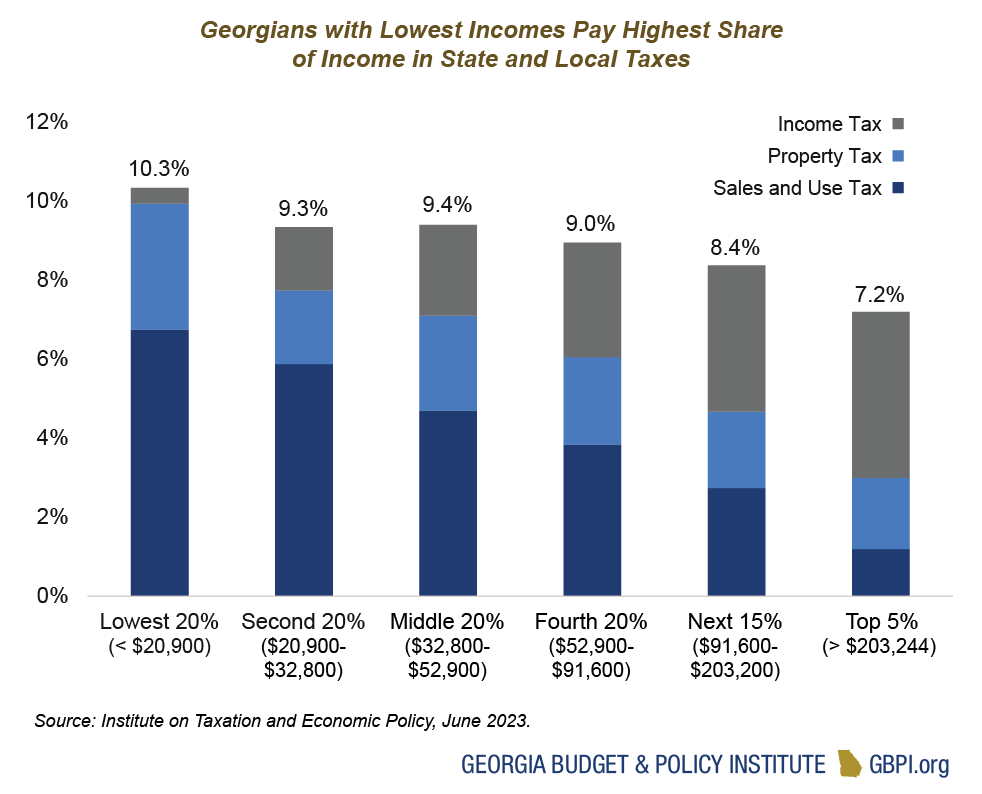

As revenues from income and sales taxes increased, the state phased out its property tax and eliminated it in 2016; local property taxes remain. Historic injustices and harmful policies have resulted in vast disparities in income across race and ethnicity in Georgia. Regressive tax policies at state and local levels worsen those disparities by asking those making the lowest incomes to pay the largest share of what they earn in taxes.

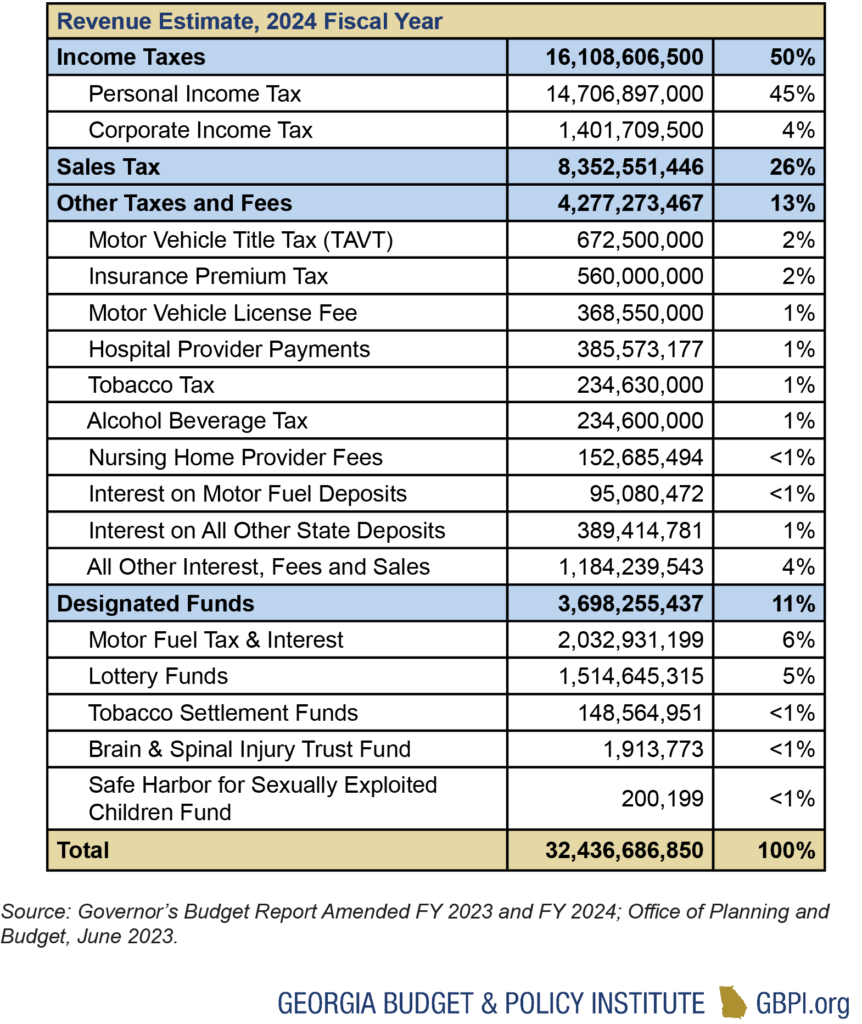

Where Does Georgia’s Money Come From?

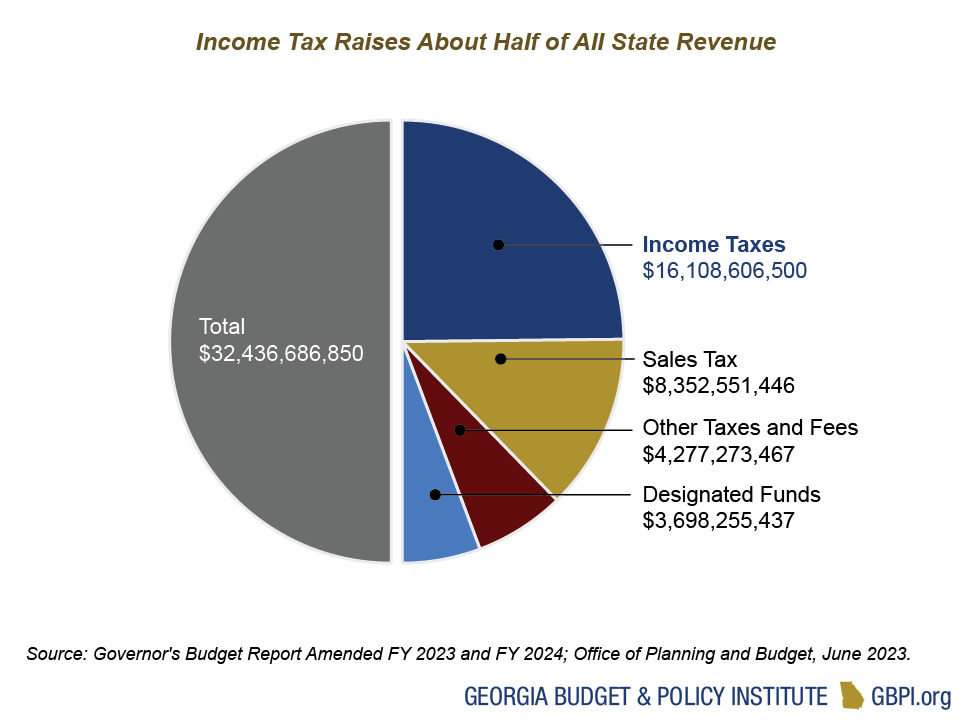

Georgia’s fiscal health depends on the state’s ability to raise money from a variety of sources in a reliable way. Like most states, Georgia collects revenue from a mix of personal and corporate income taxes, sales taxes, gas and vehicle taxes and various other levies and fees. Income taxes are the cornerstone of Georgia’s revenue system, accounting for half of all state funds. Sales taxes are the second largest revenue source, representing slightly less than a quarter of annual collections. A fair and reliable revenue system requires both types of taxes.

Income taxes help balance the regressive effects of sales taxes and fees by allowing the state to collect a proportionate share of revenue from the wealthiest earners and most profitable corporations. A healthy income tax is also less sensitive to economic trends, which can boost revenue growth during good times but decline sharply when recessions occur.

Sales taxes provide a less consistent source of yearly revenue, and they fall more sharply on middle-class families and people with lower incomes. Georgia also offers broad exemptions from sales taxes for most services. However, sales taxes remain a core funding source that allows the state to generate revenue from consumption and economic inputs that would otherwise be exempt from taxation.

In recent years, lawmakers have enacted several measures to ensure sales taxes are applied to online marketplaces and, most recently—in the 2023 Legislative Session—digital downloads. However, the state’s sales tax is not assessed on the purchase of most services and large parts of Georgia’s economy, such as construction labor, the finance industry, attorneys or physicians. Some sales tax exemptions were intentionally created to avoid taxing products families rely on, such as groceries. In contrast, sales of most services are not taxed because lawmakers have not proactively updated the tax code to include them.

Georgia’s Funding Sources

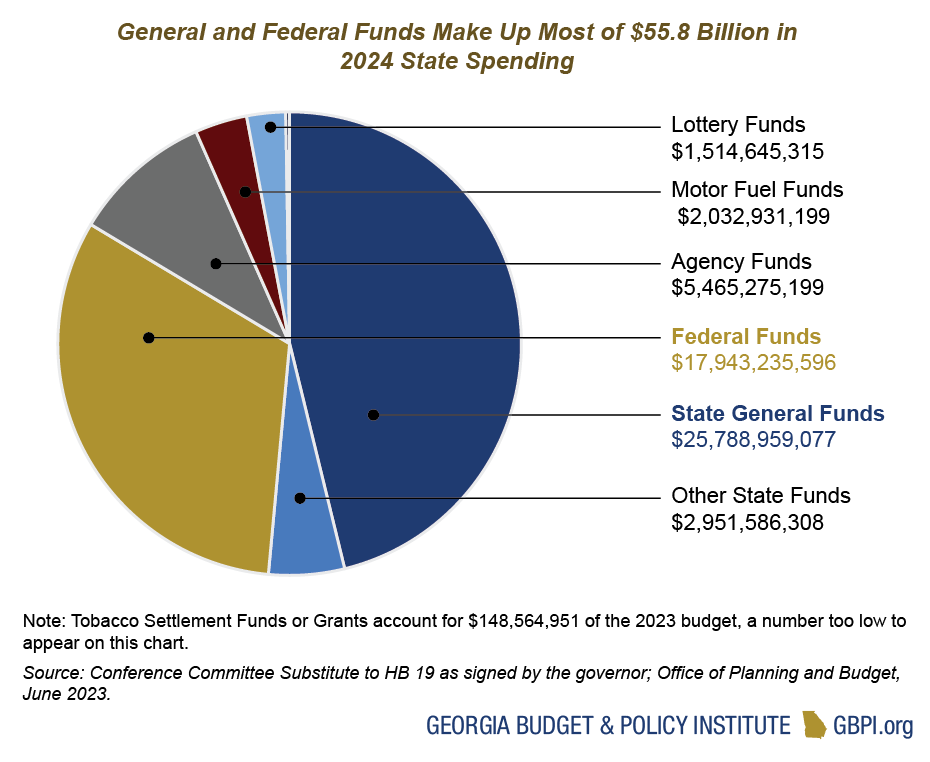

Georgia’s total FY 2024 budget, including federal funds, is $55.8 billion and is made up of six major funding sources:

- General Funds–The state-funded portions of education, Medicaid and most other traditional state services are paid for through the $30.8 billion General Fund, which includes money raised by income taxes, sales taxes and various other taxes and fees.

- Federal Funds–A large share of Georgia’s overall spending for health care, K-12 education, transportation and other services is paid through the administration of $17.9 billion in federal funds.

- Agency Funds–These $5.5 billion in revenue include tuition and fees from colleges and university system research funds, in addition to regulatory fees and revenue raised directly by individual state agencies.

- Lottery Funds–These $1.5 billion in revenue are dedicated to pre-Kindergarten programs and scholarships for higher education.

- Tobacco Settlement Funds or Grants–This ongoing annual payment, $149 million in FY 2024, resulting from a legal settlement with the country’s four largest tobacco companies over health care costs, can be used for anything in the budget.

- Intrastate Transfers–The $5.5 billion of intrastate transfers include payments from the health benefit plan for state employees.

General Funds

$30.8 Billion (55 Percent of Georgia’s Budget)

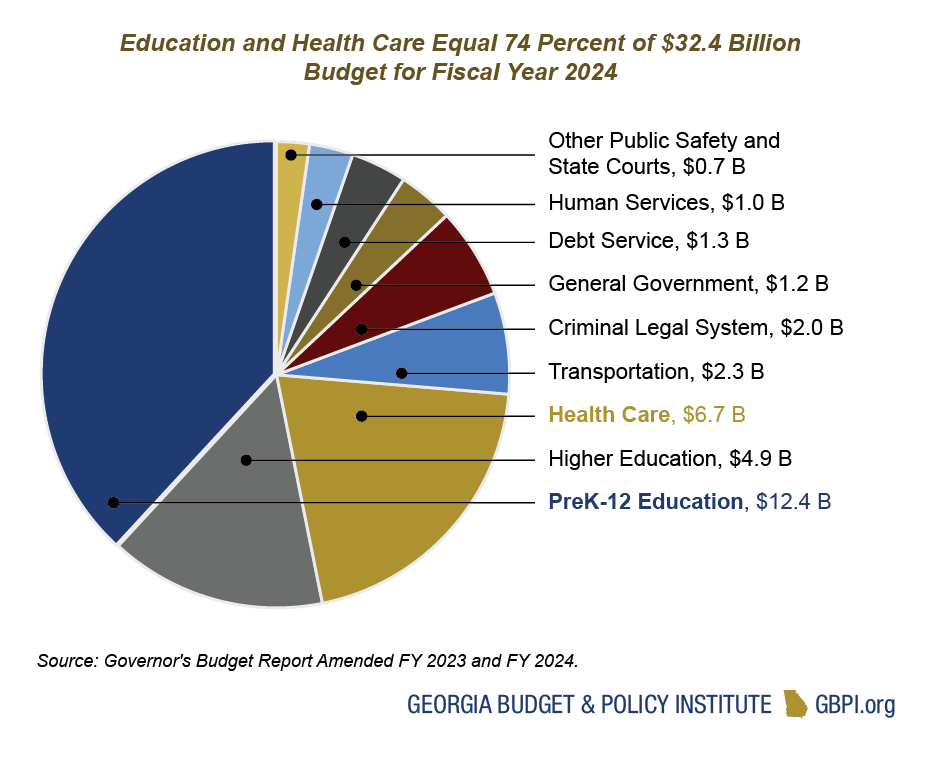

Georgia’s General Fund derives largely from income taxes on personal and corporate earnings and sales taxes on consumer transactions. The state also taxes motor fuel and assesses provider fees on hospitals and nursing homes, along with a variety of other taxes and fees. More than 97 cents of every dollar appropriated by the state pays for eight core priorities:

- Pre-K-12 Education (38 cents of every dollar spent)

- Health Care (21 cents)

- Higher Education (15 cents)

- Transportation (7 cents)

- Corrections, Juvenile Justice and Re-entry (9 cents)

- Debt Service (4 cents)

- Department of Human Services (3 cents)

The remaining General Fund spending is for state agencies, boards and commissions dedicated to activities such as economic development, agriculture and forestry and grant programs. The General Fund also covers the costs of operating the legislative, judicial and executive branches of state government. Not included in Georgia’s General Fund are dedicated taxes and fees that are collected into several other funds. Lottery proceeds are also not included in the General Fund and account for about 5 percent of total state funds or $1.5 billion.

Motor Fuel Funds

$2 Billion (4 Percent of Georgia’s Budget)

Georgia’s Constitution restricts spending revenue from state motor fuel taxes to roads and bridges. The money is dedicated to a mix of new construction, maintenance of existing infrastructure and debt service on past investments. Georgia’s 2024 motor fuel rates are 31.2 cents per gallon of gas and 35 cents per gallon of diesel, a slight uptick from last year. While the state taxes aviation gasoline at one cent per gallon, the state’s Department of Revenue has recognized a permanent tax exemption on the sale of jet fuel, which will cost the state an estimated $61 million in FY 2023. The state’s budget includes a total of $2 billion in motor fuel revenue.

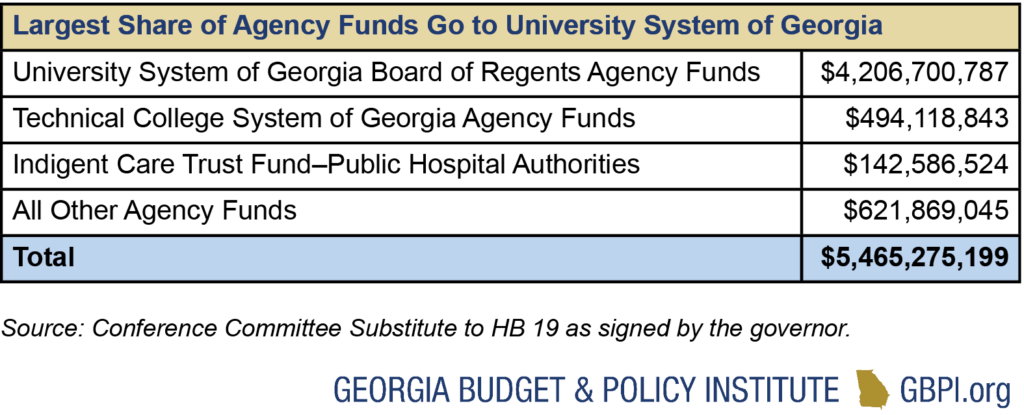

Agency Funds

$5.5 Billion (10 Percent of Georgia’s Budget)

Agency funds include $2.5 billion in tuition and fees collected by the University System of Georgia and the Technical College System of Georgia. The University System of Georgia alone accounts for $4.2 billion in Agency and Research funds. The individual schools retain the money.

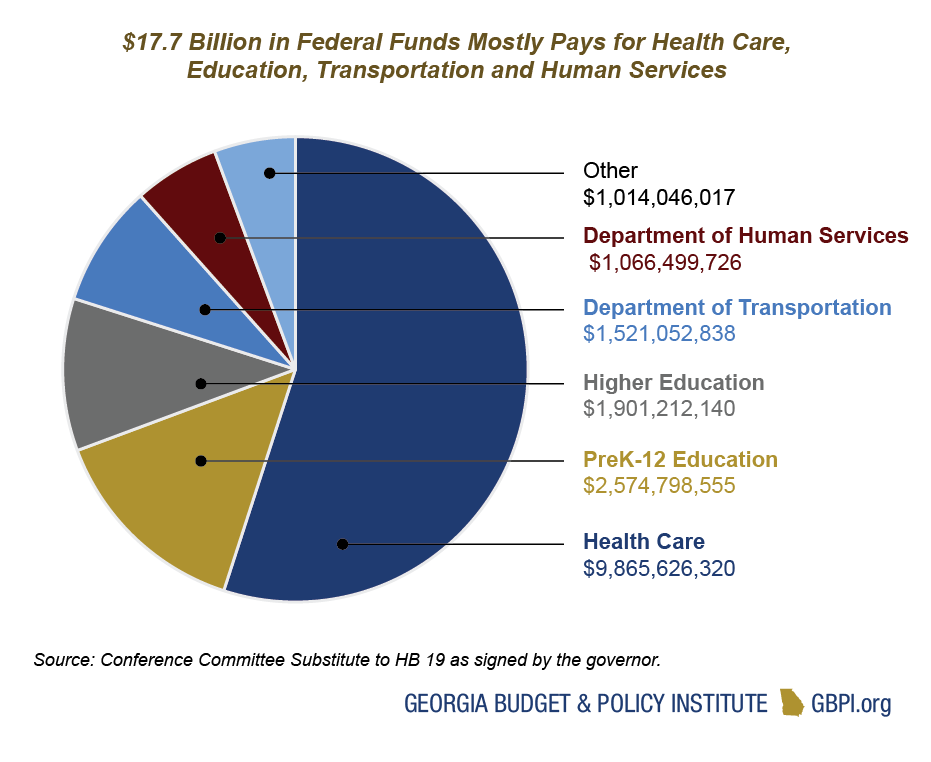

Federal Funds

$17.9 Billion (32 Percent of Georgia’s Budget)

Money from the federal government flows to a range of state programs and services. Georgia spends the vast majority of federal money on the following:

- $10.2 billion for Medicaid, PeachCare and other health care programs

- $2.6 billion for Pre-K-12 education, which includes school nutrition programs, services for students from families with low incomes and support for students with disabilities

- $1.9 billion to support Georgia’s Universities and Technical Colleges

- $1.5 billion for the Georgia Department of Transportation

- $1.1 billion for human services, Temporary Assistance for Needy Families (TANF or cash assistance) and child welfare programs

Federal rules require the state to match federal funding for Medicaid and many other investments that benefit Georgians. As a result, changes in corresponding state funding levels typically track changes in federal funding.

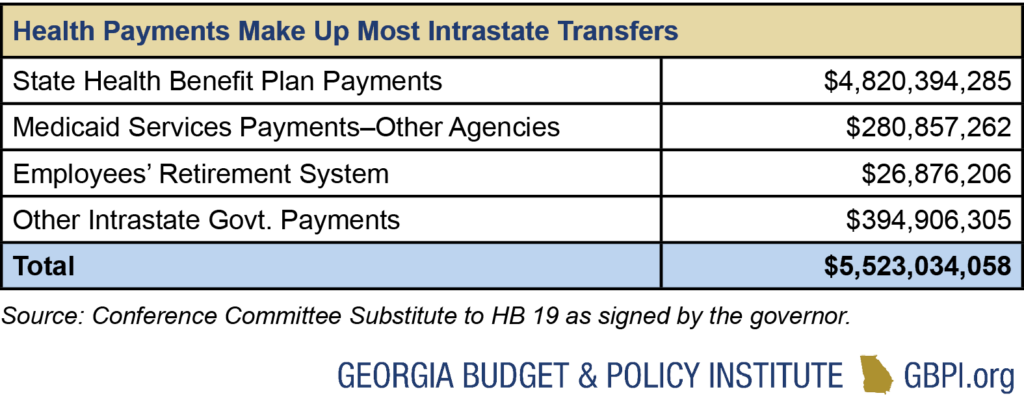

Intrastate Transfers

$5.5 Billion (Included for Reference)

Intrastate transfers are primarily payments from the State Health Benefit Plan, which insures about 665,000 state employees, school system employees, retirees and their families. This year, the employer cost of providing health coverage through the State Health Benefit Plan (SHBP)—which is paid by the state and public schools—spiked by 67 percent. Effective immediately for most state employees, with a two-year phase-in for K-12 schools, the required employer contribution will increase by $7,200 per year for each employee, or by $635 per member, per month from $945 to $1,580. This massive increase was driven by several factors, including an aging member population, the COVID-19 pandemic, stagnant subscriber levels and decisions made by state policymakers, such as a 2019 employer contribution holiday and a 2020 decrease in the employer contribution rate for state employees.

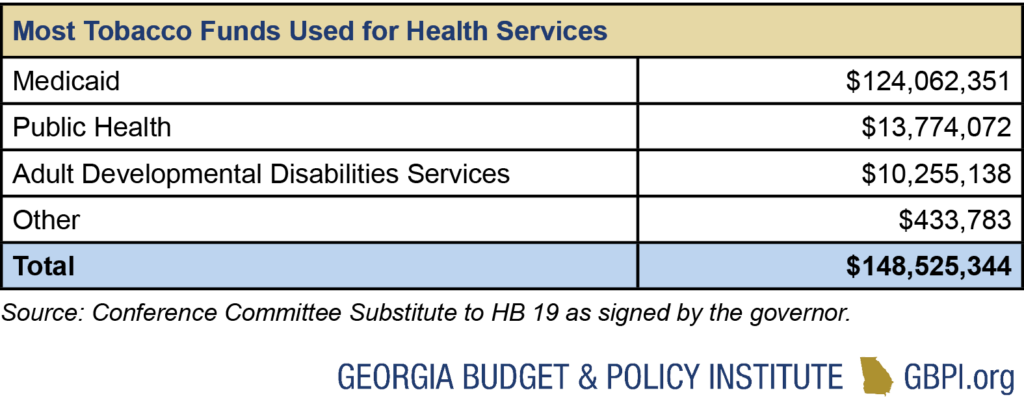

2023 Tobacco Settlement Fund Budget

$149 Million (0.3 Percent of Georgia’s Budget)

Georgia receives annual payments from a large settlement signed in 1998 with four of the country’s largest tobacco companies, known as the Tobacco Master Settlement Agreement. Georgia is not required to dedicate these payments for specific purposes. As a result, the use of tobacco settlement money can vary from year to year, though most of the money in the current year’s budget is allocated to health care.