Read More of the 2026 Budget Primer here.

Understanding Georgia’s FY 2026 Budget:

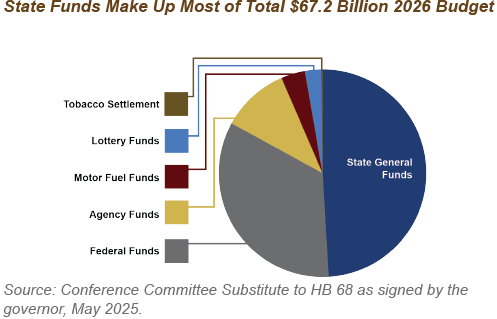

Overall, Georgia plans to spend $67.2 billion in Fiscal Year (FY) 2026, which begins on July 1, 2026 and ends on June 30, 2027.

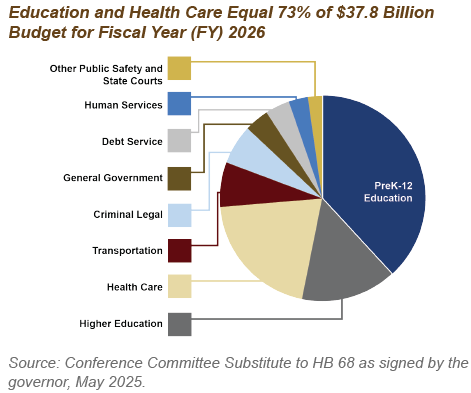

The largest share of the budget comes from $37.8 billion in state revenues, which includes $32.5 billion in state General Funds that can be appropriated freely, $2.5 billion in Motor Fuel Funds that are constitutionally dedicated for infrastructure, $1.7 billion in Lottery Funds that are constitutionally dedicated for Pre-K and higher education scholarships and $957 million in other taxes and fees that are assessed for specific purposes such as provider fees on hospitals and nursing homes for health care.

Georgia’s budget also includes $22.5 billion in federal funds, which help to cover the costs of programs such as Medicaid. For the most part, these federal funds are reserved for specific purposes and guided by eligibility criteria for enrollment in federal programs and services.

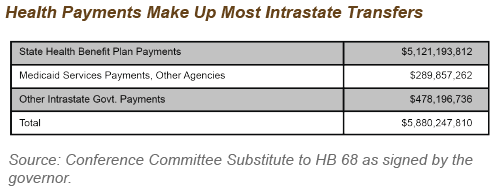

Finally, Georgia’s budget includes $7 billion in agency funds raised that fund specific areas, such as tuition for colleges and universities. Outside of the regular appropriations process, intra-state government transfers comprise $5.9 billion in state spending, with most of these funds directed to the State Health Benefit plan to insure state employees and educators.

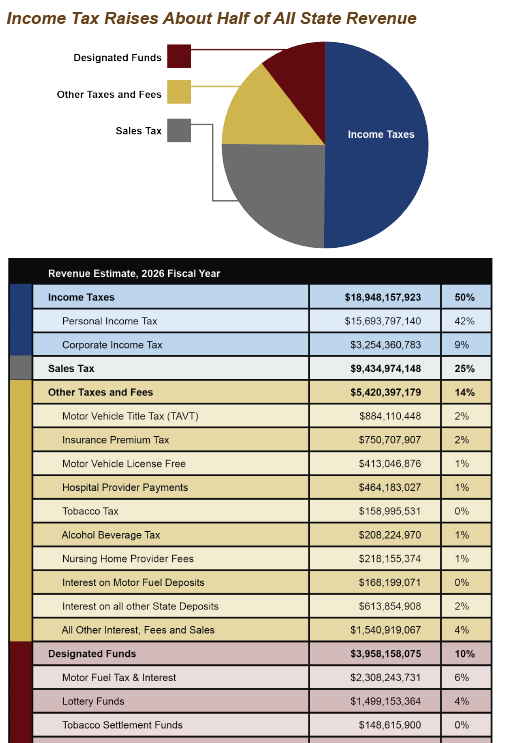

How Does Georgia Raise Revenue?

Georgia raises revenue from personal and corporate income taxes, sales taxes, gas and vehicle taxes and other levies and fees. Income taxes are the cornerstone of Georgia’s revenue system, accounting for half of all state funds. Sales taxes are the second largest revenue source, representing slightly less than a quarter of annual collections. A fair and reliable revenue system requires both types of taxes.

Income taxes help balance the regressive effects of sales taxes and fees by allowing the state to collect a proportionate share of revenue from the wealthiest earners and most profitable corporations. A healthy income tax is also less sensitive to economic trends, which can boost revenue growth during good times but decline sharply when recessions occur.

Sales taxes provide a less consistent source of yearly revenue, and they fall more sharply on middle-class families and people with lower incomes. Georgia also offers broad exemptions from sales taxes for most services, tilting the revenue system in favor of higher earners and counter to trends in other states expanding sales taxes to include services. Still, sales taxes remain a core funding source that allows the state to generate revenue from consumption and economic inputs that would otherwise be exempt from taxation.

In recent years, lawmakers have enacted several measures to ensure sales taxes are applied to online marketplaces and digital downloads. However, the state’s sales tax is not assessed on the purchase of most services and large parts of Georgia’s economy, such as construction labor, the finance industry, attorneys or physicians.

Major Funding Categories:

General Fund: $32.5 Billion (48% of Georgia’s Budget)

Georgia’s General Fund derives largely from income taxes on personal and corporate earnings and sales taxes on consumer transactions. The state also assesses excise taxes on tobacco and alcohol, along with a variety of other taxes and fees.

The state-funded portions of education, Medicaid and most other traditional state services are paid for through the General Fund.

The remaining General Fund appropriations are directed to state agencies, boards and commissions dedicated to activities such as economic development, agriculture and forestry and grant programs. The General Fund also covers the costs of operating the legislative, judicial and executive branches of state government. Not included in Georgia’s General Fund are dedicated taxes and fees that are collected into several other funds such as those raised by the Lottery and Motor Fuel taxes.

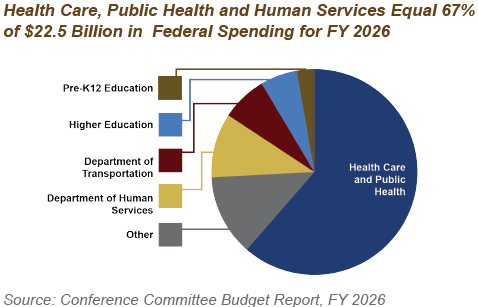

Federal Funds: $22.5 Billion (33%of Georgia’s Budget)

A significant share of Georgia’s overall spending for health care, K-12 education, transportation and other services is paid through the administration of $22.5 billion in federal funds. These federal funds usually are based on enrollment in benefit programs jointly administered by Georgia and the federal government.

Federal rules require the state to pay a share of the cost for Medicaid and other programs and services that benefit Georgians. As a result, changes in corresponding state funding levels can sometimes lead to changes in federal funding. If the federal government changes the eligibility criteria or financial formulas used to calculate funding for public benefit programs, such as Medicaid or SNAP, it can also have a significant corresponding impact on the state budget by changing the cost burden facing the state or the availability of these programs and services for state residents.

Agency and Research Funds: $7 Billion (10% of Georgia’s Budget)

The $7 billion in revenue includes university system research funds and tuition and fees from colleges. It also includes regulatory fees and revenue raised directly by individual state agencies.

Lottery Funds: $1.7 Billion (4% of Georgia’s Budget)

The $1.7 billion in revenue raised from the state lottery is dedicated to pre-Kindergarten programs and scholarships for higher education.

Motor Fuel Funds: $2.5 Billion (4% of Georgia’s Budget)

Revenue raised from the state’s motor fuel taxes is required by the state constitution to be spent on infrastructure. The money is dedicated to a mix of new construction, maintenance of existing roads and bridges and debt service on past projects. Georgia’s 2025 motor fuel rates are 33.1 cents per gallon of gas and 37.1 cents per gallon of diesel, a slight uptick from last year. While the state tax on aviation gasoline is at one cent per gallon, the state’s Department of Revenue has recognized a permanent tax exemption on the sale of jet fuel, which will cost the state around $68 million in FY 2025. The state budget includes a total of $2.5 billion in dedicated motor fuel revenue.

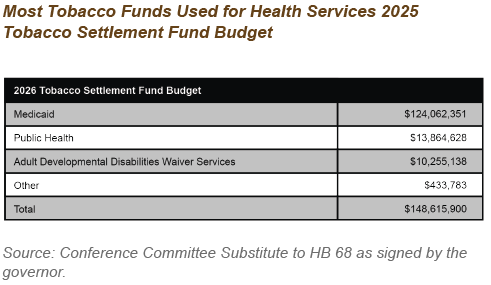

Tobacco Settlement Funds: $149 Billion (0.2% of Georgia’s Budget)

Georgia receives annual payments in perpetuity from a large settlement signed in 1998 with four of the nation’s largest tobacco companies, known as the Tobacco Master Settlement Agreement. Georgia is not required to dedicate these payments for specific purposes. As a result, the use of tobacco settlement money can vary from year to year, though most of the funds have been allocated to health care.

Intrastate Transfers $5.9 Billion

Intrastate transfers involve funds being moved from one area of government to another and primarily include payments from the State Health Benefit Plan (SHBP), which insures about 665,000 state employees, school system employees, retirees and their families. This year, the employer cost of providing health coverage through SHBP—which is paid by the state and public schools—spiked by 7%. Effective immediately for most state employees, the required employer contribution increased by $1,500 per year for each employee, or by $125 per member, per month from $1,760 to $1,885. This increase was driven by several factors, including an aging member population, stagnant subscriber levels and decisions made by state policymakers. Gov. Kemp’s FY 2026 budget proposal passes on this increase in premiums for non-certified school employees to local districts.