Georgia has slipped back more than three decades in its national ranking on a key measure of economic well-being, according to recent news reports. This trend should prompt some soul-searching among Georgia’s policymakers about the course they’ve set for the state.

Georgia has slipped back more than three decades in its national ranking on a key measure of economic well-being, according to recent news reports. This trend should prompt some soul-searching among Georgia’s policymakers about the course they’ve set for the state.

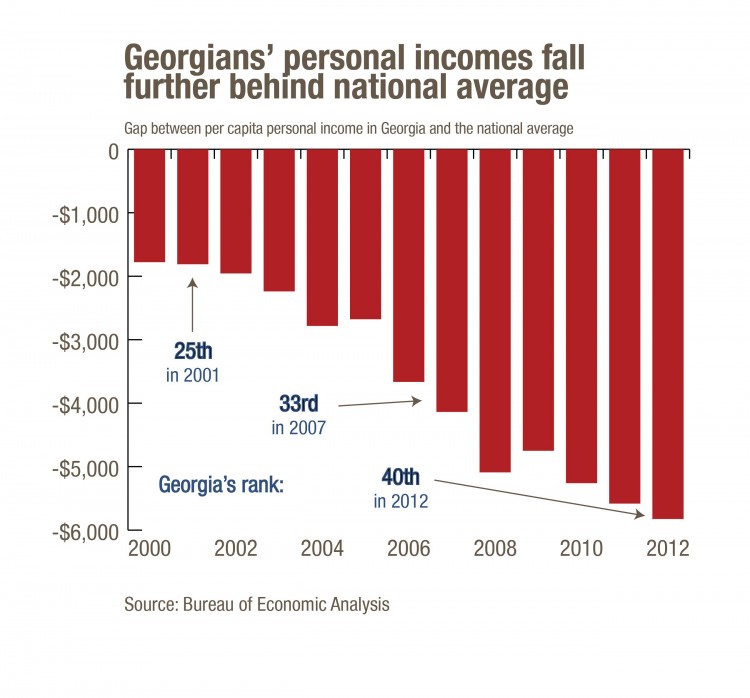

Georgia’s level of per capita income – a catch-all measure that includes wages, stock dividends, government benefits and other earnings by individuals – is down to 40th among the states as of 2012, the most recent year of data available. That is the same position Georgia held in 1979 and is down from 25th in 2001 and 28th as recently as 2006.

The original analysis by the Atlanta Journal Constitution explores several possible explanations for Georgia’s decline: an erosion of high-paying jobs since Georgia’s economic expansion of the 1990s; outside circumstances such as a natural resource boom that’s allowed some other states to pass us by; and Georgia’s overexposure to the housing bubble and dot-com bust. Evidence suggests that all of these factors play a role.

But there’s also another, perhaps more overarching explanation for this decline: Georgia has simply made itself less economically viable than it once was.

In the 1990s, when Georgia’s economy and financial well-being were leading the South and keeping pace with the nation, state leaders were making critical investments designed to expand opportunities and build Georgia’s future:

- Affordable colleges and universities that educated a new generation of workers, entrepreneurs and civic leaders.

- Ground-breaking pre-Kindergarten programs that helped prepare children for a lifetime of learning.

- Roads and infrastructure that helped attract and then pull off the 1996 Olympics.

- Enhancements to health care, social services and cultural amenities such as parks and libraries that boosted Georgians’ quality of life.

Georgia was seen as a state moving forward, and people and businesses flocked here. Today, however, Georgia seems determined to turn back the clock:

- Deep cuts to K-12 education and universities, even as employers stress the need for a well-educated workforce.

- Failure to deal with persistent transportation gridlock that’s choking economic growth.

- Draconian immigration measures that lock out workers eager to come here and attacks on services that keep poor families and the unemployed from falling further behind.

- An ideologically rigid refusal to implement affordable, common sense reforms such as Medicaid expansion, which would improve the health and security of Georgia’s workforce

And now we hear rumblings about a push for reckless tax cuts that would cripple Georgia’s finances and the state’s ability to make vital investments for the future.

The truth is that the best way to attract new businesses and jobs is to make the state attractive. That means investing in the foundations of a strong economy such as good schools, safe communities and well-maintained infrastructure. It also means building a fair and modern tax structure that raises enough money for Georgia to meet its growing needs.

Maybe these shocking new income statistics will help some of Georgia’s lawmakers see the light. Only by enacting policies that make Georgia a more attractive place to live, work and raise a family can they help reverse our fall.