*The following information reflects the legislation passed by the United States House of Representatives on May 22, 2025. Additional information will be provided as the bill progresses. ![]()

On May 22, the U.S. House passed major tax and spending legislation, entitled the “One Big Beautiful Bill Act.” This measure was advanced through a special legislative process called “reconciliation.” This process is not subject to the filibuster in the U.S. Senate, allowing the majority party to set up a lower simple majority threshold (50-votes plus the Vice President as a tie-breaker) for passage rather than the 60-vote majority usually required. However, the reconciliation legislation must abide by the Senate’s “Byrd Rule,” which prohibits including provisions that do not change spending, tax policy or the debt limit. As passed by the House, several policy changes, such as those attempting to limit federal courts from holding executive officials in contempt and deregulating gun silencers, appear unlikely to meet this requirement.

The pending budget reconciliation package is estimated to increase the net federal deficit by between $2.4 to $4.5 trillion over 10 years.[1] Most of this debt would be accrued by restructuring the tax code in ways that primarily benefit those already at the top of the economic ladder. To help accomplish this, the House-passed bill increases the debt ceiling (or federal borrowing limit) by $4 trillion.

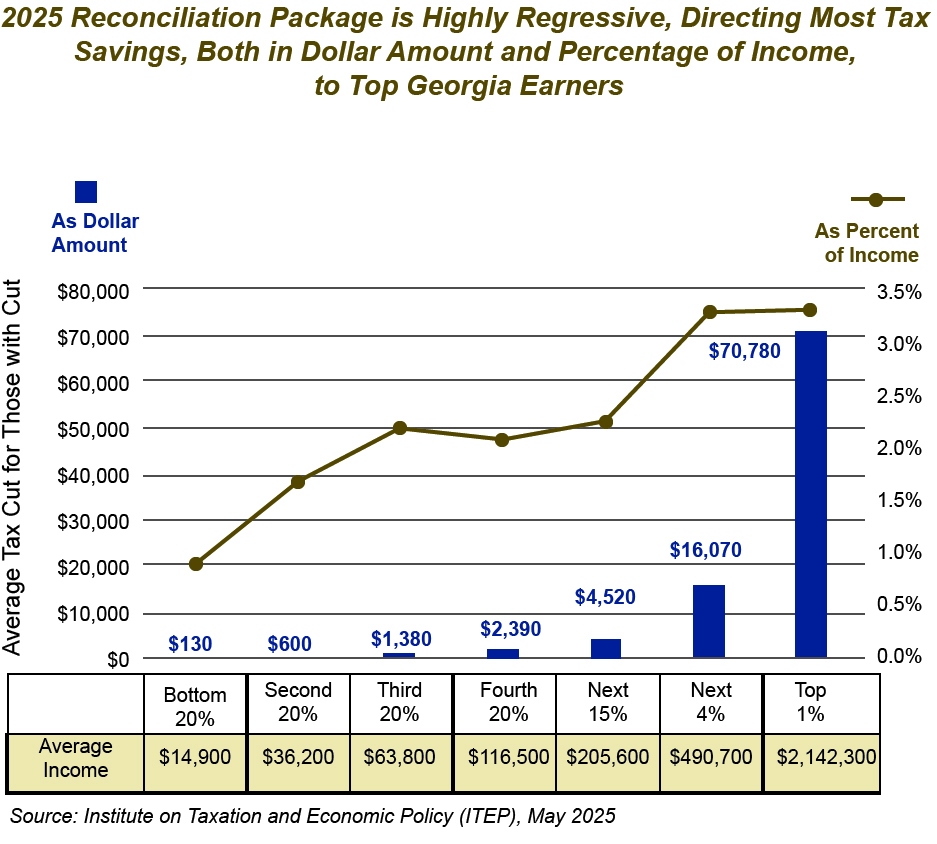

Overall, the budget reconciliation legislation would reduce federal taxes for Georgians by $16.6 billion annually. However, 69% of these savings ($11.5 billion) are directed to the highest-earning 20% of Georgia households, or those making over $153,100 per year.[2]

To partially offset the cost of up to $5.6 trillion in tax reductions, the package cuts approximately $1.8 trillion in spending over 10 years, with the lion’s share coming from health care and food assistance.[3] This analysis considers the impact of the legislation’s tax provisions in Georgia, which are heavily tilted to benefit those already at the top of the income ladder. GBPI has also published analyses that consider the budget reconciliation legislation’s impact on the Supplemental Nutrition Assistance Program (SNAP) and Medicaid, which provide food assistance and health coverage for low-income Georgians, respectively. Overall, the Congressional Budget Office (CBO) estimates that the reconciliation legislation would cause approximately 10.9 million people to lose health coverage over the next decade through both cuts to Medicaid and subsidies for marketplace plans.[4] Already, the CBO baseline had estimated that 5.1 million people would lose coverage over the next decade due to the expiration of enhanced premium tax credits at the end of 2025, bringing the total loss of coverage to approximately 16 million nationwide.

Most Georgians, those with incomes among the first 60% of households who make up to $85,300 per year, would receive just 14% of overall tax reductions ($2.4 billion). This compares to 24% of overall tax savings ($4 billion) directed to the wealthiest Georgians in the top 1% of earners who make at least $836,000 annually. The following chart further details the legislation’s impact by household income.

As a percentage of income, the level of tax savings would essentially increase with each household’s tax bracket. Those in the bottom 20% of earners, who make less than $25,600 a year, would save less than 1% of annual income. Those in the top 5% of earners, who make over $331,900 per year, would save 3.3% of total income.

For the first time in program history, the legislation would also impose cuts to food assistance (SNAP) by requiring states to pay between five to 25% of the program costs, passing the buck to Georgia’s state budget and potentially jeopardizing access to food for 440,000 Georgians.

Taken together, these provisions paint a bleak picture. To help pay for large tax cuts for top earners, Congress is considering substantially dialing back funding for food assistance and health coverage that families across Georgia depend on. Even with slashing critical program funding, the legislation fails to pay for most costs associated with the tax cuts, which would instead be added to the national debt.

Estimates from the University of Pennsylvania’s Wharton Budget Model find that, if made permanent, the reconciliation package would increase the nation’s debt by nearly 10% over 10 years and 22% over 30 years. Several provisions, such as those eliminating taxes on some income generated from tips or overtime, are currently set to expire between 2028 to 2029. However, Congress has tended to renew almost all tax reductions enacted in recent decades, offering validity for scoring the legislation’s provisions over the long run.

Estimates conclude that the budget reconciliation bill’s provisions would keep the Gross Domestic Product (GDP), the value of all goods and services produced in the United States, flat before eventually decreasing, while the average wage of Americans would fall by roughly 0.3% over 30 years.[5] This reduction in GDP and wages is largely due to two factors: (1) assuming higher levels of national debt that are likely to contribute to higher interest rates and less fiscal flexibility at the federal level, and (2) the negative economic response caused by cutting food assistance and health care benefits. Simply put, the package would leave almost all households worse off in the future and represents an attempt to mortgage our nation’s future for temporary political gain through deeply regressive tax cuts.[6]

The Joint Committee on Taxation (JCT) and the Congressional Budget Office (CBO), which provide revenue estimates for Congress, have published a detailed analysis with estimates of the budget reconciliation legislation’s provisions.[7] Although many of these provisions are complex, the legislation’s cuts to tax rates are most costly ($2.2 trillion), followed by provisions that restructure the Alternative Minimum Tax (AMT) ($1.4 trillion) which is designed to assess some level of income tax on high earners. These are followed by increases to the standard deduction ($1.3 trillion), business tax cuts ($1.2 trillion), increases to the Child Tax Credit ($836 billion), new provisions on tips, overtime, car loan interest, and for seniors ($293 billion) and expansive exemptions to the Estate Tax ($212 billion).[8]

Although some of these provisions are positive, such as those increasing the standard deduction and Child Tax Credit, removing funding from SNAP and Medicaid erases a sizable share of these benefits for families with the lowest incomes. As currently structured, approximately 735,000 Georgia children would be ineligible to receive the full child tax credit of $2,500 created because their families earn too little to qualify.[9] The legislation also requires the IRS to establish a pre-certification system for the Earned Income Tax Credit (EITC) that adds a new bureaucratic hurdle which could prevent Georgia families from claiming credits they would otherwise be eligible to receive.[10]

Looking at the combined effects of the various tax and spending measures included in the reconciliation package, estimates from the Penn Wharton Budget Model show that families with incomes in the first 40% of earners would, on average, experience a loss in after-tax income and benefit transfers (which includes assistance from SNAP and Medicaid). Those with the lowest 20% of incomes would see the sharpest drop, a median decrease of nearly 6% in 2026, while those in the second 20% would see a median decrease of about 1%.[11]

As the U.S. Senate debates the House-passed budget reconciliation bill, members should reject the legislation in favor of a more fiscally responsible, sustainable package that delivers meaningful benefits to working and middle-class Georgia families. As leading analyses have demonstrated, it is not good policy to push the nation deeper into debt to finance costly tax cuts that primarily benefit those already at the top of the economic ladder. In fact, doing so will likely cause our nation to grow at a slower pace, while punting difficult policy decisions that threaten to jeopardize the solvency of the federal government. Through a more deliberative policymaking process, our nation’s leaders can both enact positive tax changes that benefit most Georgia households—such as increases to the standard deduction and the Child Tax Credit, while asking corporations and the wealthy to pay their fair share—without also harming those who are most vulnerable through regressive cuts that pass the buck to state policymakers or by mortgaging the future of our next generation.

Endnotes

[1] Congressional Budget Office. (2025, May 28). Estimated budgetary effects of H.R. 1, the One Big Beautiful Bill Act. https://www.cbo.gov/publication/61461; Penn Wharton Budget Model, University of Pennsylvania. (2025). The House-passed reconciliation bill: illustrative budget, economic, and distributional effects with permanence https://budgetmodel.wharton.upenn.edu/issues/2025/5/28/the-house-passed-reconciliation-bill-illustrative-effects-with-permanence.

[2] Institute on Taxation and Economic Policy. (2025, May 22). Analysis of tax provisions in the House reconciliation Bill: National and state level estimates. https://itep.org/analysis-of-tax-provisions-in-house-reconciliation-bill/

[3] See Penn Wharton Budget Model, University of Pennsylvania. (2025, May 28). The House-passed reconciliation bill: illustrative budget, economic, and distributional effects with permanence. This analysis assesses costs over 10 years, assuming that provisions approved are made permanent. https://budgetmodel.wharton.upenn.edu/issues/2025/5/28/the-house-passed-reconciliation-bill-illustrative-effects-with-permanence.

[4] Congressional Budget Office. (2025, May 22). Estimated budgetary effects of H.R. 1, the One Big Beautiful Bill Act. https://www.cbo.gov/publication/61461

[5] See Penn Wharton Budget Model, University of Pennsylvania. (2025, May 28). The House-passed reconciliation bill: illustrative budget, economic, and distributional effects with permanence. This analysis assesses costs over 10 years, assuming that provisions approved are made permanent. https://budgetmodel.wharton.upenn.edu/issues/2025/5/28/the-house-passed-reconciliation-bill-illustrative-effects-with-permanence

[6] The Penn Wharton Budget Model concludes that “On a dynamic lifetime basis, lower-income households are worse off, with losses averaging $30,000 in lifetime value for the lower-income working-age population. All future households are worse off, including those who enter the economy with relatively higher productivity,” see https://budgetmodel.wharton.upenn.edu/issues/2025/5/28/the-house-passed-reconciliation-bill-illustrative-effects-with-permanence.

[7] Congressional Budget Office. (2025, May 20). Preliminary analysis of the distributional effects of the One Big Beautiful Bill Act. https://www.cbo.gov/system/files/2025-05/61422-Reconciliation-Distributional-Analysis.pdf

[8] Joint Committee on Taxation publication JCX-22-25R; Institute on Taxation and Economic Policy. (2025). The House tax plan, by the numbers. https://itep.org/house-tax-plan-trump-tax-cuts-by-the-numbers/ (Figure 3)

[9] Cox, K. (2024, September 19). Expanding the child tax credit should be a top priority in 2025 tax debate. Center on Budget and Policy Priorities. https://www.cbpp.org/blog/expanding-the-child-tax-credit-should-be-a-top-priority-in-2025-tax-debate; Marr, C., Jacoby, S., Cox, K., Lukens, G., & Hingtgen, S. (2025, May 22). House Republican tax bill is skewed to wealthy, costs more than extending 2017 tax law, and fails to deliver for families. Center on Budget and Policy Priorities. https://www.cbpp.org/research/federal-tax/house-republican-tax-bill-is-skewed-to-wealthy-costs-more-than-extending-2017

[10] Marr, C., Jacoby, S., Cox, K., Lukens, G., & Hingtgen, S. (2025, May 22). House Republican tax bill is skewed to wealthy, costs more than extending 2017 tax law, and fails to deliver for families. Center on Budget and Policy Priorities. https://www.cbpp.org/research/federal-tax/house-republican-tax-bill-is-skewed-to-wealthy-costs-more-than-extending-2017

[11] Penn Wharton Budget Model, University of Pennsylvania. (2025, May 28). The House-passed reconciliation bill: illustrative budget, economic, and distributional effects with permanence. (Table 5) https://budgetmodel.wharton.upenn.edu/issues/2025/5/28/the-house-passed-reconciliation-bill-illustrative-effects-with-permanence. “After-tax income” is income that is taken home after taxes are deducted. “Benefit transfer income” includes government payments that are not earned through work, help support those experiencing need. They are often combined and referred to as after-tax-and-transfer income.