Budget Basics

Georgia’s 2018 fiscal year runs July 1, 2017 through June 30, 2018 and the total budget available to the state is $45.2 billion. That includes $25 billion in state funding, $13.9 billion in federal funding and $6.4 billion in other funds.

The state budget outlines Georgia’s priorities, how it plans to spend money to meet them and how much revenue it expects to collect. It is the most important piece of legislation lawmakers pass. In fact, it is the only legislation that the General Assembly is legally mandated to pass each year. The Georgia Constitution requires the state to maintain a balanced budget, which means the government cannot spend more money than it collects in revenues.

The budget process is ongoing. Even as Georgia implements its current budget, it is auditing the previous year’s budget and planning for the next one. Beyond the General Assembly, many others participate including the governor, state budget director, state economists, agency leaders and budget officials, state auditors and the public.

Georgia by the Numbers

Importance of the State Budget

Georgia’s budget for 2018 touches the lives of people in every corner of the state. From the mountains of north Georgia to the southern coastal plains, the spending plan shapes the quality of life in Georgia’s communities. The state’s future prosperity depends on Georgia’s investments in essential services like education, health care, public safety and transportation, just to name a few. Here are some examples of the wide impact the state budget has on the lives of Georgians:

1.7 million – approximate number of children in the K-12 public school system. ($9.4 billion in the 2018 state budget)

2 million – approximate number of Georgians who receive health care coverage who are elderly, disabled, children or low-income parents. ($3 billion in the 2018 state budget)

18,000 – approximate miles of road overseen by the Georgia Department of Transportation. ($1.9 billion in 2018 state budget)

54,000 – approximate number of inmates in Georgia Department of Corrections facilities. ($1.2 billion in 2018 state budget)

Where Georgia Ranks Among the States

When it’s good to rank higher, Georgia is…

- 45th* – in Medicaid spending per patient

- 38th – in spending, per public school student

When it’s good to rank lower, Georgia is…

- 10th – in the number of residents living in poverty

- 10th – in the number of children living in poverty

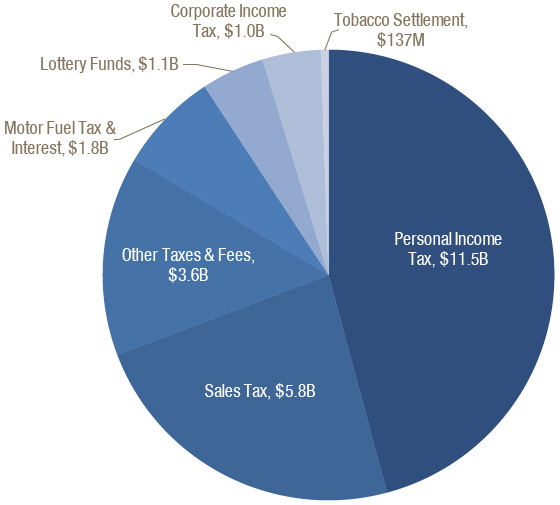

Where Does Georgia’s Money Come From?

Georgia’s fiscal health depends on the state’s ability to raise money from diverse sources in a reliable way. Like most states, Georgia collects revenue from a mix of personal and corporate income taxes, sales taxes, gas and vehicle taxes, and various other levies and fees. Income taxes are the cornerstone of Georgia’s revenue system, accounting for about half of all state funds. Sales taxes are the second largest revenue source, accounting for nearly a quarter of annual collections. A fair and reliable revenue system requires both of these taxes.

Sales taxes provide a reliable baseline of yearly revenue, but they are felt more strongly by working families. They also lag behind changes in the economy. Income taxes help balance out regressive sales taxes and fees by collecting more revenue from wealthier taxpayers and profitable corporations. A healthy income tax is also more sensitive to economic trends, so it helps states maintain strong revenue growth during the good times and recover quicker financially after recessions.

Income Tax Largest Source of State Revenue

2018 Fiscal Year Total State Revenue Projection is $25 billion

Revenue Estimate, 2018 Fiscal Year

| Income Taxes | $12,497,448,163 | 50.0% |

| Personal Income Tax | $11,454,618,163 | 45.8% |

| Corporate Income Tax | $1,042,830,000 | 4.2% |

| Sales Tax | $5,848,547,000 | 23.4% |

| Other Taxes and Fees | $3,583,705,915 | 14.3% |

| Motor Vehicle Title Tax (TAVT) | $769,270,800 | 3.1% |

| Insurance Premium Tax | $449,404,181 | 1.8% |

| Motor Vehicle License Fee | $377,260,000 | 1.5% |

| Hospital Provider Payments | $310,893,887 | 1.2% |

| Other Transportation Fees | $262,171,800 | 1.0% |

| Tobacco Tax | $215,478,400 | 0.9% |

| Alcohol Beverage Tax | $197,778,000 | 0.8% |

| Nursing Home Provider Fees | $171,469,380 | 0.7% |

| State Property Tax* | $0 | 0.0% |

| All Other Interest, Fees and Sales | $829,979,467 | 3.3% |

| Designated Funds | $3,067,650,157 | 12.3% |

| Motor Fuel Tax & Interest | $1,798,850,000 | 7.2% |

| Lottery Funds | $1,130,965,151 | 4.5% |

| Tobacco Settlement Funds | $136,509,071 | 0.5% |

| Brain & Spinal Injury Trust Fund** | $1,325,935 | 0.0% |

| Total | $24,997,351,235 | 100% |

*Georgia’s state property tax was eliminated effective January 1, 2016 after a gradual phaseout enacted in 2010 legislation. It is included here as reference.

**Less than .01%

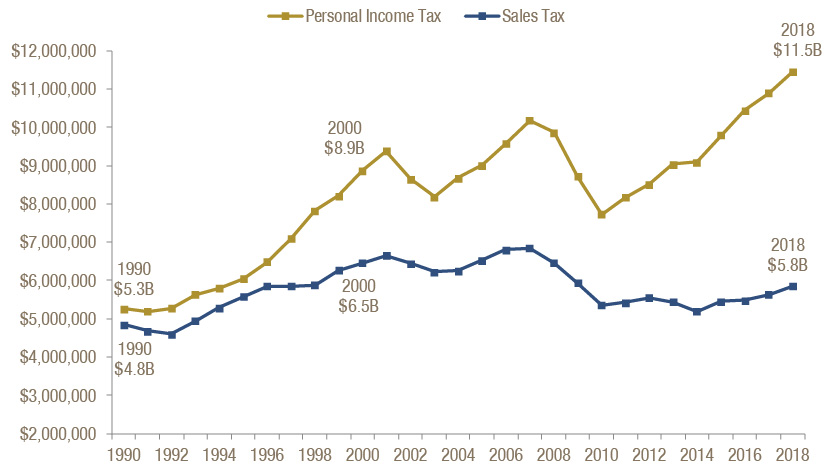

Georgia’s Bottom Line Depends on Healthy Income Tax

The potential to alter Georgia’s tax on individual income is a perennial topic at the General Assembly. Georgia employs a graduated income tax rate system with smaller levies on lower levels of income before topping out at 6 percent. Some contend Georgia needs to reduce its top rate to compete with other states, although there is little evidence that reshuffling income tax rates can drive economic growth. Others propose swapping out Georgia’s graduated structure for a new flat rate, an approach that is likely to lead to higher total tax bills for families who work in low-wage jobs.

Reasonable options to improve Georgia’s income tax are available, such as creating a state earned income tax credit. But more drastic proposals to rework the state’s personal income tax can jeopardize the viability of Georgia’s revenue system. Thirty years ago, the state collected similar amounts of revenue from taxes on personal income and consumer sales. Yet sales tax collections flattened in subsequent decades due to new tax breaks on groceries and business purchases, a difficult recession and a changing economy that shifted toward untaxed goods and services, including items purchased online. In the upcoming budget year, Georgia is expected to collect roughly twice as much revenue from personal income taxes than sales taxes.

Income Tax Collections Grow, Sales Taxes Stagnate

State tax collections by fiscal year, 2016 dollars

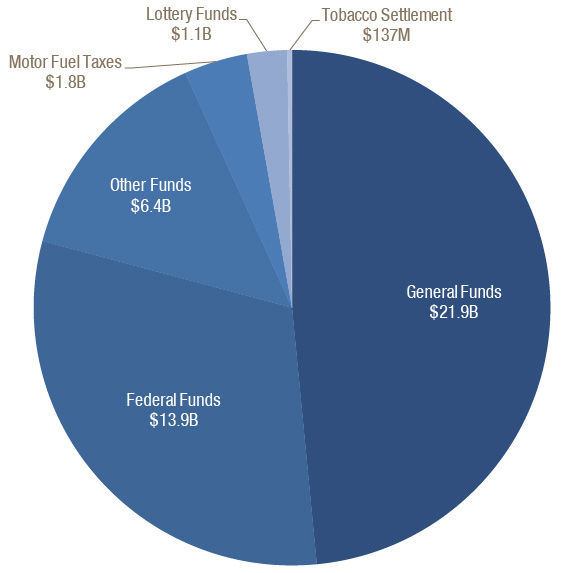

Georgia’s Diverse Funding Sources

Including federal funds, the total 2018 Georgia budget is $45.2 billion and is made up of six funding sources:

- General Funds – Education, public safety and most other traditional state services are paid for from the General Fund, which includes money raised by the motor fuel tax for transportation.

- Federal Funds – A large share of Georgia’s overall spending for services is through administration of federal funds, especially for health care, K-12 education and transportation.

- Other Funds – These include things like tuition and fees from universities and university system research funds.

- Lottery Funds – These are dedicated to Pre-Kindergarten programs and financial aid for higher education.

- Tobacco Settlement Funds – This ongoing annual payment, resulting from a legal settlement with the country’s four largest tobacco companies over health care costs, can be used for any reason in the budget.

- Intrastate Funds – The $4.1 billion of intrastate transfers include payments from the state health plan and are not counted in the $45.2 billion budget.

General and Federal Funds Make Up Most of $45.2 Billion 2018 Budget

General and Motor Fuel Funds

$23,729,877,013 (52 percent of Georgia’s budget)

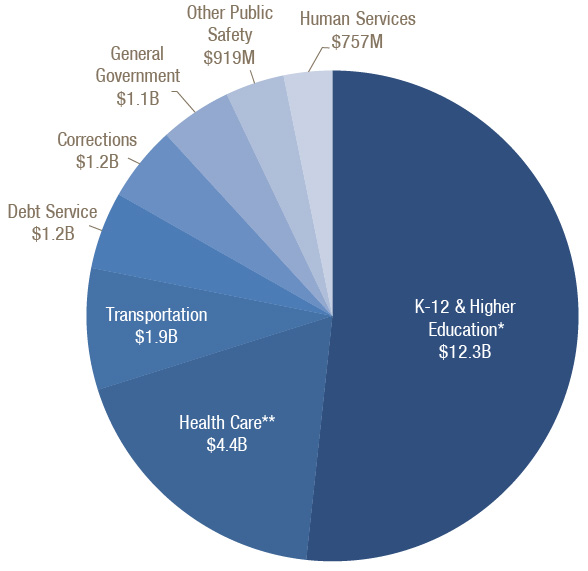

General funds come from state taxes and fees on personal and corporate income, consumer transactions, motor fuel purchases and other activity.About 95 cents of every dollar collected goes to seven areas:

- K-12 and Postsecondary Education (52 cents of every dollar spent)

- Health Care (18 cents)

- Public Safety (9 cents)

- Transportation (8 cents)

- Debt Service (5 cents)

- Department of Human Services (3 cents)

About five cents of each dollar pay for all other state agencies, boards and commissions, covering diverse responsibilities such as economic development, agriculture and forestry, labor relations and others. That remainder also includes the costs of elected officials and judges in the legislative, judicial and executive branches.

Motor Fuel Funds

Georgia’s Constitution requires revenue from the state’s tax on motor fuel to be spent only for roads and bridges. The money is dedicated to a mix of new construction, maintenance on existing infrastructure and debt service on past investments. Lawmakers passed legislation in 2015 that significantly changed the way Georgia taxes motor fuel, raising the gas tax to 26 cents per gallon of gasoline and 29 cents per gallon of diesel fuel. The 2015 reforms also indexed the new rates to inflation and rising fuel efficiency, so that motor fuel collections can keep pace with changing consumer habits and economic trends. The higher tax resulted in $657 million in additional transportation funds in the 2017 budget. The state’s 2018 budget includes about $1.8 billion in motor fuel revenue, an increase of about $139 million over last year.

Education and Health Care More than Two-Thirds of State Budget

2018 Fiscal Year State General Funds and Motor Fuel Funds Budget: $23.7 Billion

* Education spending details: Georgia’s 2018 budget for K-12 is $9.4 billion, for the University System of Georgia is $2.3 billion, the Technical College System of Georgia is $361 million. Also includes Georgia Student Finance Commission’s $114 million and the Dept. of Early Care and Learning’s $61.5 million

** Georgia’s 2018 budget for Medicaid and PeachCare is $2.9 billion; for Behavioral Health & Developmental Disabilities is $1.1 billion; for Public Health is $262 million; and for other health care is $175 million. Health care spending does not include tobacco settlement funds.

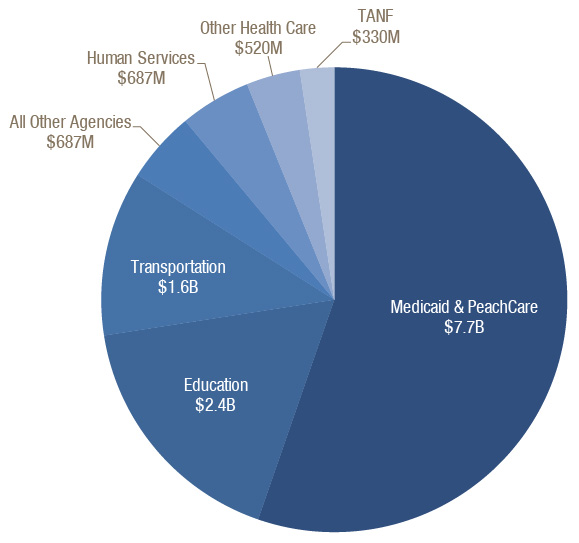

Federal Funds

$13,889,217,110 (31 percent of Georgia’s budget)

Money from the federal government flows to a wide variety of state programs and services. The great majority of federal money is spent for the following:

- $7.7 billion for Medicaid and PeachCare

- $2.4 billion for education including school nutrition programs, services for low-income students and supports for students with disabilities

- $1.6 billion for the Georgia Department of Transportation

- $1.5 billion for child welfare, elder services, Temporary Assistance for Needy Families (TANF) and other human services

The state is required to use its own dollars to match federal funding for Medicaid and many other investments in its people. Consequently, a cut in state funds for a service can lead to a corresponding cut in federal funds.

$13.9 Billion in Federal Funds Mostly Pays for Health Care, Education, Transportation and Human Services

Other Funds

$6,360,622,846 (14 percent of Georgia’s budget)

Other Funds include $3.4 billion in tuition, fees and other revenues collected by the University System of Georgia and Technical College System and $2.1 billion in University System of Georgia research funds. The money is retained by the individual schools.

Most Other Funds Come From College Tuition, Fees and Research

| Tuition and Fees for Higher Education, Other | $3,424,482,743 |

| University System of Georgia Research Funds | $2,130,007,303 |

| All other agency funds | $806,132,800 |

| Total | $6,360,622,846 |

Source: Georgia’s 2018 Fiscal Year Budget (HB 44), signed by governor

Intrastate Transfers

$3,834,802,369 (Included here for reference, but not as a net increase to Georgia’s budget)

Intrastate transfers are primarily payments from the State Health Benefit Plan.

Health Payments Make Up Most Intrastate Transfers

| State Health Benefit Plan Payments | $3,461,320,726 |

| Medicaid Services Payments – Other Agencies | $280,857,262 |

| Other Intrastate Govt. Payments | $171,675,600 |

| Workers Compensation Funds | $95,841,580 |

| State Employee and Teacher Retirement Payments | $59,401,182 |

| Total | $4,069,096,350 |

Source: Georgia’s 2018 Fiscal Year Budget (HB 44), signed by governor

Tobacco Funds

$136,509,071 (0.3 percent of Georgia’s budget)

Georgia receives annual payments from a large settlement signed in 1998 with four of the country’s largest tobacco companies, known as the Tobacco Master Settlement Agreement. Georgia does not explicitly dedicate these payments for specific purposes. As a result, the use of tobacco settlement funds vary from year-to-year.

Most Tobacco Funds Used for Health Services

| 2018 Tobacco Settlement Fund Budget | |

| Low Income Medicaid | $105,910,484 |

| Adult Developmental Disabilities Waiver Services | $10,255,138 |

| Smoking Prevention and Cessation | $6,857,179 |

| Cancer Treatment for Low Income Uninsured | $6,613,249 |

| Aged Blind & Disabled Medicaid | $6,191,806 |

| Underage Smoking Compliance | $433,783 |

| Departmental Administration | $131,795 |

| Cancer Registry | $115,637 |

| Total | $136,509,071 |

Source: Georgia’s 2018 Fiscal Year Budget (HB 44), signed by governor

Budget Trends

The $25 billion state budget signed into law by Gov. Nathan Deal for the 2018 fiscal year starting July 1, 2017 represents a $1.26 billion increase in total state spending from last year, an increase of 5.3 percent. Georgia’s rate of revenue collection continues to show consistent yet modest growth since the end of the economic downturn earlier this decade. Annual revenue growth averaged 4.3 percent from the 2012 to 2017 budget years, excluding a one-time surge due to a package of transportation taxes enacted in 2015.

While the 2018 budget represents a high-water mark for Georgia in absolute dollar terms, it is slightly less than the last budget passed before the recession once accounting for economic changes and the rising needs of a growing state. Once both inflation and the addition of nearly 1 million new Georgians are factored in, the 2018 budget equates to $2,379 per person, or $82 less than the 2009 per-person amount. The 2018 budget would include about an extra $865 million if state lawmakers spent the same per Georgian as before the recession.

The 2018 budget includes some worthwhile investments, such as modest increases to pay for child care subsidies, new child welfare case workers and additional waivers for Georgians with disabilities to receive care at home or in their community. State lawmakers also authorized sizable salary increases of 20 percent for state troopers and 19 percent for child welfare workers to help with recruitment and retention. At the same time, most of the new money is consumed by meeting the needs of an aging and growing population, including increased student enrollment, growing pension liabilities, high health care costs and cost of living adjustments for state employees.

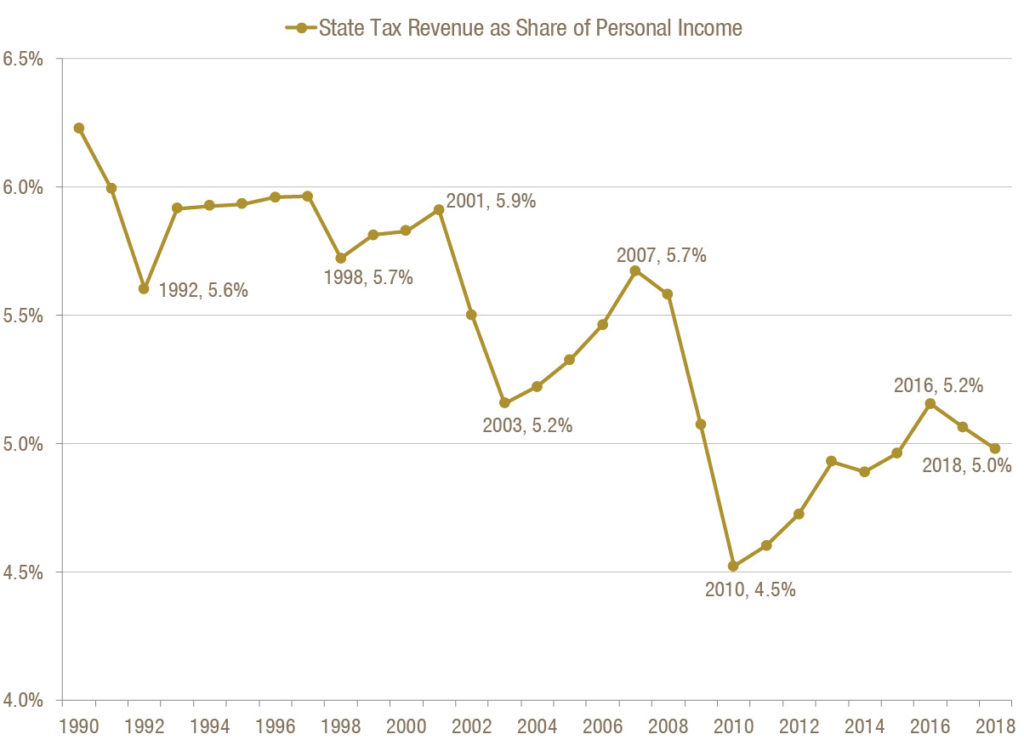

Georgians’ Taxes Lower than in Past

The average Georgian today pays a lower effective tax rate than at most points over the last three decades. During the 1990s, Georgians contributed an average of 5.9 percent of their income to the state treasury, once accounting for all state levies. Those include taxes on income, sales and personal property such as vehicles. Even as state lawmakers cut taxes during that decade with measures like a new exemption for groceries, Georgians’ average effective tax rate remained about the same. A strong economy allowed the state to cut taxes while still offering key services.

This dynamic changed at the turn of the century. Georgians saw a dramatic drop in state tax bills on average due to a combination of a weakened sales tax base, two economic downturns and a slew of new tax breaks passed during the 2000s. Revenues plummeted to 4.5 percent of personal income in 2010 due to the fiscal crisis brought on by the Great Recession. Revenues ticked back up in subsequent years, but at 5 percent forecast for the 2018 fiscal year, expected collections are still relatively low. The average Georgian paid an effective tax rate of 5.6 percent at the low point of the 1990s. If that held true today, state lawmakers would gain about an extra $3 billion in the next budget year to invest in education and other building blocks of a strong economy and thriving communities.

Georgians Pay Lower Effective Tax Rate than in Past

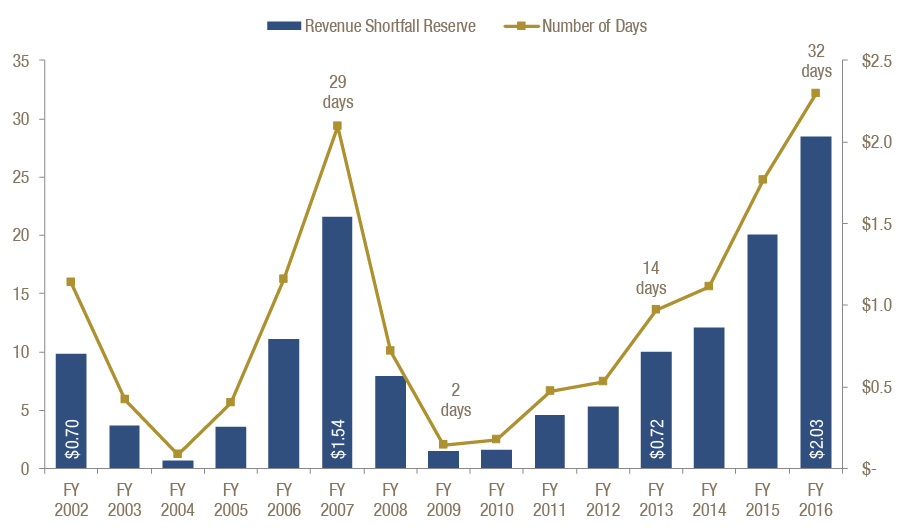

State Savings Account Back to Adequate Level

The Revenue Shortfall Reserve is Georgia’s rainy day fund, meant to provide stability during economic downturns. The fund acts like a savings account for the state to cover expenses and maintain services when revenues decline unexpectedly. Sound financial management guides lawmakers to build up the reserves during good economic times and spend it down in bad times to avoid damaging cuts to key services. Maintaining adequate reserve money is also important to keep Georgia’s stellar AAA bond rating, a top rating that allows lawmakers to borrow money at favorable terms and save millions of dollars in annual interest payments.

The General Assembly cannot appropriate money to the reserves through the normal budget process. Instead, any money not spent by the end of each fiscal year is automatically transferred to the fund. Georgia law says the fund cannot exceed 15 percent of the previous year’s net revenue. At the end of the 2016 budget year, Georgia’s reserves held more than $2 billion, or 9.1 percent of that year’s tax receipts. Now at its highest level in the past 15 years, the reserve fund holds enough money to operate the functions of state government for about 32 days.

Rainy Day Fund Tops $2 Billion Goal

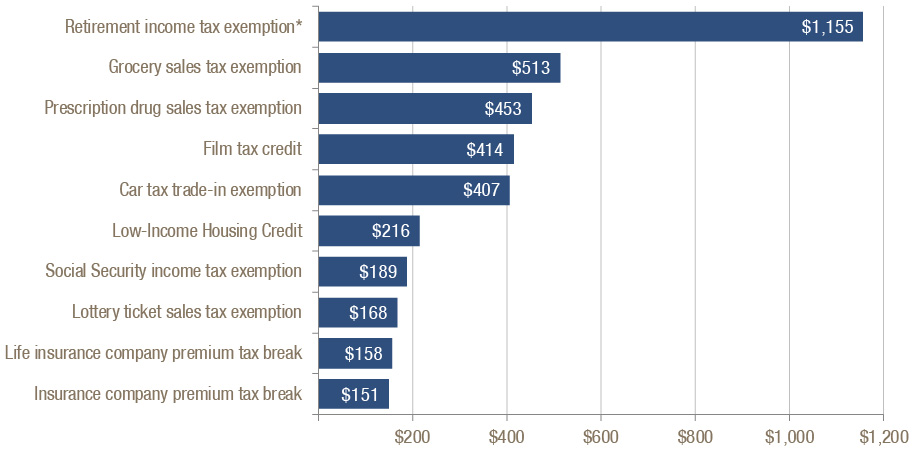

Unclear if All Tax Breaks Worth the Cost

Georgia foregoes billions of dollars in state revenue each year through dozens of credits, deductions and other breaks technically known as tax expenditures. Aimed at policy goals such as economic growth or boosting family pocketbooks, Georgia’s assortment of tax breaks add up to an estimated $8.6 billion in lost state revenue in the 2018 budget year. Even by a more conservative estimate that excludes a set of business exemptions found in most states, Georgia’s tax breaks still yield an annual cost of about $5 billion.

Some of Georgia’s tax breaks, such as sales tax exemptions for groceries and key business purchases including energy used in manufacturing, provide protections for families and the economy. But others deliver outsized gains to select groups or industries, often with questionable benefit to the state. It’s unclear which tax breaks are worth the cost and which aren’t because Georgia lacks any formal review process to measure and compare costs and benefits. A growing number of states is charting a path that protects taxpayers and makes sure tax breaks are working as lawmakers intend. In the past five years, at least 27 states, including Florida, Texas and other Southern neighbors, either created a new tax break review process or improved upon existing practices.

Estimate Value of 10 Largest Tax Breaks

All state tax expenditures amount to $8.61 billion in 2018

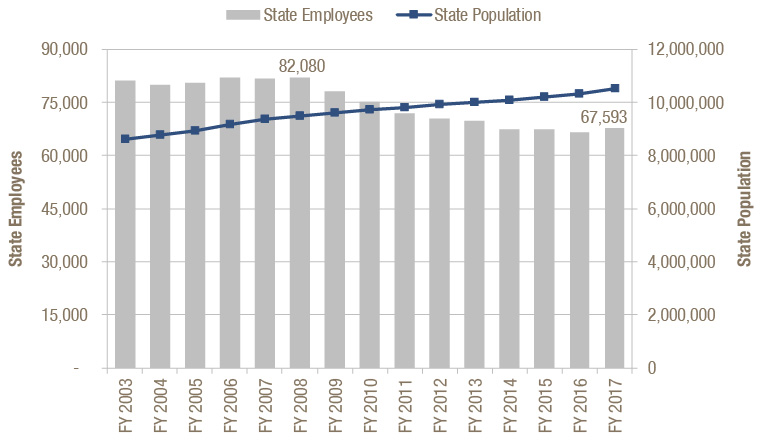

Fewer Employees Serving More People

Georgia continues to grow rapidly, adding residents and businesses faster than the national average. The state’s ongoing growth brings many benefits, but also a slew of challenges on issues such as housing, transportation and public safety. Since the Great Recession, Georgia’s state employee workforce has shrunk while the needs of the state’s population and economy have grown. Georgia employed about 14,500 fewer state workers during 2017 than it did in 2008 before the economic downturn, a drop of nearly 18 percent over a decade.* Georgia added about 1 million new residents in that same span, a spike of nearly 11 percent.

As a result, a smaller number of state employees are stretched thin to cover a growing set of needs. That means a decrease in state patrol officers keeping highways safe, fewer health and safety inspectors protecting the public and fewer examiners to keep up with demand for business licenses. One positive sign is the fact that Georgia’s workforce grew over the last year, the first growth since the recession. State agencies added nearly 1,100 workers from 2016 to 2017, due mostly to a large boost in the number of child welfare workers in the Department of Family and Child Services. Lawmakers also included new money in the budget to increase salaries for social service case workers and state troopers to address dangerously high turnover rates in those fields.

Fewer State Employees Serving Larger Population*

*Numbers exclude Board of Regents, University System

Continue Reading the 2018 Georgia Budget Primer

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2017/georgia-budget-primer-2018/”]Intro[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2017/georgia-k-12-education-budget-primer-state-fiscal-year-2018/”]K-12 Education[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2017/georgia-higher-education-budget-primer-state-fiscal-year-2018/”]Higher Education[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2017/georgia-human-services-budget-primer-state-fiscal-year-2018/”]Human Services[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2017/georgia-health-budget-primer-state-fiscal-year-2018/”]Health[/button]