Powered by unprecedented federal support to mitigate the economic fallout of the COVID-19 pandemic, Gov. Kemp’s proposed Fiscal Year (FY) 2023 budget presents a sharp reversal from the deep budget cuts implemented during FY 2021-22. It includes an 11 percent spike in per-capita state spending that will add approximately $3 billion in funding for Georgia’s thinly stretched state government. With few notable exceptions, such as the Department of Labor, most agencies would receive increases in appropriations sizable enough to move at least incrementally ahead of pre-pandemic funding levels.

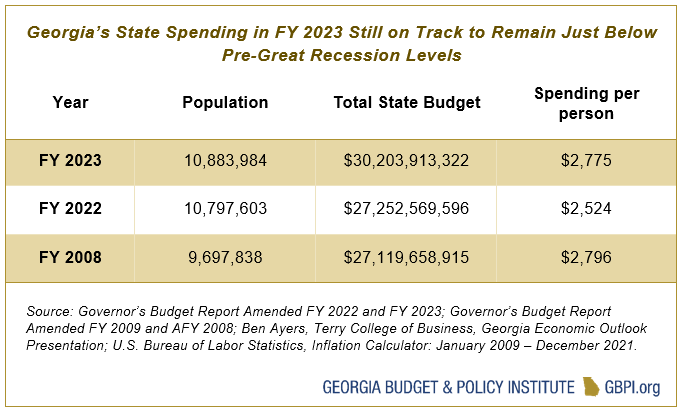

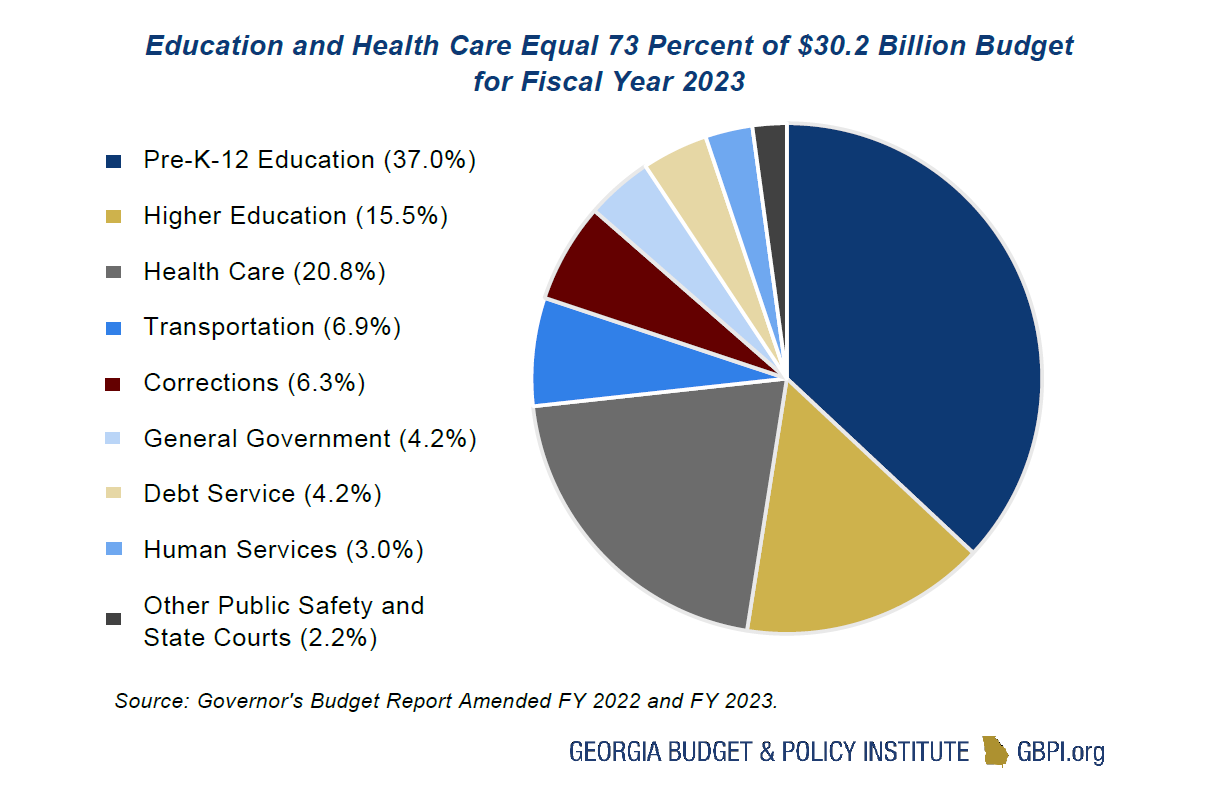

The FY 2023 budget largely marks a restoration to pre-pandemic funding levels. The increase is led by spending to reverse budget cuts to public education and increase teacher salaries, improvements to Georgia’s health care system, long-overdue pay raises and compensation increases for state employees, and a series of capital construction and agency reorganization proposals. Aided by federal support, rebounding revenues also cover the costs of implementing a series of priorities launched earlier in Gov. Kemp’s term as state government reels from years of persistent underfunding. While Georgia’s FY 2023 budget puts the state in line with its pre-pandemic trajectory, the state’s recovery remains incomplete. Even with the proposed 11 percent increase to the overall state budget from FY 2022 to FY 2023, Georgia remains on track to spend slightly less per person than in FY 2008. As the state considers restoring budget cuts made over the past two years, it is also important to recognize the cumulative effects of persistently underfunding vital programs and services since the Great Recession that have left hundreds of thousands of Georgia families vulnerable to continued economic hardship, including disproportionate numbers of Black Georgians and people of color.[1]

Proposed Amended Fiscal Year (AFY) 2022 and FY 2023 Budget Restores Majority of Pandemic Cuts

Each January, the governor proposes two distinct budgets. The proposals are called the executive budget. The amended budget for FY 2022 adjusts spending levels for the current fiscal year that ends June 30 to reflect actual tax collections, enrollment growth and any spending changes over the year. The full or “big” budget for FY 2023 lays out a new spending plan for the next fiscal year that starts on July 1, 2022.

Beginning with the FY 2021 budget that took effect in July of 2020, Georgia lawmakers adopted deep across-the-board cuts of approximately $2.2 billion from the prior year—representing about 10 percent of the annual budget—as the state’s primary response to reduced revenue projections due to the COVID-19 economic recession.[2] Gov. Kemp’s executive budget proposal for AFY 2022 would bring an end to most of these cuts by adding $2.6 billion in spending. Still, in FY 2023, state spending is on track to remain just below the level reached before the Great Recession, after adjusting for changes in inflation, at approximately $2,775 per person.[3]

To address persistent staffing shortages and state employee turnover rates at an all-time high of 23 percent, the AFY 2023 budget also includes a $5,000 cost of living adjustment for state employees. Moreover, the budget adds $119 million to increase the state’s employer 401(k) match from a maximum of 3 to 9 percent.[4] While these changes mark important progress, it is unlikely that a single cost of living increase will be enough to reverse the most severe staffing challenges, as some agencies such as the Department of Juvenile Justice report annual employee turnover rates over 90 percent for correction officers.[5] In FY 2021, Georgia maintained a workforce of 76,000 full-time state employees—down over 9 percent from FY 2019 and 25 percent since the start of the Great Recession—who were paid a median annual salary of $39,000.[6] Of these state employees, 65 percent are women, 46 percent are Black and 3 percent are Hispanic, demonstrating the clear gender and racial inequities of persistently underpaying and overburdening a shrinking workforce. Part of what has contributed to the state’s diminishing workforce in recent years is a pattern of eliminating vacant positions as a cost-cutting measure rather than appropriating sufficient resources for state agencies to attract and retain qualified applicants. Going forward, in addition to continuing to increase salaries, state leaders must also reevaluate staffing needs across government to ensure agencies can adequately serve Georgians.

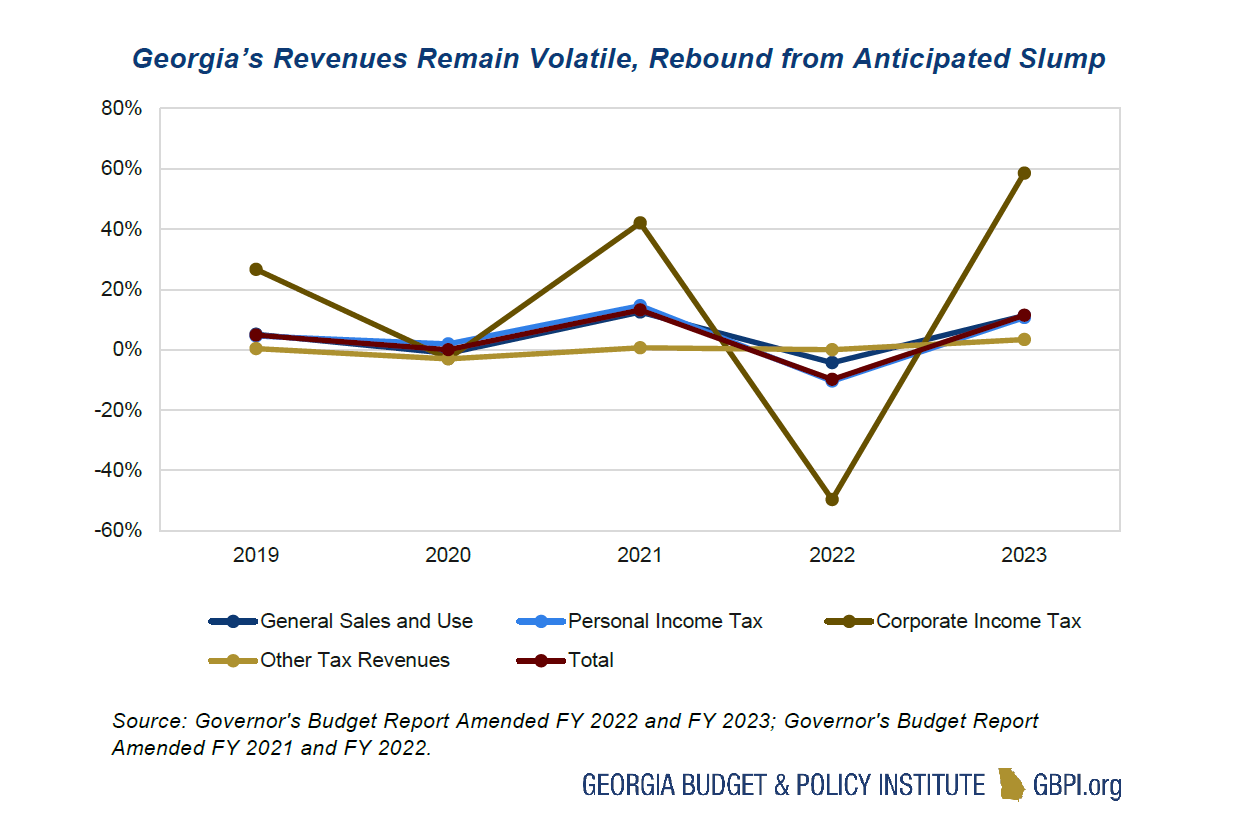

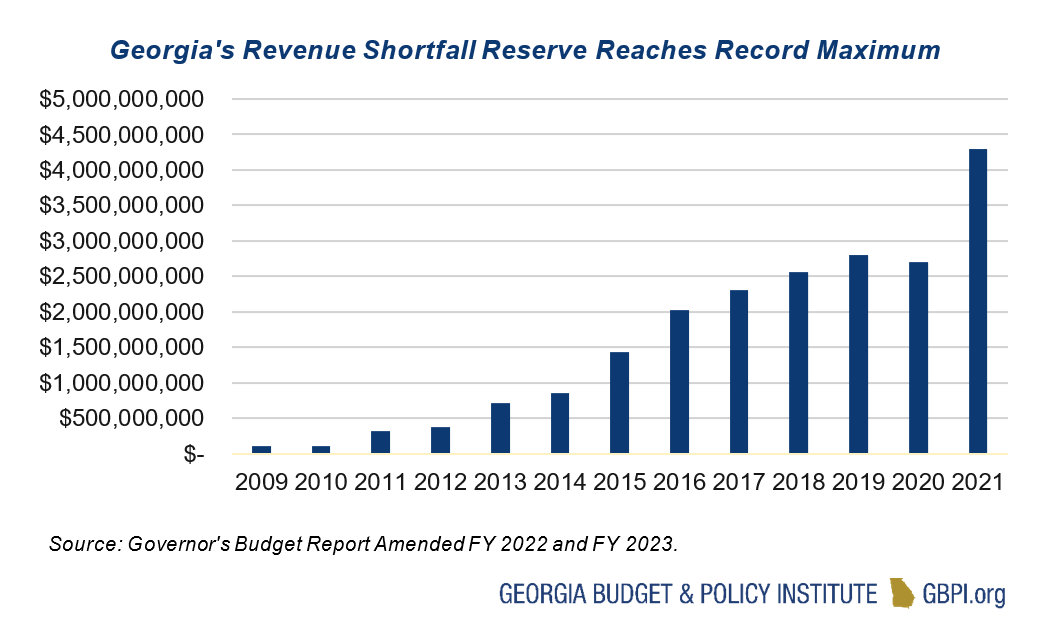

Rebounding state revenues pushed the state’s Amended Fiscal Year (AFY) 2022 revenue estimate upward by nearly $1.1 billion in personal income taxes and more than $500 million across both corporate income taxes and state sales and use taxes. Overall, from the state’s original baseline, Gov. Kemp’s updated revenue estimate predicts an increase of 9.4 percent in the amount of tax revenue the state expects to raise through June 2022. With Georgia’s state saving’s account, also known as the Revenue Shortfall Reserve (RSR), at a record maximum level of $4.3 billion and over $4.7 billion in flexible funding granted to the state under the federal American Rescue Plan, the FY 2023 budget could present a springboard to make up much of the ground lost to the COVID-19 pandemic and position the state with sufficient resources to achieve long sought-after improvements to its education and health care systems.

The RSR was created in 1976 to help manage instability in revenue collections and hedge against the possibility of a recession. FY 2021 marks the state’s first time reaching the fund’s maximum since the reserve was expanded to hold 15 percent of the prior year’s revenue collections in 2011.[7] In AFY 2022, Gov. Kemp’s budget elects to use a $1.6 billion portion of the $3.8 billion surplus generated during FY 2021 to distribute one-time, flat refunds of $250 to single filers and $500 to married filers.[8] Rather than dividing $1.6 billion among all taxpayers, Georgia’s leaders should adopt a more targeted approach modeled after a proven program structure, such as the Earned Income Tax Credit (EITC). An EITC would deliver larger payments over a longer period. Moreover, these funds could also be deployed to strengthen other core state programs cut back in recent years. Beyond accounting for expected increases in state revenues, the executive budget does not make use of the remainder of Georgia’s FY 2021 budget surplus that rests in the state’s $4.3 billion savings account or the more than $4.7 billion in flexible funding allocated to the state under the American Rescue Plan (ARP).

State Budget Restores Most Cuts to Education and Health Care, Funds Governor’s Priorities

In addition to restoring $383 million to fully fund Georgia’s K-12 education system according to the state’s long-standing Quality Basic Education (QBE) funding formula, Gov. Kemp’s executive budget also proposes adding $287 million to increase salaries for certified educators by $2,000 beginning in September of 2022. Kemp’s amended current-year budget would also direct $346 million to provide a one-time salary supplement of $2,000 to full-time employees and $1,000 to those who work part-time, in addition to adding sufficient funding to restore cuts to QBE beginning in 2022. While the state needs to meet its minimum funding commitment to public schools going forward, since the Great Recession, Georgia has failed to adequately fund QBE in 11 out of the 14 most recent fiscal years, amounting to more than $7 billion in withheld funding.[9] As leaders look for ways to close deficits in public education, budget writers should consider strengthening Georgia’s public school formula by adding additional dedicated funding for students living in poverty—as 44 states across the nation currently do—to maximize state resources behind improving student outcomes.

After experiencing deep budget cuts and reductions in funding for teaching in the wake of the COVID-19 pandemic, the FY 2023 budget includes $230 million to restore funding to the teaching formula while enabling University System of Georgia (USG) institutions, such as Georgia State University, to eliminate the Special Institutional Fee (SIF). SIF was instituted in 2009 as a temporary response to makeup funding lost during the Great Recession by increasing student costs. The Special Institutional Fee effectively raised tuition for students—costs not covered by the HOPE scholarship—and has been assessed up through the present day, despite the original temporary purpose of its creation. Educators in Georgia’s higher education system would also benefit under the FY 2023 budget with a $5,000 pay adjustment at an annual cost of $231 million. Funding is also included to make the adjustment begin during the current year. The executive budget also funds an increase to the HOPE Scholarship and Grant program to cover 90 percent of tuition across all USG and technical college institutions, up from the previous range between 76 to 90 percent.

In FY 2023, the Department of Public Health would receive an additional $76 million or nearly 27 percent from FY 2022. The Department of Behavioral Health and Developmental Disabilities would gain 11 percent or $129 million. The Department of Community Health (DCH) is set to grow its budget by nearly 13 percent or $513 million, largely to cover increased Medicaid costs due to the expected expiration of the COVID-19 Public Health Emergency. At the onset of the pandemic, Congress authorized the federal government to temporarily pay a higher-than-usual share of the costs of state Medicaid programs to manage increased pressure on health care systems for the duration of the national public health emergency declaration. This authorization was most recently extended for 90 days by the U.S. Health and Human Services Secretary on January 16, 2022.

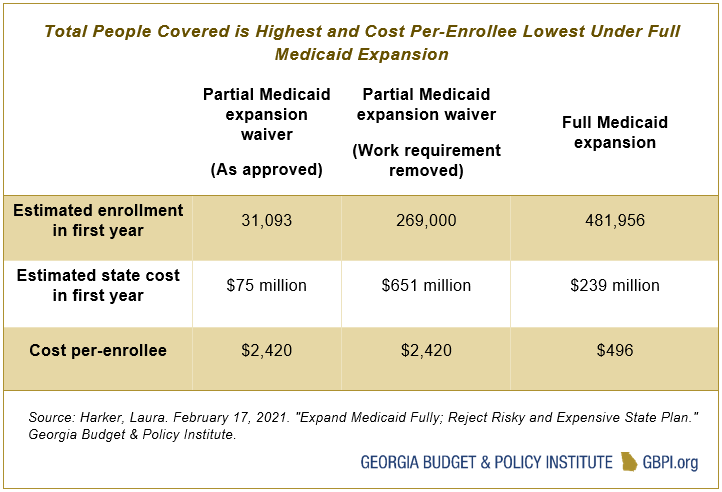

Despite marked improvements in both the AFY 2022 and FY 2023 budgets, the state has yet to address how Georgia will proceed after the Biden Administration’s effective denial of its waiver request to create a narrow expansion of Medicaid coverage with burdensome work requirements. More than 500,000 Georgians who could gain coverage under full Medicaid expansion remain uninsured. With the administration’s rejection of the work requirements provision of the waiver that would have limited expected enrollment to about 10 percent of those eligible statewide, partial Medicaid expansion would cost the state approximately $2,400 per enrollee, or nearly five times as much.[10] Full Medicaid expansion would cost less than $500 per enrollee or $239 million in the first year.[11] This cost would also be offset by an immediate infusion of between $1.4 to $1.9 billion in federal funding authorized under the ARP to help manage the costs of Medicaid expansion.

Georgia’s FY 2023 budget also includes $90 million to DCH to cover increases to Medicaid provider rates, $39 million to increase access to health care for children through express enrollment for recipients of the Supplemental Nutrition Assistance Program (SNAP, or food assistance) and Temporary Assistance for Needy Families (TANF), and $28 million to extend Medicaid coverage eligibility for new mothers from six to 12 months. Although the executive budget recommends a 10 percent increase for adult addictive diseases and mental health outpatient services, some areas of the FY 2023 budget remain funded below pre-pandemic (FY 2020) levels, including $22 million in ongoing cuts to child and adolescent mental health services. Significant increases in the Department of Public Health’s budget include $10 million in funding for the AIDS Drug Assistance Program and the Health Insurance Continuation Program (HICP) to support Georgians living with HIV/AIDS, as well as $47 million to cover salary increases and other employee compensation improvements through Public Health Formula grants to counties.

The 2023 executive budget includes $124 million to finance a reinsurance program first approved under the 2019 General Assembly-passed legislation that authorized Gov. Kemp’s office to seek federal waivers to improve access to care and lower costs. Through a reinsurance program designed to bring balance to the variation of costs incurred by enrollees, Georgia will seek to lower marketplace costs for some of the approximately 654,000 Georgians enrolled in private health care plans through the Affordable Care Act marketplace.[13] The FY 2023 budget proposal also includes roughly $16 million to finance the costs of building a state-run health care exchange, a proposal that is still pending before the Biden Administration. After the ARP increased subsidies for marketplace plans in March 2021, enrollment surged to record numbers, raising serious questions about the need to abandon the federal exchange and the state’s ability to provide a comparable level of consumer service to the current system.[14] Finally, through the Department of Administrative Services, the FY 2023 budget includes $1.2 million to finance the development of an All-Payer Claims Database to enable analysis and public reporting on health care costs and the utilization of services statewide, as part of the state’s broader $100 million+ effort to modernize and shift data systems to a more accessible cloud platform.

As State Debt Remains Far Below Constitutional Limit, AFY 2022 and FY 2023 Budgets Propose Using General Funds for Major Capital Projects

Although the Georgia Constitution limits annual debt to 10 percent of the prior year’s revenue collections, the state projects its annual debt service to fall far below that limit at 5.5 percent or just $1.3 billion.[15] Due to the state’s long-held AAA bond rating, Georgia can borrow at low-interest rates to finance capital projects.

Rather than financing the bulk of the project costs over a longer period of time using bonds, the AFY 2022 budget recommends appropriating $433 million in general funds to the State Properties Commission to fund state prison facility transformation as part of an ongoing effort to replace four-decades-old correctional facilities. In addition to these funds, the FY 2023 budget includes $168 million in bond funds for the same program, as the state is set to begin construction on a new 3,000-bed state prison and purchase another existing prison. Currently, the Georgia Department of Corrections also maintains contracts with two private prison companies to house approximately 8,000 residents at a cost of $130 million in FY 2023. Although the state faces serious challenges in addressing the many negative conditions in its correctional facilities and eliminating reliance on costly private prisons, other prudent options likely remain available to the state to finance the costs of capital construction and acquisition efforts as Georgians face continued hardship caused by the COVID-19 pandemic and the need to build an equitable economic recovery statewide.[16] As state leaders clarify these priorities, lawmakers should carefully examine the prospect of allocating $433 million in general funds to acquire an existing prison while evaluating the proposed facility transformation program as a whole to determine the benefits to Georgia residents as compared to alternative investments in sentencing and reentry reforms, public education, health care and economic support programs. Increased funding for student transportation remains an urgent need. As the state works to replace its aging fleet of school buses that transport more than 1 million students daily, the AFY 2022 budget recommends $188 million for the Department of Education to replace 1,747 school buses with safer models over the next three years. This is another key area where the state’s low debt could be a strong asset in enhancing its financial power to make further improvements.

Since 1991, state funding for student transportation has steadily declined from 54 percent of overall costs to approximately 16 percent in FY 2020, forcing local districts to shoulder the costs while balancing the need to replace aging vehicles.[17] However, with approximately $88,000 budgeted per school bus, it is not clear if this level of funding will be sufficient to purchase the total number of 1,747 buses promised. The average cost of a school bus reported by Georgia districts was over $92,000 in 2017 and vehicle costs have continued to rise.[18] Moreover, as of 2018, approximately 3,500, or 24 percent, of daily route school buses were older than 14 years of age, suggesting more significant funding is needed to upgrade the vehicles in use across the state fully.

The FY 2023 proposed budget also includes $291 million in bonds for local school systems to fund construction and renovation projects, $140 million in bonds for capital projects at USG institutions, $39 million in bonds for projects at TCSG institutions, $31 million in bonds to renovate the Law Building and $80 million for the continued expansion of the state convention center in Savannah.

Conclusion

As Georgia nears the two-year mark since the start of the COVID-19 pandemic, the state has the opportunity to regain ground lost to deep budget cuts and set a new fiscal course. Georgia can avoid repeating a prolonged period of underfunding state priorities as the state did in the decade that followed the Great Recession. To do so, lawmakers must guard against attempts to weaken Georgia’s still-volatile revenue system or risk the state’s ability to sustain its funding commitments by rejecting risky tax proposals that would disproportionately benefit the wealthiest individuals and/or select corporations at the expense of working Georgians. With unprecedented resources on hand, including billions in surplus funds and over $4.5 billion in flexible ARP federal funding available—and the potential of numerous bipartisan proposals to raise revenue, such as opportunities to lift the tobacco tax from the lowest level in the nation to the national average—state leaders have a unique opportunity during the 2022 session to find bipartisan consensus by investing in an equitable recovery for all Georgians.

Endnotes

[1] Kanso, Danny. October 6, 2022. “Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial and Economic Inequality. GBPI. Accessed: https://gbpi.org/reimagining-revenue-how-georgias-tax-code-contributes-to-racial-and-economic-inequality/

[2] Kanso, Danny. January 21, 2021. “Overview of Georgia’s 2022 Fiscal Year Budget. GBPI. Accessed: https://gbpi.org/overview-of-georgias-2022-fiscal-year-budget/

[3] Governor’s Budget Report Amended FY 2022 and FY 2023; Governor’s Budget Report Amended FY 2009 and AFY 2008; Ben Ayers, Terry College of Business. Georgia Economic Outlook Presentation. (January 13, 2022).

[4] Human Resources Administrative Division, Department of Administrative Services. July 1, 2020 – June 30, 2020. “State of Georgia TeamWorks HCM System Fiscal Year End 2021 Workforce Report”. Accessed: https://doas.ga.gov/assets/Human%20Resources%20Administration/Workforce%20Reports/Fiscal%20Year%20End%202021%20Workforce%20Report.pdf

[5] Department of Juvenile Justice, presentation to Joint Appropriations Committees of the General Assembly, January 19, 2022.

[6] Ibid; Among the 75,820 full-time employees considered are those employed by the executive branch, including most state agencies, the judicial branch, legislative branch, and affiliated local government positions, including county public health employees, community service boards, and mental health service centers.

[7] Source: Governor’s Budget Report Amended FY 2022 and FY 2023.

[8] State of Georgia Revenues and Reserves Report, Fiscal Year Ended June 30, 2021, State Accounting Office.

[9] Owens, Stephen. January 6, 2022. “State of Education Funding (2022)”. GBPI. Accessed: https://gbpi.org/state-of-education-funding-2022/

[10] Harker, Laura. February 17, 2021. “Expand Medicaid fully; Reject Risky and Expensive State Plan. GBPI. Accessed: https://gbpi.org/expand-medicaid-fully-reject-risky-and-expensive-state-plan/

[11] Ibid.

[12] Harker, Laura. March 17, 2021. “Medicaid is now an even better deal for Georgia.” GBPI. Accessed: https://gbpi.org/medicaid-is-now-an-even-better-deal-for-georgia/

[13] Kaiser Family Foundation. November 1, 2020. “Tracking Section 1332 State Innovation Waivers.” Accessed: https://www.kff.org/health-reform/fact-sheet/tracking-section-1332-state-innovation-waivers/

[14] Rau, Jordan. November 3, 2020. “Feds Approve Fractious Georgia Plan to Change ACA Marketplace.” Kaiser Family Foundation. Accessed: https://khn.org/news/just-2-days-before-election-feds-approve-fractious-ga-plan-to-change-aca-marketplace/; Miller, Andy. September 22, 2021. “Exchange enrollment hits record level in state. Georgia Health News. Accessed: http://www.georgiahealthnews.com/2021/09/georgia-exchange-enrollment-hits-record-level/

[15] Lauth, Thomas P. 2010. “Budget Deficits in the States: Georgia.” Public Budgeting & Finance/Spring 2010.

[16] Dunlap, Stanley. January 19, 2022. “Georgia corrections prepares to spend $600M to replace older prisons”. GPB News. Accessed: https://www.gpb.org/news/2022/01/19/georgia-corrections-prepares-spend-600m-replace-older-prisons

[17] Owens, Stephen. March 22, 2019. “Georgia Lawmakers Should Renew Their Commitment to Student Transportation.” GBPI. Accessed: https://gbpi.org/georgia-lawmakers-should-renew-their-commitment-to-student-transportation/

[18] Georgia Department of Education. (August 2018) Pupil Transportation Division Quick Facts.