The steep budget cuts currently enacted in Georgia are keeping families from being able to recover from the COVID-19 pandemic and thrive. We will rebound faster if we keep money flowing to communities. Use this toolkit to help advocate for a budget that meets the needs of our state.

Join GBPI, 9to5 Georgia, Small Business Majority, Faith in Public Life, Atlanta Jobs with Justice and New Georgia Project for a Budget Day of Action on Wednesday, February 10 from 9 a.m. to 5 p.m.![]()

How to Participate

On February 10 from 9 a.m. to 5 p.m., send letters and phone calls to lawmakers asking to restore cuts to the health, education and economic mobility programs and services Georgians need. Use the contact information linked below and the talking points for phone calls.

A template for a letter-writing campaign can be found here.

From 11 a.m. to 2 p.m., amplify the message on social media. GBPI has provided sample graphics and social media posts, but you can also create your own! Use the hashtags #gapol and #RestoretheCuts.

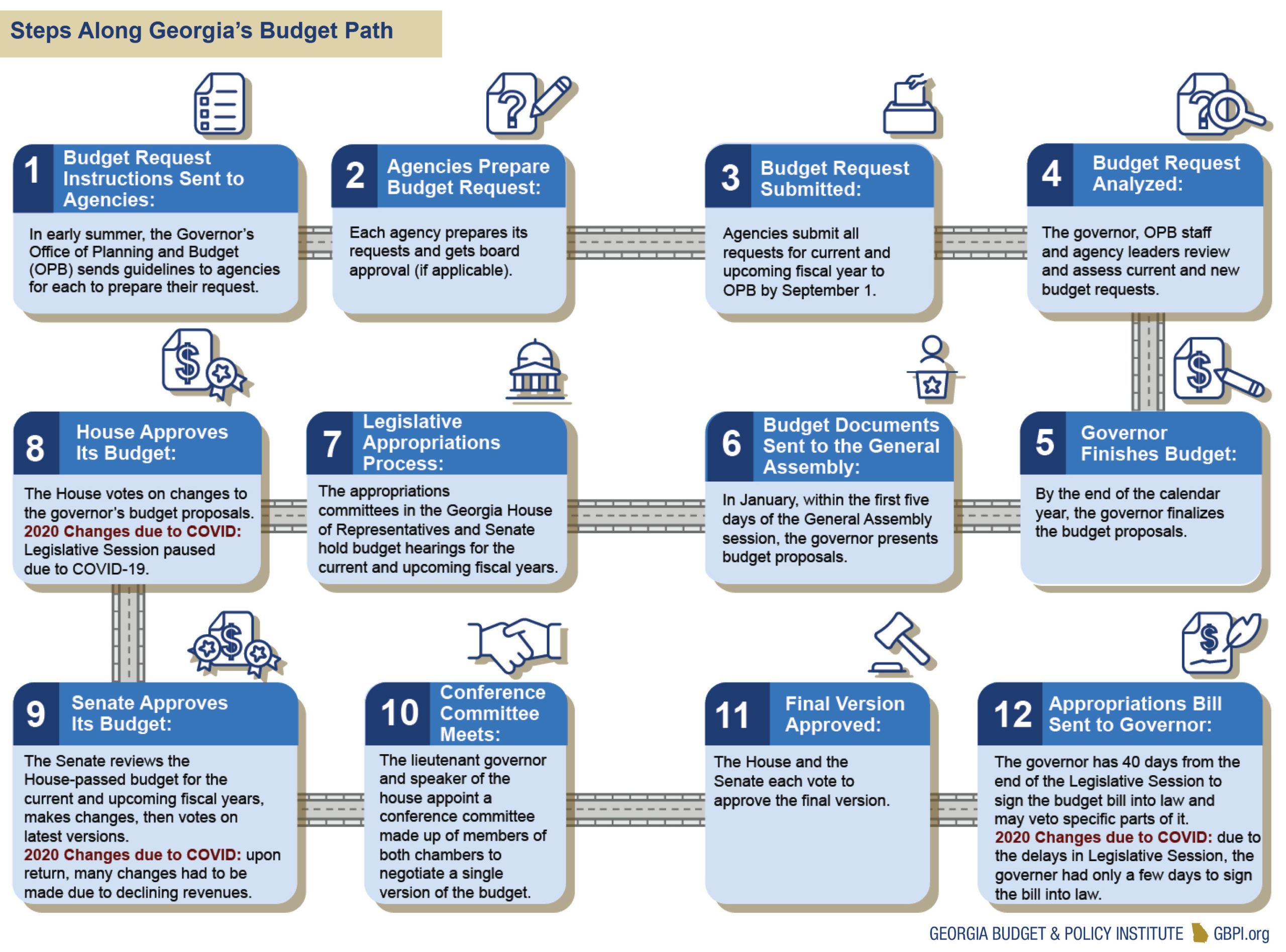

The Budget Process

Who to Contact

All of your lawmakers need to hear this message. Individuals should reach out to their state senator and state representative. You can find out who your local lawmakers are here.

Appropriations Committee members have particular power when it comes to setting the budget. Your organization may want to reach out directly to them. A list of committee members can be found here for the House and here for the Senate.

Only the governor can authorize the use of our state’s rainy day fund, or Revenue Shortfall Reserve. The governor’s contact information is available here.

Sample Social Media Posts

Georgia will rebound faster from COVID-19 if funding flows to our communities. Ask your state lawmakers to support new revenues and a fully-funded budget today: https://www.gbpi.org/restorethecuts

Georgia cannot cut its way to prosperity, but lawmakers continue to enact steep budget cuts that are keeping our state from recovering from COVID-19. But the governor has the power to pull funds from our rainy day fund, which exists for moments like these. Ask him to help fully fund the programs and services Georgia families need: https://georgia.gov/contact-georgiagov

Click here to tweet: Georgians need adequate health care, a strong safety net, better schools and more. Ask your lawmakers to restore the cuts to our budget so every family can prosper: https://www.gbpi.org/restorethecuts #gapol #RestoreTheCuts

Click here to tweet: Georgia can’t cut its way to prosperity. Ask state lawmakers to restore cuts to our budget this year: https://www.gbpi.org/restorethecuts #gapol #RestoreTheCuts

Shareable Graphics and Graphic Templates

You can download all of these images and the unbranded template here, or download the PowerPoint template in order to add your logo to the images here.

Potential Talking Points

Value

- Every Georgia family should live in a healthy community, one with a strong workforce, thriving families and an educated youth. But the steep budget cuts currently enacted in Georgia are keeping families from being able to recover from the COVID-19 pandemic and thrive. We will rebound faster if we keep money flowing to communities.

Problem

- Georgia cannot cut its way to prosperity; that much has been made clear in the aftermath of the Great Recession and in the midst of this global pandemic. Deep cuts into critical services and programs will disproportionately harm communities of color and rural communities while curbing the state’s ability to recover.

- There are reasons Georgia, particularly southwest Georgia and rural communities, are being hit hard by this pandemic: leaders have chosen disinvestment so we never fully recovered from the last economic recession.

- State leaders must choose to do everything in their power to restore devastating cuts:

- Cuts are disproportionately harming our K-12 schools, even with some funding restored.

- These cuts also affect Georgia’s already-weak health care infrastructure, which is already overburdened by the pandemic.

- Budget cuts also carry steep costs, both direct and indirect, and may shift costs to other areas of government (like the state employee retirement system)

- These cuts disproportionately harm people of color, who are already suffering from COVID-19 at higher rates and disproportionately facing unemployment, even as some jobs return to the state. Maintaining these cuts will only exacerbate these issues.

Solution

- But there are options the state can choose to take to restore these cuts and better fund programs and services that improve health and economic outcomes for Georgians:

- Kemp can choose to authorize money from Georgia’s robust rainy day reserve, which exists specifically to help fund the budget in times like these. It’s raining now.

- State lawmakers can choose to approve commonsense revenue-raising options such as:

- Lifting the tobacco tax to the national average, $1.81.

- Closing special interest loopholes that cause the state to forego billions of dollars.

- Removing Georgia’s itemized tax break for state taxes paid, also known as the “double deduction,” which is only available to about 14 percent of Georgia filers who earn an average of $240,000 per year.

- State lawmakers can also call on federal lawmakers to provide state and local federal relief in a comprehensive COVID relief package.

Action

- If Georgia lawmaker: Please choose new revenues over steep cuts so that funds can flow to communities in need, and ask our federal lawmakers to support state and local fiscal relief.

- If federal lawmaker: Please support a new COVID relief package that includes funding for state and local programs and services so that our communities can recover and thrive.

- If agency or administration staff: Please urge the governor to use the Revenue Shortfall Reserve to revise the revenue estimate and help fund programs and services that will help our communities recover and thrive.

Key Points by Issue

Overall

- Even before these cuts, Georgia was spending less per resident than the state did before the Great Recession.

- The FY 2022 budget proposal spends $100 less per person (adjusted for inflation) than in FY 2008, before the Great Recession

- The state has a healthy $2.7 billion Revenue Shortfall Reserve, or Rainy Day Fund. The Governor could authorize the use of this money to help funding flow to Georgians, but money from the RSR is not being used.

Education

- FY 2022 budget maintains cuts to public libraries with 8 percent less than the FY 2020 budget

- Adult Education remains underfunded with $4 million in cuts compared to FY 2022

Economic Mobility

- $26 million in cuts since COVID started to the department tasked with administering key anti-poverty programs like SNAP and TANF (the Department of Human Services)

Health

- The Department of Community Health is looking at a proposed $68 million to implement the Patients First Act (partial Medicaid expansion up to the poverty line with work requirements and premiums): $65.4 million in Medicaid benefits spending, $2.6 million in administrative costs.

- The state will receive the regular federal Medicaid match of 66.85% to implement this program; not the enhanced match rate for full Medicaid Expansion.

- $8.2 million in additional funds allotted to the Department of Human Services for managing program eligibility.

- The total cost per enrollee of the Medicaid waiver is $2,054. Full Medicaid expansion net cost is $298.

- The Department of Public Health budget currently relies on federal money for COVID response and does very little to address ongoing capacity challenges as the state responds to other health priorities.

- When federal funding goes away, county departments—which receive grants from the state DPH, will essentially face a cut.