Our recent report on potential tax shift plans in Georgia estimates that a seismic shift from incomes taxes to sales taxes would raise total state taxes for as many as four in five Georgia taxpayers. You might ask how cutting income taxes could actually increase taxes on most families. Our new fact sheet provides a brief explanation.

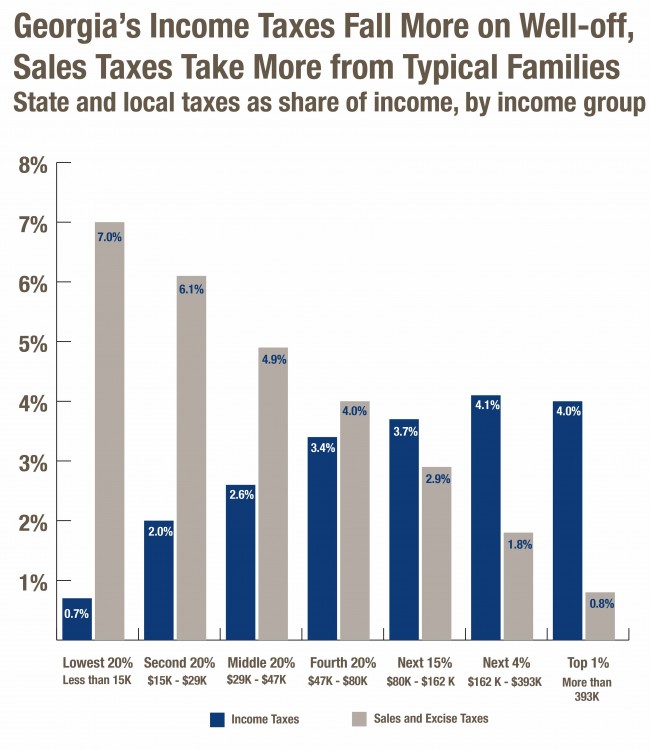

If you shift from income taxes to sales taxes, you increase state government’s reliance on levies that already take a greater share from lower- and middle-income people. At the same time, a shift away from income taxes decreases state government’s reliance on taxes that take more from large corporations and the well-off. Georgians making less than $15,000 per year, for example, pay an average of 0.7 percent of their annual earnings in personal income taxes and an estimated 7 percent in sales taxes.

Our recent report lays out three scenarios for tax shift legislation in Georgia. They vary slightly based on our assumptions about the potential details of a final plan. We crafted these scenarios based on analysis of both similar plans pursued in other states and the discussions within Georgia, including legislation awaiting next year’s General Assembly. Our scenario for halving Georgia’s income tax, for example, is based on plans suggested at a recent meeting of Georgia’s Senate Fair Tax Study Committee.

To generate our estimates for this report, we ran the three scenarios through one of the most respected “tax simulators” in the country, the tax microsimulation model of the Washington, D.C.-based Institute on Taxation and Economic Policy (ITEP). Created in 1996, the model has a long track record and is widely considered on par with simulators used by the congressional Joint Committee on Taxation, the U.S. Treasury Department and the Congressional Budget Office. The organization’s figures are reliable.

As proposals in Georgia add key details, we will update our estimates. If tax shift supporters craft a plan that cuts taxes for most Georgians or prevents the deep cuts in state revenue caused by similar plans in other states, we will be the first to report that. But the technicalities of how state taxes work make creating such a scheme extremely hard. Other states haven’t been able to solve that puzzle.