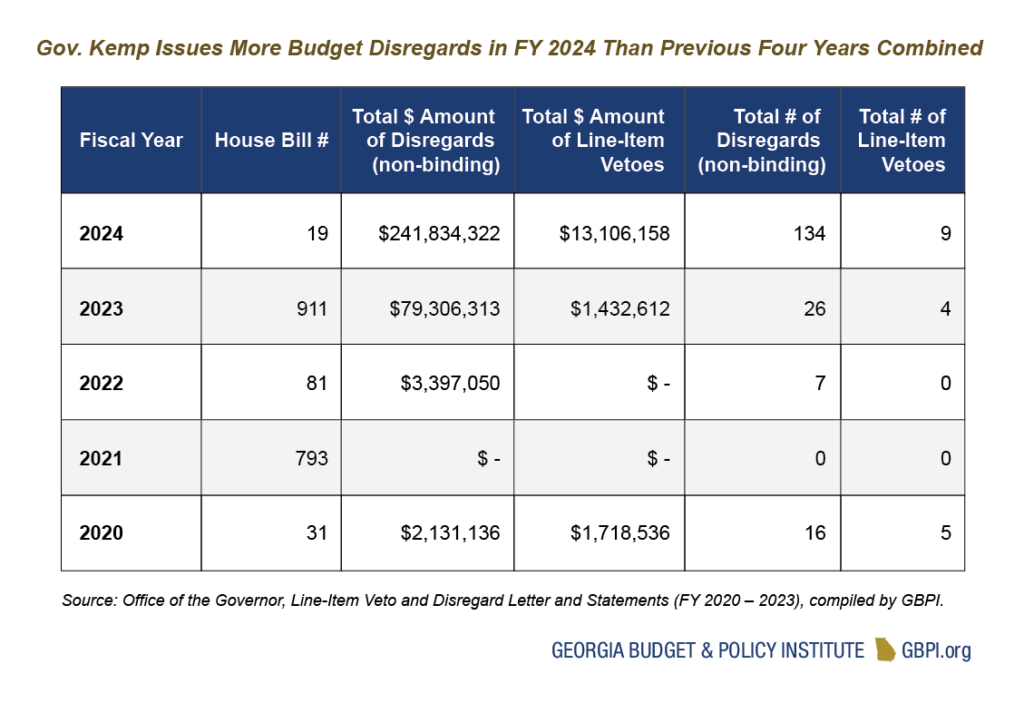

With Gov. Brian P. Kemp’s signature, Georgia’s Fiscal Year (FY) 2024 budget became law ahead of the state’s next fiscal year, which begins on July 1, 2023. However, Gov. Kemp’s approval of the spending plan was accompanied by a wave of 134 non-binding orders to either fully or partially disregard budget language and appropriations comprising $242 million in state spending, along with nine line-item vetoes, which cut $13.1 million from the budget entirely. These actions will withhold tens of millions from the state’s ailing health care system and safety net, block $6.3 million in funding to the Department of Education to cover the cost of breakfast and lunch for reduce-pay students and slash a host of priorities championed by lawmakers across the aisle. Taken together, these actions are relatively unprecedented. Throughout the previous four years of Kemp’s governorship, from FY 2020 – 2023, 49 non-binding disregards were issued on $85 million of state spending and nine line-item vetoes were issued on $3.2 million in allocations.  Under Georgia’s constitution, the governor is entrusted with authority to veto “any appropriation” through the line-item veto.[1] Throughout Kemp’s governorship, rather than rely primarily on the line-item veto to modify appropriations legislation, the governor has traditionally employed “non-binding disregards” and signing statements to provide additional instructions to relevant state agencies and, in some cases, to explain why funds will be withheld for provisions approved by the General Assembly. This blending of executive authority demonstrates the wide range of powers held by the state’s chief executive over state appropriations, which Gov. Kemp has made expanded use of in recent years. Although described as non-binding, these orders have a similar effect to line-item vetoes in practice, while preserving the availability of state funds for other purposes, or to be appropriated in subsequent amended appropriations plans.

Under Georgia’s constitution, the governor is entrusted with authority to veto “any appropriation” through the line-item veto.[1] Throughout Kemp’s governorship, rather than rely primarily on the line-item veto to modify appropriations legislation, the governor has traditionally employed “non-binding disregards” and signing statements to provide additional instructions to relevant state agencies and, in some cases, to explain why funds will be withheld for provisions approved by the General Assembly. This blending of executive authority demonstrates the wide range of powers held by the state’s chief executive over state appropriations, which Gov. Kemp has made expanded use of in recent years. Although described as non-binding, these orders have a similar effect to line-item vetoes in practice, while preserving the availability of state funds for other purposes, or to be appropriated in subsequent amended appropriations plans.

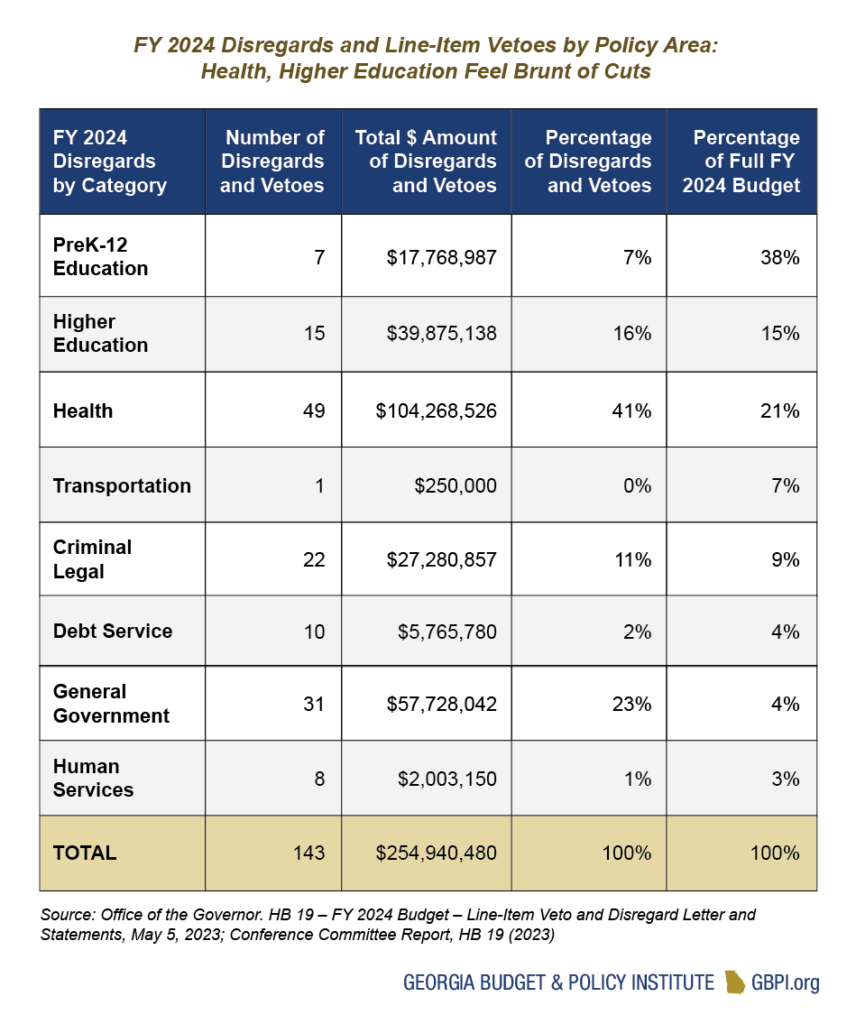

Georgia law also includes authority that enables the governor to require agencies to reserve appropriations for budget reductions and to withhold agency allotments to maintain spending within projected revenues, which the governor holds unilateral authority to set in establishing the state’s revenue estimate.[2] In practice, this authority offers wide latitude to the state’s chief executive to exercise control over funding allotted to state agencies. Nevertheless, as the use of non-binding budget disregards proliferates, it remains an open question as to how lawmakers will respond to the expanded use of this authority employed in the FY 2024 budget.  Of approximately $255 million in non-binding budget disregards and line-item vetoes issued by Gov. Kemp, the lion’s share of these cuts will reduce funding for health and education programs and services. Several of these items only slightly modify the spending plan approved by the General Assembly, such as the $11 million allocated to annualize the cost of 513 NOW/COMP waiver program slots for individuals with intellectual and developmental disabilities. In this case, the governor instructed the Department of Behavioral Health and Developmental Disabilities to simply utilize funding for direct waiver expenses only, while removing the possibility of covering administrative overhead with these funds.

Of approximately $255 million in non-binding budget disregards and line-item vetoes issued by Gov. Kemp, the lion’s share of these cuts will reduce funding for health and education programs and services. Several of these items only slightly modify the spending plan approved by the General Assembly, such as the $11 million allocated to annualize the cost of 513 NOW/COMP waiver program slots for individuals with intellectual and developmental disabilities. In this case, the governor instructed the Department of Behavioral Health and Developmental Disabilities to simply utilize funding for direct waiver expenses only, while removing the possibility of covering administrative overhead with these funds.

In most cases, however, funds are set to be withheld entirely from the programs and services approved by the General Assembly. Such is the case across a wide array of budget items intended to strengthen the state’s Medicaid program, including $19 million approved to increase funding for primary care and OB/GYN services, $10.5 million to provide a rate increase for home- and community-based service providers, and a $5 million reimbursement rate increase for speech-language pathology, audiology, physical therapy and occupational therapy providers, among a host of other cuts. In response to these budget disregards, the governor declares that “the General Assembly seeks to fund these increases by reducing required base funding for the Medicaid program, which is likely to create a shortfall.”[3] Unless instructions state otherwise, appropriations will not be made to agencies for budget items that were disregarded, and the General Assembly will have the opportunity to reengage on these measures when the legislature convenes for its next session.

Under Gov. Kemp’s executive budget proposal $4.48 billion was allocated for the state’s Medicaid program, while the General Assembly reduced that amount by $37 million to $4.44 billion. Overall, Gov. Kemp issued 28 non-binding disregards affecting just over $50 million in line-item budget enhancements to the state’s Department of Community Health (DCH).

One of the few health policy breakthroughs in the FY 2024 budget that was met with approval from both the governor and General Assembly was the inclusion of $584,000 in state funds, matched by $1.1 million in federal funds, and instructions to the Department of Community Health to amend the Medicaid state plan and remove the five-year waiting period for Medicaid-eligible pregnant women and children who are lawful permanent residents. Twenty-four states have removed the five-year waiting period for pregnant women and children; 10 states have removed it for children only; and one state has removed it for pregnant women only. During a time when Georgia faces staggering maternal mortality rates and a recent upswing in infant mortality rates, this investment will have a critical impact.

Another significant area of disagreement between Gov. Kemp and General Assembly leaders is related to the state’s spending plan for higher education. With few resources available under the state’s extremely conservative revenue estimate set by Gov. Kemp, lawmakers cut and redistributed $66 million in funding from the University System of Georgia’s (USG) annual teaching budget, which is shared across 26 public colleges and universities. In justifying the cuts, state appropriators cited $504 million in “carry forward” funding available across member institutions.[4] Noting that the University System had already sustained a cut of about $230 million in FY 2021—funding which was never restored—in response to the COVID-19 pandemic and projected hit to state revenues, Chancellor Perdue called this year’s cut of $66 million “an incredibly disappointing outcome” that “will have a significant impact on institutions and the services that students and families depend on.”[5]

Caught in the crossfire was HB 249 and $2 million in appropriations—added on top of $10 million in recurring funding first allocated in FY 2023—to fund the state’s modest need-based college completion grant program. However, with the veto of HB 249, which would have lowered the credit threshold at which students become eligible and differentiated between two- and four-year degree programs, eligibility criteria remain extremely rigid. Currently, students are required to complete 80 percent of their degree program to apply for funding. By deferring common sense improvements to this program, Georgia remains an outlier nationally in terms of the lack of need-based funding available to students with low incomes seeking a post-secondary education.[6]

However, in a positive move to increase the state’s merit-based higher education aid program, lawmakers honored Gov. Kemp’s request to increase funding for Georgia’s HOPE Grant and HOPE Scholarship. The HOPE program will now cover tuition costs at a factor rate of 100 percent for public colleges and universities, up from 90 percent, reversing 2012 legislative changes that cut financial assistance for higher education. Under this change, full-time students would save an average of $444 per year.[7]

State Revenues Continue to Significantly Outpace Spending

Against the backdrop of the budget disregards and line-item vetoes issued by Gov. Kemp is a continued multibillion-dollar imbalance between state spending and revenues. For two consecutive years, from FY 2021-2022, the state generated large budget surpluses, and appears set to continue this trend when the 2023 fiscal year concludes on June 30, 2023.

Georgia finished FY 2021 with approximately $3.8 billion in unspent revenue, filling its rainy day fund to 15 percent of prior year collections for the first time ($4.3 billion), and designating the remaining $2.3 billion as ‘undesignated surplus’.[8] At the conclusion of FY 2022, $6.7 billion in unspent revenues were distributed to grow the state’s RSR to $5.2 billion and increase the amount in undesignated surplus accounts to nearly $7 billion, while also backfilling the $1 billion cost of the state’s first round of non-refundable $250/500 (single/married) rebates for income tax filers.[9]

Each month, the Department of Revenue issues a summary of tax collections, which generally comprise approximately 90 percent of total treasury receipts, with the remainder of taxes and fees reported separately at the conclusion of the fiscal year. Through the first eleven months of FY 2023, the state has collected roughly $2 billion in tax revenue above the full fiscal year revenue estimate for total net taxes projected by Gov. Kemp, under the advice of State Economist Dr. Jeffrey Dorfman. While Kemp predicted that year-over-year state tax collections would fall by about 14 percent, so far through eleven months, overall tax revenues for FY 2023 are relatively flat, up slightly from 2022.[10] If state revenues continue to track at this pace in June, the state is likely to generate a surplus in excess of $5 billion for FY 2023.

This means that any revenues that the state generates in the month of June will likely be added to the state’s Revenue Shortfall Reserve and unobligated reserve accounts. In FY 2022, Georgia reported raising nearly $2.9 billion in net tax revenue in the month of June. Given this trajectory, it appears likely that the state will raise a substantial, multi-billion-dollar surplus once again. Such funds would be added to existing reserves, which currently total $11.2 billion. The funds include $5.2 billion in Georgia’s Revenue Shortfall Reserve and an estimated $5.98 billion that will remain unspent in undesignated surplus accounts at the conclusion of FY 2023. This year, Georgia’s leaders allocated only a fraction of these funds—approximately $1 billion in unobligated reserve funding—to finance the cost of a second round of one-time rebate payments sent to income tax filers in 2023, with the rest of the funding remaining in state coffers.

Conclusion

Georgia’s FY 2024 spending plan falls short of meeting the needs of its 11 million residents. Despite this, the state continues to leave considerable resources on the table rather than address long-deferred needs and worsening conditions across state government. A decade-plus of austerity that, in many cases, was never restored or backfilled, still looms over state agencies and core functions of government. State leaders must do more to realize the promise of opportunity and prosperity for all Georgia families.

In addition to underfunding key priority areas such as behavioral health, Medicaid, and public schools—from K-12 to higher education—serious challenges remain across state government. Between 2008 and 2022, the state’s workforce dropped from 83,000 full-time employees to less than 60,000, even as Georgia’s population grew by more than one million residents.[11] By the conclusion of FY 2022, turnover across all state agencies reached an all-time high of over 25 percent and greater than 29 percent among full-time employees. Meanwhile the number of applicants for state positions fell to an all-time low. Even with a $2,000 across-the-board increase added this year to stem turnover and maintain existing staffing levels, the median starting salary for executive branch employees remains at approximately $36,000, with the workforce-wide median at just below $47,000 per year.[12]

Ultimately, Georgia’s system of government depends on cooperation between the governor and General Assembly leaders to meet the needs of their constituents. With unilateral authority to set the state’s revenue estimate—which in effect acts as a spending cap—held by the governor, and power over appropriations solely vested in the General Assembly, authority is divided between the state’s executive and legislative branches to create a system of checks and balances. Going forward, state leaders have a historic opportunity to improve the quality of life for generations of Georgians with more unspent funds freely available than ever before. Lawmakers must act responsibly by deploying available resources, both in terms of one-time surplus funds and the substantial unappropriated revenues that amass each fiscal year.

End Notes

[1] State of Georgia Constitution, Article V, Paragraph XIII.

[2] O.C.G.A. § 45-12-86.

[3] Office of the Governor. HB 19 – FY 2024 Budget – Line-Item Veto and Disregard Letter and Statements, May 5, 2023.

[4] McCray, V. & Salzer, J. (2023, March 30). “Sonny Perdue: $66 million university cut ‘incredibly disappointing.” Atlanta Journal-Constitution, https://www.ajc.com/education/sonny-perdue-66-million-university-cut-incredibly-disappointing/FXXYEQYCYJBS3A367X4D3VRGNA/

[5] University System of Georgia. Additional state budget decrease of $66 million will hurt University System of Georgia Institutions. Retrieved March 30, 2023, from https://www.usg.edu/news/release/additional_state_budget_decrease_of_66_million_will_hurt_university_system_of_georgia_institutions/

[6] Schaefer, D. Sine Die 2023 Recap. Georgia Budget & Policy Institute. Retrieved June 8 from https://gbpi.org/sine-die-2023/

[7] Bluestein, G. (2023, January 18). ‘Hallelujah.’ Many HOPE recipients in line for a boost. Atlanta Journal-Constitution. https://www.ajc.com/politics/politics-blog/hallelujah-many-hope-recipients-in-line-for-a-boost/CRBS2T2IBZD5FMH4WROFP7HSOU/?state=refreshTokenFallback

[8] The Governor’s Budget Report, Amended Fiscal Year 2022 and Fiscal Year 2023

[9] The Governor’s Budget Report, Amended Fiscal Year 2023 and Fiscal Year 2024

[10] The Governor’s Budget Report, Amended Fiscal Year 2023 and Fiscal Year 2024; Department of Revenue, Comparative Summary of State General Fund Receipts (July 2022 – May 2023).

[11] Department of Administrative Services, Human Resources division. (2023, January). State of Georgia TeamWorks HCM System Fiscal Year 2022 Workforce Report: July 1, 2021 – June 30, 2022.

[12] Ibid.