Contrary to rumors that working families don’t pay their fair share of taxes, Georgia’s state and local taxes actually take a much larger share of income from low- and middle-income families than from the wealthy. That’s among the findings of “Who Pays?” – a new report from the Institute on Taxation and Economic Policy (ITEP), a national group supporting sound state tax policy.

Contrary to rumors that working families don’t pay their fair share of taxes, Georgia’s state and local taxes actually take a much larger share of income from low- and middle-income families than from the wealthy. That’s among the findings of “Who Pays?” – a new report from the Institute on Taxation and Economic Policy (ITEP), a national group supporting sound state tax policy.

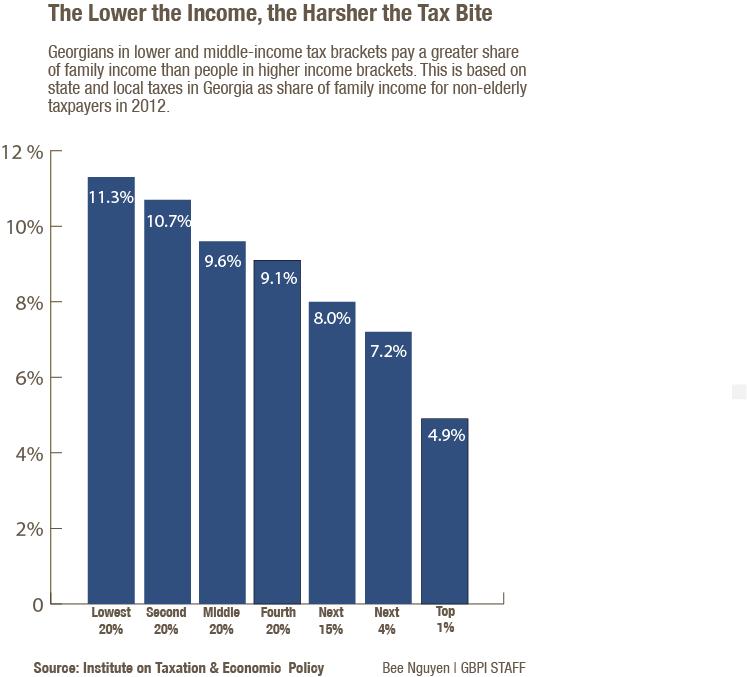

Once all of Georgia’s income, property, sales and excise taxes are taken into account, the bottom 20 percent of families devote 11.3 percent of their income to taxes. That compares to 9.6 percent for families in the middle and only 4.9 percent for the richest 1 percent.

The reason Georgia’s tax system is upside down is fairly straightforward: state and local governments rely heavily on sales taxes and fees, which hit working families harder than any other single tax. Sales and excise taxes take 7 percent of income for families at the bottom of the income scale, versus less than 1 percent for those at the very top.

Most states, including Georgia, try to offset this inequity with a graduated income tax, but Georgia’s version of that tax is abnormally flat. Its top rate of 6 percent kicks in at only $7,000 of taxable income for singles and $10,000 for couples – meaning almost all Georgia families pay the same top rate, whether they’re working for minimum wage job or a larger executive salary. As a result, Georgia’s gap between what the richest and poorest pay is larger than many other states.

Policymakers could address this imbalance in some simple ways, such as adding a new top rate for extremely high-income families, or enacting tax benefits (like the Earned Income Tax Credit) designed to lighten the load for the poor or middle class. The opposite approach is to slash income taxes too deep or even eliminate them entirely over time, but that would be a huge mistake. Cutting income taxes to rely on other fees instead is the surest way to make an already upsidedown tax system even more off kilter.