Budget Basics

Georgia’s 2017 fiscal year is July 1, 2016 through June 30, 2017 and the total budget available to the state is $43.7 billion. That includes $23.7 billion in state funding, $13.7 billion in federal funding and $6.3 billion in other funds.

The state budget outlines Georgia’s priorities, how it plans to spend money to meet them and how much revenue it expects to collect. It is the most important piece of legislation lawmakers pass. In fact, it is the only legislation that the General Assembly is legally mandated to pass each year. The Georgia Constitution requires the state to maintain a balanced budget, which means the government cannot spend more money than it collects in revenues.

The budget process is ongoing. Even as Georgia is implementing its current budget, it is auditing the previous year’s budget and planning for the next one. Beyond the General Assembly, many others participate in the process, including the governor, state budget director, state economists, agency leaders and budget officials, state auditors, advocates and the public.

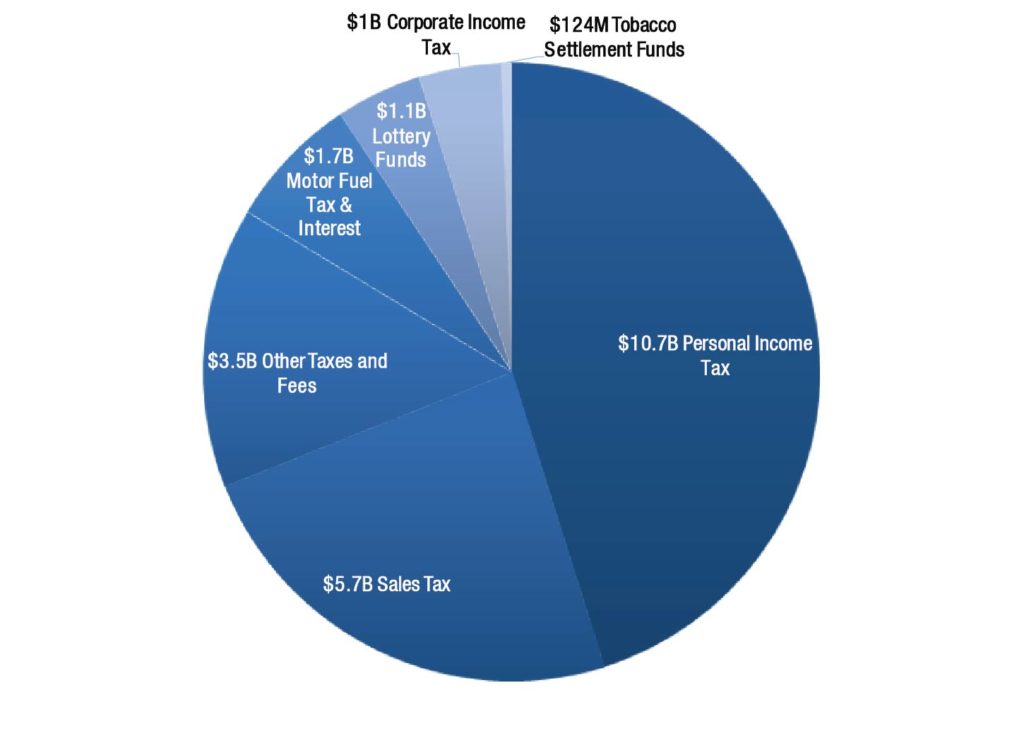

Where Does Georgia’s Money Come From?

Georgia’s fiscal health depends on the state’s ability to raise money from diverse sources in a reliable way. While Georgia has a mix of income taxes, sales taxes and other fees, the reliability of the revenue structure is faltering. The tax code needs to be updated to reflect Georgia’s shift in recent decades to a more service-based economy from one that relied on sales of cars, household appliances and other tangible goods. Many services in Georgia are not taxed, depleting the state’s revenue year after year. The income tax accounts for about half of all state revenue and adds the most stability and fairness to the state tax system. (See “Targeted Tax Reforms Could Bolster Georgia Families and Finances” below)

Income Tax Largest Source of State Revenue

2017 Fiscal Year Total State Revenue Projection is $23.7 billion

Revenue Estimate, 2017 Fiscal Year

| Income Taxes | $11,738,770,014 | 49.4% |

| Personal Income Tax | $10,715,557,454 | 45.1% |

| Corporate Income Tax | $1,023,212,560 | 4.3% |

| Sales Tax | $5,658,900,000 | 23.8% |

| Other Taxes and Fees | $3,482,155,966 | 14.7% |

| Tobacco Tax | $209,073,000 | 0.9% |

| Alcohol Beverage Tax | $189,067,700 | 0.8% |

| Property Tax | $7,000,000 | 0.0% |

| Insurance Premium Tax | $441,973,500 | 1.9% |

| Motor Vehicle License Fee | $347,238,700 | 1.5% |

| Nursing Home Provider Fees | $167,969,114 | 0.7% |

| Motor Vehicle Title Tax (TAVT) | $795,830,333 | 3.4% |

| Hospital Provider Payments | $283,993,012 | 1.2% |

| Other Transportation Fees | $157,985,500 | 0.7% |

| All Other Interest, Fees and Sales | $882,025,107 | 3.7% |

| Designated Funds | $2,859,444,258 | 12.0% |

| Motor Fuel Tax & Interest | $1,660,064,000 | 7.0% |

| Lottery Funds | $1,073,563,561 | 4.5% |

| Tobacco Settlement Funds | $124,490,762 | 0.5% |

| Brain & Spinal Injury Trust Fund* | $1,325,935 | 0.0% |

| Total | $23,739,270,238 | 100% |

Source: Governor’s Budget Report Fiscal Year 2017; *Less than .01%

Targeted Tax Reforms Could Bolster Georgia Families

A debate over whether to tinker with Georgia’s tax system roils the General Assembly nearly every year. Supporters of change have a point that Georgia’s aging tax system could use an update. Still, proposals to date mostly miss the mark. Better options are available for lawmakers who want to strengthen Georgia families, broaden economic prosperity and set the state on firm financial footing for the future.

Most recent tax reform plans focus on cutting the 6 percent top rate of Georgia’s personal income tax and in some cases increasing the sales tax to recover resulting lost revenue. But cutting income tax rates is a misguided approach. It delivers meager benefits to most Georgia families, gives a windfall to a select group of taxpayers at the very top and likely jeopardizes the state’s financial health. More than half of the benefit from a 2016 plan to cut Georgia’s top rate, for example, would flow to the wealthiest 20 percent of Georgians, or households making more than about $100,000 a year. And because income taxes account for half of Georgia’s annual revenue, any large-scale cuts to them could weaken state support for schools, infrastructure and other building blocks of a strong economy.

Other tax reform options offer lawmakers a way to target tax cuts to Georgians who can benefit most, while protecting key state services that help families and communities thrive. Creating a state earned income tax credit, or Georgia Work Credit, gives a bottom-up tax cut to more than 1 million Georgia families. Increasing the amount of money Georgians can shield from taxes through standard deductions and exemptions targets an income tax cut to the struggling middle class. And scaling back special deductions and tax breaks that benefit a small share of taxpayers could help offset the lost revenue. More details on ways to target smart tax reforms are available online at gbpi.org in our report “A Tax Blueprint to Strengthen Georgia.”

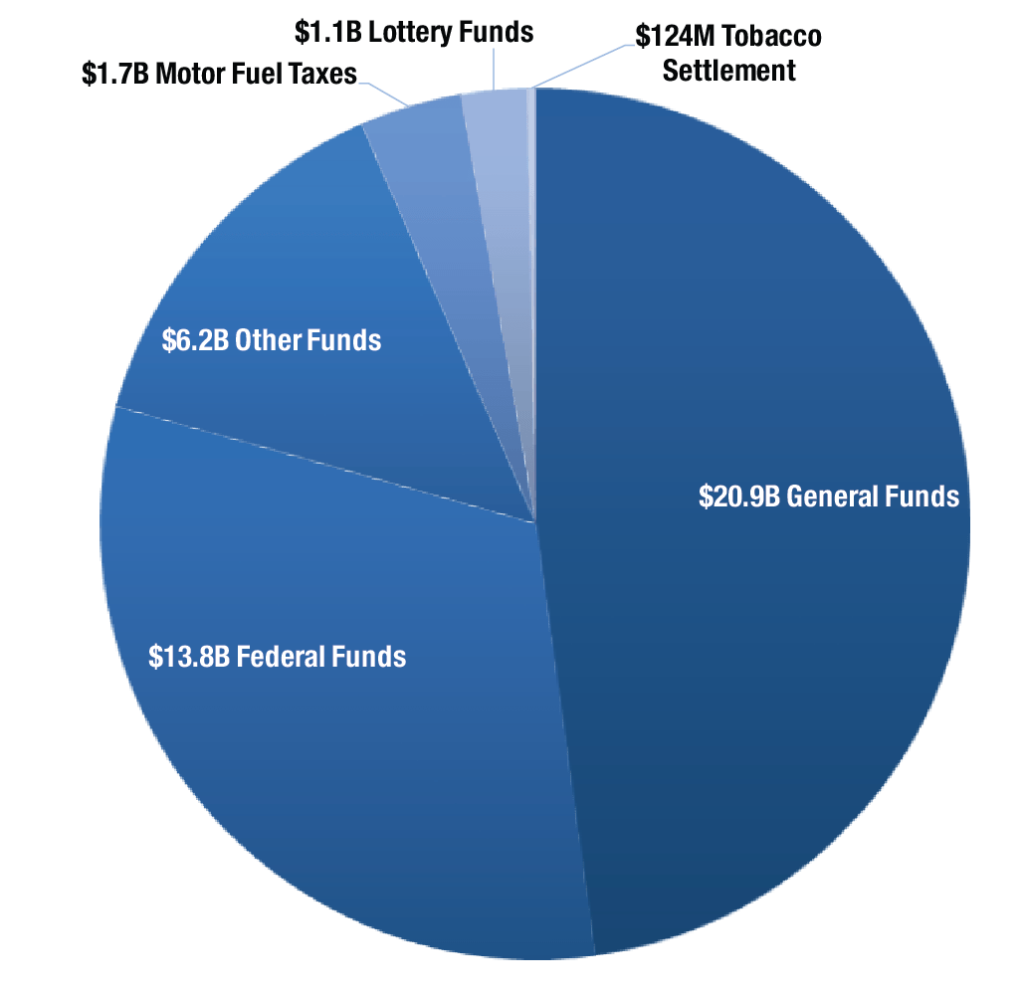

Georgia’s Diverse Funding Sources

Including federal funds, the total 2017 Georgia budget is $43.7 billion and is made up of six funding sources:

- General Funds – Education, public safety and most other traditional state services are paid for from the General Fund

- Federal Funds – A large share of Georgia’s overall spending for services is through administration of federal funds

- Other Funds – These include things like tuition and fees from universities and university system research funds

- Lottery Funds – These are dedicated to Pre-Kindergarten programs and scholarships for higher education

- Tobacco Settlement Funds – This ongoing annual payment resulting from a legal settlement with the country’s four largest tobacco companies over health care costs can be used for any reason in the budget

- Intrastate Funds – The $3.8 billion of intrastate transfers include payments from the state health plan and are not counted in the $43.7 billion budget

General and Federal Funds Make Up Most of the $43.7 Billion 2017 Fiscal Year State Budget

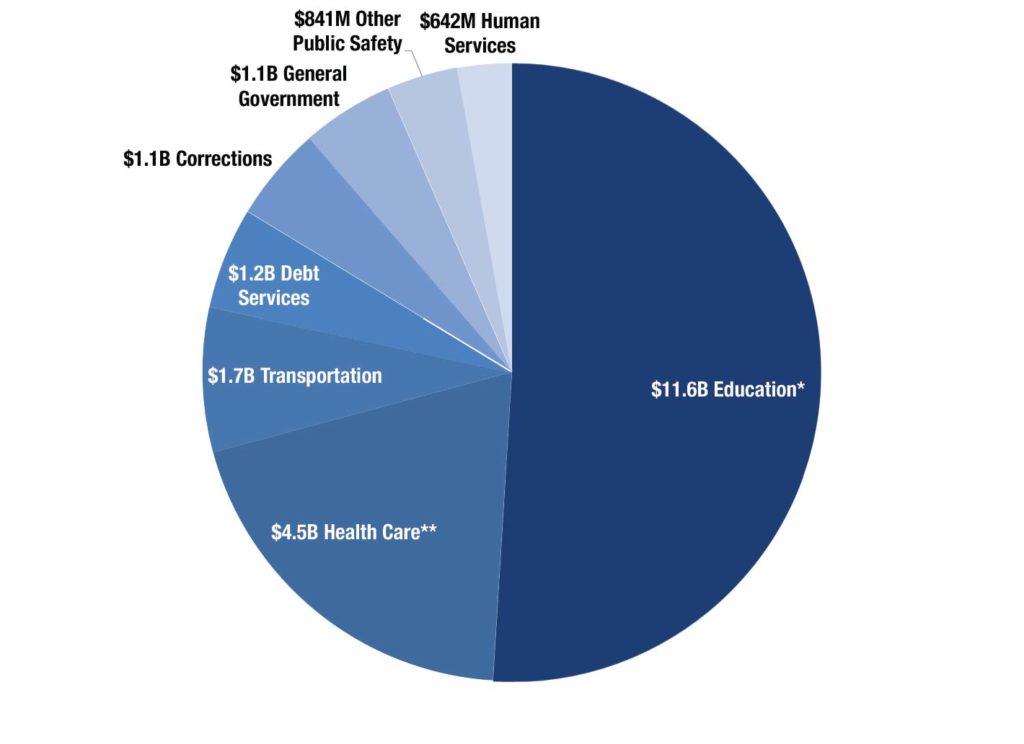

General and Motor Fuel Funds

$22,665,706,677 (54 percent of Georgia’s budget)

General funds come from state taxes and fees. Nearly 95 cents of every dollar collected goes to seven areas:

- K-12 and Postsecondary Education (51 cents of every dollar spent)

- Health Care (20 cents)

- Public Safety (9 cents)

- Transportation (8 cents)

- Debt Service (5 cents)

- Department of Human Services (3 cents)

The remaining five cents of each dollar pays for all other state agencies, boards and commissions, as well as the judicial and legislative branches.

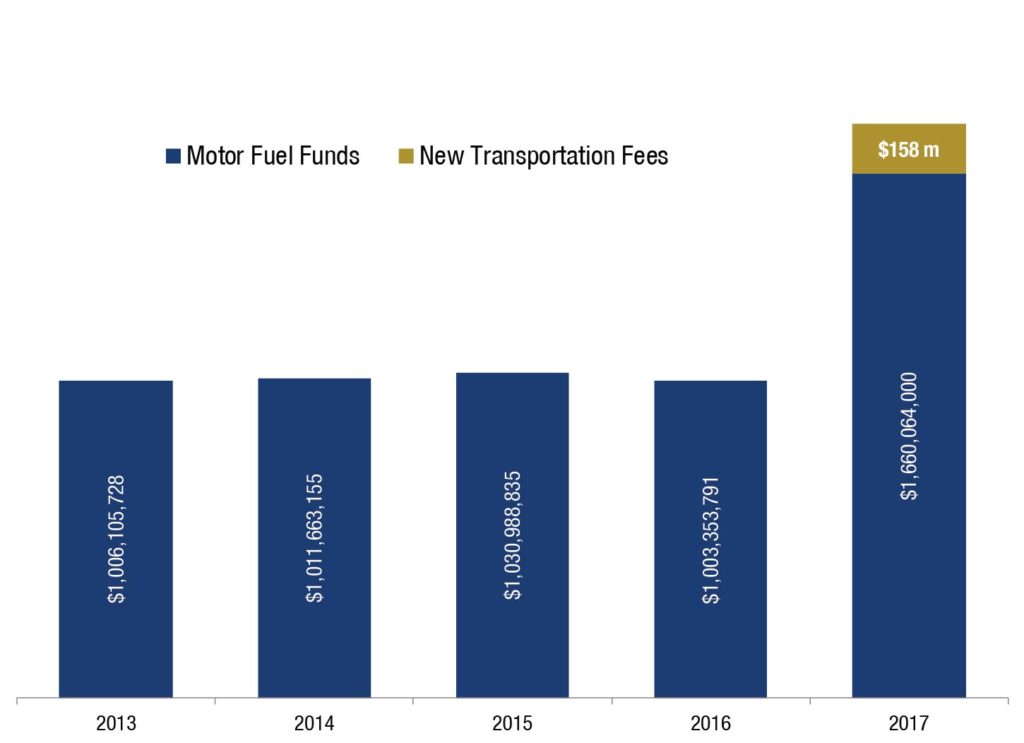

Motor Fuel Funds

Georgia’s Constitution requires spending revenue from the state’s tax on motor fuel only on public roads and bridges. The money is dedicated to a mix of new construction, maintenance on existing infrastructure and debt service on past investments. Lawmakers passed legislation in 2015 that significantly changed the way Georgia taxes motor fuel, raising the gas tax to 26 cents per gallon of gasoline and 29 cents per gallon of diesel fuel for an increase of 7 to 8 cents per gallon. The 2015 reforms also indexed the new rates to inflation and rising fuel efficiency, so that motor fuel collections can keep pace with changing consumer habits and economic trends. The higher tax results in an anticipated $1.66 billion in Motor Fuel Funds for the state’s budget for the 2017 fiscal year, a $657 million increase over the original 2016 budget. Also, all gas tax revenue now goes to the Department of Transportation, whereas some of it went to the state’s general fund under the prior system.

Education and Health Care Dominate General Fund Spending

2017 Fiscal Year State General Fund and Motor Fuel Funds Budget: $22.7 Billion

* Education spending details: Georgia’s 2017 budget for K-12 is $ 8.9 billion, for the University System of Georgia is $2.1 billion, the Technical College System of Georgia is $350 million. Also includes Georgia Student Finance Commission’s $91 million and the Dept. of Early Care and Learning’s $55.6 million

** Health care spending details include tobacco funds: Georgia’s 2017 budget for Medicaid and PeachCare is $3 billion; for Behavioral Health & Developmental Disabilities is $1 billion; for Public Health is $243 million; and for other health care is $174 million

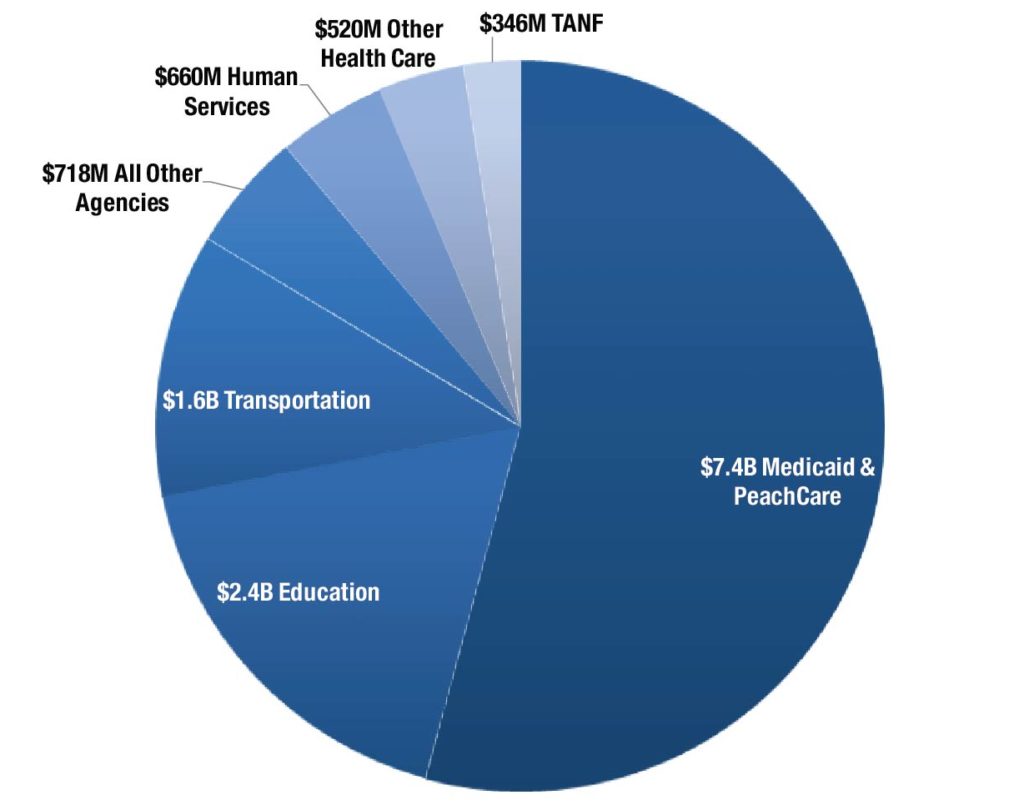

Federal Funds

$13,681,479,298 (31 percent of Georgia’s budget)

Money from the federal government flows to a wide variety of state programs and services. The great majority of federal money is spent for the following:

- $7.4 billion for Medicaid and PeachCare

- $2.4 billion for students with disabilities, low-income students, school nutrition and other education services

- $1.6 billion for the Georgia Department of Transportation

- $1.7 billion for child welfare, elder services, Temporary Assistance for Needy Families (TANF) and other human services

The state is required to use its own dollars to match federal funding for Medicaid and many human services. Consequently, a cut in state funds for a service can lead to a corresponding cut in federal funds.

Federal Funds Primarily Pay for Health Care, Education, Transportation and Human Services

2017 Fiscal Year Federal Funds, $13.7 Billion

Other Funds

$6,162,398,689 (14 percent of Georgia’s budget)

Other Funds include $3.3 billion in tuition and fees paid by University System of Georgia and Technical College System students and $2.2 billion in University System of Georgia research funds. The money is retained by the individual schools.

Most Other Funds Come From College Tuition, Fees and Research

| Tuition and Fees for Higher Education, Other | $3,250,203,241 |

| University System of Georgia Research Funds | $2,188,313,412 |

| All Other | $723,882,036 |

| Total | $6,162,398,689 |

Source: Georgia’s 2017 Fiscal Year Budget (HB 751), signed by governor

Intrastate Transfers

$3,834,802,369 (Included here for reference, but not as a net increase to Georgia’s budget)

Intrastate transfers are primarily payments from the State Health Benefit Plan.

Intrastate Transfers

| State Health Benefit Plan Payments | $3,294,877,137 |

| Medicaid Services Payments – Other Agencies | $280,857,262 |

| Self Insurance Trust Fund Payments | $159,257,398 |

| Other Intrastate Govt. Payments | $42,907,037 |

| State Employee and Teacher Retirement Payments | $56,903,535 |

| Total | $3,834,802,369 |

Source: Georgia’s 2017 Fiscal Year Budget (HB 751), signed by governor

Tobacco Funds

$124,490,762 (0.3 percent of Georgia’s budget)

Georgia receives annual payments from a legal settlement with four of the country’s largest tobacco companies, known as the Tobacco Master Settlement Agreement. Georgia does not earmark these payments for specific purposes. As a result, the use of tobacco settlement funds can vary from year to year.

Tobacco Settlement Funds Focus on Medicaid

| 2017 Tobacco Settlement Fund Budget | |

| Low Income Medicaid | $93,892,175 |

| Adult Developmental Disabilities Waiver Services | $10,255,138 |

| Cancer Treatment for Low Income Uninsured | $6,613,249 |

| Elder Community Living and Support Services | $6,191,806 |

| Cancer Screening | $2,915,302 |

| Smoking Prevention and Cessation | $2,368,932 |

| Regional Cancer Coalitions | $1,204,740 |

| Clinical Trials, Outreach and Education | $500,000 |

| Underage Smoking Compliance | $433,783 |

| Cancer Registry | $115,637 |

| Total | $124,490,762 |

Source: Georgia’s 2017 Fiscal Year Budget (HB 751), signed by governor

Budget Trends

Improving Revenue Growth Still Catching up After Years of Cuts

Georgia’s 2017 fiscal year budget is based on projected revenue growth of $1.9 billion, or 8.8 percent, over projected revenues from the 2016 fiscal year. About 43 percent of this revenue growth is due to a transportation funding package enacted in the 2015 session but was not reflected in the original 2016 budget. The $1.1 billion in growth from outside the transportation package represents a moderate increase of 5.3 percent.

The Great Recession caused a dramatic decline in state revenues from the 2008 to 2010 fiscal years, falling by $3.6 billion, or 19.2 percent. Revenues improved at a moderate pace since the 2011 fiscal year and have picked up since 2014, yet inflation-adjusted, per-capita state revenue in 2017 is still expected to fall short of pre-recession levels.

The majority of revenue growth in the 2017 budget is obligated to pay for normal growth in government expenses and services. More students are enrolled in Georgia schools, wages lost in the sluggish economy made more Georgians eligible for Medicaid and PeachCare and the state is incurring increased expenses due to state employees and retirees’ health insurance and retirement costs. Revenues are not sufficient to replenish the vast majority of services lawmakers cut from 2008 to 2010, during the depths of the recession. Increases in the 2017 state budget include:

- $300 million for partial restoration of the K-12 funding formula cut

- $210 million statewide and targeted pay raises for state agencies, universities and technical colleges

- $182 million for K-12 and University system formula growth

- $106 million for enrollment growth and higher reimbursement rates for Medicaid

- $105 million increased funding for out-of-home care, which includes replacing federal funding no longer available

- $29 million for Move on When Ready

- $20 million for economic development programs, including Invest Georgia

New Road and Bridge Money Drives Revenue Growth

The $23.7 billion state budget for the 2017 fiscal year includes a $1.9 billion increase in spending compared to the 2016 budget approved last year, an uptick of almost 9 percent. A sizable chunk of that growth is due to the state’s new commitment to adequately maintain Georgia’s roads and bridges. Lawmakers approved legislation in 2015 to raise new revenue for roads and bridges. The changes raised the state motor fuel tax by about 7 cents per gallon of gasoline and 8 cents per gallon of diesel, added fees on electric cars and heavy trucks and created a new $5 per night tax on hotel stays. Combined, the higher fuel tax and new vehicle fees caused transportation revenue estimates for the 2017 budget year to swell by $815 million above the state’s 2016 budget. That increase accounts for 43 percent of the state’s total $1.9 billion revenue growth over that same span.

Transportation Funding Leaps Due to New Tax Changes

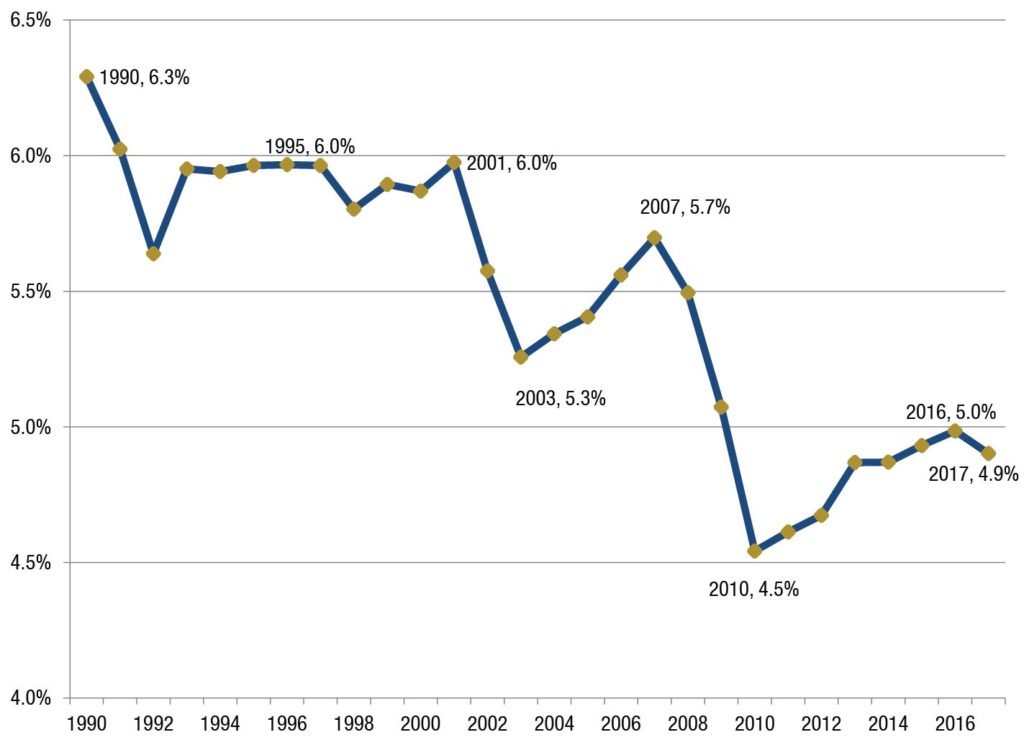

Georgians Paying Historically Less in Taxes

The average Georgian today devotes a smaller share of their income to state taxes than was the case for most of the last three decades. During the 1990s, Georgians paid an average of 5.9 percent of their income in state taxes. Even as the state cut taxes during the 1990s, the share of the average Georgian’s income taxed to support state government remained the same. A strong economy allowed the state to cut taxes while still offering key services.

This dynamic changed last decade. The prior tax cuts combined with subsequent recessions to cause a dramatic drop in the share of income Georgians pay in taxes. Revenues plummeted as a share of personal income to an historic low of 4.5 percent in 2010. State revenue as a share of personal income ticked up to 5 percent in the 2016 fiscal year as the economy improved and new revenue was generated by the 2015 transportation tax legislation. But that percentage is still historically low. The average Georgian paid 5.6 percent in personal state income taxes at the low point during the 1990s. If that held true in 2017, the state would gain about $3.2 billion to invest in education and other building blocks of a strong economy.

Georgians Paying State Smaller Share of Income Than in Past

State revenue as percentage of personal income (1990-2017 fiscal years)

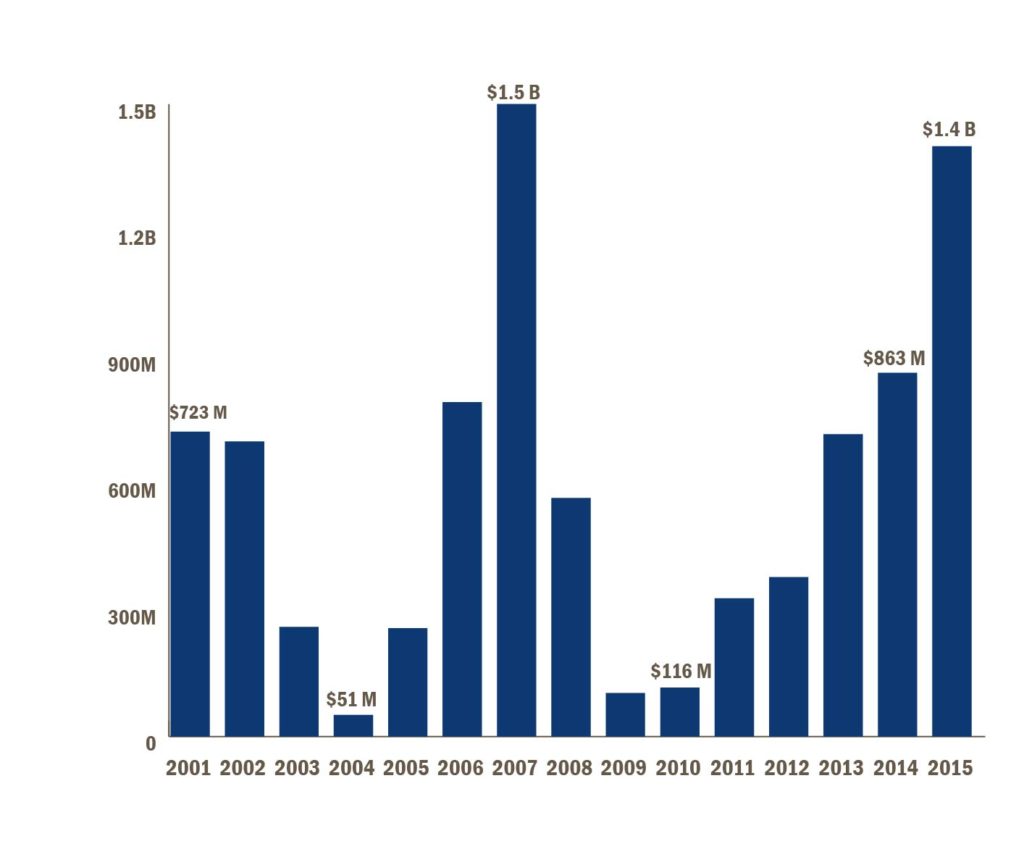

Reserve Fund

The Revenue Shortfall Reserve is Georgia’s “rainy day” fund, meant to provide stability during economic downturns. The fund acts like a savings account for the state to cover expenses and maintain services when revenues decline unexpectedly. Georgia law says the fund cannot exceed 15 percent of the previous year’s net revenue. At the end of the 2015 fiscal year, this fund held $1.4 billion, which is as large as it has been since the start of the Great Recession. Reserves would need to be about $2.7 billion to match 15 percent of last year’s revenues.

Maintaining an adequate amount of money in the fund is important to keep Georgia’s exceptional AAA bond rating, a top rating that allows the state to borrow money at the most favorable terms, which saves millions of dollars in interest payments. The General Assembly may also use the fund to spend an amount equal to 1 percent of the previous year’s net revenue to pay for increased K-12 education needs. The General Assembly cannot appropriate money to the fund through the normal budget process. Instead, any money not spent by the end of each fiscal year is automatically transferred to the fund. Prior to the Great Recession, the reserves grew to $1.5 billion, or enough to operate the state for about 30 days.

Rainy Day Fund Nearly Back to Pre-Recession High

Revenue Shortfall Reserve, 2001- 2014 Fiscal Years

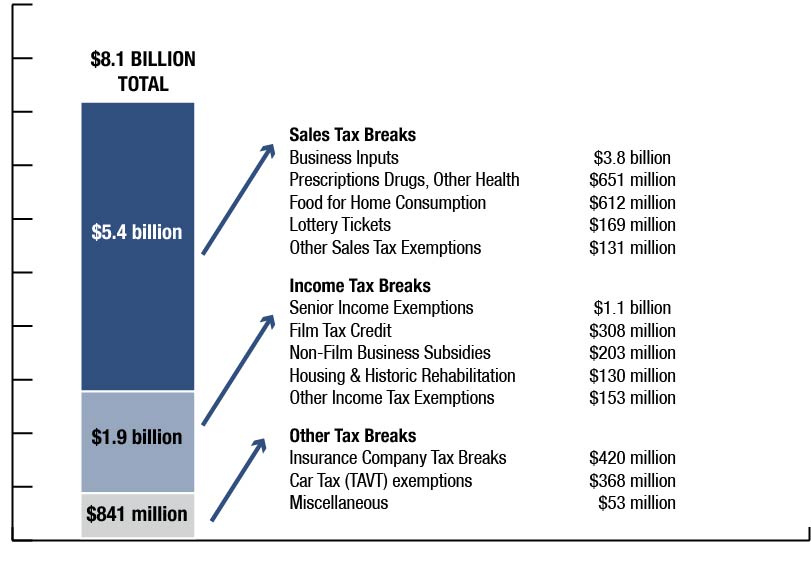

Tax Expenditures

Georgia foregoes billions of dollars in state revenue each year through dozens of credits, deductions and other special preferences called tax expenditures. Often described as hidden spending, tax expenditures are intended to promote policy objectives that can range from economic development to support for working families. Georgia’s assortment of tax breaks will cost the state an estimated $8.1 billion in the 2017 budget year, or nearly the amount state lawmakers invest annually in K-12 education.

Some of Georgia’s tax breaks, such as the state sales tax exemption on groceries, provide critical protections for families and the economy. Others offer abnormally large benefits to groups like wealthy retirees and insurance companies and may not deliver enough benefit to offset the state’s lost revenue. A growing number of states are scrutinizing this hidden spending to get a better deal for taxpayers. Since 2012, 19 states including Alabama, Florida, Tennessee and Texas either created a new tax break review process or improved upon existing policies. Following their lead can help Georgia get a better bang for its buck.

Georgia’s Tax Expenditures are Costly

State Employee Declines

Until recent years, Georgia employed enough people to respond to the needs of a growing population. Georgia employed more than 15,000 fewer state workers during the 2016 fiscal year than it did prior to the Great Recession, a drop of about 19 percent over nearly a decade.* The result is a much smaller group of state employees trying to serve a much larger population. That means fewer state patrol officers keeping our highways safe, fewer health and safety inspectors protecting the public from illness and injury and fewer examiners to meet the demand for business licenses.

Fewer State Employees Serving Larger Population

[visualizer id=”13848″]

Source: Email from Georgia Department of Administrative Services, May 16, 2016. *Excludes Board of Regents, University System of Georgia.

Largest State Agency Employers

| Agency | Employees* |

| Corrections | 11,232 |

| Human Services – Dept of Family & Children Services | 6,218 |

| Technical Colleges | 6,007 |

| Behavioral Health Centers / CSB | 4,963 |

| County Public Health Depts. | 4,838 |

| Other Public Safety | 4,737 |

| Dept. of Beh. Health & Dev. Disabilities | 4,144 |

| Transportation | 4,034 |

| Juvenile Justice | 3,612 |

| Human Services – Other | 3,422 |

| Agriculture & Forestry | 2,722 |

| Court System & related | 1,745 |

| Other Education | 1,434 |

| Community Health | 904 |

| All Other | 6,500 |

| Total | 66,512 |

Source: Email from Georgia Department of Administrative Services, May 26, 2016; *Full-time equivalent employees

Continue Reading the 2017 Georgia Budget Primer

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2016/georgia-education-budget-primer-for-state-fiscal-year-2017/”]Education Budget Overview[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2016/georgia-human-services-budget-primer-for-state-fiscal-year-2017/”]Human Services Budget Overview[/button]

[button color=”” size=”” type=”” target=”” link=”https://gbpi.org/2016/georgia-health-budget-primer-for-state-fiscal-year-2017/”]Health Budget Overview[/button]