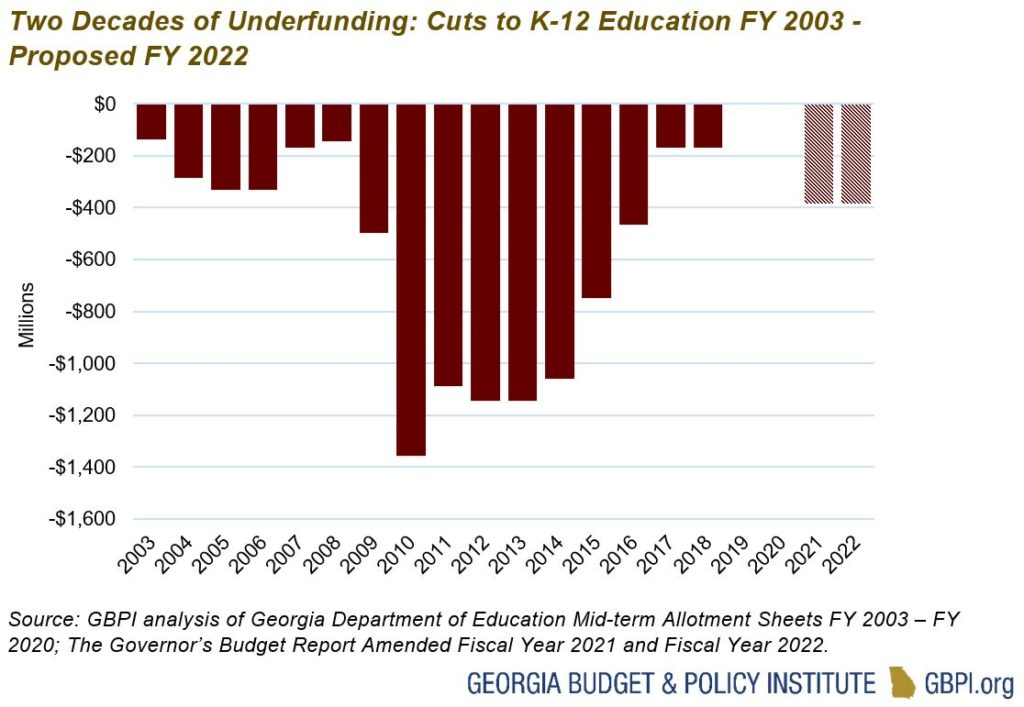

Gov. Kemp’s budget proposal for Fiscal Year (FY) 2022 provides Georgia’s public schools $10.2 billion, a $573 million increase above current funding. This addition would partially restore cuts from the FY 2021 budget, with the Quality Basic Education funding formula underfunded by $393 million moving forward. The proposal includes a reduction of $69 million due to student enrollment decline attributed to the pandemic. Growth in state charter school enrollment and increased formula-driven funds for equalization grants make up the bulk of the remaining additional dollars. If passed, this budget would continue a pattern of underfunding public schools in Georgia and straining local school budgets. Fiscal year 2022 would be the 18th year of the last 20 that the state has failed to meet the minimum requirements to fund public schools.

By the Numbers

Amended 2021 Fiscal Year Budget

- Funding to partially restore $568 million in cuts to the FY 2021 budget will take effect in the AFY 2021 budget instead of waiting until the beginning of FY 2022, leaving $393 million in cuts.

- Increases in funding for nine programs in the Department of Education to restore previous cuts totaling $9.2 million. The Georgia Network for Educational and Therapeutic Support (GNETS) receives the largest funding restoration at $3.7 million, while preschool disability services gain $2.5 million.

2022 Fiscal Year Budget

- Funding in the proposed 2022 budget for the Georgia Department of Education will increase by $573 million, or 6 percent, from the original FY 2021 amount.

- A proposed reduction of $166 million attributed to lower student school enrollments through the Quality Basic Education (QBE) formula, the state’s method for calculating K-12 funding.

- Increases in funding for the QBE formula are partially offset by a reduction of $112 million under the Local Five Mill Share component of the formula. This is a result of climbing property values in some areas of the state, which increased school districts’ contribution to total QBE funding.[1] The Local Five Mill Share is a requirement that Georgia’s schools are partially funded by local property taxes.

- The state will pay an additional $57 million to reflect a slightly higher employer contribution rate to the Teachers Retirement System.

- Funding for the Equalization program, which provides supplemental dollars to districts with low property wealth, would command an additional $72 million. Being formula-driven, increases in this grant represent growing inequality between the property-tax collections of the bottom half of the school districts as compared to the state average collection.

- School districts will receive $20 million in bonds for school bus replacement.

- Proposed $12,275,000 in bonds for career, technical and agricultural equipment for schools.

Partially Restored Cuts Improve Situation While Leaving Schools in a Hole Moving Forward

The proposed mid-term inclusion of $568 million to QBE and $9.2 million to other programs in the Department of Education is a welcome, but incomplete, reprieve from harsh budget cuts implemented in FY 2021. In certain years of previous budget reductions, Georgia’s schools have been dealt cuts in the amended budget, making yearly financial planning difficult. The fact that this partial restoration will take place in the amended will allow school districts to undo some of the changes made over the summer in response to the FY 2021 $952 million budget cut.

However, without additional funding to support the services that Georgians rely on, Georgia will have only fully-funded public education in two of the last 20 years.

Failure to Maintain Grants Worsens Inequality

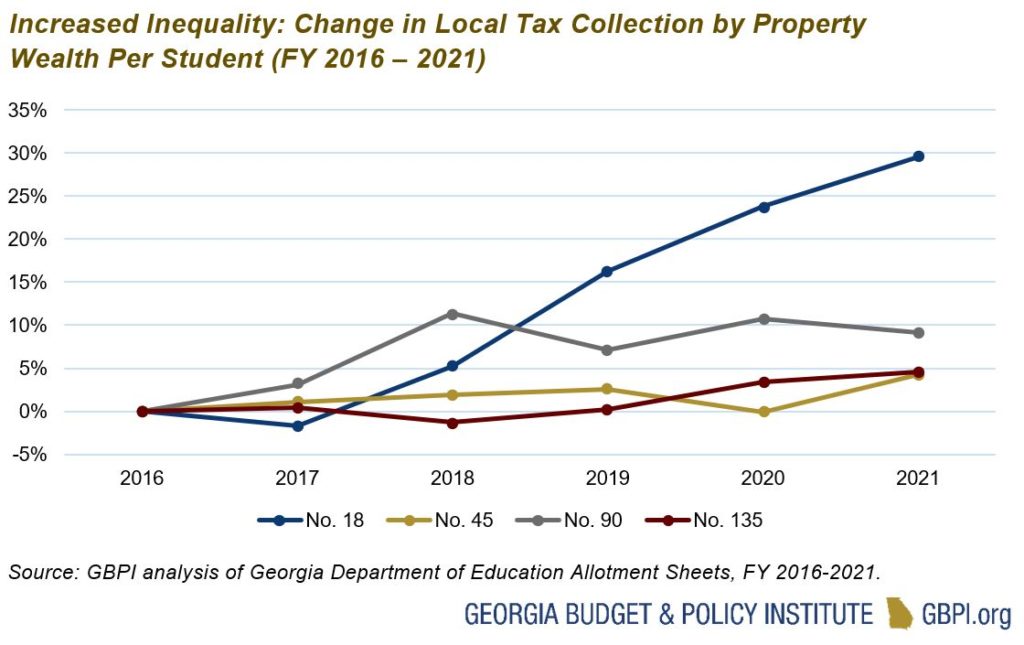

The last decade has seen Georgia lawmakers underfund several grants that school districts rely on to provide an adequate public education. Districts with lower-than-average property values have felt the effects worse than the rest of the state.

The average school district saw increased property tax collections the last five years, not because of higher rates of taxation, but because property values increased. However, the growth is not the same statewide. The graph below shows select school districts based on their rank of property value per student.

In the district that ranks No. 18 for wealth (90th percentile) per student property, values increased 30 percent from FY 2016 to FY 2021. Over the same time period the districts ranked No. 45 (75th percentile), No. 90 (state average: 50th percentile) and No. 135 (25th percentile) averaged increases between 5 and 9 percent.

The uniquely-American system of paying for public schools with local property taxes bakes in inequality that began centuries before. The governor’s proposed budget increases Equalization grant funding by $72 million in FY 2022, but this is based on a formula that was reduced in the wake of the Great Recession. The result is hundreds of millions of dollars less for schools. Sparsity grants, which support more rural, smaller schools continue to be funded at a fraction of the formula requirements in the governor’s budget.[2] The cumulative effect is a growing inequality between school districts that can raise local funds and those that depend on a weakened state commitment. The entire state stands to suffer as a result.

End Notes

[1] For more information on how Georgia public schools are funded, see: Owens, S. (2019). How does Georgia fund schools? Georgia Budget and Policy Institute. https://gbpi.org/how-does-georgia-fund-schools/ (“5 Mills” 3:16 marker in video)

[2] Data provided to GBPI by the Georgia Department of Education.