Read More of the 2026 Budget Primer here.

As Georgia Awaits Potential Federal Changes, Opportunities Abound on Horizon

The $37.8 billion state budget signed into law by Gov. Kemp for FY 2026 represents a 4.5% year-over-year increase from the budget signed into law the prior year. With no funding released from Georgia’s overflowing reserve accounts for FY 2026 and the state issuing bonds at the lowest level in modern history, the budget remains well below the state’s capacity to address on-going needs from health care to public education.

Georgia’s governor holds unilateral authority to set the state’s revenue estimate, which effectively acts to cap spending. Georgia is currently in a cycle in which state revenue collections continue to outpace spending, adding to an already historic level of unobligated reserves available for allocation.

Entering FY 2026, Georgia remains at an inflection point, with a strong level of resources on-hand, along with a current-year budget that prioritizes one-time spending over recurring investments with bonds. There is a clear opportunity available to state leaders to respond to longstanding needs and new gaps created by federal cuts across public education, access to health care and economic mobility during the 2026 legislative session. Up to this point, outside of limited rebates and paying for capital projects in cash, state leaders have chosen to maintain increasingly large reserves that remain mostly unallocated. However, state leaders have also shown signs of shifting their posture—with Amended Fiscal Year (AFY) 2025 marking the first time the state has released reserves for non-emergency spending. Going forward, Georgia can reach its full potential by wisely investing recurring revenues and responsibly allocating reserves to finance targeted investments.

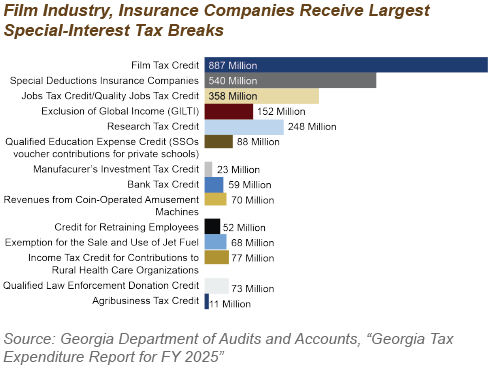

Mounting Tax Breaks Tilt Georgia’s Revenue System Toward Large Corporations: $11 Billion in Forgone Revenue Collections in FY 2026

Georgia offers a wide array of tax credits, deductions and other tax breaks, also known as tax expenditures, that give preferential treatment to certain taxpayers and corporations. The tax breaks will cost the state more than $11.1 billion in revenue in FY 2026. Some tax breaks provide key protections for families, such as the sales tax exemption on groceries, while others provide credits or incentives to specific industries or special interest groups. Several of Georgia’s largest tax breaks deliver outsized gains to select groups or industries—such as manufacturing, film or insurance—often with questionable benefit to the state or its people.

Georgia lacks a standardized review process to measure and compare the costs and benefits of all existing and proposed tax breaks. During the 2021-2022 session, however, the state enacted legislation that allows the chairs of the General Assembly’s tax-writing committees to request analyses of a limited number of tax expenditures. Senate Bill 366, which was enacted during the 2024 legislative session, tweaked this process and now permits at least 12 economic analyses per year.

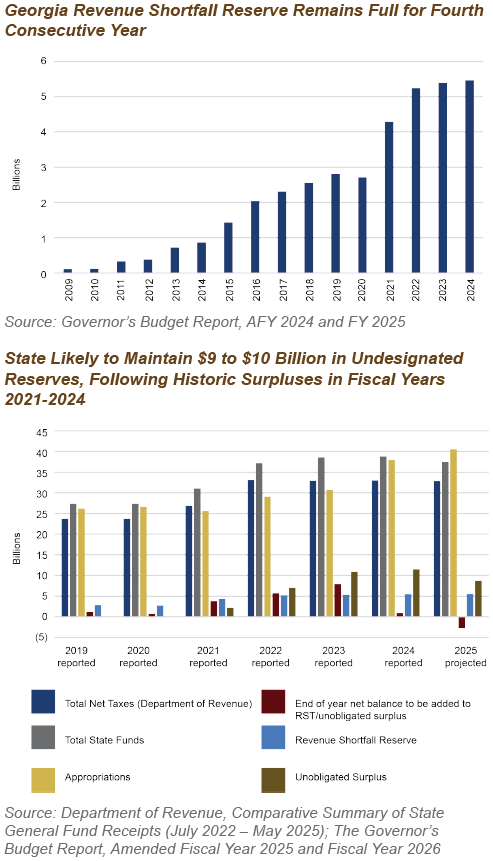

State Savings Account Remains Full

The Revenue Shortfall Reserve (RSR), Georgia’s rainy-day fund, provides stability in economic downturns. The fund is like a savings account to pay expenses and maintain services when revenues decline unexpectedly. Maintaining adequate reserve money helps Georgia keep its decades-long streak of maintaining its AAA bond rating, allowing the state to borrow on favorable terms and save millions in interest. Money is not appropriated into the RSR; the balance grows at the end of each fiscal year if there is surplus state revenue (up to 15% of prior year revenue). The governor is also authorized to release for appropriation any amount over the minimum balance required—4% of prior year revenues—in case of a fiscal emergency or as part of the annual state budget. Since the end of FY 2021, Georgia’s Revenue Shortfall Reserve has remained at its maximum level, with consistently conservative revenue estimates (which effectively acts to cap spending) issued by Gov. Kemp resulting in an additional unobligated surplus.

At the close of 2024, Georgia’s Revenue Shortfall Reserve stood at $5.5 billion, equivalent to 15% of prior year revenues, or enough to fund the state’s operations for just over two months.

In FY 2024, Georgia generated revenues that were $901 million above what the state spent, which increased the amount held in unobligated reserves to $11.5 billion and elevated overall state general fund reserves to $17 billion. With $40.6 billion in AFY 2025 spending, Georgia’s budget appropriates roughly $2.7 billion more than the governor’s revenue estimate and is likely to end the year with between $14 billion to $16 billion in General Fund reserves. FY 2025 looks like it will be the first year since FY 2020 that state general fund reserves have trended down.

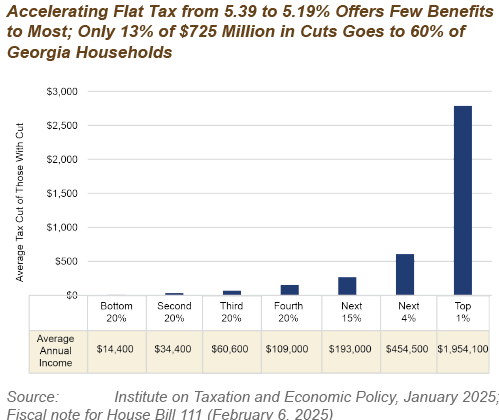

State Advances Flat Tax Implementation

House Bill 1437, signed into law by Gov. Kemp in 2022, sets Georgia on a course of personal and corporate income tax rate reductions that will primarily benefit the state’s highest earners. This year, lawmakers accelerated the implementation of HB 1437 and enacted HB 111 (signed by the governor in April) to retroactively reduce the state’s flat corporate and personal income tax rates to 5.19% as of January 2025.

The flat tax plan requires overall revenue growth of at least 3% for the plan to be fully implemented. Unless further action is taken, the state’s income tax rate will be reduced to 5.09% in January 2026 if state revenues meet the benchmarks set under state law.

For Georgia families earning the median income or less, these pending tax changes would offer little to lift incomes or increase economic opportunity. Rather, the changes may redirect resources from programs and services that could otherwise support working families, thus widening disparities across income, race and ethnicity.