Overview

After a stretch of largely uninterrupted growth that saw state revenues climb by an annual average of 6 percent between fiscal years (FY) 2011 and 2019, many of Georgia’s agencies have been asked to make mandatory spending cuts. Those cuts are in response to slowing economic activity, increased spending driven by Gov. Brian P. Kemp’s priorities and the effects of recent tax changes that will lower revenue collections by an estimated $1 billion from the previous year’s baseline.

Each January the governor proposes two distinct budgets. The amended budget for FY 2020 adjusts spending levels for the current fiscal year that ends June 30 to reflect actual tax collections, enrollment growth and any spending changes over the course of the year. The full budget for FY 2021 lays out a new spending plan for the next fiscal year that starts the following July 1.

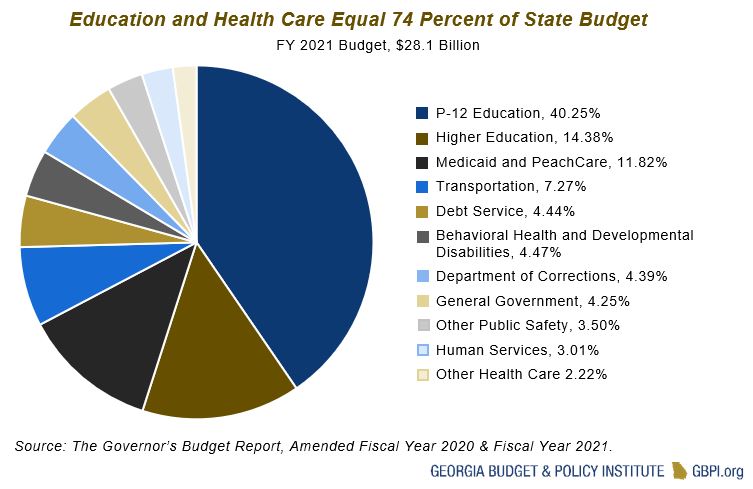

The FY 2021 budget proposes $1.1 billion in new spending above the state’s current obligations, driven by growth in program enrollment and Gov. Kemp’s call to increase annual pay for certified educators by $2,000. New additions are for the most part limited to $400 million in pay raises for teachers and state employees, along with approximately $600 million to cover rising costs of enrollment-driven programs such as K-12 education, Medicaid and PeachCare, the university system and technical colleges.

Gov. Kemp’s 2021 budget also proposes $300 million in budget cuts, calling for Georgia’s state agencies to reduce appropriations by cutting back funding for operations, staffing, program grants and initiatives. The largest share of cuts included in the governor’s executive budget would reduce state funding for public safety ($105 million), followed by essential government agencies ($78 million), health care ($58 million), education ($35 million), agriculture and environmental stewardship programs ($17 million) and economic development and community affairs ($8 million).

Helping the state meet its constitutional requirement of a balanced budget is $191 million in FY 2021 savings due to a scheduled reduction that lowers the state’s contribution to the Teacher Retirement System (TRS) from 21.14 to 19.06 percent and a $150 million reduction in the amount of funding sent down to local districts driven by increased local property tax collection. While these changes will reduce the state’s year-over-year funding obligations by $340 million in FY 2021, the effects will not necessarily translate into sustainable savings. In the case of Georgia’s TRS contributions, the required funding level is actuarially determined by the fiscal condition of the pension system. Looking ahead to future years, TRS payments are almost certain to increase as time goes on.

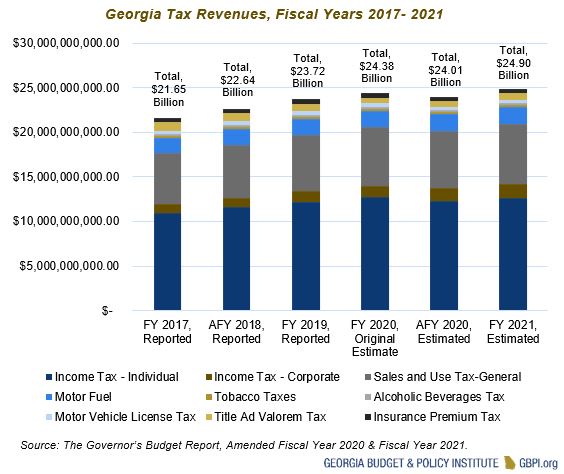

Revenues and General Fund Collections

Through the first six months of the 2020 fiscal year, the individual income tax—which makes up 51 percent of Georgia’s tax collections—raised $30 million less than the state collected during the same timeframe over the previous year.[1] In part, these negative revenues can be explained by the combined effects of major policy changes initiated by the federal Tax Cuts and Jobs Act of 2017 (TCJA), Georgia’s state response of 2018 and other previously enacted legislative changes to the state’s income and sales tax provisions.[2]

Georgia’s state response to the TCJA was adopted in two phases that reshaped the structure of the state’s largest source of revenue. First, effective February of 2018, the state aligned its tax code with most of the 2017 federal changes to itemized deductions and doubled its standard deduction. In January 2019, the top income rate was reduced to 5.75 percent, the first reduction since it was set at 6 percent in 1937. While the current FY 2020 budget anticipated that income tax revenues would remain steady at 4.7 percent growth, the combined effects of the reduction in the state’s top income tax rate and the growth of other tax expenditures contributed a significant slow-down in revenue growth.

As a result, Gov. Kemp’s amended 2020 budget reduces the state’s revenue estimate for the individual income tax by $450 million from the original estimate used to craft the current FY 2020 budget, shifted down from $12.75 billion to $12.3 billion. However, state forecasters are projecting that personal income tax revenues will rebound in FY 2021, estimating nearly 3 percent growth and revenues of $12.65 billion.

The estimate for the state’s second largest source of revenue, sales tax, was also revised downward by $75 million for 2020 to reflect a 3 percent rate of growth, reduced from its original growth projection of 4.4 percent. However, state leaders have prioritized the passage of House Bill 276 during the 2020 legislative session to close loopholes that allow some online retailers to avoid collecting sales taxes. This legislation will likely help stem the trend that has seen the sales tax decline as a percentage of the state’s overall revenue collections. The sales tax was nearly 31 percent of general fund receipts in 2011 and only an estimated 25 percent in FY 2021.[3]

Although the top income tax rate for corporations was also lowered to 5.75 percent, the state’s corporate income tax, which makes up less than 6 percent of tax collections, is overperforming. The state’s reduced 2020 revenue estimate anticipates nearly 11 percent growth in the corporate income tax, or about $137 million more than the amount collected in the previous fiscal year. The state forecasts that this rapid growth will continue into 2021, estimating a 9 percent rate of increase that will lift revenues by $128 million above the FY 2020 projection next year.

Another source of revenue currently demonstrating weak growth is the state’s tobacco tax, which is down 3.6 percent from the previous fiscal year, with only $111 million raised over the first six months of FY 2020. Georgia continues to maintain the nation’s third-lowest tobacco tax, levying a fee of just $0.37 cents per pack of cigarettes. Thirty-seven states assess fees of $1 or more per pack and the national average is currently $1.81.[4] Although the governor’s budget projects relatively low revenue growth of about 3 percent in 2020 and 2 percent the following year, the state of Georgia could significantly increase tobacco revenues by relinquishing its status as a regional outlier while taking an important step to improve public health.

Currently, Georgia spends about $3.18 billion a year on medical costs associated with cigarette smoking, including an estimated $650.4 million in Medicaid spending. In addition to increasing revenues from product sales, raising the cigarette tax by $1.50 would save Georgia $12.27 million in fewer lung cancer cases and $28.11 million in fewer heart attacks and strokes over five years.[5] Legislative consensus also appears to be forming around creating parity for currently un-taxed vaping products under the state’s tobacco tax schedule.

Gov. Kemp’s budget also includes an economic report in his executive budget, which notes that, “As Georgia is the twelfth most trade-dependent state in the United States, slow economic growth in most of our major trade partners is slowing Georgia’s economic growth.” With the report estimating that job numbers grew at an estimated rate of “0.2 or 0.3 [percent] from July 2018 to July 2019,” the state’s economic performance will remain an important factor in maintaining the state’s positive growth trajectory.[6]

Adding increased pressure to the state budget is the relatively unprecedented cost of Gov. Kemp’s proposal to budget for an additional $5,000 in pay for Georgia’s 132,000 certified educators, which, if approved, will commit the state to increasing annual appropriations by a total of $900 million over a two-year period. Although Georgia has made large-scale investments in recent years, such as the General Assembly’s 2016 effort to boost transportation spending with House Bill 170, such major spending increases have often been accompanied by corresponding revenue measures to support elevations in appropriations without shifting resources away from other priorities. Notwithstanding the recommended spending cuts, the state will continue to require strong revenue performance to maintain the baseline set by Georgia’s already-lean FY 2021 budget.

Going forward, Georgia’s economy must grow by an estimated 2.5 percent annually to preserve state spending at the reduced level recommended in Gov. Kemp’s executive budget. Economic forecasts suggest that Georgia’s growth is being powered by population growth, the health care industry, higher defense spending, building construction and expansion driven by the 26 Fortune 1000 companies located in the state.[7] With the baseline level of spending expected to rise by 9 percent from $26 billion in the amended 2020 fiscal year to $29 billion by FY 2024, Georgia’s revenues must continue to steadily increase in the years ahead to simply maintain the level of spending proposed in the governor‘s FY 2021 budget.

Reserves Help State in Event of Emergency, Recession

Reserves Help State in Event of Emergency, Recession

Georgia’s Revenue Shortfall Reserve, or “rainy day fund,” stands at $2.81 billion in January 2020, or 11 percent of 2019 general fund revenues. Current reserves would be sufficient to allow the state to operate for 36 days in the event of an emergency or recession.

Rather than lawmakers appropriating funds to the reserve fund, the balance grows at the end of each fiscal year if there is surplus state revenue—up to 15 percent of prior year revenues. Prior to the Great Recession, the reserves grew to $1.5 billion before lawmakers justifiably tapped the savings to help balance budgets in 2008, 2009 and 2010. Even so, many important services and programs experienced cuts during and after the recession. As the General Assembly debates budget cuts, Georgia still faces big needs in areas such as K-12 schools and access to health care.

Amended Fiscal Year 2020 Budget Includes Deep Cuts

Amended Fiscal Year 2020 Budget Includes Deep Cuts

The amended 2020 budget includes more than $210 million in agency budget cuts, which follow Gov. Kemp’s decision to lower the state’s revenue estimate by $416 million because of underperforming tax collections. Under the newly issued FY 2020 revenue estimate, general fund tax and fee collections are expected to grow at an annual rate of 0.66 percent, revised down from the state’s original estimate of 3.2 percent.

Nearly $256 million in additional funds will be added to the state budget from the Mid-Year Adjustment for Education, which provides additional money at the midpoint of each fiscal year to pay for historically rising K-12 student enrollment. Overall, the governor’s amended 2020 budget seeks to reduce the state’s current level of spending by $148 million over the final six months of the fiscal year. As a result, state agencies have been asked to implement the first mandatory budget cuts since the Great Recession.

Fiscal Year 2021 Budget Also Includes Cuts to Key State Priorities

Formula-driven spending for education, health care, public safety and human services comprise about 85 percent of Georgia’s $26.6 billion spending plan. While the state’s basic formulas for education and health care remain funded at their current level, Gov. Kemp’s FY 2021 budget includes approximately $300 million of cuts targeting a wide array of state government functions. Outside of formula-driven spending and most of the state’s courts, virtually every agency of state government is set to implement budget reductions in FY 2020 and FY 2021.

Most agencies are facing cuts of about 3-6 percent to their discretionary operating budgets; however, some agencies are facing even deeper cuts, such as the Department of Agriculture, which has been asked to reduce spending by nearly 13 percent over the next fiscal year. The agencies facing the largest overall share of the $300 million in proposed budget cuts for 2021 are Corrections ($54 million), the Department of Behavioral Health and Developmental Disabilities ($35 million), Human Services ($29 million), Juvenile Justice ($19 million), Public Health ($16 million), Education ($12 million) and Transportation ($11 million).

Across every core category of government, members of the General Assembly will find cuts to recent legislative priorities included in the FY 2021 budget. Some of Georgia’s most vitally important safety-net agencies, such as the Department of Behavioral and Developmental Disabilities and the Department of Human Services, are facing cuts that scale back funding for critical functions of state government.

For example, if the cuts in FY 2021 remain unchanged, Georgia will reduce its spending on Child and Adolescent Mental Health Services by $14 million, while also cutting the funds appropriated to assist low-income Georgians in verifying their eligibility to obtain existing federal benefits. The proposal also recommends $105 million in cuts to public safety and criminal justice agencies. These cuts include deep funding reductions for the Departments of Corrections and Community Supervision, along with the Criminal Justice Coordinating Council, which administers grant funding for accountability courts that manage cases for non-violent offenders, veterans and Georgians struggling with substance abuse.

Major Budget Provisions for FY 2021 and Amended FY 2020

Major Provisions of the 2020 Amended Fiscal Year budget include:

Appropriations Added for Education and Child Care

- $113 million for a midterm adjustment for increased enrollment in public K-12 and state charter schools required by the Quality Basic Education (QBE) funding program.

- $27 million for the State Charter Schools Commission to implement HB 787 and increase state funding provided to charter schools.

Cuts Affecting Education and Child Care

- $15 million in cuts to programs administered by the Board of Regents of the University System of Georgia, including: $1.7 million in cuts to public libraries, $6.2 million cuts to the Agricultural Experiment Station and Cooperative Extension Service, $1.3 million in cuts to the Medical College of Georgia Hospital and Clinics and $1.1 million in cuts to the Enterprise Innovation Institute.

- $7 million in cuts to the Department of Education, including $600,000 in cuts to the Chief Turnaround Officer program and $600,000 in reduced funding for Regional Education Service Agencies (RESAs).

- $743,000 from Bright from the Start: Department of Early Care and Learning that reduces funds for childcare services, including a $500,000 reduction for the Childcare and Parent Services (CAPS) program.

- $2.1 million in reduced funding for the Technical College System of Georgia (TCSG).

Appropriations Added for Health Care

- $23 million to support the Indigent Care Trust Fund and draw down additional federal money for Disproportionate Share Hospital payments and $10.7 million in state costs for Medicare patients.

- $200,000 to the Secretary of State to establish the Georgia Access to Medical Cannabis Commission.

Cuts Affecting Health Care

- $33.3 million in reduced funding to Department of Behavioral Health and Developmental Disabilities, including: $12.8 million cut from Child and Adolescent Mental Health Services, $5 million for adult addictive disease services and $4.1 million in reduced direct care support services.

- $4.3 million in cuts to agencies and grant programs attached to the Department of Community Health, including: $463,000 cut from the Rural Health Systems Innovation Center, $273,000 cut from the Accelerated Track Graduate Medical Education program, $962,000 in reduced funds for the Mercer School of Medicine Operating Grant, $1.2 million cut from the Morehouse School of Medicine Operating Grant and $282,000 withheld from the Georgia Drug and Narcotics Agency.

- $6.2 million in cuts to the Department of Public Health, including: $7.3 million in reduced grant funding for county boards of health, $1.4 million from Adolescent and Adult Health Promotion, $590,000 in cuts for Infectious Disease Control and $410,000 in cuts for Infant and Child Essential Health Treatment Services.

Cuts Affecting Public Safety and Criminal Justice

- $47 million in cuts to the Department of Corrections, including: $35.3 million in cuts to state prisons, $7.6 million for health care and $1.8 million in reduced funding for Transition Centers.

- $14.7 million in reduced funding for the Department of Juvenile Justice, cutting appropriations for Youth Detention Centers by $12.2 million and community service programs by $2.2 million.

- $7.5 million in cuts to the Department of Community Supervision.

- $4.9 million cut from the Georgia Bureau of Investigation (GBI), including: $693,000 in cuts to Forensic Scientific Services, $1.7 million for Regional Investigative Services and $2.1 million in reduced funding to the Criminal Justice Coordinating Council, which includes $1.3 million in reduced funds for state grants to local accountability courts.

- $7.4 million cut from the Department of Public Safety, including $5 million cut from Field Offices and Services.

- $1.9 million in funding cut from the Georgia Public Defender Council.

- $920,000 in combined cuts to the Georgia Public Safety Training Center and Georgia Peace Officer Standards and Training Council.

Cuts affecting Essential Services, Rural Georgia and Low-Income Families

- $25.4 million in cuts to the Department of Human Services, including: $6.8 million in cuts to Child Welfare Services, $4.9 million in cuts to Federal Eligibility Benefit Services and $1.2 million in cuts to 67 child support services agent positions.

- $3.8 million cut from the Department of Natural Resources, including $1.2 million for Environmental Protection and $700,000 for Wildlife resources.

- $3.6 million in cuts to the Department of Revenue for Tax Compliance.

- $1.8 million in reduced funding to the Department of Agriculture.

- $5.3 million cut from the Department of Community Affairs.

- $3.8 million in cuts to Insurance Regulation.

- $1.7 million in reduced funding for the Department of Economic Development.

- $1.5 million in cuts to the Department of Veterans Service.

Major Provisions of the FY 2021 budget include:

Appropriations Added Across All Agencies of State Government

- $44.3 million to provide $1,000 salary increases to full-time state employees earning less than $40,000 per year

Appropriations Added for Education and Child Care

- $356.9 million to increase salaries for certified teachers by $2,000 and to provide a $1,000 salary increase for non-certified personnel earning less than $40,000 per year, effective July 1, 2020.

- $143.5 million to cover student enrollment growth and routine adjustments in teachers’ salaries through the Quality Basic Education formula for public schools. Student enrollment will reach 1.75 million in FY 2021, with more than 132,000 teachers and administrators employed across the state.

- $78.1 million for enrollment growth and operating costs in the university system.

- $56 million in lottery funds for HOPE scholarships to cover projected need.

- $50.5 million for the State Charter Schools Commission to increase state funding provided to charter schools.

- $32 million for the equalization program, which provides funds to districts with low property wealth.

- $12.5 million in bonds for buses for local school districts, reduced from $20 million in the previous fiscal year.

- $5.4 million to provide a 5 percent salary increase to transportation and food service employees.

Cuts Affecting Education and Child Care

- $22 million in cuts to programs administered by the Board of Regents of the University System of Georgia, including: $7.6 million in cuts to the Agricultural Experiment Station and Cooperative Extension Service, $3.1 million in cuts to public libraries, $2 million in cuts to the Medical College of Georgia Hospital and Clinics and $1.5 million in cuts to the Enterprise Innovation Institute.

- $12.5 million in cuts to the Department of Education, including: $1.8 million in cuts to the Chief Turnaround Officer program, $2.5 million to reduce enrollment in the Georgia Network for Educational and Therapeutic Support (GNETS) and $2 million eliminated from grants for the Career, Technical and Agricultural Education and Technology (CTAE) program.

- $982,000 in funding cuts from Bright from the Start: Department of Early Care and Learning: reduce funds for childcare services, including a $500,000 reduction for the Childcare and Parent Services (CAPS) program.

- $700,000 in funding cut for the Technical College System of Georgia (TCSG).

Appropriations Added for Health Care

- $169 million for Medicaid and PeachCare, including $79.8 million to offset a reduction in the matching Federal Medical Assistance Percentage (FMAP) rate.

- $2.7 million for 125 slots for New Options Now program for individuals with intellectual and developmental disabilities.

Cuts Affecting Health Care

- $35.4 million in reduced funding to Department of Behavioral Health and Developmental Disabilities, including: $14 million cut from Child and Adolescent Mental Health Services, $8 million in reduced adult behavioral health services, $5 million for adult addictive disease services and $4.8 million in direct care support services.

- $6.2 million in cuts to agencies and grant programs attached to the Department of Community Health, including: $463,000 cut from the Rural Health Systems Innovation Center, $400,000 cut from the Accelerated Track Graduate Medical Education program, $1.4 million in reduced funds for the Mercer School of Medicine Operating Grant, $1.7 million cut from the Morehouse School of Medicine Operating Grant and $330,000 withheld from the Georgia Drug and Narcotics Agency.

- $16.4 million in cuts to the Department of Public Health, including: $9.2 million in reduced grant funding for county boards of health, $1.9 million from Adolescent and Adult Health Promotion and $500,000 in cuts for Infectious Disease Control.

Appropriations Added for Public Safety and Criminal Justice

- $7.2 million for Phase III of the Metro Reentry Facility.

- $2.5 million to provide a rate increase for private prisons.

- $884,000 to expand the GBI Gang Taskforce.

Cuts Affecting Public Safety and Criminal Justice:

- $54 million in cuts to the Department of Corrections, including: $43.7 million in cuts to state prisons, $6.9 million for health care and $3 million in reduced funding for Transition Centers.

- $19 million in reduced funding for the Department of Juvenile Justice, cutting appropriations for Youth Detention Centers by $18 million and community service programs by $1 million.

- $10.5 million in cuts to the Department of Community Supervision.

- $8 million cut from the Georgia Bureau of Investigation (GBI), including: $950,000 in cuts to Forensic Scientific Services, $2.5 million for Regional Investigative Services and $3.2 million in reduced funding to the Criminal Justice Coordinating Council, which includes $2.1 million in reduced funds for state grants to local accountability courts.

- $6.6 million cut from the Department of Public Safety, including $5.5 million cut from Field Offices and Services.

- $3.5 million in funding cut from the Georgia Public Defender Council.

- $1.3 million in combined cuts to the Georgia Public Safety Training Center, Georgia Peace Officer Standards and Training Council and Georgia Firefighter Standards and Training Council.

Cuts Affecting Essential Services, Rural Georgia and Low-Income Families

- $28.8 million in cuts to the Department of Human Services, including: $11 million in cuts to Child Welfare Services, $6.2 million in cuts to Federal Eligibility Benefit Services, $4.6 million in reduced funding for Elder Support Services and $1.8 million in cuts to 101 child support services agent positions.

- $11 million in cuts to state funding for the Department of Transportation (non-Motor Fuel).

- $9 million cut from the Department of Natural Resources, including $1.8 million for Environmental Protection and $1.6 million for Wildlife resources.

- $7.5 million in cuts to the Department of Revenue for Tax Compliance.

- $6.5 million in reduced funding to the Department of Agriculture.

- $5.5 million cut from the Department of Community Affairs.

- $3.8 million in cuts to Insurance Regulation.

- $2.7 million in reduced funding for the Department of Economic Development.

- $1.8 million in cuts to the Department of Veterans Service.

Endnotes

[1] Georgia Department of Revenue, “Comparative Summary of State General Fund Receipts For the Month Ended December 2019,” January 2020.

[2] Danny Kanso, “The Tax Cuts and Jobs Act in Georgia: High Income Earners Receive Greatest Benefits,” GBPI, July 2019.

[3] Georgia Department of Revenue, Comparative Summary of State General Fund Receipts. GBPI analysis of reports from 2011-2020.

[4] Campaign for Tobacco Free Kids, State Cigarette Excise Tax Rates & Rankings, June 28, 2019.

[5] “New Revenues, Public Health Benefits and Cost Savings From A $1.50 Cigarette Tax Increase in Georgia.” Estimates from the Campaign for Tobacco-Free Kids, Tobacconomics, and American Cancer Society Cancer Action Network. 2018.

[6] Appendix: ”Georgia Economic Report,” The Governor’s Budget Report, Amended Fiscal Year 2020 & Fiscal Year 2021.

[7] Selig Center for Economic Growth, Terry College of Business, The University of Georgia, ”Georgia Economic Outlook,” December 6, 2018