Introduction

Georgia plans to spend $26.2 billion in state funds raised through taxes and fees for the 2019 fiscal year. The budget plan anticipates a revenue increase of $1.2 billion, or 4.9 percent more than the prior year.

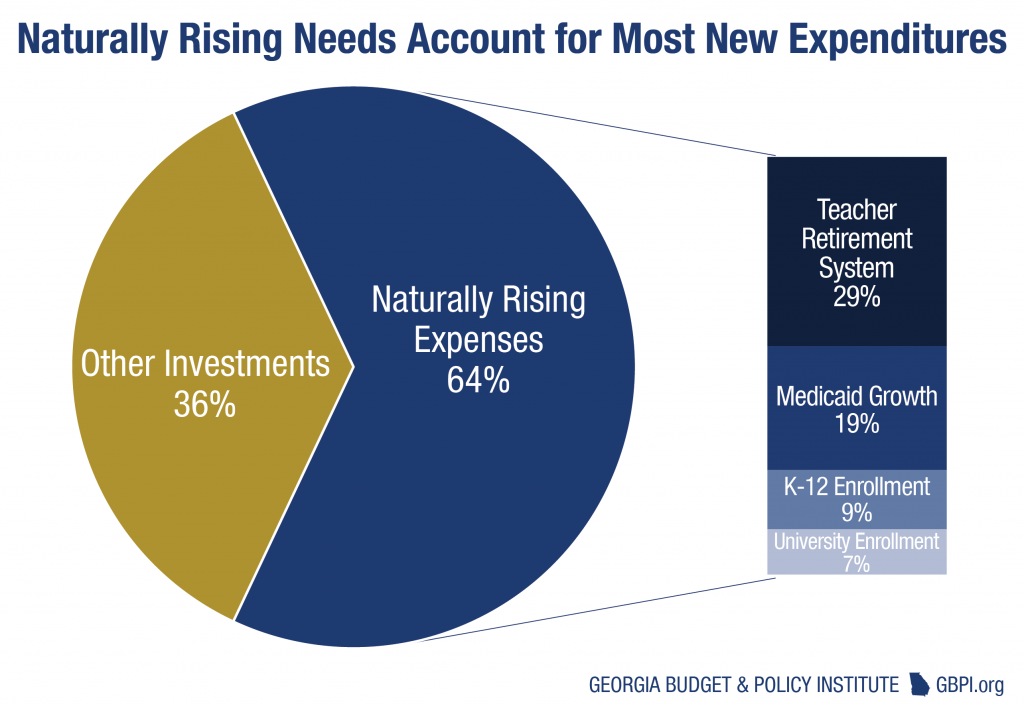

Keep in mind when you hear Georgia’s $26.2 billion budget is record-setting that 64 percent of the increase over the year before is due to natural growth. Unless the state’s economy sinks, factors like an increasing population and rising retirement benefits for state employees will almost always make the cost of running the state higher from year to year. You’ll find a guide to state spending for public services and other needs critical to the quality of life for people across Georgia in the pages that follow.

Georgia’s 2019 budget adds $167 million more to the K-12 spending plan than the prior year, fully funding the state’s own formula for the first time in 16 years. The 2019 budget also adds $20.5 million for children’s mental health services for crisis intervention, education assistance and suicide prevention programs. Meanwhile, providers of foster care are allotted $15.1 million more in the 2019 state budget to keep pace with need, largely caused by Georgia’s opioid crisis.

The Georgia Budget and Policy Institute’s Georgia Budget Primer 2019 is a clear explanation of the state’s revenue collections and its spending plan. It includes basics to help a novice understand the budget’s complexities. Seasoned observers of state government will also find this publication is an authoritative reference during the 12-month fiscal year that starts July 1, 2019.

The governor proposed the 2019 state budget at the start of the Georgia General Assembly in January 2018. State lawmakers made minor changes to it before Gov. Nathan Deal signed the budget into law in May. Lawmakers will amend the 2019 state budget after the next legislative session starts January 2019 to reconcile it with actual revenues and make other needed adjustments. GBPI will provide up-to-date analysis of the changes along the way.

An extended run of healthy annual state revenues resulted in a 2019 spending plan that provides a solid foundation for Georgia to invest more in its health care system, schools and communities. Still, much work remains to create a fair and inclusive Georgia where all people prosper.

Budget Basics

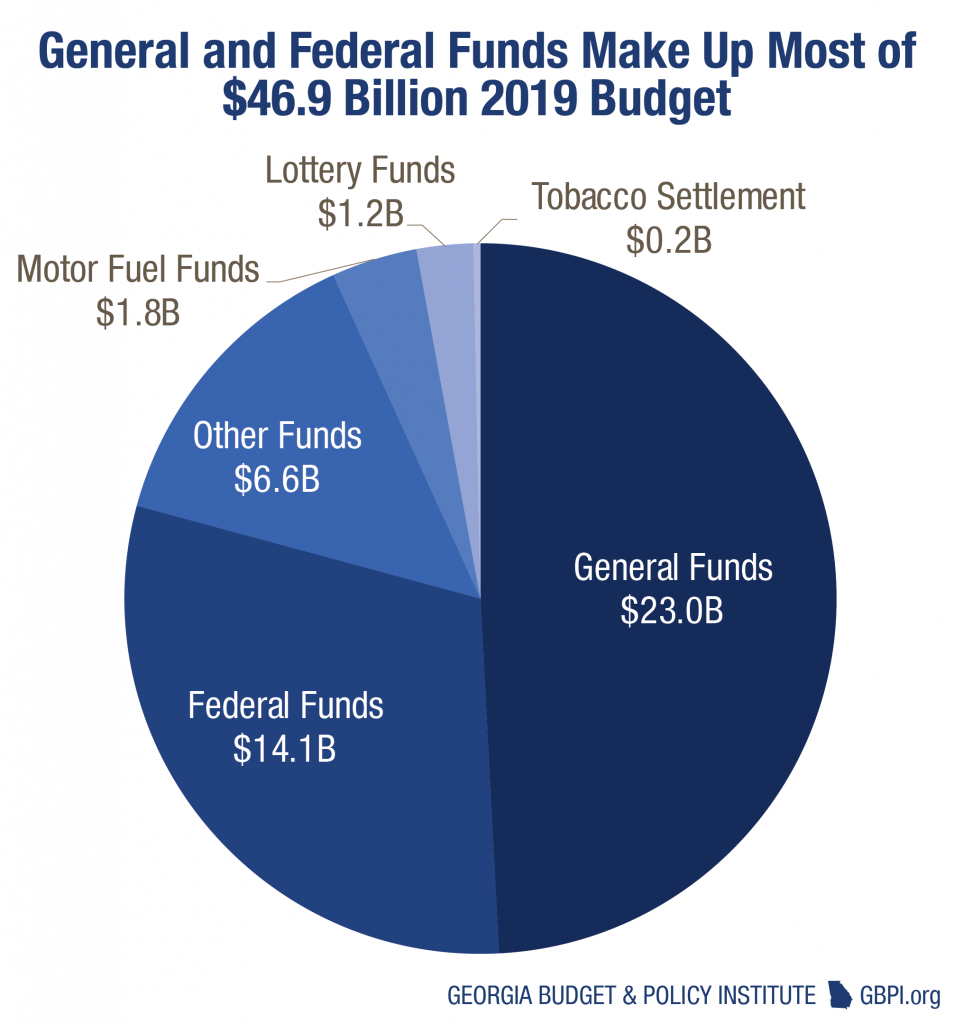

Georgia’s 2019 fiscal year runs July 1, 2018 through June 30, 2019 and the total budget available to the state is $46.9 billion. That includes $26.2 billion in state funding, $14.1 billion in federal funding and $6.6 billion in other funds.

The state budget outlines Georgia’s priorities, how it plans to spend money to meet them and how much revenue it expects to collect. It is the most important piece of legislation lawmakers pass. In fact, it is the only legislation that the General Assembly is legally mandated to pass each year. The Georgia Constitution requires the state to maintain a balanced budget, which means the government cannot spend more money than it collects in revenues.

The budget process is ongoing. Even as Georgia is implementing its current budget, it is auditing the previous year’s budget and planning for the next one. Beyond the General Assembly, many others participate in the process, including the governor, state budget director, state economists, agency leaders and budget officials, state auditors and the public.

Georgia by the Numbers

Importance of the State Budget

Georgia’s budget for 2019 touches the lives of people in every corner of the state. From the mountains of north Georgia to the southern coastal plains, the spending plan affects the quality of life in Georgia’s communities. The state’s future prosperity depends on Georgia’s investments in essential services like education, health care, public safety and transportation, just to name a few. Here are some examples of the ways the state budget affects the lives of Georgians:

1.7 million – approximate number of children in the K-12 public school system ($9.9 billion in the 2019 state budget)

2 million – approximate number of Georgians who receive health care coverage who are elderly, disabled, children or low-income parents ($3.1 billion in the 2019 state budget)

18,000 – approximate miles of road overseen by the Georgia Department of Transportation ($1.9 billion in 2019 state budget)

53,000 – approximate number of inmates in Georgia Department of Corrections facilities ($1.2 billion in 2019 state budget)

Where Georgia Ranks Among the States

When it’s good to rank higher, Georgia is…

- 45th – in Medicaid spending per patient

- 37th – in spending, per public school student

When it’s good to rank lower, Georgia is…

- 10th – in the number of residents living in poverty

- 5th – in the percent of residents without health coverage

Where Does Georgia’s Money Come From?

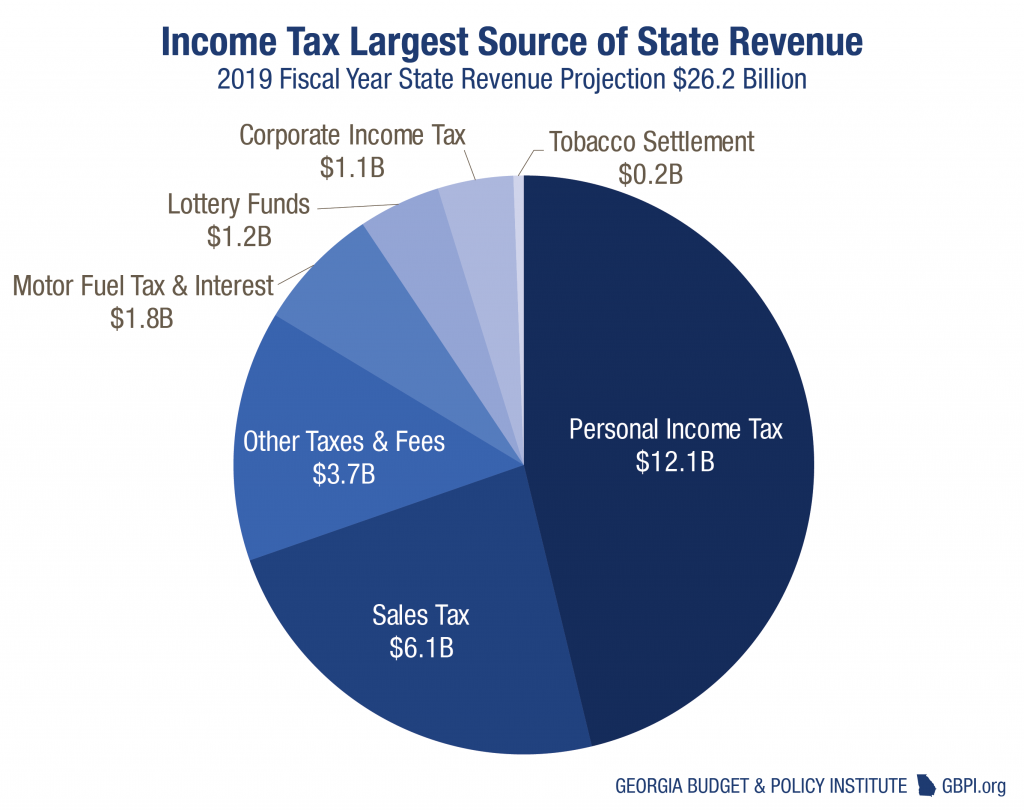

Georgia’s fiscal health depends on the state’s ability to raise money from diverse sources in a reliable way. Like most states, Georgia collects revenue from a mix of personal and corporate income taxes, sales taxes, gas and vehicle taxes, and various other levies and fees.

Income taxes are the cornerstone of Georgia’s revenue system, accounting for about half of all state funds. Sales taxes are the second largest revenue source, accounting for nearly a quarter of annual collections. A fair and reliable revenue system requires both of these taxes, rather than primarily using one or the other.

Sales taxes provide a consistent baseline of yearly revenue, but they fall more sharply on people and families who work. They also lag behind changes in the economy including the rapid growth of online commerce. Income taxes help balance out regressive sales taxes and fees by collecting more revenue from wealthier taxpayers and profitable corporations. A healthy income tax is also more sensitive to economic trends, so it helps states maintain strong revenue growth during the good times and recover quicker financially after recessions.

Revenue Estimate, 2019 Fiscal Year

| Income Taxes | $13,228,652,059 | 50.4% |

| Personal Income Tax | $12,125,672,979 | 46.2% |

| Corporate Income Tax | $1,102,979,080 | 4.2% |

| Sales Tax | $6,141,780,824 | 23.4% |

| Other Taxes and Fees | $3,672,880,037 | 14.0% |

| Motor Vehicle Title Tax (TAVT) | $719,908,414 | 2.7% |

| Insurance Premium Tax | $508,348,030 | 1.9% |

| Motor Vehicle License Fee | $379,458,109 | 1.4% |

| Hospital Provider Payments | $326,188,448 | 1.2% |

| Other Transportation Fees | $285,000,000 | 1.1% |

| Tobacco Tax | $221,000,000 | 0.8% |

| Alcohol Beverage Tax | $199,472,000 | 0.8% |

| Nursing Home Provider Fees | $157,326,418 | 0.6% |

| State Property Tax* | $0 | 0.0% |

| All Other Interest, Fees and Sales | $876,178,618 | 3.3% |

| Designated Funds | $3,183,602,054 | 12.1% |

| Motor Fuel Tax & Interest | $1,830,500,000 | 7.0% |

| Lottery Funds | $1,201,496,219 | 4.6% |

| Tobacco Settlement Funds | $150,159,978 | 0.6% |

| Brain & Spinal Injury Trust Fund** | $1,445,857 | 0.0% |

| Total | $26,226,914,974 | 100% |

*Georgia’s state property tax was eliminated effective January 1, 2016 after a gradual phaseout enacted in 2010 legislation. It is included here as reference.

**Less than .01%

Georgia’s Diverse Funding Sources

Including federal funds, the total 2019 Georgia budget is $46.9 billion and is made up of six funding sources:

- General Funds – Education, public safety and most other traditional state services are paid for from the General Fund, which includes money raised by the motor fuel tax for transportation.

- Federal Funds – A large share of Georgia’s overall spending for services is through administration of federal funds, especially for health care, K-12 education and transportation.

- Other Funds – These mostly include tuition and fees from universities and university system research funds.

- Lottery Funds – These are dedicated to Pre-Kindergarten programs and scholarships for higher education.

- Tobacco Settlement Funds – This ongoing annual payment, resulting from a legal settlement with the country’s four largest tobacco companies over health care costs, can be used for any reason in the budget.

- Intrastate Funds – The $4.2 billion of intrastate transfers include payments from the state health plan and are not counted in the $46.9 billion budget.

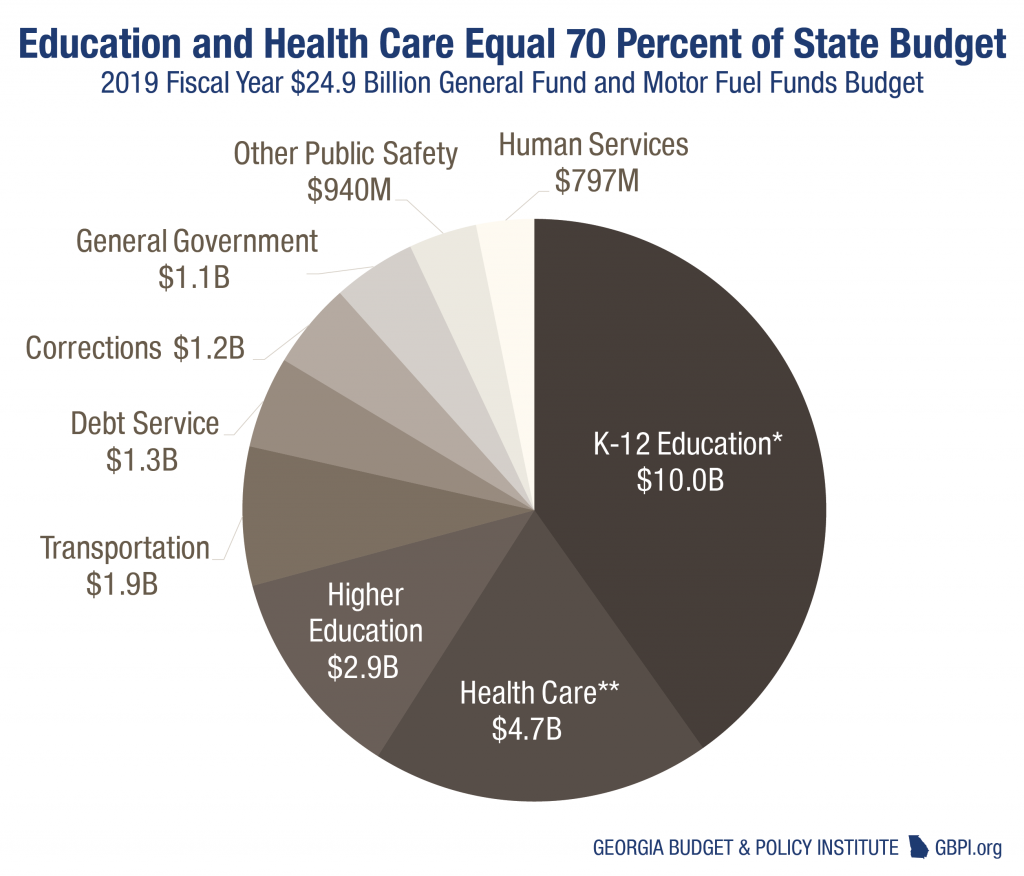

General and Motor Fuel Funds

$24,875,258,777 (53 percent of Georgia’s budget)

General funds come from state taxes and fees on personal and corporate income, consumer transactions, motor fuel purchases and other activity. Nearly 96 cents of every dollar collected goes to seven areas:

- K-12 Education (40 cents of every dollar spent)

- Health Care (19 cents)

- Higher Education (12 cents)

- Public Safety (9 cents)

- Transportation (8 cents)

- Debt Service (5 cents)

- Department of Human Services (3 cents)

The remaining four cents of each dollar pay for all other state agencies, boards and commissions, covering diverse responsibilities such as economic development, agriculture and forestry, labor relations and others. Those four cents also include the costs of elected officials and judges in the legislative, judicial and executive branches.

Motor Fuel Funds

Georgia’s Constitution requires revenue from the state’s tax on motor fuel to be spent only for roads and bridges. The money is dedicated to a mix of new construction, maintenance on existing infrastructure and debt service on past investments. Lawmakers passed legislation in 2015 that modified and slightly increased the state’s motor fuel tax. The 2015 reforms also tied the new rates to both inflation and rising fuel efficiency, so that collections can keep pace with economic trends and changing consumer habits. Georgia’s motor fuel rates in 2018 are 27 cents per gallon of gasoline and 30 cents per gallon of diesel, a slight uptick from last year due to the automatic adjustments. The 2015 reforms allowed Georgia to collect an additional $881 million for investments in roads and bridges in the 2017 budget, the first year collections from the higher levy were included. The state’s 2019 budget includes $1.83 billion in motor fuel revenue, an increase of about $32 million over the 2018 budget.

*Education spending details: Georgia’s 2018 budget for K-12 includes $9.9 billion for the Department of Education and $61.5 million for the Department of Early Care and Learning. Higher Education spending includes $2.4 billion for the Board of Regents, $369 million for the Technical College System and $142 million for the Student Finance Commission.

** Health Care spending includes $3.1 billion for Medicaid and PeachCare, $1.1 billion for Behavioral Health and Development Disabilities, $269 million for Public Health and $175 million for other health care.

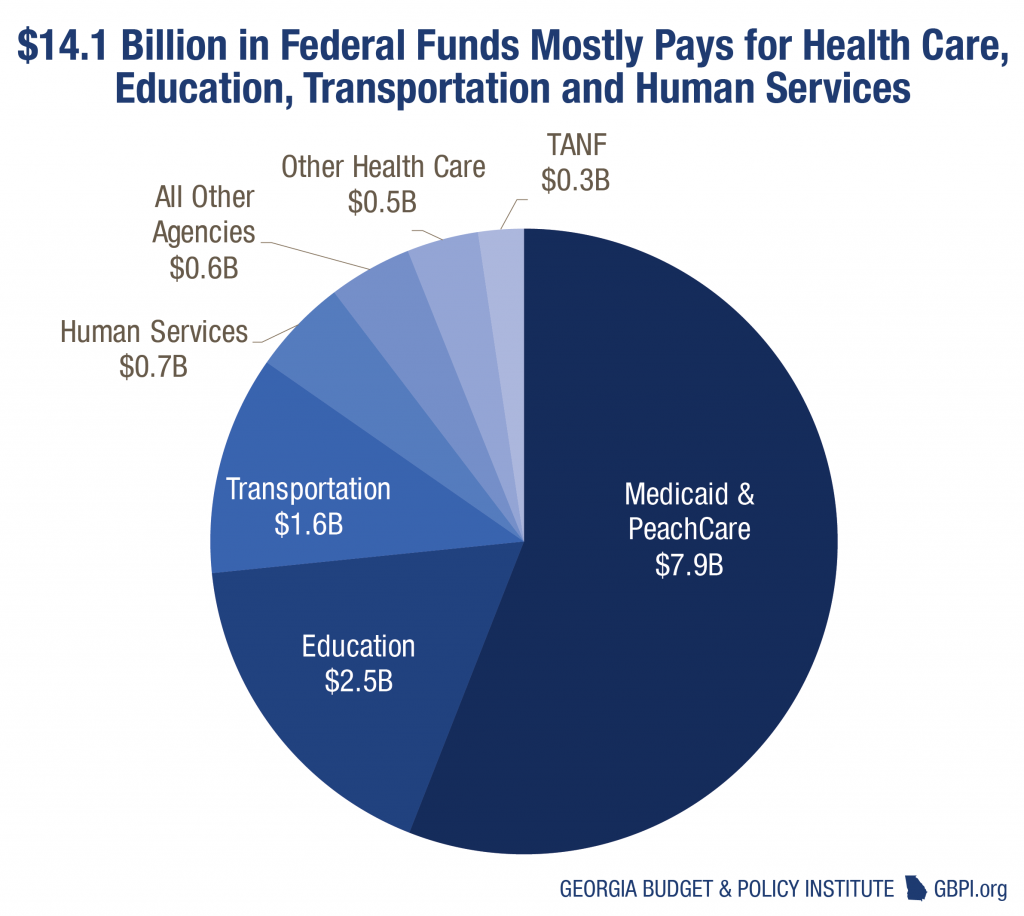

Federal Funds

$14,075,878,141 (30 percent of Georgia’s budget)

Money from the federal government flows to a range of state programs and services. Georgia spends the vast majority of federal money on the following:

- $7.9 billion for Medicaid and PeachCare

- $2.5 billion for education including school nutrition programs, services for low-income students and supports for students with disabilities

- $1.6 billion for the Georgia Department of Transportation

- $1.5 billion for child welfare, elder services, Temporary Assistance for Needy Families (TANF) and other human services

The state is required to use its own dollars to match federal funding for Medicaid and many other investments in its people. Consequently, a cut in state funds for a service can lead to a corresponding cut in federal funds.

Other Funds

$6,562,704,363 (14 percent of Georgia’s budget)

Other Funds include $3.4 billion in tuition, fees and other revenues collected by the University System of Georgia and Technical College System and $2.3 billion in University System of Georgia research funds. The money is retained by the individual schools.

Most Other Funds Come From College Tuition, Fees and Research

| Tuition and Fees for Higher Education, Other | $3,402,081,697 |

| University System of Georgia Research Funds | $2,334,323,592 |

| All other agency funds | $826,299,074 |

| Total | $6,562,704,363 |

Source: Georgia’s 2019 Fiscal Year Budget (HB 684), signed by governor

Intrastate Transfers

$4,166,681,595 (Included here for reference, but not as a net increase to Georgia’s budget)

Intrastate transfers are primarily payments from the State Health Benefit Plan.

Health Payments Make Up Most Intrastate Transfers

| State Health Benefit Plan Payments | $3,672,579,618 |

| Medicaid Services Payments – Other Agencies | $280,857,262 |

| Other Intrastate Govt. Payments | $149,157,733 |

| Workers Compensation Funds | $64,086,982 |

| Total | $4,166,681,595 |

Source: Georgia’s 2019 Fiscal Year Budget (HB 684), signed by governor

Tobacco Funds

$150,159,978 (0.3 percent of Georgia’s budget)

Georgia receives annual payments from a large settlement signed in 1998 with four of the country’s largest tobacco companies, known as the Tobacco Master Settlement Agreement. Georgia does not explicitly dedicate these payments for specific purposes. As a result the use of tobacco settlement money can vary from year to year, though most dollars in recent budgets have gone to health care.

Most Tobacco Funds Used for Health Services

| 2019 Tobacco Settlement Fund Budget | |

| Low Income Medicaid | $119,561,391 |

| Adult Developmental Disabilities Waiver Services | $10,255,138 |

| Smoking Prevention and Cessation | $6,857,179 |

| Cancer Treatment for Low Income Uninsured | $6,613,249 |

| Aged Blind & Disabled Medicaid | $6,191,806 |

| Underage Smoking Compliance | $433,783 |

| Departmental Administration | $131,795 |

| Cancer Registry | $115,637 |

| Total | $150,159,978 |

Source: Georgia’s 2019 Fiscal Year Budget (HB 684), signed by governor

Budget Trends

The $26.2 billion state budget signed into law by Gov. Nathan Deal for the 2019 fiscal year starting July 1, 2018 represents a $1.23 billion increase in total state spending from last year, an increase of 4.9 percent. The spending plan marks a positive step forward on education and a few other crucial issues, yet also falls short of addressing some of the state’s pressing needs.

The budget includes the first fully funded K-12 education formula in 16 years, more money for foster care and a boost in support for mental health and substance use services, among other positive trends. At the same time, state leaders missed chances to boost Georgia’s communities and families, especially allowing another year to pass without accepting billions of federal dollars available to put a health insurance card in every Georgian’s pocket through Medicaid expansion.

Georgia’s rate of revenue collection continues to show consistent growth since the end of the Great Recession, yet is also more constrained than before the crash. The modest pace of revenue growth means most new spending covers the costs associated with naturally rising needs and expenses, rather than new initiatives. About 64 percent of the $1.23 billion increase in general and motor fuel funds in the 2019 budget pays for growing enrollment in Georgia’s public schools and universities, increased need in Medicaid or the Teacher Retirement System.

State Investment Struggles to Keep Pace with Rising Needs

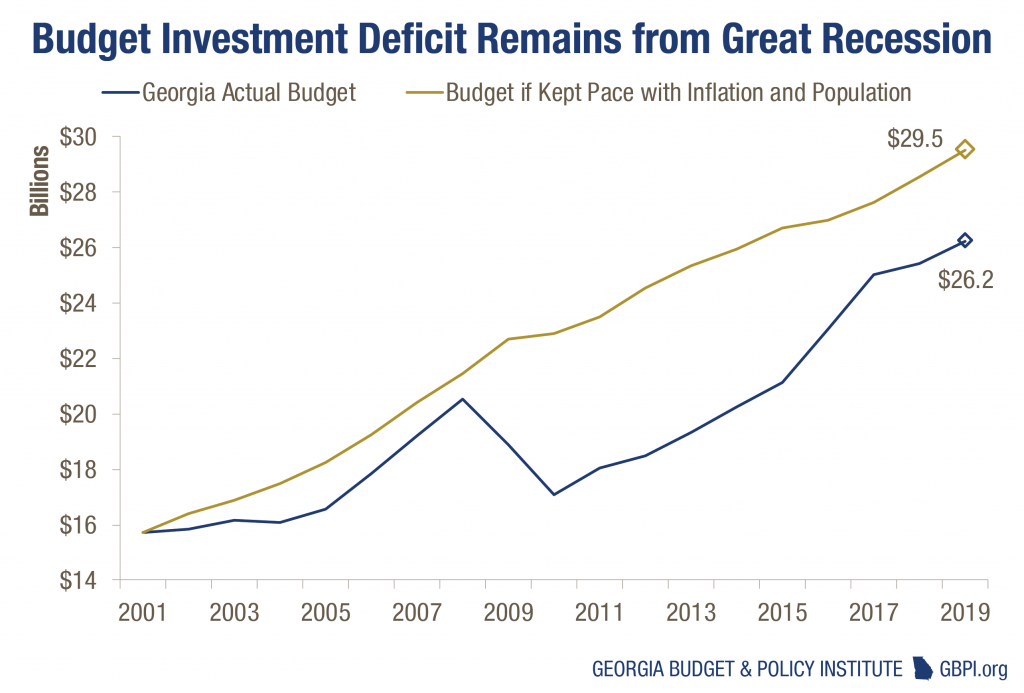

Georgia’s $26.2 billion spending plan is the largest budget in state history in absolute dollar terms, yet it fails to keep pace with the Peach State’s rapidly rising needs. The 2019 budget is about $10.5 billion larger than the 2001 plan passed at the turn of the century, before adjusting for inflation. Meanwhile, Georgia’s population grew enormously during that span, adding 2.4 million new residents from 2001 to 2018, a 29 percent increase. Rising population means increased demand on services, including more children attending schools, more drivers on the roads and more seniors in need of health care. The cost of core state functions also increases naturally with the economy over time.

Georgia’s budget would be an estimated $29.5 billion today if state spending kept pace with population and inflation since the turn of the century. The $3.3 billion gap between that hypothetical budget and Georgia’s actual 2019 spending plan represents the difference between how much Georgia invests and what may be a fairer characterization of the true needs of its people. The deficit is due in large part to the recession of the late 2000s, when state revenues plummeted and lawmakers responded with deep cuts to crucial services. Though narrowing in recent years, the gap makes it difficult for lawmakers to tackle urgent challenges such as the opioid crisis or rural hospital closings.

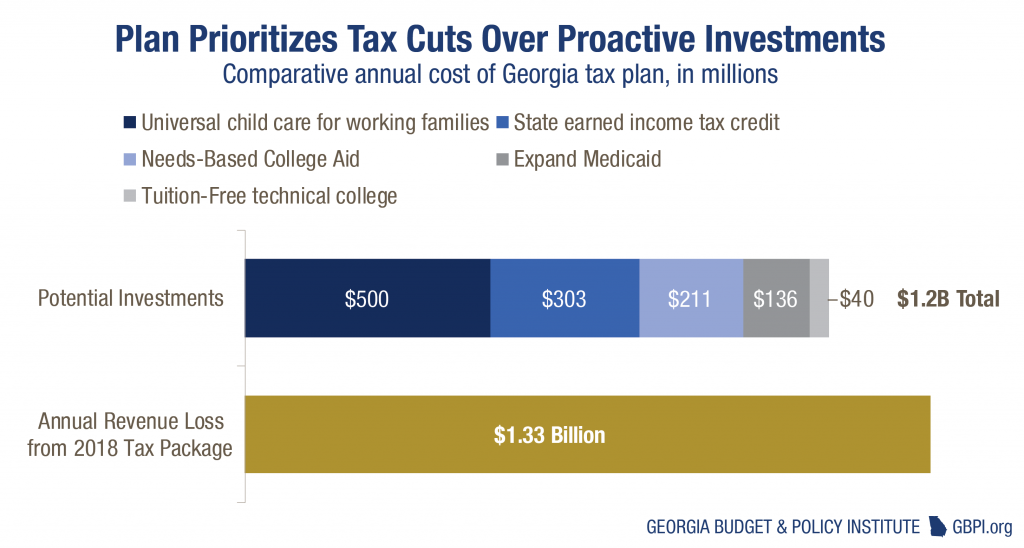

Risky Income Tax Plan Makes a Stark Choice

Georgia lawmakers in 2018 approved some of the state’s most sweeping tax changes in decades. Legislators rushed to approve a large income tax cut in response to a potential influx of surplus state revenue Georgia stood to collect as a side effect of recent federal tax changes. The tax plan doubles Georgia’s standard deduction and cuts the state’s personal and corporate income tax rates to 5.75 percent in 2019 from their decades-long level of 6 percent. The legislation also envisions the state’s income tax rates falling further to 5.5 percent in 2020, if lawmakers approve that second step during the 2020 legislative session.

Had lawmakers instead accepted the revenue surge, Georgia stood to gain about an extra $1.2 billion a year on average over the next five years. Now Georgia will likely collect slightly less in annual revenue than it would have had Congress left prior federal tax law intact. For perspective, the foregone revenue from the tax cut plan is likely more than the combined annual cost to make technical colleges tuition-free, create a needs-based college aid program, enact a state earned income tax credit, eliminate Georgia’s health coverage gap by expanding Medicaid and provide universal child care for low-income Georgians under 5-years-old.

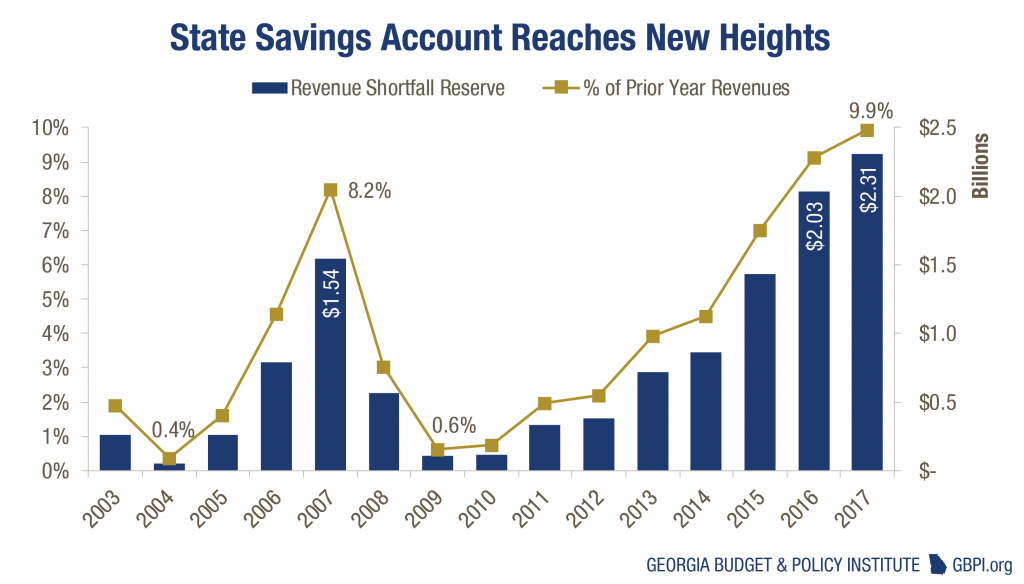

State Savings Account Back to Adequate Level

The Revenue Shortfall Reserve is Georgia’s rainy day fund, meant to provide stability during economic downturns. The fund acts like a savings account for the state to cover expenses and maintain services when revenues decline unexpectedly. Maintaining adequate reserve money is also important to keep Georgia’s stellar AAA bond rating, a top rating that allows lawmakers to borrow money at favorable terms and save millions of dollars in annual interest payments. The General Assembly cannot appropriate money to the reserves through the normal budget process. Instead, any money not spent by the end of each fiscal year is automatically transferred to the fund. Georgia law says the fund cannot exceed 15 percent of the previous year’s net revenue.

Georgia budget-writers nearly emptied out the reserve fund during the Great Recession, to soften the severity of cuts to key state services. The governor and legislators responsibly rebuilt the savings account in the years since. At the end of the 2017 budget year, Georgia’s reserves held $2.3 billion, or 9.9 percent of the year’s tax receipts. Now at its highest level in the past 15 years, the reserve fund holds enough money to operate the functions of state government for about 32 days.

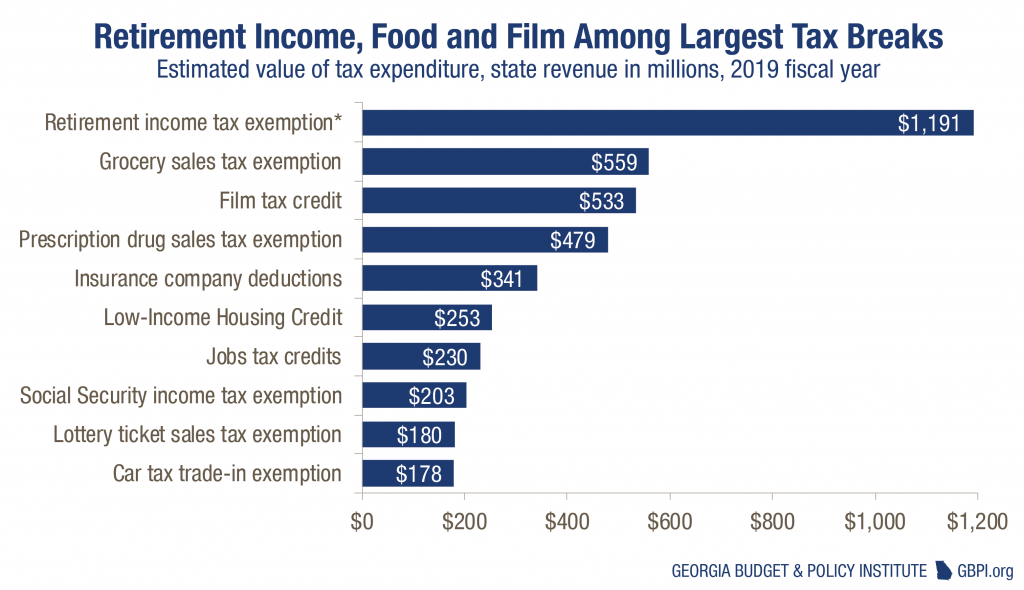

Unclear if All Tax Breaks Worth the Cost

Georgia foregoes billions of dollars in state revenue each year through dozens of credits, deductions and other breaks technically known as tax expenditures. Aimed at policy goals such as economic growth or boosting family finances, Georgia’s assortment of tax breaks add up to an estimated $8.8 billion in lost state revenue in the 2019 budget year. Even by a more conservative estimate that excludes a set of business sales tax exemptions found in most states, Georgia’s tax breaks still yield an annual cost of about $5.3 billion.

Some of Georgia’s tax breaks, such as sales tax exemptions for groceries and some business purchases including energy used in manufacturing, provide key protections for families and the economy. But others deliver outsized gains to select groups or industries, often with questionable benefit to the state. It’s unclear which tax breaks are worth the cost and which aren’t because Georgia lacks a formal review process to measure and compare costs and benefits. Though state lawmakers have begun to slowly move in the right direction in recent years, Georgia still lags behind best-practices policies increasingly common nationwide. In the past five years, at least 27 states, including Florida, Tennessee and Texas, either created a new tax break review process or improved upon existing practices.

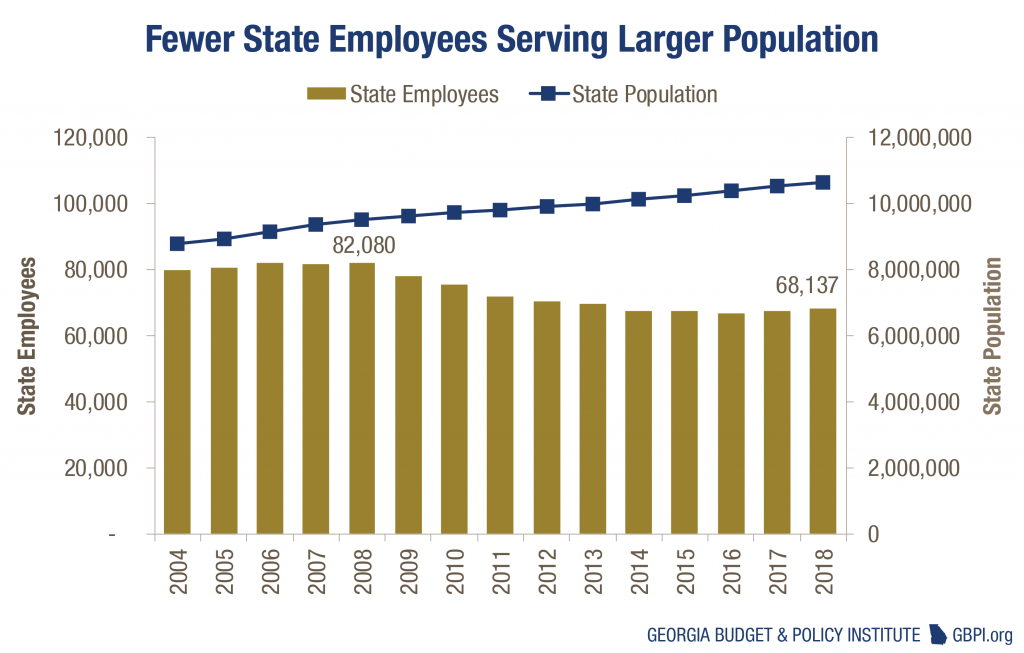

State Workforce Stretched Thin to Cover Growing Needs

Georgia continues to grow rapidly, adding residents and businesses faster than the national average. The state’s ongoing growth brings many benefits, but also a slew of challenges on issues such as housing, transportation and public safety. Georgia’s state employee workforce shrank since the Great Recession while the needs of the state’s population and economy grew. Georgia employed about 14,000 fewer state workers in the 2018 budget year than it did in 2008 before the economic downturn, a drop of 17 percent over a decade.* Georgia added more than 1.1 million new residents in that same span, a spike of 12 percent.

Georgia’s workforce rose slightly over the past two years, as both the economy and state revenue collections increased. Still, Georgia’s state employees are stretched thin to cover a growing population’s needs. Today there is only one state employee per every 156 Georgians, compared to one for every 116 Georgians before the economic crash. That means a decrease in state patrol officers keeping highways safe, fewer health and safety inspectors protecting the public and fewer examiners to keep up with demand for business licenses.

*Numbers exclude Board of Regents, University System

Continue Reading the 2019 Georgia Budget Primer

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2018/georgia-budget-primer-2019/”]Intro[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2018/georgia-k-12-education-budget-primer-state-fiscal-year-2019/”]K-12 Education[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2018/georgia-higher-education-budget-primer-state-fiscal-year-2019/”]Higher Education[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2018/georgia-human-services-budget-primer-state-fiscal-year-2019/”]Human Services[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2018/georgia-health-budget-primer-state-fiscal-year-2019/”]Health[/button]