Tracking Our Priorities in Georgia Legislature

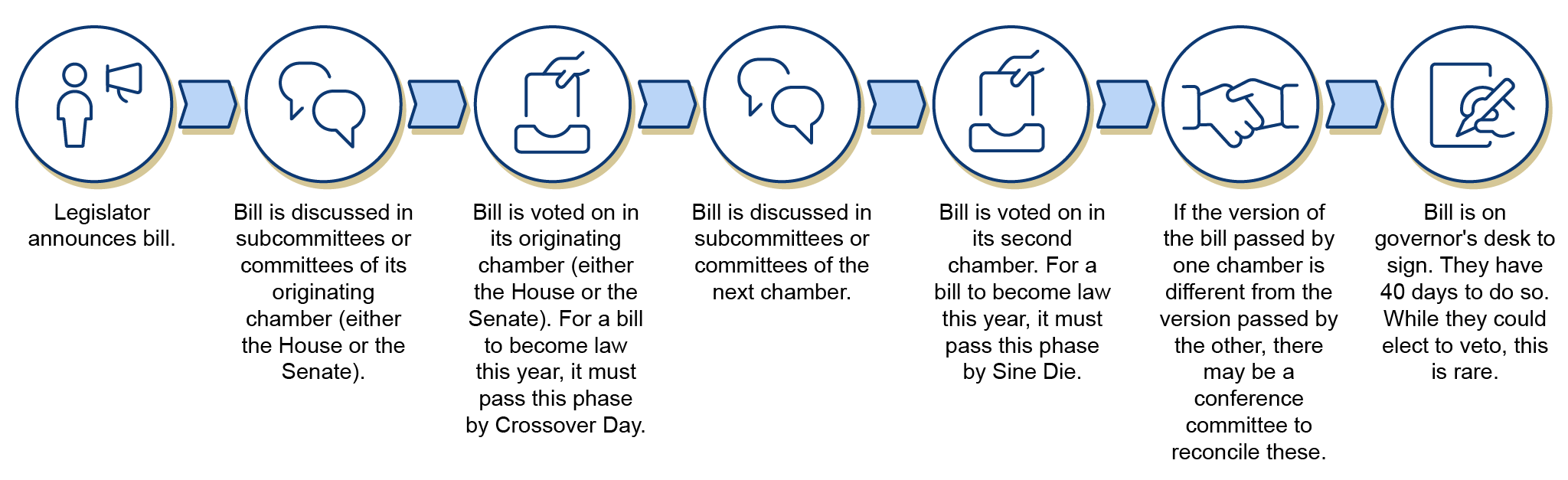

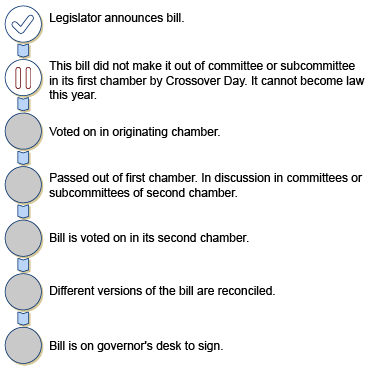

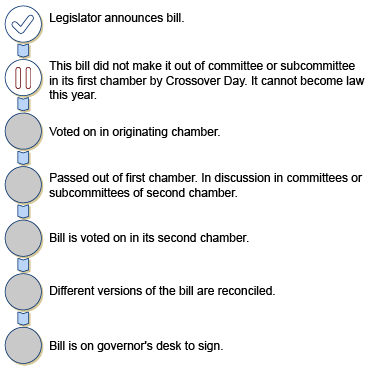

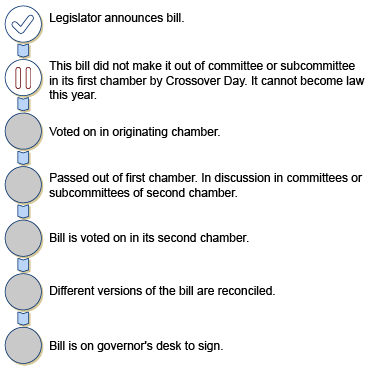

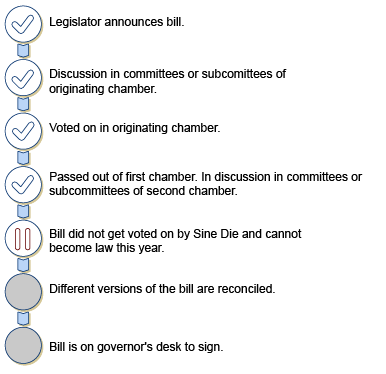

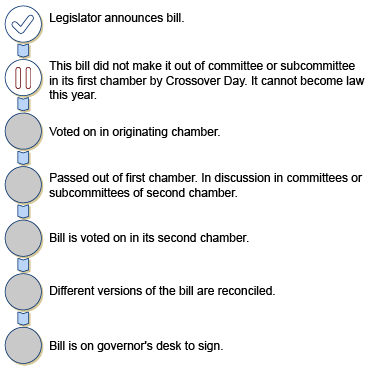

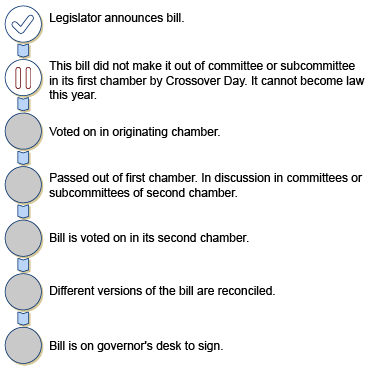

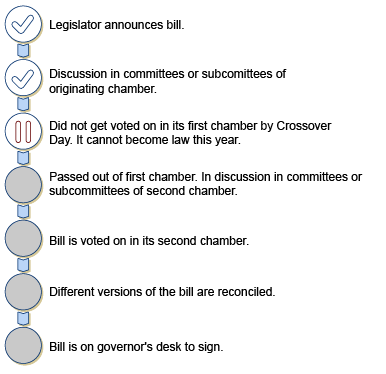

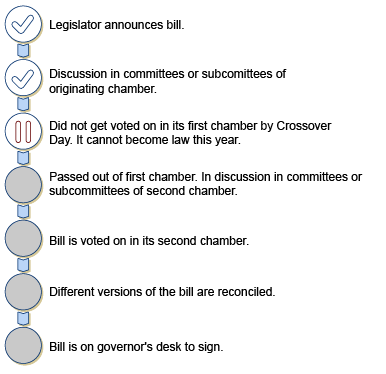

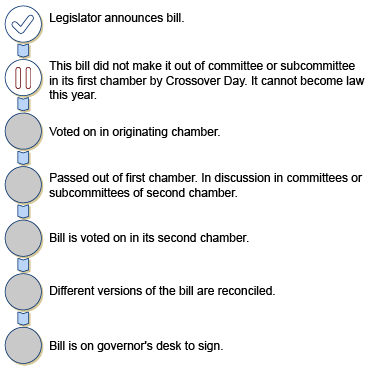

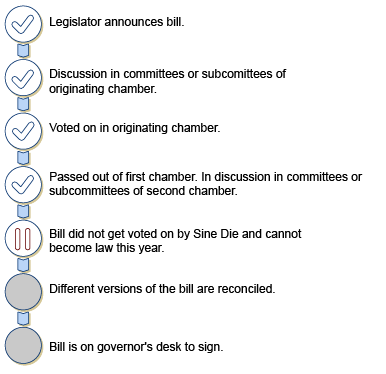

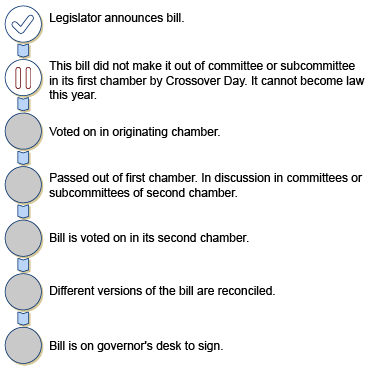

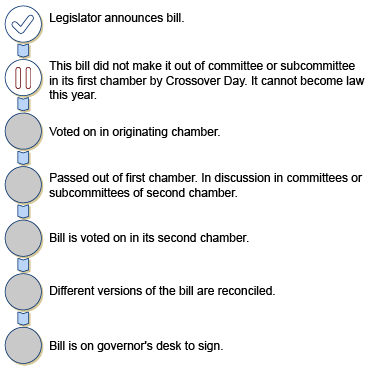

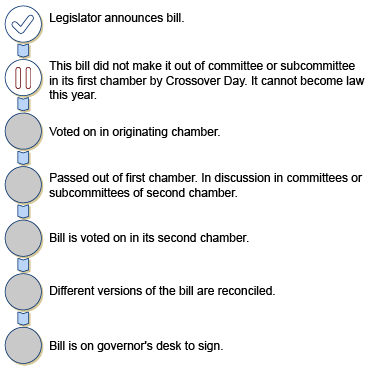

Steps for a Georgia Bill to Become Georgia Law

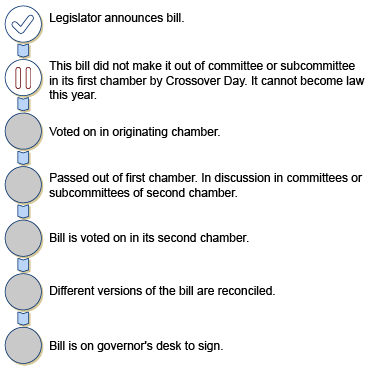

Where Are We In the Legislative Session?

As of March 25, 2024 (this page’s last update), we have past crossover day. This means that bills can only become law this year if they have already passed their originating chamber.

To learn more about the key policies we focus on, you can view the 2024 Policy Priorities page.

This tracker was last updated on March 25, 2024 at 10:00 am.

Bills We Are Watching

Promote State Government Transparency

Without data and state adherence to established statutes and rules for sharing information related to government activities, Georgians cannot hold elected officials accountable for their actions and decisions, and the ability of our state’s people to meaningfully participate in the legislative process is compromised.

Fund State Government Transparently, Equitably and Responsibly

Analyze state budget proposals to ensure the result is fair and sufficiently appropriates funding for critical services and programs like health and education.

Advance fiscally responsible tax reform proposals that strengthen state revenue, protect existing revenue streams and support working families.

Senate Bill 364

House Bill 581/ HR 1022

Allows for a statewide referendum to cap annual assessment increases for homesteaded property taxes (owner-occupied primary residences) at the rate of inflation. Also includes a measure that allows local governments to substitute some of property tax revenues with a 1-cent sales tax. Importantly, the measure includes a provision that allows local governments to opt-out of the cap.

House Bill 1021

House Bill 192

House Bill 413

House Bill 1015

Senate Bill 366

House Bill 1180

House Bill 1181

Adds sunsets to a series of tax credits and new limitations to the time limit in which tax credits must be used.

House Bill 1192

House Bill 1023

House Bill 79/ Senate Bill 118

House Bill 808

Ensure Equitable Education

Creating and funding an Opportunity Weight to provide additional money to educate students living in poverty, shining a light on efforts to divert state dollars away from public schools and increasing state investment in pupil transportation through formula increases.

House Bill 3

Would provide an additional 25% in funding for each student living in poverty to create an opportunity weight. Was not announced.

House Bill 668 and Senate Bill 284

These bills propose a $1,500 per-pupil and $1,750 per-pupil weighted supplement for students living in poverty by amending Georgia’s Quality Basic Education (QBE) funding formula, thus creating an opportunity weight. Was not announced.

House Bill 131

House Bill 1124/ SB 237

A version (HB 249) was vetoed last year by the governor. Expands the eligibility criteria for a completion grant so that students who finish at least 70% of a four-year degree program or 45% of a two-year degree program can qualify to receive need-based financial aid. HB 1124 did not advance far enough in time, but SB 237 is still on the table.

Senate Bill 386 / Senate Resolution 579

Senate Bill 233

Establishes a state school voucher program that would give $6,000 to parents to cover the cost of private school tuition.

House Bill 941 and Senate Bill 360

Calls school systems to consider projected pre-k student counts when considering capital improvements. This should support the creation of more pre-k classrooms in public schools. Currently SB 360 has progressed out of the first chamber but HB 941 has not.

Senate Bill 476

House Bill 853

House Bill 579

Senate Bill 105

Raises the pension amount for those enrolled in the Public Schools Employee Retirement System (e.g., bus drivers, custodial workers) and gives the Employees Retirement System of Georgia the latitude to raise the amount in the future without legislative action.

Enhance Georgian's Economic Security

Enact policies like paid family medical leave and protect Georgia’s safety net programs from budget cuts and legislative proposals that threaten an equitable economic recovery.

House Bill 565

House Bill 1010

House Bill 348

Senate Bill 63

Senate Bill 362

Senate Bill 63

Senate Bill 475

House Bill 501

Build Healthy Communities

Ensure all Georgians have a fair and just opportunity at good health by fully expanding Medicaid without a harsh work requirement or burdensome monthly reporting, ensuring Medicaid-eligible children retain coverage during and after the Medicaid unwinding, and strengthening our state’s ability to deliver behavioral health and developmental disabilities’ services.

House Bill 1339

HB 1339 enacts modest reforms to the way the state approves the creation of new or expansion of existing health care facilities; increases the cap for the Rural Hospital Tax Credit; and establishes a Comprehensive Health Coverage commission to advise on issues related to healthcare for uninsured/low-income Georgians.

House Resolution1231

HR 1231 is a resolution to create a House Study Committee on maternal, prenatal, and pediatric care, access, and funding

House Bill 1037 / House Bill 1046

Senate Bill 293

SB 293 revises the qualifications for district health directors and makes minor changes to the state's public health governance structure

Status: Discussion in committees or subcommittees of originating chamber

House Bills 38, 62 and Senate Bills 17, 24

Close the healthcare coverage gap; however, if access to healthcare for uninsured, lower income adults is to be expanded this year, it will come as an amendment to an existing bill that has already crossed over.

House Bill 215/ Senate Bill 524

HB 1077

Empower Immigrant Communities

House Bill 127 / 282

Establishes rules and regulations for foreign language interpreters working with students in educational settings and requires that parents and children be informed of the availability of interpretation services in Individual Education Plan.

Senate Bill 420

House Bill 1105

Senate Bill 264

Senate Bill 478

House Bill 1359

House Bill 301

Empower Immigrant Communities

Support tuition equity legislation, expand driver’s licenses, expand language access, and ensure state policies are inclusive of the immigrant community.