State legislators are considering a package of income tax changes in the final days of the 2017 session that could lead to major changes for families, businesses and the state’s financial health. The headline-grabbing core of House Bill 329 is to swap Georgia’s longstanding graduated tax structure with rates ranging from 1 to 6 percent with a new flat-rate tax set at 5.4 percent. While the overall bill contains a few good policy pieces, the flat tax aspect is a serious defect. A large part of the rationale behind the flat tax proposal is the belief that tweaking Georgia’s tax rate is a sound approach to boost economic growth. That is not supported by mainstream economic research or evidence from other states.

A common argument in favor of Georgia lowering income taxes is the strategy can be credited with growing jobs and the economy in other states. But restructuring personal income tax rates is a strategy with a poor track record in the last few years. More than a dozen states cut personal income tax rates since 2010, with Kansas, Maine, North Carolina, Ohio and Wisconsin embracing the five largest. Four of the five largest-cutting states experienced slower job growth than the nation as a whole in the years immediately following their cuts.

The fifth state, North Carolina, experienced slightly better job growth than the country overall after shifting to a flat tax in 2013. But the Tarheel State is also adding jobs more slowly than its regional competitors, including Georgia. Private sector employment in North Carolina grew by 6.9 percent from the end of 2013 to end of 2016, compared to the national rate of 6 percent. Job growth over that same span was 7.4 percent in Tennessee, 7.9 percent in South Carolina, 9.1 percent in Georgia and 11.3 percent in Florida.

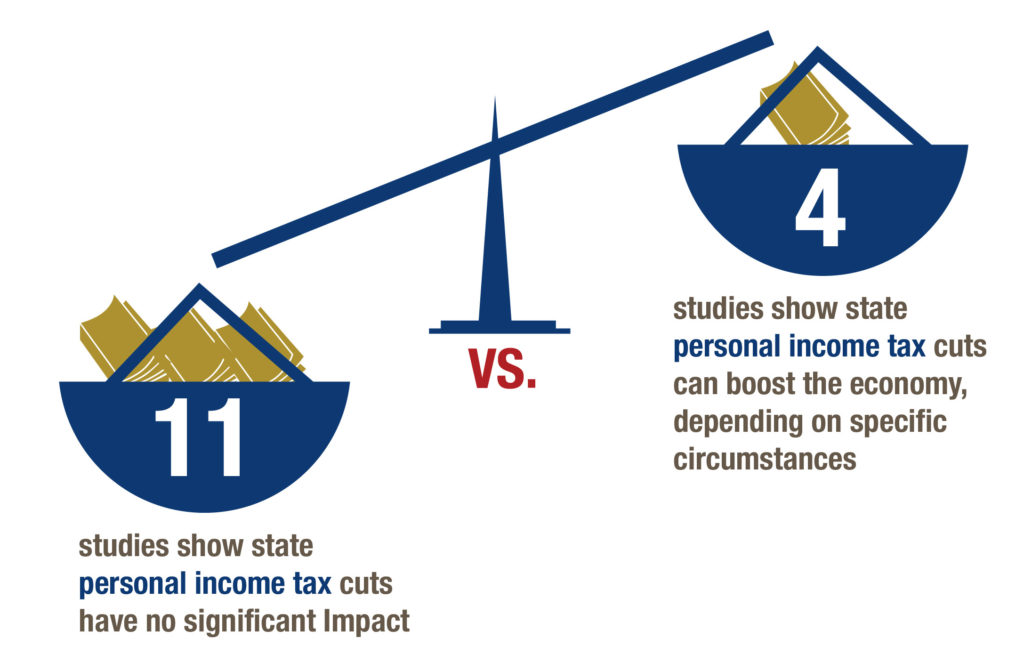

The mediocre results in states that cut income tax rates is predicted in the findings of mainstream research, which typically finds tax rates provide little to no impact on economic growth. Of the 15 major academic studies published since 2000 that examine how personal income taxes influence state economies, 11 say there are no significant effects.

Recent Studies Find Little Benefit from Income Tax Cuts

Number of peer-reviewed articles on state personal income tax cuts in academic journals or books since 2000

Part of the reason state income tax cuts don’t unleash economic growth is because they don’t benefit nearly as many businesses as advertised. For one, cuts don’t do much to attract new out of state companies. Most new jobs are grown organically by in-state firms and entrepreneurs. And for the few companies that do relocate, state tax rates are down the list of priorities. As the 2010 Georgia Special Council on Tax Reform and Fairness determined: “Research on business firm location finds that while taxes matter, other factors seem to play a larger role. Factors such as a functioning transportation system, availability of water, and the quality of public education are more important components of the decision-making process.”

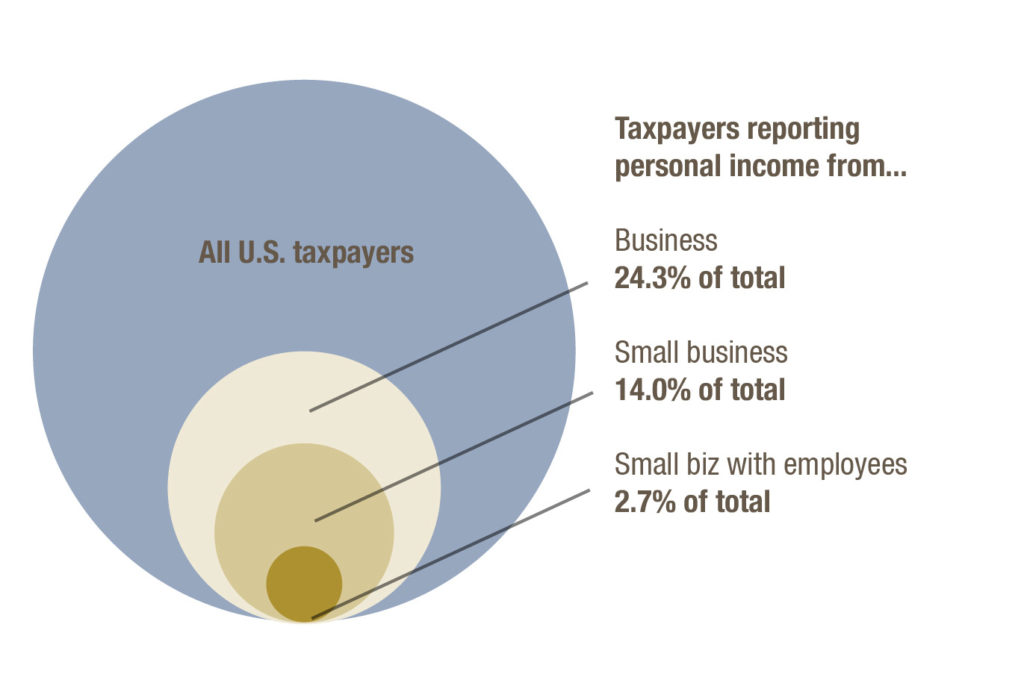

Small businesses are unlikely to generate many jobs due to tax cuts either, contrary to proponents’ claims. Most small business owners are taxed through the personal rather than corporate income tax level, which is the basis for this thinking. But the vast majority of taxpayers are in no position to create any jobs at all. Only 2.7 percent of all personal income taxpayers nationwide are owners of bona fide small businesses with employees other than the owners.

Most Taxpayers Aren’t Small Businesses With Employees

Even for the few small businesses that might profit, the gain from personal income tax cuts is typically too small to create any jobs.

Just 13 percent of U.S. small businesses bring in $50,000 or more in taxable income in a given year. The rest make less than that or lose money. Dropping Georgia’s personal income tax rate to 5.4 percent from 6 percent would generate an annual tax cut of only $300 for businesses at that level. That’s clearly not enough profit to sway an owner to hire a new employee.

Tax cuts can even decrease new business investment in a state if the resulting budget cuts in education and other services weaken the state’s workforce or undermine communities’ ability to thrive. Kansas suffered this tax-cutting downside in recent years after the Sunflower State’s governor slashed billions from the budget and eviscerated public investments for little to no economic gain in return. Entrepreneurs and skilled workers don’t want to live in states where the roads are crumbling, hospitals are closing and families cannot find high-performing schools.

Research on business firm location finds that while taxes matter, other factors seem to play a larger role.

-2010 Georgia Special Council on Tax Reform and Fairness

Georgia lawmakers can find sensible reasons to consider a small reduction in Georgia’s top personal income tax rate of 6 percent. Thoughtful tax reform can be a way to bolster families, give workers a break and keep the state’s financial house in good working order. Our proposed fix to House Bill 329 released last week details how a targeted revision to the legislation allows for a modest rate cut that helps middle class families while still protecting Georgia’s long-term finances. But it is a mistake to vote for sweeping tax changes based on faulty promises of more business growth or jobs. Experience shows those claims don’t hold water.