If a car salesman told you that Fords are the highest ranked car, would you drive one off the lot without looking under the hood? A new report that ranks states on their “business tax climates” seems to hope you would.

Put out earlier this month, the Tax Foundation’s 2012 State Business Tax Climate Index ranks Georgia 34th among the states, seemingly suggesting that taxes are an undue burden for businesses in the state. But as explained in our new brief, the ranking system fails to provide an accurate picture of Georgia’s true business-friendliness and should be disregarded as a guide for sound tax policy.

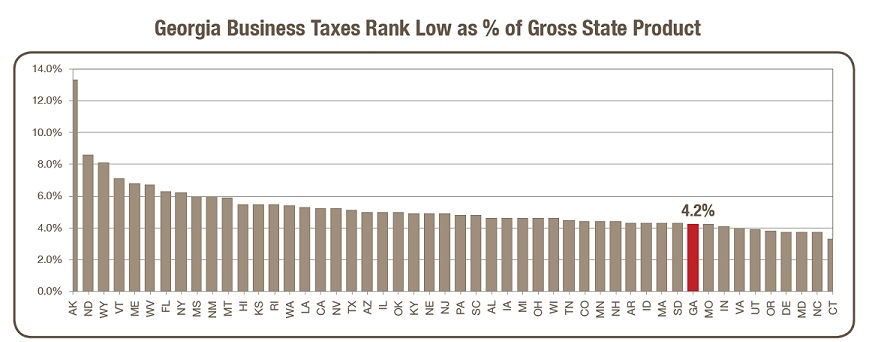

The main reason is that the Tax Foundation does not actually rank states based on how much businesses pay. As their report clearly states, “The [index] does not measure business tax burdens.” If it did, it would have found the same thing that essentially any objective analysis of state policy would tell us: that Georgia is a low-tax, low-regulation, and business-friendly state. As shown by Census data, businesses in Georgia pay less in state and local taxes as a share of the state’s economy than in almost any other state:

So if business taxes are low, why does Georgia’s “business tax climate” rank poorly in the Tax Foundation’s eyes? Essentially it’s because their ranking system employs an arbitrary formula of 118 tax variables that one economist calls a “mishmash of stuff the Tax Foundation doesn’t like.” Some of the variables are important to sound tax policy, but many others aren’t. States are penalized, for example, if they have multiple brackets in their tax code, versus rewarded if they abolish major taxes (e.g. personal income, corporate income). Little evidence suggests that graduated ratesare impediments to business though, and getting rid of major taxes can undermine a state’s economy and quality of life—just ask Nevada and Florida, who despite lacking income taxes were among the hardest hit by the economic crisis.

Setting aside the technical flaws, even a perfect report on taxes would still not fully tell us if Georgia’s a good state for business. Why? Because being business-friendly is not just about taxes. Sure, owners and entrepreneurs care about taxes, but not anymore than they care about safe communities, trained workers, and good schools for their kids. People build businesses in states where they want to live, work, and raise a family. Making sure Georgia remains such a state requires strategic investments as well as sound tax policy, and the Tax Foundation’s rankings give us little or no guidance on either.